Welcome to MarketMaze, the #1 newsletter for staying on top of the latest in Ecommerce & Marketplaces.

TODAY’S MAZE

What’s actually driving e-commerce? Digital’s influence goes way beyond the checkout button, luxury buyers are getting more demanding (and digital), and Reddit’s quietly becoming an ad powerhouse. Add mobile-first luxury, $7M sold by avatars.

🧠 INSIGHTS:

Digital Drives More Sales Than You Realize 🤯

AI is the New Butler for Luxury Shoppers 🤖

Reddit’s Ripple Effect: Where Community Drives Commerce (and ROAS).

Europe’s Luxury Shoppers Are Going Mobile—And Changing Everything.

How Digital-Only Avatars Sold $7M of Stuff in Six Hours (and Nobody Noticed)?

UK’s Neobanks: Who’s Winning, Who’s Fading, and Why It Matters.

📖 NEWS:

🇺🇸 Walmart to Launch Shoppable Ads on Vizio TVs.

🇺🇸 TikTok Shop Shifts to Chinese Leadership Amid Sales Struggles.

🇺🇸 PayPal Launches Storefront Ads to Boost Merchant Sales.

🇸🇪 Klarna Aims to Become AI-Driven Super App Despite Losses.

🇺🇸 FedEx's EV Shift: Delivering on Circularity and Net-Zero.

🌍 Middle East's E-Commerce Boom Faces Hurdles.

