TODAY’S MAZE

Happy Sunday! Amazon is building massive retail supercenters that rival the scale of big-box stores. This move blends the speed of online shopping with a physical footprint.

By turning these stores into logistics hubs, the company aims to control every step of the shopping process. Can legacy retailers survive once Amazon masters the physical aisle?

In today’s MarketMaze focus:

Amazon builds retail supercenters

JPMorgan takes Apple Card

Retail import volumes drop

Economic freedom drives wealth

Walmart advertising revenue surges

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Amazon is scaling its physical presence with a 228,000-square-foot mega store concept in Illinois that combines grocery shopping with general merchandise and on-site fulfillment. This move signals a direct offensive against legacy big-box retailers by merging Prime convenience with physical scale.

This massive facility rivals the footprint of modern Walmart Supercenters and marks a major shift for the tech giant into a category that defined American retail for decades.

The new format includes prepared food options and dedicated spaces where customers can collect online orders within an hour via the company's emerging rush pickup service.

While its existing Amazon Fresh locations focus on groceries, this expansion adds housewares and apparel to capture a broader share of the $100 billion annual spend from its massive US shopper base.

Why it matters: Bridging the gap between digital speed and physical scale forces traditional retailers to defend their territory while Amazon solves the last mile by turning storefronts into logistics hubs. The future of retail dominance depends on owning the entire customer journey from screen to shelf.

FROM OUR PARTNERS

The best marketing ideas come from marketers who live it. That’s what The Marketing Millennials delivers: real insights, fresh takes, and no fluff. Written by Daniel Murray, a marketer who knows what works, this newsletter cuts through the noise so you can stop guessing and start winning. Subscribe and level up your marketing game.

MAZE STORY

The Maze: U.S. ports face a significant cooling period as container imports continue their year-over-year slide through early 2026. Data from the Global Port Tracker report suggests retailers are entering a shipping lull compounded by shifting trade policies.

Shipping activity typically increases in January as brands accelerate cargo deliveries to beat the Asian factory shutdowns that occur during Lunar New Year celebrations.

Forecasters predict that March 2026 will mark the steepest decline in the forecast period with import volumes expected to plummet 12.4% annually.

Supply chain leaders must manage inventory levels carefully while facing chronic uncertainty from potential tariff changes that disrupt long-term planning across the sector.

Why it matters: Adjusting operations during this lull tests the resilience of ecommerce margins as brands balance carrying costs against maintaining available inventory. Reliability returns to the supply chain in May, but until then, staying agile allows companies to navigate volatility and protect their bottom lines.

FROM OUR PARTNERS

Get the investor view on AI in customer experience

Customer experience is undergoing a seismic shift, and Gladly is leading the charge with The Gladly Brief.

It’s a monthly breakdown of market insights, brand data, and investor-level analysis on how AI and CX are converging.

Learn why short-term cost plays are eroding lifetime value, and how Gladly’s approach is creating compounding returns for brands and investors alike.

Join the readership of founders, analysts, and operators tracking the next phase of CX innovation.

MAZE STORY

The Maze: Apple is transitioning its flagship credit card partnership to JPMorgan Chase in a $2.2 billion deal following significant consumer lending losses at Goldman Sachs. This strategic shift stabilizes the platform for 12 million cardholders during an estimated 24-month transition while keeping core features like Daily Cash intact.

Goldman Sachs initially sought to disrupt consumer finance but eventually reported $1 billion in losses because the card’s unique design encourages rapid debt paydown and charges zero consumer fees.

Chase brings established banking systems to the partnership, which enables maintaining high-engagement features like the high-yield Savings account currently offering a 4.15% annual percentage yield.

Mastercard remains the exclusive payment network for the program despite a reported $100 million offer from Visa to replace them during the complex transition occurring between issuing banks.

