TODAY’S MAZE

Happy Black Friday! It used to be about crowded malls and impulse buys. This year it revealed something bigger: the shift from consumer frenzy to business planning. Companies aren’t just chasing discounts — they’re using the weekend to lock in suppliers, influence budgets and move stock before Q1 even begins.

At the same time, shoppers are changing how they discover products. More Europeans now start their holiday search with AI tools, not retailers. And while the UK argues over delayed tax reforms that favour cross-border giants, cyber threats remind every retailer how fragile peak season really is.

In today’s MarketMaze:

B2B’s Black Friday turn

AI-led holiday discovery

UK’s tax loophole fight

Holiday cybersecurity surge

Black Friday vs Cyber Monday gaps

+

Handpicked recent news you need to know:

🏬 Ecommerce Players (Marketplaces, e-Retailers, D2C)

📣 Ecommerce Ecosystem (Marketing, Tools, Logistics)

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Black Friday has quietly become a B2B sales engine, not a consumer holiday. Companies now use it to lock in suppliers, move inventory and influence annual budgets. The most telling shift is that B2B sellers report stronger YoY gains than consumer brands, showing the event is evolving into a predictable procurement moment rather than a one-day impulse spree.

In 2024, 63% of B2B retailers reported higher Black Friday sales than the year before, and 48% said revenue beat a normal period, with large firms the biggest winners as 69% expect Black Friday to lift yearly results.

The participation rate is rising fast: 85% of B2B sellers plan to run offers in 2025 across 19 surveyed countries by DHL, using the event to influence supplier choice and reactivation cycles for existing clients.

Shopper behaviour pushes the shift. Around 80% abandon carts when preferred delivery options are missing, while free and trusted delivery drives cross-border B2B purchases, turning logistics quality into a deal-maker.

Why it matters: Black Friday has become a reliable B2B demand trigger, not just a consumer holiday, pulling procurement decisions forward. Reliable delivery and transparent pricing now matter more than deep cuts. The long-term winners will be the companies that treat peak season as a trust and logistics competition, not a race to slash prices.

FROM OUR PARTNERS

Your competitors are already automating. Here's the data.

Retail and ecommerce teams using AI for customer service are resolving 40-60% more tickets without more staff, cutting cost-per-ticket by 30%+, and handling seasonal spikes 3x faster.

But here's what separates winners from everyone else: they started with the data, not the hype.

Gladly handles the predictable volume, FAQs, routing, returns, order status, while your team focuses on customers who need a human touch. The result? Better experiences. Lower costs. Real competitive advantage. Ready to see what's possible for your business?

MAZE DEEP DIVE

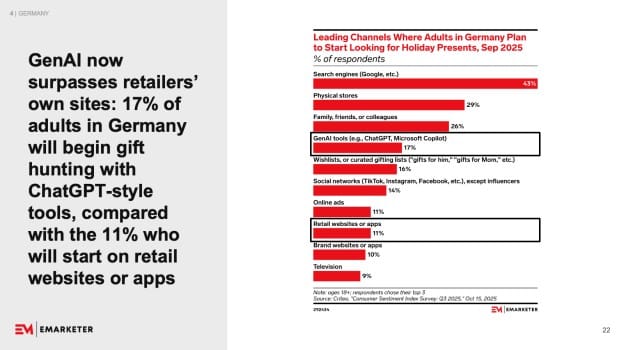

The Maze: Holiday shopping in Western Europe is shifting, and the first click is no longer on a retailer’s site. 17% of German adults now begin their gift hunt with GenAI tools like ChatGPT, ahead of retail apps and brand websites. Search engines still lead, but the rise of AI assistants signals a new gatekeeper emerging between shoppers and merchants, compressing browsing, comparing, and shortlisting into one guided conversation.

In September 2025, 43% of German adults start shopping with search engines, but AI tools already capture a meaningful 17 %, ahead of retailer sites at 11% and brand sites at 10%.

Younger shoppers drive this shift, with 52% of Gen Z and Millennials planning to shop during Black Friday, compared with 32% of Gen X and Boomers.

