The Maze: Capital is no longer spread evenly. In 2025, VC flowed hard into fewer categories and even fewer companies, pulling value creation forward and leaving broad consumer models behind. The pattern repeats across AI, defense, SaaS, and startup cohorts.

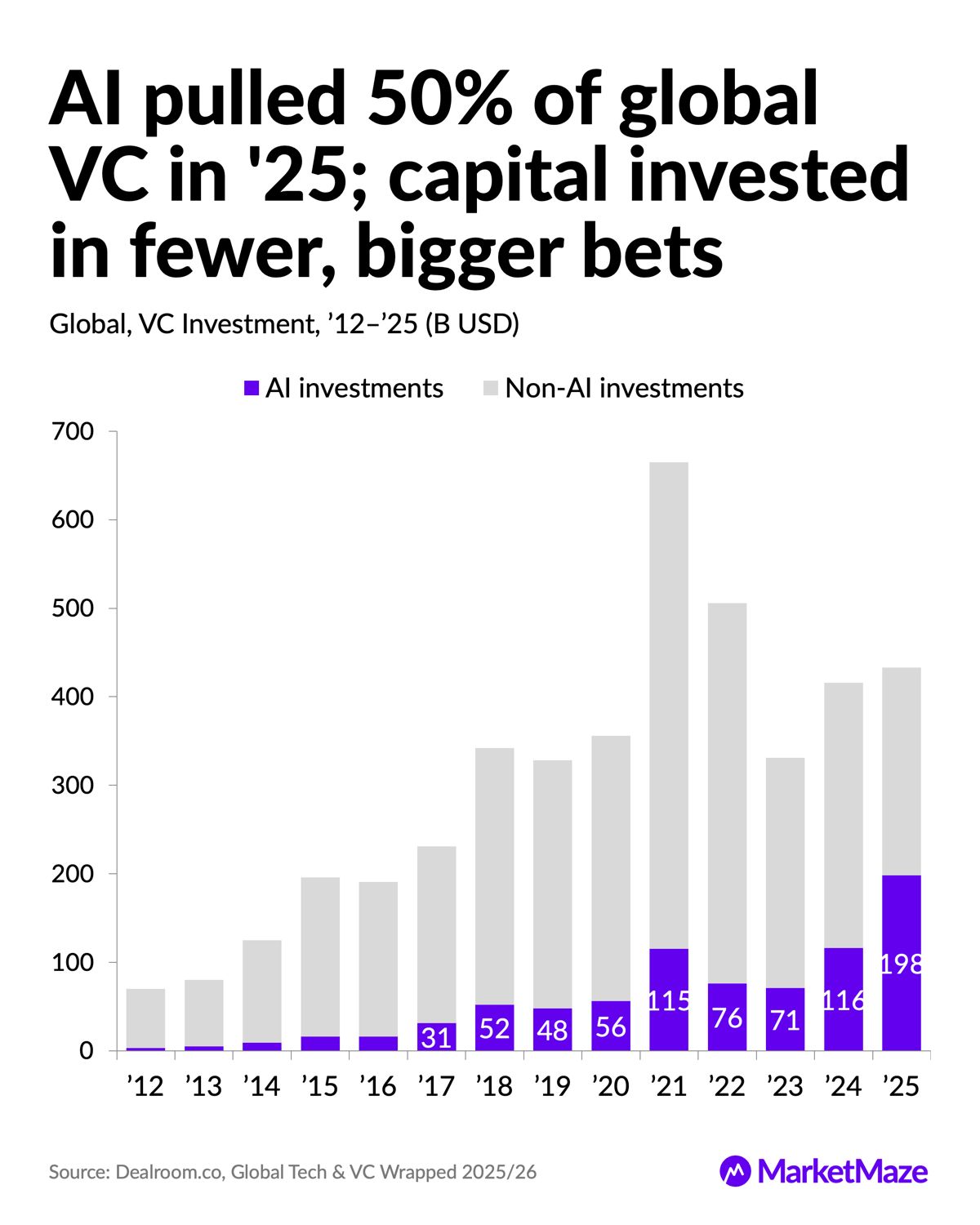

• AI concentration: AI absorbed $198B in 2025, nearly 50% of global VC, while total deal count fell, signaling bigger checks into fewer platforms