+ 15 other handpicked news from the last week you need to know 🔥

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

🌀 Maze Story

Digital Drives More Sales Than You Realize 🤯

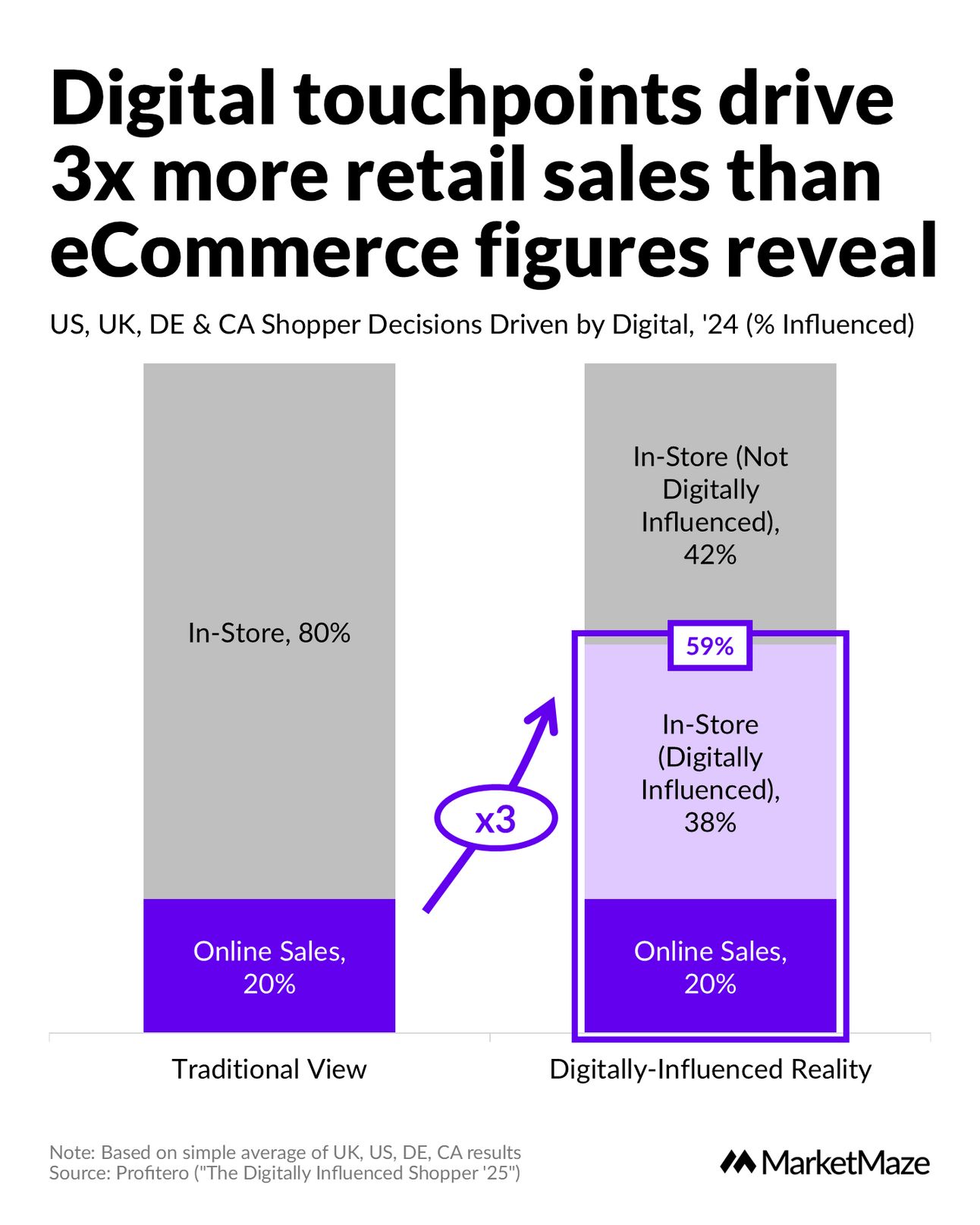

Most brands are sleepwalking through digital, treating it as a sideshow instead of the main event. Profitero’s latest study on the UK, US, Canadian, and German market, reveals a retail reality check: digital touchpoints now influence nearly three times more sales than traditional e-comm numbers show. In an era of tighter budgets and stiffer competition, underinvesting in digital isn’t just a mistake, it’s brand malpractice.

Underinvest in Digital, Miss the Real Action 🚦

Brands still treat digital as a sideshow, allocating crumbs instead of capital. Averaging data across the countries shows that digital touchpoints influence 59% of all purchase decisions, nearly 3x the classic e-commerce penetration figure, which sits at just 20%. In-store purchases that aren’t digitally influenced now make up only 42% of the total, while 38% of in-store sales are driven by digital touchpoints. Digital is no longer just about online sales, it’s quietly reshaping what’s happening in every aisle, every store, every day.

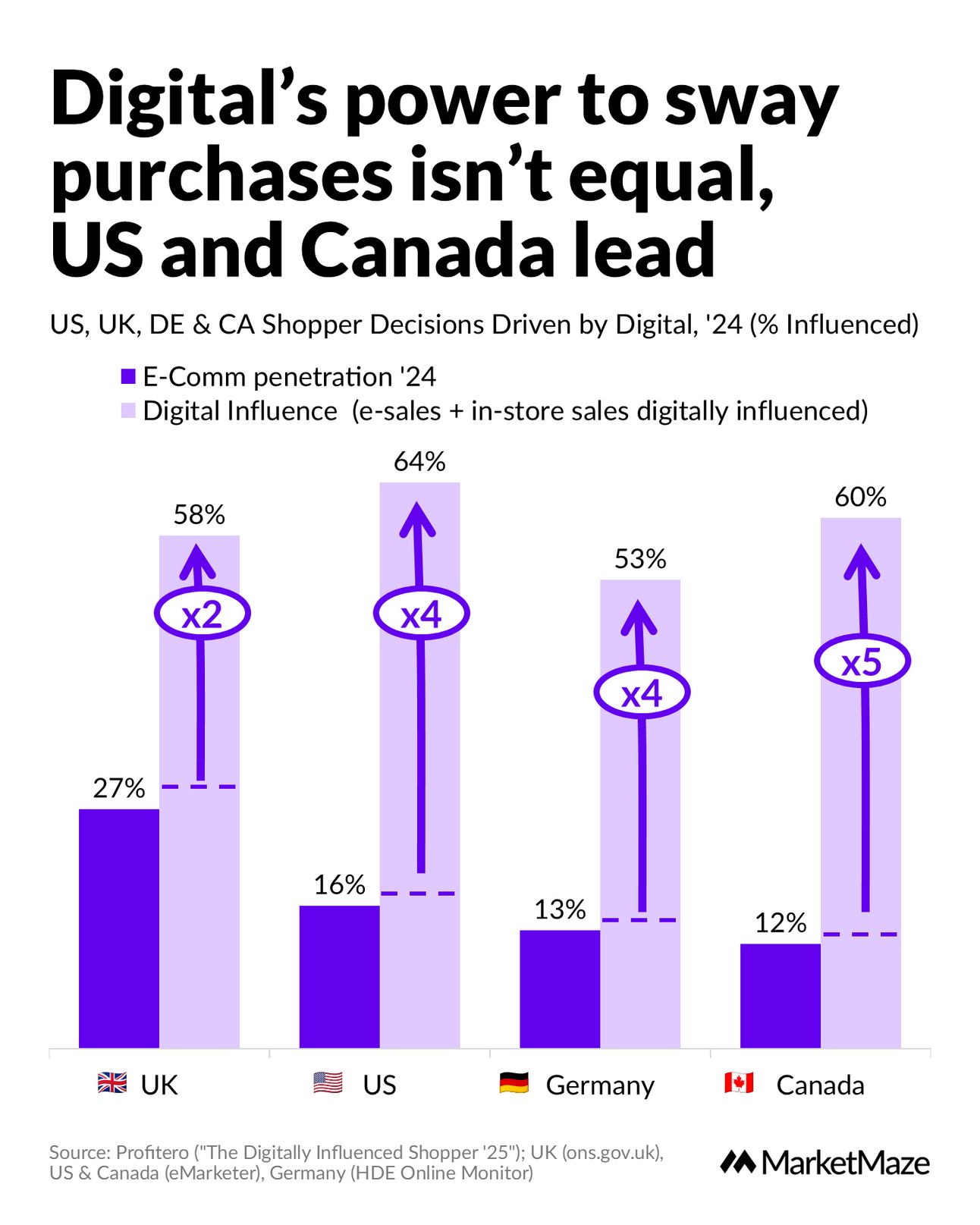

The Digital Divide: North America Leads, Europe Gains 🌎

Digital’s influence isn’t one-size-fits-all. Just look at the numbers:

UK: E-comm is 27%, but digital touchpoints sway 58% of all sales (2x multiplier).

