TODAY’S MAZE

Europe is moving to put a price on the flood of ultra-cheap parcels, and the implications go far beyond a €3 fee. From July 2026, cross-border ecommerce will no longer be frictionless by default.

At the same time, China’s logistics engine keeps accelerating. Parcel volume has become a structural advantage, exporting low-cost fulfillment models into markets where regulators and incumbents are struggling to keep up.

And while regulators focus on parcels and safety, commerce itself is shifting layers. Mirakl’s “Santa Quits” campaign is a reminder that the next battle is not storefronts, but systems built for AI agents, not humans.

In today’s MarketMaze:

EU moves to tax the small-parcel flood

China’s parcel scale becomes a global weapon

Mirakl bets on agent-driven commerce

Value beats premium as shoppers trade down

Surprise fees expose cracks in cross-border shopping

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Europe is putting a price on the flood of ultra-cheap parcels. From July 2026, the EU will charge €3 per product type on low-value e-commerce imports, targeting the scale economics behind Temu and Shein style shipping. This is not about revenue. It is about control.

• In 2024, 4.6 billion low-value parcels entered the EU, around 90% from China, overwhelming customs systems and creating a cost advantage over EU-based sellers.

• The new rule charges €3 per product type, meaning mixed-item parcels pay more, directly hitting the bundling tactics used to keep prices low and inspections rare.

• The measure comes two years early, ahead of the planned 2028 end of the €150 exemption, as ministers cite unsafe goods, fraud, and unfair competition.

Why it matters: Cross-border ecommerce just got less frictionless in Europe. Ultra-low-price models now face higher costs or slower delivery. Retailers with EU inventory, local sellers, and compliant marketplaces gain ground as free entry quietly disappears.

FROM OUR PARTNERS

ElevenLabs Agents are real-time conversational AI agents that talk, type, and take action. They resolve shopper questions, guide purchases, and scale across e-commerce using your data.

Reduce cart abandonment and lift conversion.

Agents answer product questions and guide checkout in real time.Drive upsell and higher lifetime value.

Context-aware concierges recommend relevant products and bundles.Scale support without adding headcount.

Voice and chat agents resolve issues and hand off to humans when needed.Enterprise-ready for marketplaces and retailers.

Built with strong security, monitoring, and compliance controls.

DATA TREASURE

The Maze: China’s logistics engine has reached a scale the rest of the world cannot touch and parcel volume has become a structural advantage. Shipments passed 180 billion this year and are moving toward 200 billion. Low prices drive high frequency and platforms like Pinduoduo and Douyin turn impulse into national infrastructure demand. Cost falls. Volume rises. The flywheel accelerates.

• China handled more than 180 billion parcels by late 2025 versus roughly 23 to 25 billion each in the United States and the European Union and about 18 to 20 billion in Southeast Asia which shows a gap that is widening every year.

• Daily parcel peaks approach 770 million as low cost categories and high frequency buying reshape fulfillment economics while average domestic delivery costs sit below 1.5 RMB which makes millions of tiny orders economically viable.

• The logistics model is now expanding overseas as platforms build cross border lines and local warehouse networks which exports China’s low cost fulfilment structure into markets where carriers struggle to match density and automation.

Why it matters: China’s cost base is becoming a global benchmark and local retailers must adapt before low price and fast shipping redefine consumer expectations. Regulators will feel pressure to revisit import rules as logistics flows shift. Ecommerce strategy in the West increasingly depends on understanding an engine built thousands of kilometers away that is already reshaping global demand.

MAZE STORY

The Maze: Mirakl used Santa walking off the job to signal a bigger shift. Its fully AI-generated holiday ad is not about creativity, but about positioning Mirakl as the infrastructure layer for agent-driven buying. The message is clear: humans browsing is old news.

• In December 2025, Mirakl launched the “Santa Quits” film, built entirely with AI tools, to show it does not just sell AI-ready commerce, it operates inside it.

• The campaign runs globally across LinkedIn, YouTube, and programmatic channels to reach decision-makers shaping future marketplaces, not end consumers.

• Mirakl ties the story directly to Mirakl Nexus, positioning it as the system AI agents will use to search, compare, and execute purchases autonomously.

Why it matters: If AI agents become the buyers, storefronts lose power and systems gain it. Mirakl is betting that marketplaces must be programmable, not just browsable. In that world, the winner is not who attracts shoppers, but who serves machines best.

FROM OUR PARTNERS

Lyro AI by Tidio is a customer service agent built for e-commerce. It answers shoppers instantly, resolves issues, and supports sales across digital channels.

Reduce abandonment with instant answers.

Lyro handles delivery, returns, and product questions in real time.Increase conversion through chat recommendations.

Product-aware replies help shoppers decide and buy faster.Scale support without losing quality.

Lyro follows your rules and escalates to humans when needed.Built for global e-commerce teams.

Supports 45+ languages and integrates with existing helpdesks.