Why it matters: This pivot marks the end of Apple’s experiment with a non-traditional banking partner as it returns to the stability of a financial incumbent. For ecommerce leaders, the deal protects a high-conversion payment ecosystem that successfully integrates hardware financing with daily consumer spending habits.

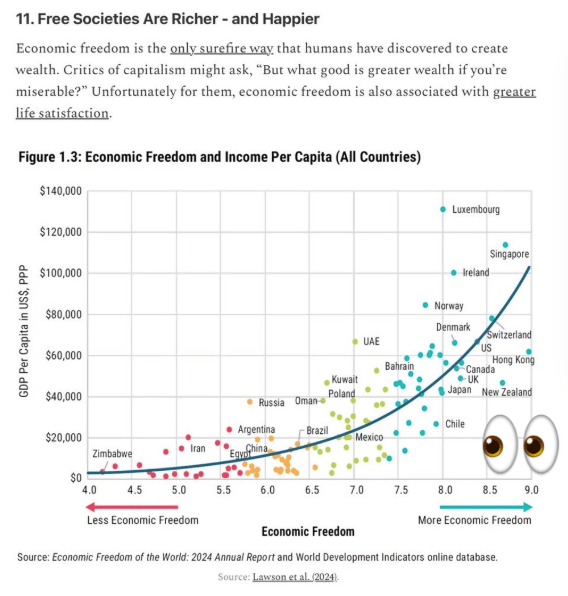

DATA TREASURE

The Maze: Economic freedom and income rise together, sharply. Countries with open markets, stable rules, and strong property rights cluster at far higher income levels than controlled economies. The curve steepens fast once institutions work.

High-freedom economies like Luxembourg, Singapore, Ireland, and the US sit above $70K GDP per capita, while low-freedom countries cluster below $20K, showing wealth compounds where rules are predictable.

The relationship accelerates past a threshold, meaning small institutional improvements can unlock outsized income gains once trust and enforcement are in place.

The pattern holds across regions, suggesting long-term consumption power depends more on systems than short-term stimulus.

Why it matters: Ecommerce demand follows institutions. Disposable income, payment trust, and logistics competition scale faster where economic freedom is high. Market size is not just population, it is rule quality.