US: E-comm is 16%, digital influence rockets to 64% (4x multiplier).

Germany: E-comm at 13%, digital touchpoints push that to 53% (4x multiplier).

Canada: E-comm lags at 12%, but digital influences a whopping 60% (5x multiplier).

Translation? In North America, digital is the secret sauce, with the US and Canada leading the world in digitally influenced shopping. Europe isn’t far behind, but every market demands its own playbook.

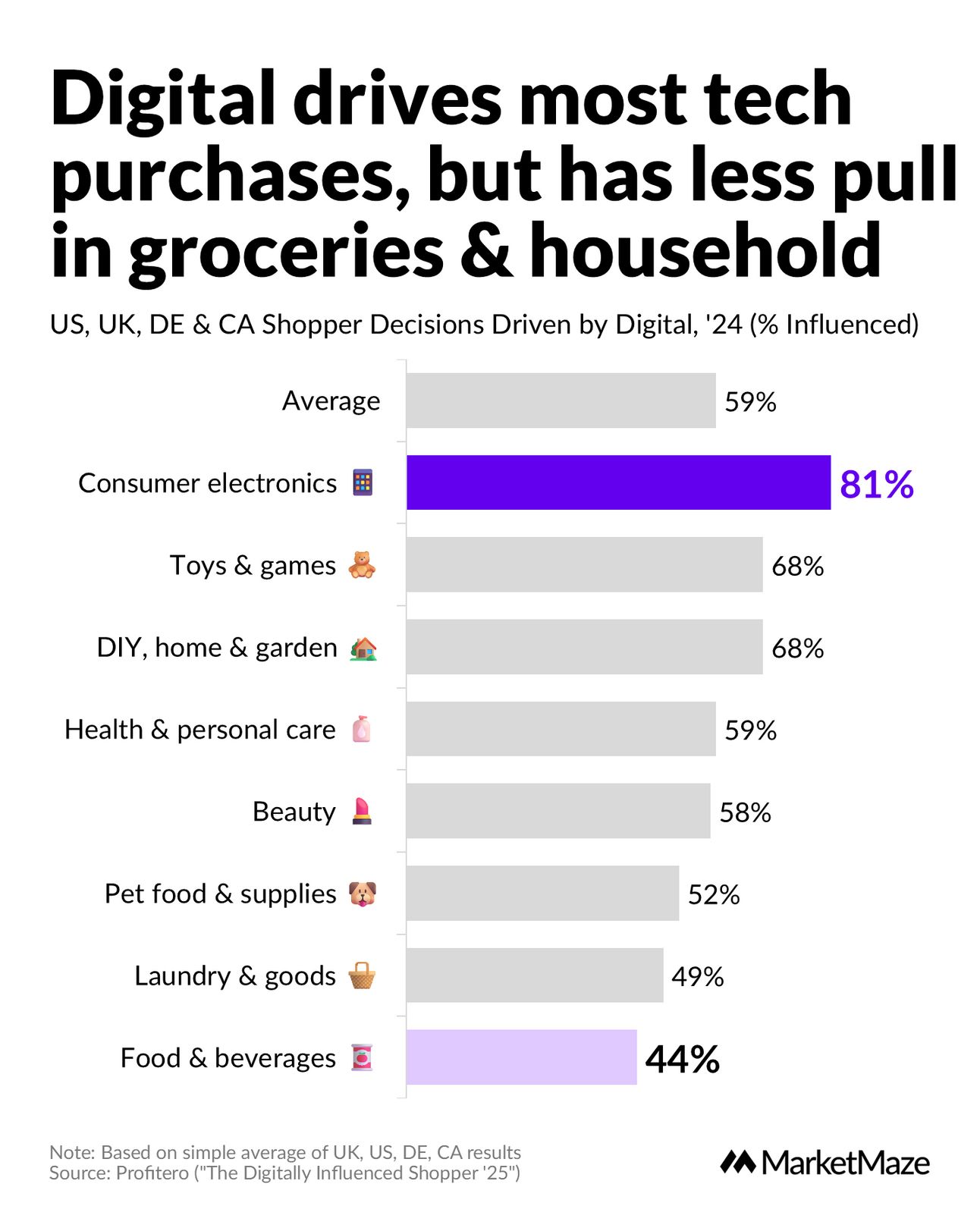

Digital’s Fingerprints Are Everywhere 🛒

Don’t limit digital to online checkouts, its influence runs deep in every aisle, every cart. Electronics lead the pack with a jaw-dropping 81% of purchases shaped by digital touchpoints, but categories like toys, DIY, beauty, and even food are catching up. Whether it’s reviews, search, or a TikTok haul, digital is steering both online and in-store sales.

