TODAY’S MAZE

Happy Wednesday! Amazon is shuttering all Fresh and Go locations, ending its standalone cashierless experiment. The giant is pivoting back to Whole Foods and pure logistics.

Investors cheered the move, but Instacart shares took a hit. The question remains: is Amazon’s path to grocery dominance purely about logistics speed?

In today’s MarketMaze focus:

Amazon closes cashierless stores

Anta acquires Puma stake

Nike automates supply chain

EU mandates circular fashion

Global ecommerce gravity shifts

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Amazon announced plans to shutter all Amazon Fresh and Amazon Go locations to prioritize Whole Foods expansion and delivery, citing difficult lease economics for the cashierless formats.

Amazon addresses Whole Foods' limited assortment by testing an automated micro-fulfillment concept that dispenses mainstream brands like Tide and Pepsi onsite.

"Just Walk Out" technology shifts from a proprietary retail feature to a licensing business currently installed in over 360 third-party locations like stadiums and airports.

Wall Street endorsed the move as Amazon shares rose while rival Instacart fell nearly 6%, signaling market confidence in the aggressive push toward same-day delivery dominance.

Why it matters: This pivot signals that Amazon recognizes its competitive advantage lies in logistics infrastructure rather than trying to replicate the traditional brick-and-mortar grocery experience.

How do you expect large retailers like Amazon to use physical stores in the future?

- 🏪 Fulfillment hubs (local delivery, returns, and pickup for online orders)

- 🛒 Assortment showcases (limited selection to support online discovery)

- 📦 Micro-warehouses (automated sites focused on fast-moving goods)

- 🧪 Brand labs (testing new formats, tech, and private labels)

- 🏬 Traditional stores (full grocery or retail experience for walk-in shoppers)

FROM OUR PARTNERS

Want to get the most out of ChatGPT?

ChatGPT is a superpower if you know how to use it correctly.

Discover how HubSpot's guide to AI can elevate both your productivity and creativity to get more things done.

Learn to automate tasks, enhance decision-making, and foster innovation with the power of AI.

MAZE STORY

The Maze: Chinese sportswear giant Anta Sports has acquired a 29% stake in Puma for €1.5 billion, officially replacing the Pinault family as the German brand's largest shareholder. The all-cash deal positions Anta to leverage its massive retail network to support Puma's global growth.

The transaction prices Puma shares at €35 each, representing a significant premium over the recent closing price of €21.63.

Anta intends to seek representation on Puma's supervisory board to assist with strategy but confirmed it has no immediate plans to initiate a full takeover.

This move aligns with Anta's "single-focus, multi-brand" strategy, adding Puma's global footprint to a portfolio that already includes Fila and Jack Wolfskin.

Why it matters: This acquisition cements Anta’s status as a global heavyweight capable of revitalizing heritage brands through superior execution capabilities. It signals a major shift in the sportswear landscape as Asian conglomerates aggressively expand their influence over European legacy markets.

FROM OUR PARTNERS

Ready to Plan Your Retirement?

Knowing when to retire starts with understanding your goals. When to Retire: A Quick and Easy Planning Guide can help you define your objectives, how long you’ll need your money to last and your financial needs. If you have $1 million or more, download it now.

MAZE STORY

The Maze: Nike is eliminating approximately 775 warehouse roles to accelerate supply chain automation while simultaneously investigating a massive 1.4TB data breach claimed by the ransomware group World Leaks.

CEO Elliott Hill describes the logistics consolidation across Tennessee and Mississippi as vital to the "middle innings" of a turnaround strategy aimed at improving long-term EBIT margins.

The hacking collective formerly known as Hunters International claims to have exfiltrated over 188,000 files targeting internal manufacturing workflows and factory training resources rather than customer databases.

Management continues to reshuffle the executive deck to support this streamlining, recently appointing new regional leadership for Greater China to help the brand regain its competitive footing.

Why it matters: Retail giants face a precarious dual challenge of aggressively upgrading physical infrastructure for efficiency while defending proprietary product data against increasingly coordinated digital extortion attempts.minority stakes into broader market dominance.