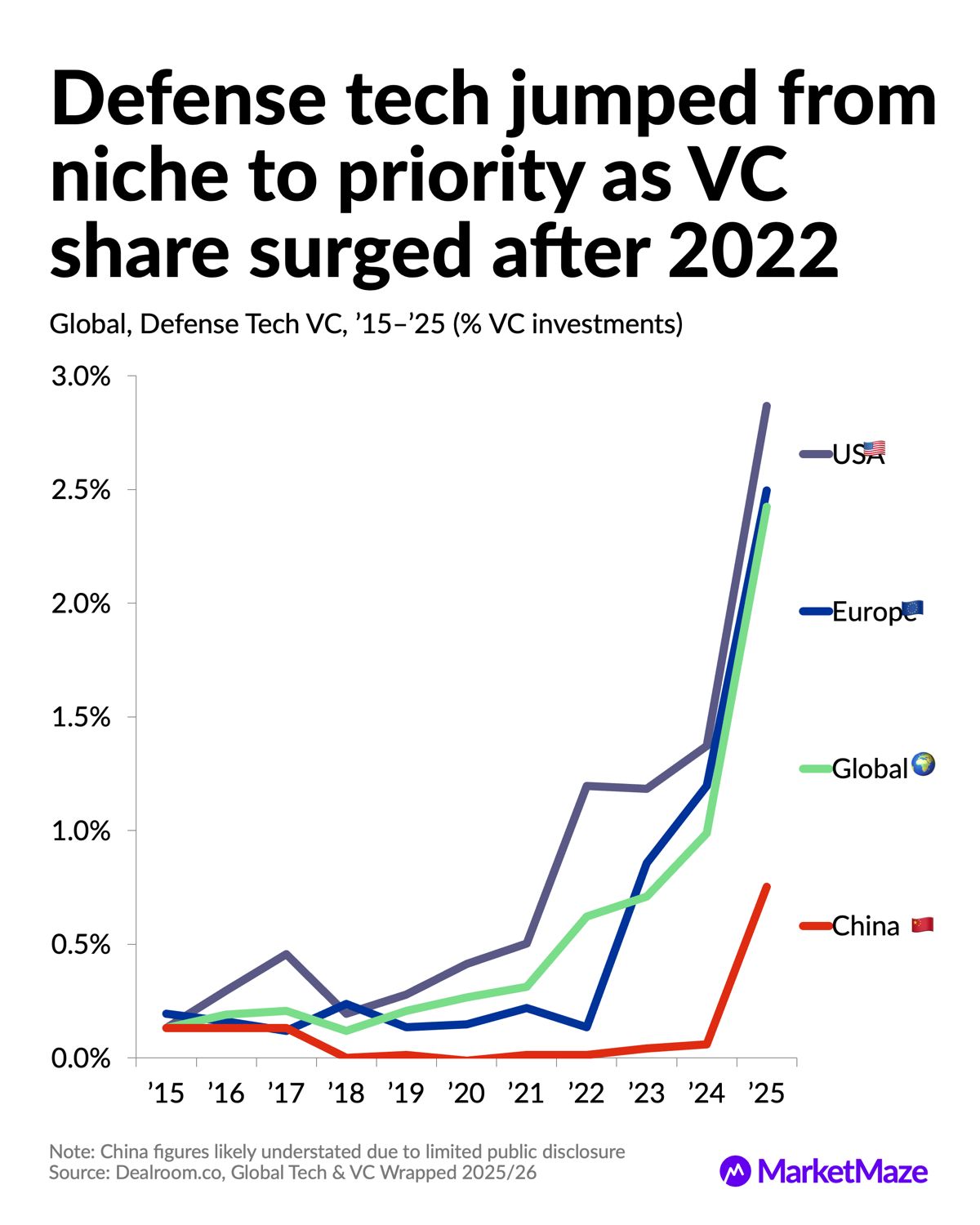

• Defense inflection: Defense tech jumped from ~0.3% of VC pre 2022 to ~2% globally by 2025, led by the US and Europe after security priorities reset