From our partners

Guess Which Wedding Suit Costs $1,200

The answer might surprise you. The suit on the right is from The Black Tux at under $500. The one on the left? Some designer brand charging $1,200 for virtually identical construction and styling.

Your wedding day deserves the perfect suit, but your bank account deserves the smart choice. Why pay luxury prices when you can look just as sharp for half the cost?

💎 Data Treasure

AI is the New Butler for Luxury Shoppers 🤖

Luxury shopping has a satisfaction problem - BCG’s 2025 Luxury Customer Experience Survey finds that 56% of high-end buyers aren’t happy with how brands treat them. Competition is brutal, growth is slowing, and shoppers want more than a logo and a glass of bubbly. In a world built by iPhones and Netflix, “exclusive” now means remembering my style, my wishlist, and my dog’s birthday before I even ask. The future of luxury? AI-powered service.

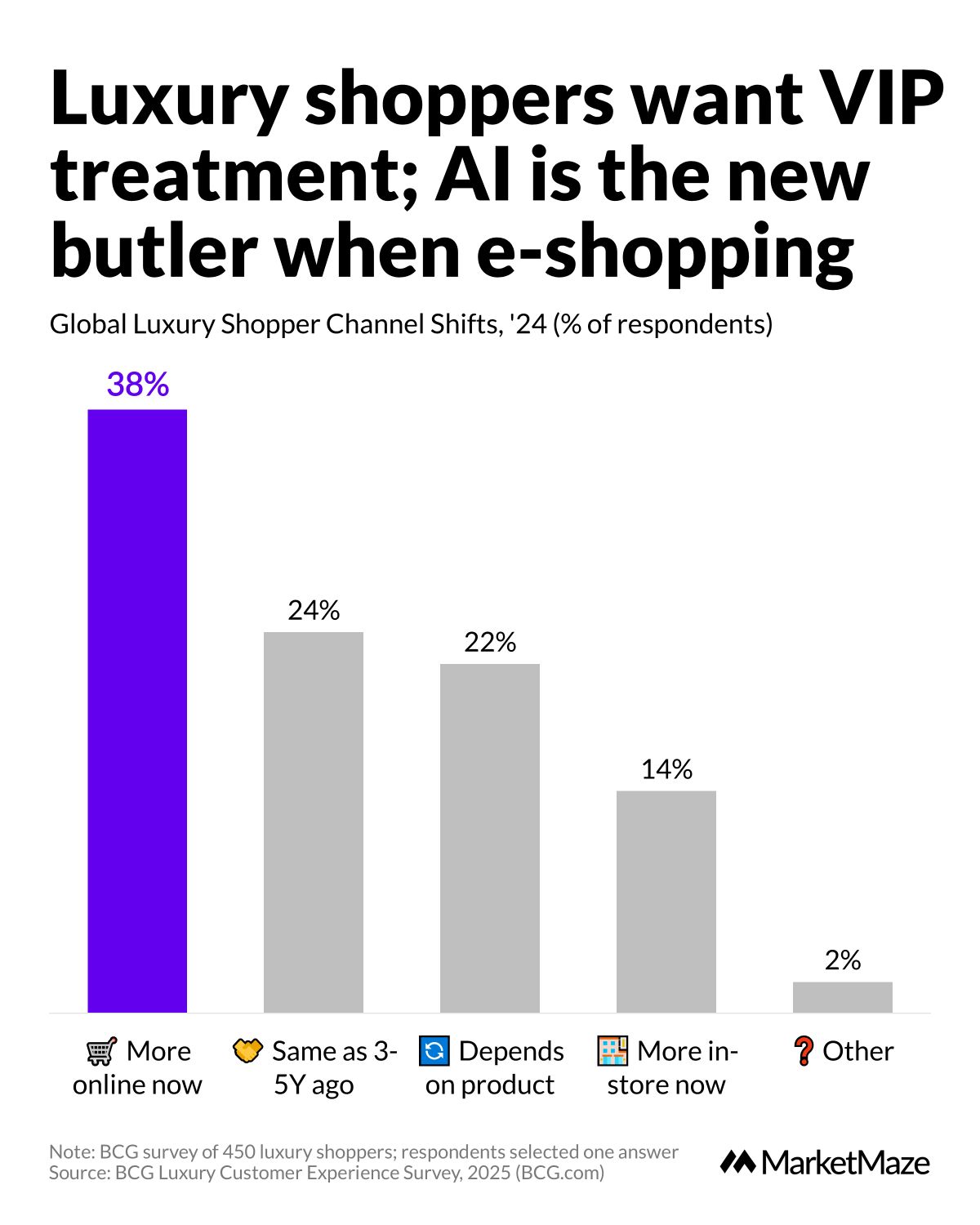

The New Luxury: More Clicks, Fewer Marble Floors 🛒

Let’s talk about where luxury is headed: online, and fast. BCG’s survey of 450 shoppers says 38% buy more luxury online now than 3–5 years ago. Only 14% say they shop in-store more, and 24% are holding steady. The luxury client journey is splitting into dozens of paths. BCG reports 77% demand brands recognize them across all channels—digital and physical. If your “white-glove” service ends at the store door, you’re yesterday’s news.

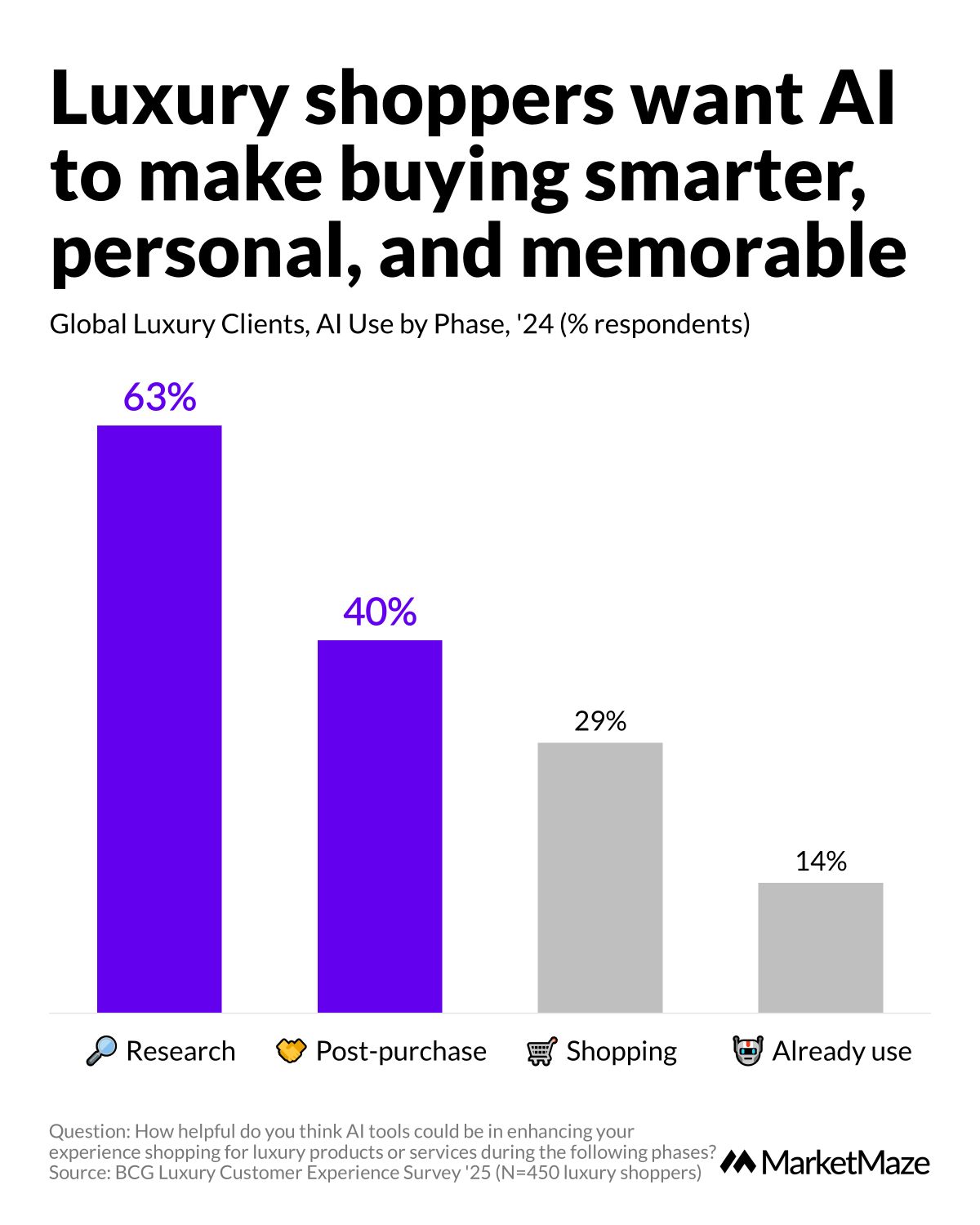

AI: The White-Glove Upgrade Luxury Needs 🎩

Here’s where the smart money is: 63% of luxury shoppers want AI to boost their research phase, 40% want AI-powered post-purchase magic, and 29% want sharper, smarter shopping. Only 14% actually use AI today, but that’s about to change.