Across Europe, habits diverge as Italy and Spain lead seasonal ecommerce growth while France grows only 0.5% and the UK sees ecommerce take one third of all holiday retail sales.

Why it matters: AI is becoming the front door of shopping, pushing retailers to optimise product data for machines as much as for people. Discovery moves from pages to prompts, weakening traditional site traffic and brand-controlled entry points. For ecommerce teams, competing for visibility now means showing up in the conversation before the shopper even opens a browser.

FROM OUR PARTNERS

With KeepCart or Without It — See the Margin Difference

Every checkout leak costs you. KeepCart shows exactly how coupon extensions quietly shrink your revenue — and how blocking them can recover hundreds per order. Your profit margin deserves a before-and-after moment.

Top brands like Bucketlisters and Quince have already seen the difference.

MAZE STORY

The Maze: Major UK retailers are slamming the government for delaying the end of the de minimis tax loophole—which currently exempts imported goods under £135 from customs duty—until 2029, a timeline they argue unfairly benefits rivals like Shein and Temu and prolongs damage to domestic high street brands.

The British Retail Consortium highlights the sheer scale of the arbitrage, noting that 1.6 million parcels now arrive in the UK every day, which is double the volume seen just last year.

UK executives criticized the four-year wait because it allows overseas competitors to continue exploiting the loophole while domestic online sellers are already paying duties when exporting low-value goods to the US and EU.

The controversy escalated across the channel when Belgian retailers called bpost’s expanded partnership with Temu “a slap in the face,” alleging the platform circumvents customs controls through false valuations and misreported data.

Why it matters: This four-year delay gives Chinese platforms a final, massive window to solidify market share before their primary logistics advantage evaporates, forcing Western retailers to battle an uneven playing field through 2029. Operations and compliance teams must prepare for new friction points post-2029 as the global harmonization of duty requirements makes real-time tariff classification essential for maintaining cross-border margins.

MAZE STORY

The Maze: Retailers enter Black Friday with record traffic and record exposure. Teams rush out new servers and updates, creating blind spots that bad actors know how to find. The real story is that cyber risk now scales faster than sales, and every misconfigured checkout page or plugin becomes a revenue threat. The holiday season is no longer a promo window; it is a live-fire test of a retailer’s digital resilience.

In late 2025, Tenable’s Scott Caveza warned that security teams face more than 302k known software flaws, while many retailers cut staffing by over 50% during holiday weekends, giving attackers a predictable window to strike.

Between early November and Black Friday, retail-themed phishing attacks jumped 600%, with brand spoofing of Walmart, Target and Best Buy rising more than 2,000%, plus millions of fake Black Friday emails hitting Australian consumers.

Ransomware hits climbed roughly 58% in Q2 2025, and the Marks and Spencer breach in May disrupted payments, click-and-collect and deliveries for weeks, wiping billions in value and showing how peak-season outages escalate into board-level crises.

Why it matters: The holiday rush amplifies every weak spot in a retailer’s stack. Attackers follow incentives, and November offers both traffic and emotional shoppers clicking fast. Companies that win the season will be those treating visibility, authentication and configuration hygiene as revenue engines, because lost trust costs more than any discount.