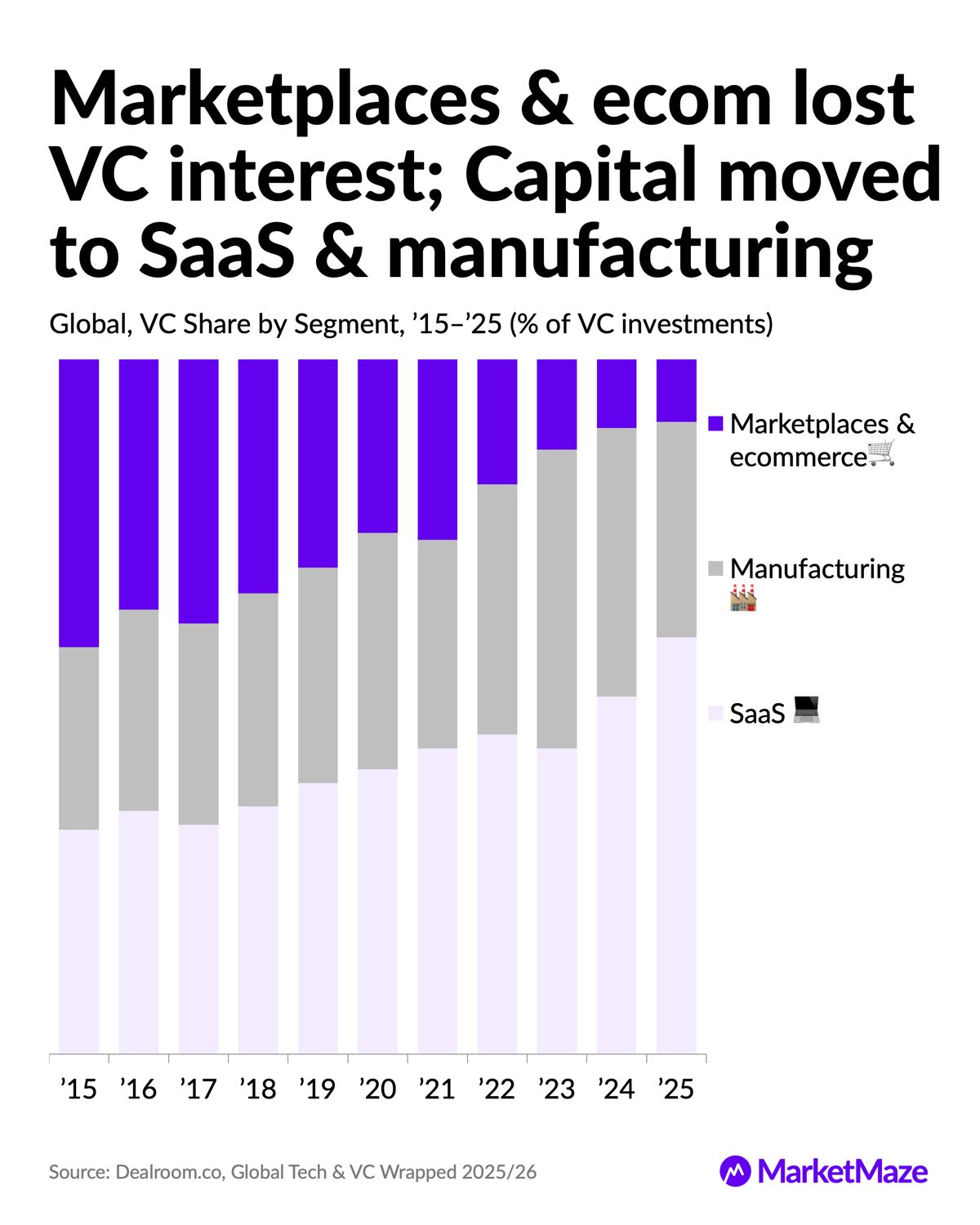

• Segment rotation: Marketplaces fell from ~40% of VC in 2015 to <10% in 2025 as SaaS climbed to ~60% and manufacturing gained share