AI isn’t here to steal the human touch; it’s here to scale it. “Superhuman” advisors powered by AI can remember every birthday, follow up at just the right moment, and handle service requests without dropping the ball. Brands that treat AI as an embedded team member (not just a gadget) will turn every VIC (Very Important Client) into a VVIC: a Very, Very Important Client. That’s the new status symbol in luxury, personal attention and “wow” moments for all, not just the top spenders.

From our partners

Start learning AI in 2025

Keeping up with AI is hard – we get it!

That’s why over 1M professionals read Superhuman AI to stay ahead.

Get daily AI news, tools, and tutorials

Learn new AI skills you can use at work in 3 mins a day

Become 10X more productive

👀 Outside the Maze

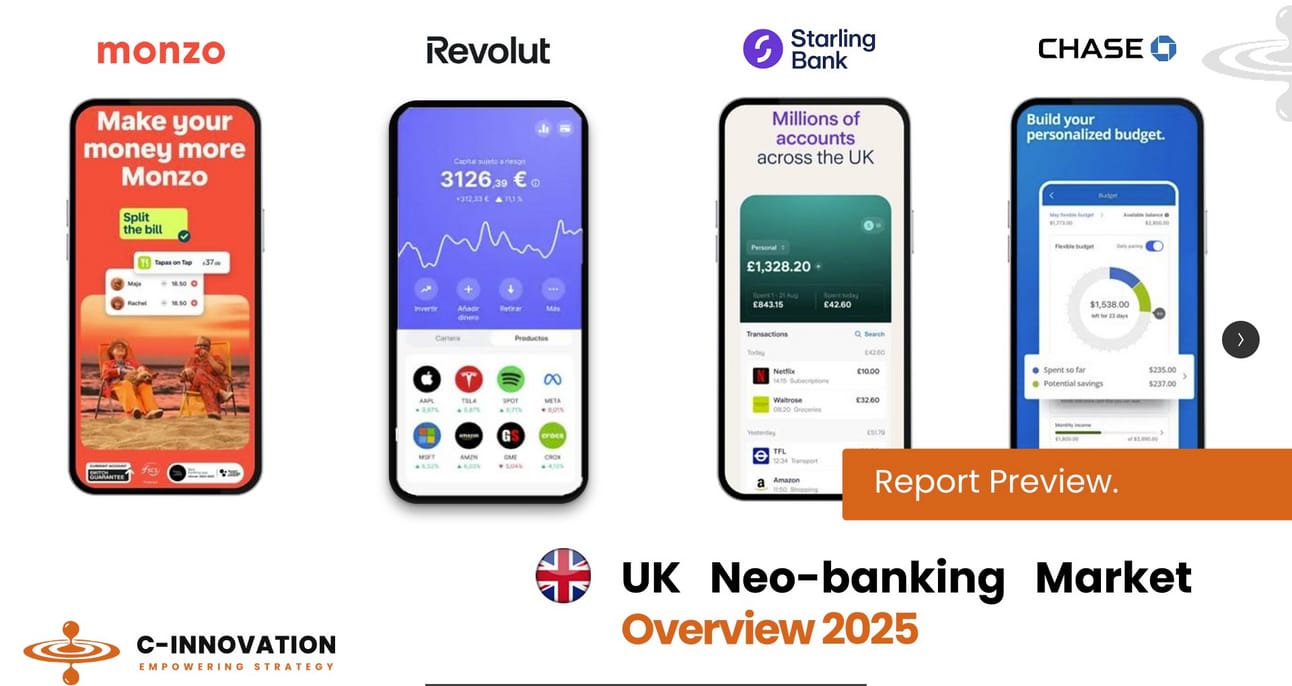

UK’s Neobanks: Who’s Winning, Who’s Fading, and Why It Matters.

Javier Guevara Torres unpacks the UK’s digital banking battleground: Revolut is building a “super app,” Monzo banks on paid tiers, and Starling makes real money serving businesses. The market’s not about user growth anymore—it’s about profit models and future-proofing. Over 40 million Brits now bank digital-only, so the game is getting crowded and ruthless. 👉 C-Innovation Report

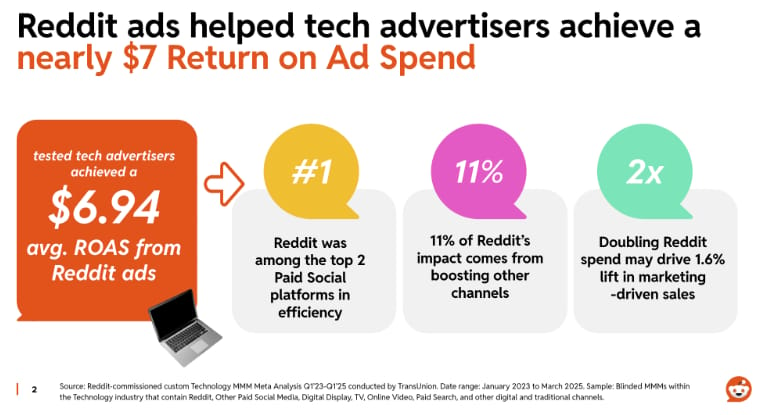

Reddit’s Ripple Effect: Where Community Drives Commerce (and ROAS).