DATA TREASURE

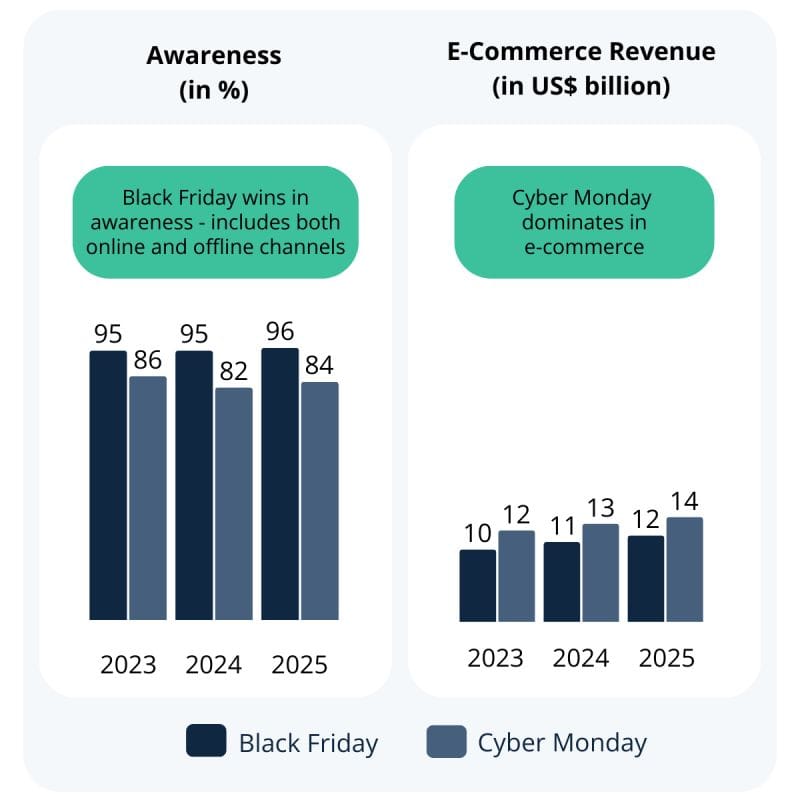

The Maze: Shoppers everywhere know Black Friday, but Cyber Monday quietly wins the online checkout. Global awareness for Black Friday sits near universal levels while Cyber Monday trails, yet US online revenue flips the scoreboard. The weekend has become a behavioral funnel where people browse on Friday, compare over the weekend, and convert on Monday. Rising use of digital payments and BNPL pushes even more spending into Monday’s late surge.

n 2024 US consumers spent roughly 13.3 billion dollars online on Cyber Monday while Black Friday generated about 10.8 billion, marking the largest digital shopping day of the year.

Between 2023 and 2025 Cyber Monday’s online revenue grows by around 2 billion dollars while Black Friday remains lower despite higher global awareness.

Surveys show 95 to 96% of shoppers recognize Black Friday globally while Cyber Monday ranges in the mid 80s, yet online buyers still shift part of their big ticket spending into Monday.

Why it matters: The peak shopping weekend is no longer a single-day sprint. It is a four-day digital funnel where Friday drives discovery and Monday captures conversions. For ecommerce leaders the winner is clear: Black Friday sets the stage, but Cyber Monday delivers the money.

BRIEFING

🏬 Everything else in Ecommerce & key players

🇺🇸 Macroeconomic warnings surfaced as Goldman Sachs pointed to growing weakness in the US jobs market, potentially leading 62% of shoppers to prioritize deals and affordability this Q4.

🌍 UK marketplace OnBuy announced it is achieving 30% month-over-month growth across Europe, signaling strong expansion and intensifying competition on the continent.

🇺🇸 Kohl’s reported that its Q3 ecommerce sales grew at double the rate of its overall revenue, suggesting the digital channel is mitigating broader financial decline for the retailer.

🇨🇳 Puma shares surged 17% following reports that Chinese sports retail giants Anta Sports and Li Ning, along with Japan’s Asics, are considering a takeover bid.

🇰🇷 The K-beauty market surge, fueled by TikTok, has initiated a sharp US retail race as giants like Ulta and Walmart rush to significantly expand their offerings in the high-growth cosmetics category.

🇺🇸 Urban Outfitters Inc. achieved record quarterly sales of $1.53 billion, driven by double-digit growth across its core retail, subscription service (Nuuly), and wholesale segments.

BRIEFING

📣Everything else in Ecommerce ecosystem

🇺🇸 Google Ads is rigorously testing 'Nano Banana Pro AI,' a new tool specializing in rapid visual asset generation, optimized for quickly creating seasonal, mood, and lighting variations for ad visuals.

🇬🇧 eBay collaborated with InPost to expand drop-off and collection options for sellers and buyers using lockers and parcel shops, boosting convenience for out-of-home delivery services.

A report indicates that embedded finance tools are helping 64% of online marketplaces reduce customer churn, making them core to competitive strategy.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

RECOMMENDED NEWSLETTERS

Craving more sharp reads? Check out these MarketMaze-recommended newsletters.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team