DATA TREASURE

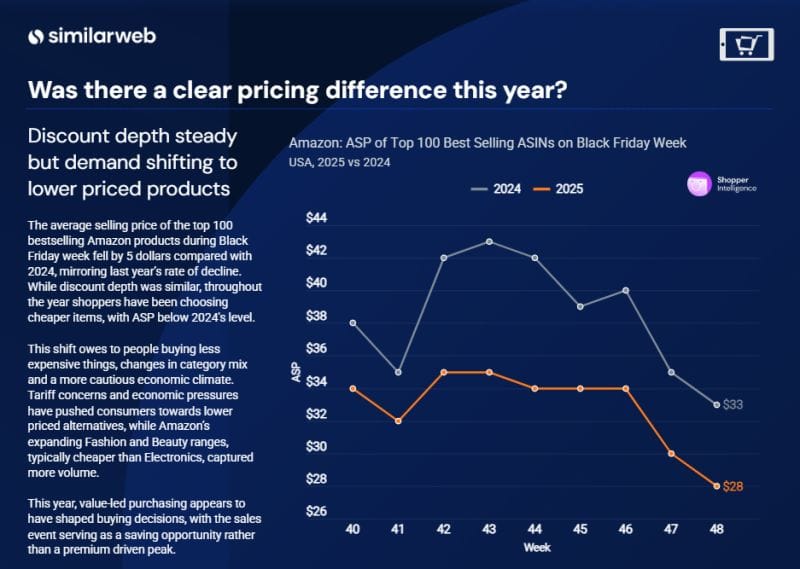

The Maze: Online shoppers did not disappear this year, they moved down the price ladder. Amazon’s most purchased products skewed cheaper, even though discount depth stayed broadly unchanged. The signal is clear: value won attention, and demand shifted toward lower priced items rather than deeper promotions.

• In late 2025 the average price of Amazon’s top 100 bestselling products was about five dollars lower than the prior year, finishing near twenty eight dollars versus roughly thirty three, showing shoppers picked cheaper winners rather than waiting for bigger discounts.

• Demand steadily tilted toward lower priced items across the year as buyers traded down within categories and favored entry level products, smaller pack sizes, and everyday goods over premium electronics and higher ticket discretionary items.

• Fashion and beauty captured more share inside Amazon’s bestseller mix, benefiting creator led and viral brands with lower price points, while economic caution and tariff worries pushed consumers to prioritize affordability over brand stretch.

Why it matters: Value pricing is no longer a seasonal tactic but a structural shift in how people buy online. For ecommerce players planning 2026 assortments, entry price anchors and smart pack architecture become growth tools, not margin killers. For D2C brands, the pressure is sharper: revenue models must survive lower willingness to pay without breaking the economics of ads, fulfillment, and returns.

MAZE STORY

The Maze: Cross-border shopping is quietly getting riskier for US consumers. New tariff rules mean fees often appear after checkout, not before. The surprise is not theoretical. It is already happening at the door.

• Amazon says customs charges are collected at checkout, but marketplaces like Etsy leave it to individual sellers, forcing buyers to message merchants to ask who pays duties.

• Grailed and Sonnet and Fable warn customers they may receive tariff invoices after purchase, and Sonnet says packages can be delayed or discarded if buyers miss payment emails.

• UPS adds a 12 dollar surcharge if duties are paid at delivery instead of online, while FedEx sends invoices by mail and warns shoppers to watch for scam payment requests.

Why it matters: Ecommerce breaks when pricing stops being final. Surprise fees increase refunds, disputes, and lost trust. Platforms that show landed cost clearly or ship from US inventory will convert better as cross-border friction rises.

BRIEFING

🏬 Everything else in Ecommerce

🇬🇧 TikTok Shop UK broke its all time sales record on Black Friday, selling 27 items every second and posting 50% year over year growth, as more established brands leaned into live shopping and in-app deals.

🇺🇸 Amazon is expanding BrainBox AI with Amazon Web Services (AWS) and Trane to cut energy use in grocery fulfillment centers, targeting lower operating costs in energy-intensive cold chain facilities.

🇫🇷 Mirakl and Stripe announced a partnership to connect merchants to “agentic commerce” marketplaces using Stripe’s AI commerce connections, enabling AI shopping agents to complete transactions end to end.

🇺🇸 President Trump signed an executive order to push a single federal framework for artificial intelligence, limiting state-by-state rules and reducing compliance fragmentation for national platforms.

🇺🇸 Disney announced a partnership with OpenAI to license intellectual property, including more than 200 characters, for Sora-generated video content aimed at boosting Disney+ engagement.

🇺🇸 OpenAI launched GPT-5.2, its new flagship model, highlighting the accelerating pace of competition as businesses demand more reliable, production-ready AI systems.

🇺🇸 Amazon tested a one-hour pickup concept linked to its physical stores, blending online ordering with instant local fulfillment to compete on speed without last-mile delivery costs.

🇬🇧 TikTok Shop UK moved upmarket as larger UK retailers experiment with in-app selling and live commerce formats, signaling a shift beyond impulse purchases.

🇺🇸 Uber launched “Uber Intelligence,” offering advertisers insights built from rides and food delivery data, positioning Uber closer to a retail media platform with real-world demand signals.

🇵🇱 Shein opened a major European logistics hub near Wrocław to support faster, localized fulfillment across the EU and reduce reliance on long-haul cross-border shipping.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team