Reddit’s latest data shows why the smartest brands are using the platform to shape purchase decisions—not just run ads. Over 88% of users use Reddit to vet what to buy, and the average post keeps pulling views for six months or more. 👉 Reddit Ripple Effect Report

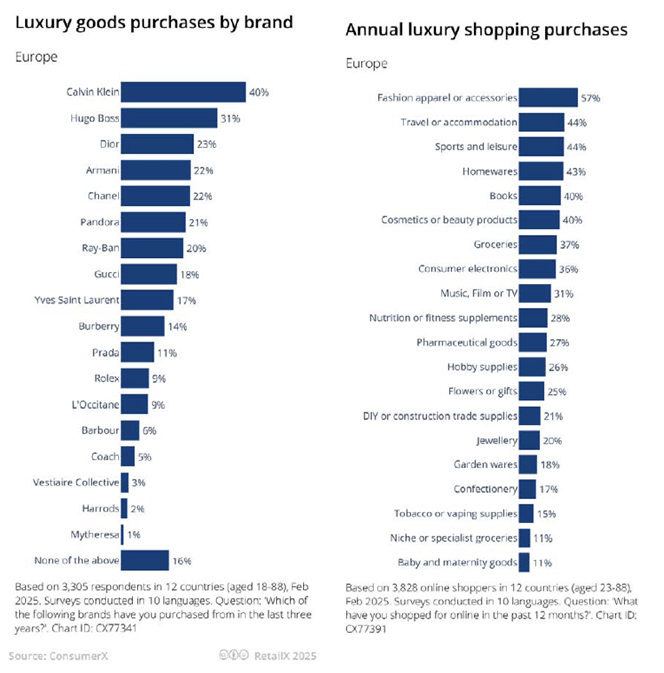

Europe’s Luxury Shoppers Are Going Mobile—And Changing Everything.

InternetRetailing lays out why mobile commerce is now the default for Europe’s luxury buyers. High spenders want frictionless, personalized shopping, and brands that fail to deliver on mobile are losing ground. The report runs through key stats, emerging tech, and why the “mobile-first” mantra is now a survival strategy for luxury. 👉 InternetRetailing

How Digital-Only Avatars Sold $7M of Stuff in Six Hours (and Nobody Noticed)?

Philipp Labkovskiy spotlights a new milestone for AI in commerce: two Chinese influencers let Baidu’s AI turn their entire video library into lifelike digital avatars, then raked in ¥55 million ($7M) in just six hours—no humans on screen. Thirteen million people tuned in, none the wiser. This is the next frontier for livestreaming and influencer marketing, and it’s not coming—it’s here. 👉 Philipp Labkovskiy

📰 Maze Briefing

📣Ecommerce Marketing

🇺🇸 Walmart to Launch Shoppable Ads on Vizio TVs. Walmart bought Vizio for $2.3B in 2024 and now plans to roll out shoppable ads on Vizio TVs, letting people buy stuff right from their couches. The goal is to juice up its ad business, which already pulled in $4.4B in fiscal year 2025. 👉 Bloomberg

🇺🇸 TikTok Shop Shifts to Chinese Leadership Amid Sales Struggles. TikTok Shop swapped out its US bosses for Chinese ones after US sales hit just $9B in 2024, way below the $17.5B target. This shake-up comes as TikTok stares down a possible US ban and regulatory heat. 👉 TechNode

🇺🇸 Meta Unveils New Ad Formats for WhatsApp. Meta’s dropping three new ad types—Channel subscriptions, Promoted Channels, and Ads in Status—into WhatsApp’s “Updates” tab for its 1.5B daily users. They’re keeping “Chats” ad-free and using minimal user data to target these ads. 👉 ChannelX

🇬🇧 Farfetch Boosts Ad Platform for Luxury Brands. Farfetch, now under Coupang’s wing, relaunched its ad platform to push luxury names like Versace and Dolce & Gabbana worldwide. It’s all about targeted ads to drive traffic and make brands’ ad bucks work harder. 👉 Yahoo Finance

🇺🇸 DoorDash Upgrades Ad Division with AI and Acquisitions. DoorDash spent $175M to buy ad-tech firm Symbiosys and added AI tools to help restaurants advertise better. It’s pushing to grow its retail media game and rake in more ad cash. 👉 Marketing Dive

🇺🇸 Pinterest and Instacart Team Up for Shoppable Ads. Pinterest and Instacart joined forces to turn Pinterest ads into instant buys through Instacart, aiming at shoppers ready to spend. They’re using Instacart’s data to sharpen ad targeting and track sales results. 👉 Social Media Today