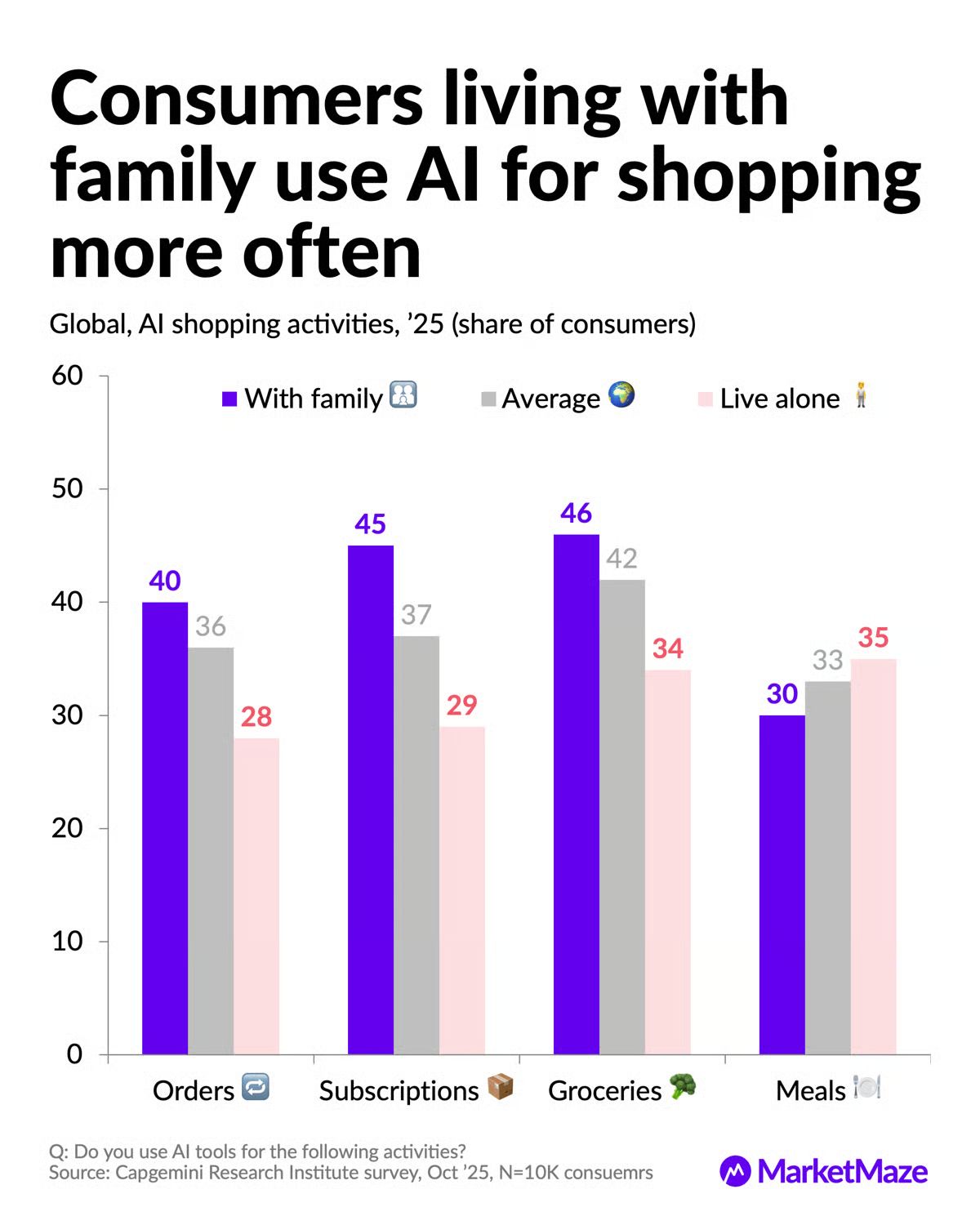

DATA TREASURE

The Maze: AI shopping has crossed from novelty to habit. New consumer data shows who adopts first, what drives trust, and where automation sticks. The signal is clear: context matters more than age, and routine beats hype.

Families use AI shopping tools 6 to 17 pp more than solo consumers, peaking at groceries at 46% vs 34%

75% of consumers are open to Gen AI recommendations, while 53% already bought based on AI suggestions

Comfort with AI shopping assistants is stable across Gen Z, Millennials, Gen X, and Boomers at ~49 to 51%

20% of consumers already use AI assistants several times a week or daily for shopping automation

Why it matters: AI is no longer just discovery tech. It is becoming execution infrastructure for ecommerce. Platforms that own routines win share, data, and loyalty at the same time.

BRIEFING

🏬 Everything else in Ecommerce & Big Tech

🇺🇸 Walmart launched Marty, a new conversational AI agent for Walmart Connect designed to help advertisers more efficiently manage and measure campaigns within its retail media network.

🇺🇸 Google is testing expanded video asset limits in Performance Max, giving advertisers more creative variety without requiring them to fragment their campaign structures.

🇺🇸 Google rolled out asset group A/B testing for Performance Max to all users, allowing advertisers to experiment with creative combinations via a new beta feature.

🇺🇸 Amazon is integrating its Alexa assistant into Samsung TVs and BMW vehicles, signaling a major push for voice-commerce to live across third-party hardware ecosystems.

🇭🇰 AS Watson is preparing a $2 billion dual IPO in London and Hong Kong for the parent company of Superdrug and Kruidvat, marking one of the year's most anticipated retail listings.

🇯🇵 Uniqlo surged to a record $1.3 billion quarterly profit, with strong international growth helping parent company Fast Retailing offset rising trade costs and potential global headwinds.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team