DATA TREASURE

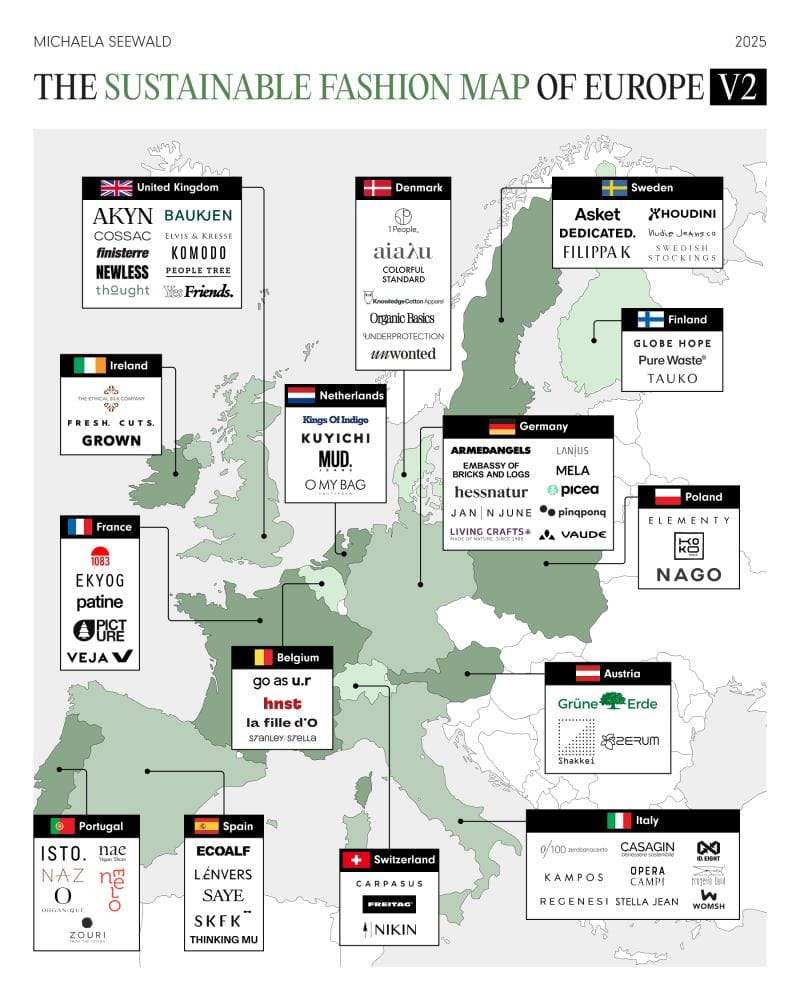

The Maze: Sustainability in fashion is moving from values to operations. Regulation turns circularity into a requirement, not a brand choice, and forces new distribution models.

Europe’s sustainable fashion market is estimated at €2.4B, growing 20%+ annually, driven by materials innovation, durability, and resale readiness.

From 2026, unsold textiles can no longer be destroyed, pushing brands toward resale, repair, donation, and controlled off-price flows to manage inventory.

Brands already design for long life, repair, and traceability, while marketplaces become the plumbing that makes circular models scalable and profitable.

Why it matters: Circular fashion needs infrastructure. Platforms that verify, resell, and redistribute inventory will capture value brands are legally forced to unlock.

DATA TREASURE

The Maze: Global e-commerce is concentrating fast. Scale follows population and growth, and Europe is no longer where most new volume is created.

BRICS and NAFTA generate 74% of global e-commerce revenue, with $2.2T and $1.1T respectively in 2024, dwarfing other regions.

EU-27 holds 9% share and grows about 5% annually, while ASEAN grows ~13%, narrowing the gap despite starting from a smaller base.

Marketplaces mirror this shift, with Amazon dominating mature regions, while Shopee, Pinduoduo, Flipkart, and Mercado Libre scale inside faster-growing markets.

Why it matters: Slow growth markets become margin games. European players must optimize efficiency at home and attach themselves to faster-growing regions to stay relevant.

BRIEFING

🏬 Everything else in Ecommerce & Big Tech

🇺🇸 Amazon prepares to cut thousands of corporate roles, specifically in AWS and HR, as part of a restructuring initiative to reduce bureaucracy.

🇺🇸 eBay banned the use of AI "buy-for-me" agents, updating its terms of service to prohibit third-party bots from interacting with the marketplace without prior consent.

🇫🇷 LVMH reported a 5% revenue decline and margin squeeze, citing currency volatility and an Asian market slowdown as key factors impacting its fashion and leather goods divisions.

🇺🇸 Pinterest cuts 15% of its staff, laying off hundreds of employees to reallocate resources toward its AI-driven transformation initiatives.

🇺🇸 Amazon rolled out AI-generated ad collections, a new Sponsored Brands format that replaces custom headlines with AI text and requires a minimum of three products.

🇺🇸 Amazon added QuickBooks integration to Seller Central, allowing merchants to connect directly, though some sellers worry about sharing granular financial data.

🇪🇺 The EU & India signed a historic free trade agreement that eliminates tariffs on over 90% of goods, promising a massive boost for cross-border textile and apparel trade.

🌍 Global Retailers saw holiday returns hit $181 billion, as return rates jumped to 12.2% in early January with shoppers sending back a massive volume of purchases.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team