🇺🇸 Disney and Amazon Join Forces for Streaming Ad Targeting. Disney and Amazon linked up, merging Disney’s ad exchange with Amazon’s platform to better target ads on Disney+, Hulu, and ESPN+. The deal cuts ad overlap and boosts impact with shared data. 👉 The Hollywood Reporter

🇨🇳 Temu's US Sales Plunge 25% After Ad Cuts. Temu’s US sales tanked over 25% from May to June 2025 after slashing ad spending, hit hard by Trump’s tariffs. Rivals like Shein and Amazon kept growing while Temu lost its pricing edge. 👉 Tech in Asia

🇺🇸 Ad Watchdog Challenges Microsoft's Copilot Claims. The BBB’s ad division called out Microsoft for claiming Copilot boosts productivity by 67%, 70%, and 75% without solid proof. Microsoft agreed to tweak or drop those numbers. 👉 The Verge

🛠️Ecommerce Software

🇺🇸 PayPal Launches Storefront Ads to Boost Merchant Sales. PayPal’s rolling out Storefront Ads so people can buy straight from ads using PayPal or Venmo, tackling merchants’ woes as AI eats into website traffic. They’re launching this summer in the U.S., with brand carousels coming later. 👉 PYMNTS

🇸🇪 Klarna Aims to Become AI-Driven Super App Despite Losses. Klarna’s boss, Sebastian Siemiatkowski, wants to make it an AI-powered super app, adding a $40/month U.S. mobile plan with Gigs. Even with a $99M Q1 loss, their U.S. market—100M users strong—is making money. 👉 CNBC

🇺🇸 Chargeflow Launches Automated Chargeback Solution for WooCommerce. Chargeflow dropped the first fully automated chargeback tool for WooCommerce, using AI to jack up win rates 4x for 4M+ merchants. CEO Ariel Chen says it’s a fix for the growing chargeback headache, plugging right into dispute systems. 👉 PR Newswire

🇯🇵 AnyMind Group Integrates with TikTok Shop in Japan. AnyMind Group linked its AnyX and AnyLogi platforms with TikTok Shop in Japan to streamline product and order data for brands. CEO Kosuke Sogo sees TikTok Shop as a goldmine, with seminars set for June 12 and 19 to hype it up. 👉 AnyMind Group

🇺🇸 Fermat Raises $45M for AI-Powered Commerce Platforms. Fermat nabbed $45M in Series B cash to build AI commerce platforms, personalizing shopping for brands like Unilever. CEO Rishabh Jain bragged about 5x revenue growth since 2024, eyeing an $8T e-commerce pie by 2027. 👉 PR Newswire

🇺🇸 Lily AI Launches Content Optimization for AI Search. Lily AI’s new tool tweaks product content for AI search engines like ChatGPT, fixing the 80% of shoppers who ditch searches over lousy info. CEO Purva Gupta says it’s built for retail’s shifting, AI-driven future. 👉 GlobeNewswire

🇺🇸 Amazon's AI Push Sparks Job Cut Concerns. Amazon’s CEO Andy Jassy says AI will slash corporate jobs, with experts warning entry-level roles could take a big hit. With 1.5M workers and 500K sellers using AI tools, efficiency’s up—but so are worries about the fallout. 👉 BBC News

🚚Ecommerce Logistics

🇺🇸 FedEx's EV Shift: Delivering on Circularity and Net-Zero. FedEx is racing to hit carbon-neutral by 2040, cutting emissions and growing its electric vehicle fleet fast. In FY24, they dropped Scope 1 emissions by 6.1% and boosted their EV count to over 8,000, saving big on fuel. 👉 EV Magazine

🌍 Middle East's E-Commerce Boom Faces Hurdles. The Middle East’s online shopping market could reach $76.29 billion in 2024, but rules and slow shipping are holding it back. Tools like AI and blockchain help, yet local tastes and competition keep it from going global. 👉 Logistics Middle East

🇺🇸 Retailers See Cargo Surge Coming. U.S. stores expect a huge import wave this summer, thanks to a tariff break with China, hitting 12.54 million TEUs in early 2025. But if tariffs kick back in, that rush could shrink fast. 👉 FreightWaves

🇨🇦 DHL Express Canada Strike Disrupts Operations. A lockout and strike hit DHL Express Canada, affecting 2,100 workers and halting deliveries over pay fights. Starting June 20, 2025, a nationwide shutdown will mess with big names like Temu and Lululemon. 👉 The Loadstar

🇸🇬 FedEx Expands Singapore Locker Network. FedEx set up over 1,000 smart lockers across Singapore for easy package drop-offs, boosting online shopping convenience. They tie into FedEx Delivery Manager, letting folks track and tweak deliveries. 👉 FedEx Newsroom

That's it for today! Before you go we’d love to know what you thought of today's maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team