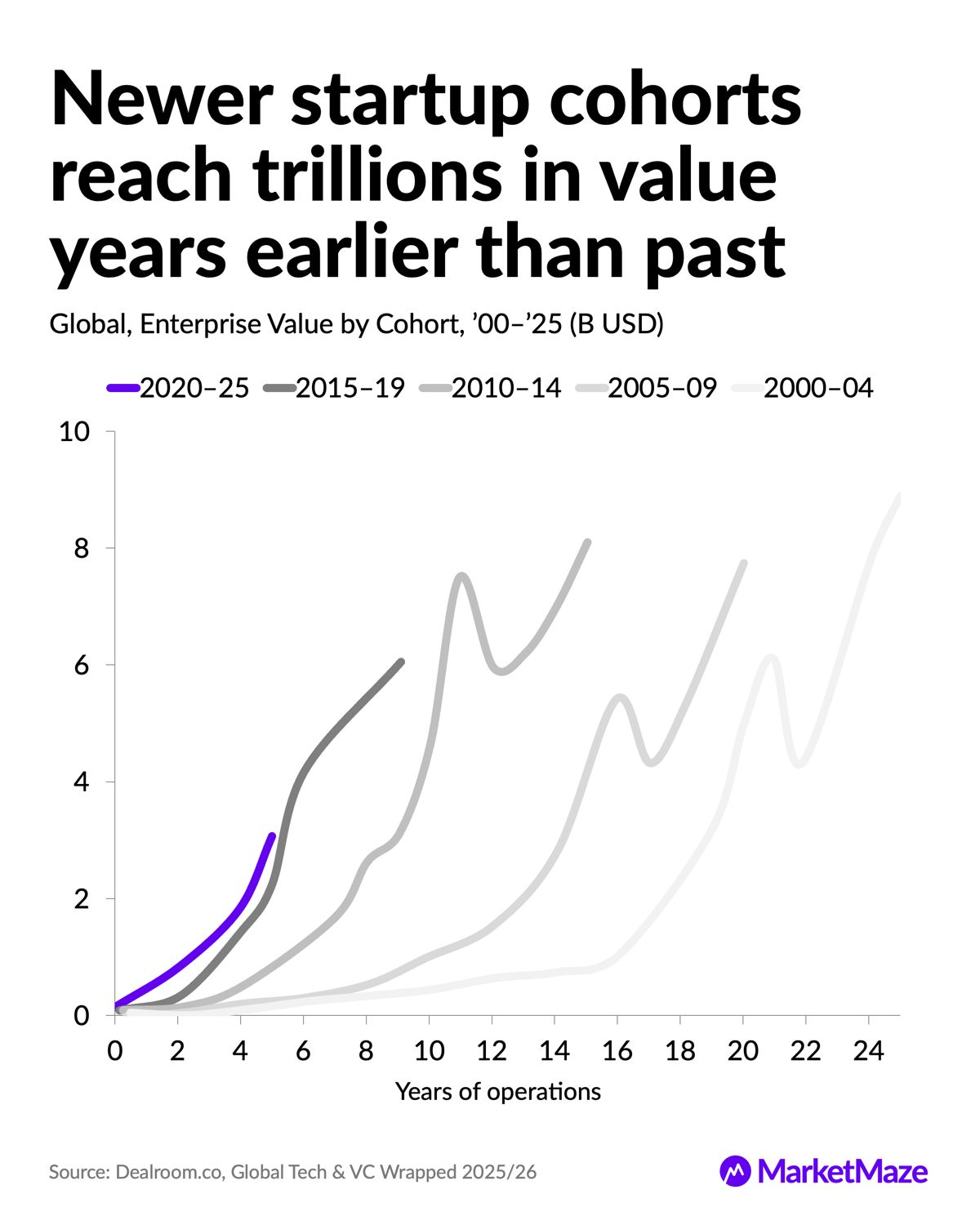

• Time compression: Startups founded after 2015 reached trillions in enterprise value years earlier than 2000s cohorts, even with less capital

Why it matters: Capital now rewards speed, scale, and strategic relevance. Ecommerce and consumer aggregation face tougher math, while software and hard tech pull investment forward. For operators and investors, timing matters more than ever.

🤖 AI Surge

Half of global VC went to AI in 2025

AI stopped being a category and became the default destination for venture dollars. By 2025, capital clustered around foundation models, infrastructure, and platforms with global reach, accelerating scale but narrowing the field.

• AI funding rose from single digit billions in 2012 to $198B in 2025, roughly matching all non AI categories combined

• Mega rounds drove the shift, with fewer deals but larger checks, as compute, data, and talent costs favored scale leaders

• The post 2021 correction hit non AI harder, while AI funding rebounded faster and stayed structurally elevated

The result is a winner takes most dynamic where capital follows perceived inevitability. That pulls future value forward but raises the cost of being wrong.

🛡️ Defense Shift

Security priorities reshaped venture allocations

Defense tech moved from taboo to strategic. After 2022, venture money followed governments, budgets, and urgency, pushing the sector into the core of tech investing.

• US defense tech share rose to nearly 3% of VC by 2025, with Europe close behind as procurement and policy aligned

• Global defense share crossed ~2%, up from ~0.3% pre 2022, marking a clear regime change

• Drones, cyber, space, and dual use software benefited from faster adoption cycles and clearer buyers

Defense remains hard. Long sales cycles and regulation still punish weak execution. But the direction of travel is clear and sticky.

🛒 Marketplace Fade

Capital rotated away from consumer aggregation

Marketplaces once dominated VC portfolios. A decade later, they sit on the margins as capital chases margins, predictability, and enterprise spend.

• Marketplace share fell from ~41% of VC in 2015 to ~9% in 2025 as growth slowed and consolidation took over

• SaaS rose from ~32% to ~60% of VC, favored for recurring revenue, pricing power, and global scalability

• Manufacturing gained share as software fused with hardware in automation, robotics, and supply chains

Marketplaces are not dead. They are mature. Value now comes from optimization and M&A, not greenfield disruption.

🚀 Faster Cohorts

Startups reach scale years earlier

Newer startups are not just growing faster. They are hitting massive enterprise value milestones much earlier in their life cycles.

• 2015 to 2019 cohorts reached multi trillion value in under 10 years, far ahead of 2000s cohorts

• The 2020 to 2025 cohort crossed ~$2T within five years despite tighter funding conditions

• Cloud infrastructure, global distribution, and capital concentration compressed the value creation timeline

The clock has sped up. Miss the early innings and most of the upside is already gone.

Editable Slides & Sources:

🔒 Available for MarketMaze+ subscribers

🎓 Found this insightful?

📩 Get free ecommerce news & insights, subscribe to the MarketMaze newsletter

📈 Join the MarketMaze+ Platform to access hundreds of insights like this, resources, and exclusive reports

📘 Understand retail media with our 60+ pg white paper or marketplace landscape with our 300+ Marketplace database

🔬 Ask for on-demand insight or report to make better decisions. Reach out here.

That’s it!

Before you go we’d love to know what you thought of this maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team