TODAY’S MAZE

Happy Thursday! Amazon is looking to solidify its generative AI position by reportedly entering discussions for a massive $10 billion partnership with OpenAI.

This potential investment aims to unlock strategic access to advanced models, integrating them deeply across Amazon’s e-commerce and conversational platforms.

In today’s MarketMaze:

Amazon’s potential $10B OpenAI deal

AWS unifies AI, silicon development

Shopify boosts merchant conversion tools

Amazon Gains Ground

AI Crown Rotates

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Amazon is reportedly in "very fluid" discussions to deploy massive capital into OpenAI, potentially committing $10 billion to gain strategic access to the AI leader’s capabilities. This financial and technical alliance aims to deepen Amazon's AI infrastructure and integrate advanced models into its core e-commerce and Alexa platforms.

The proposed investment, which could reportedly value the AI startup at up to $500 billion, includes provisions for OpenAI to utilize Amazon’s Trainium chips for AI workloads, directly challenging competitors like Nvidia and Google, as reported by sources familiar with the matter to at least $10 billion.

A critical component involves OpenAI selling an enterprise version of ChatGPT to Amazon, potentially allowing for integration with new shopping features Amazon is developing across its mobile apps and conversational interfaces.

These talks highlight OpenAI’s mission to widen its partnership base and secure crucial computing resources ahead of its anticipated potential $1 trillion IPO, despite Microsoft’s existing exclusive IP rights until 2032.

Why it matters: This major strategic pairing could dramatically accelerate the deployment of generative AI across Amazon’s product discovery and conversion funnels, forcing marketplaces and sellers to adapt quickly to conversational commerce. Executives must assess how AI-powered search, recommendation, and ad placements will shift customer journeys and potentially redefine traditional ad revenue models.

FROM OUR PARTNERS

Go from AI overwhelmed to AI savvy professional

AI keeps coming up at work, but you still don't get it?

That's exactly why 1M+ professionals working at Google, Meta, and OpenAI read Superhuman AI daily.

Here's what you get:

Daily AI news that matters for your career - Filtered from 1000s of sources so you know what affects your industry.

Step-by-step tutorials you can use immediately - Real prompts and workflows that solve actual business problems.

New AI tools tested and reviewed - We try everything to deliver tools that drive real results.

All in just 3 minutes a day

DATA TREASURE

The Maze: While everyone debates artificial intelligence and retail media, Amazon is winning the old fashioned way. Its US retail sales are growing roughly twice as fast as Walmart, and if that pace holds, Amazon nearly matches Walmart’s scale by 2027. Compounding beats commentary.

In Q3 2025, Walmart US revenue reached $120.7B with about 5.1% growth, while Amazon followed at $106.3B growing 11.2%, a gap that narrows quickly at this scale.

Projecting current trends forward puts Walmart near $133B and Amazon near $131B by Q3 2027, turning a historic retail leader gap into a rounding error within two years.

Target sits at $25.3B with flat growth, showing how mid tier generalists get squeezed when shoppers favor price certainty, delivery speed, and endless assortment.

Why it matters: Scale funds advantage. More volume means faster delivery, lower unit costs, and more ad inventory. For ecommerce brands, Amazon and Walmart are no longer channels. They are gravity.

FROM OUR PARTNERS

Smarter CX insights for investors and founders

Join The Gladly Brief for insights on how AI, satisfaction, and loyalty intersect to shape modern business outcomes. Subscribe now to see how Gladly is redefining customer experience as an engine of growth—not a cost center.

MAZE STORY

The Maze: Amazon consolidated its core AI model development, custom silicon, and quantum computing efforts under AWS veteran Peter DeSantis, aiming to maximize optimization across hardware and software after the exit of AGI head Rohit Prasad.

The new organization will unify foundational AI initiatives, including the Nova AI models and custom chips like Graviton and Trainium, to improve efficiency and speed development cycles.

Peter DeSantis, who oversaw AWS Utility Computing, will report directly to CEO Andy Jassy, enabling him to focus resources on this strategic convergence point for the company’s future growth.

Robotics AI researcher Pieter Abbeel, who joined Amazon in 2024, now leads the frontier model research team within AGI, taking over the crucial task of advancing base model capabilities.

Why it matters: This restructuring makes possible better integration of AI agents into warehouse automation and optimizes logistics, which ultimately drives down fulfillment costs for sellers and Amazon alike. Unifying these technologies allows Amazon to maintain its competitive advantage against rivals like OpenAI and Google by accelerating internal model deployment through its growing custom silicon infrastructure.

DATA TREASURE

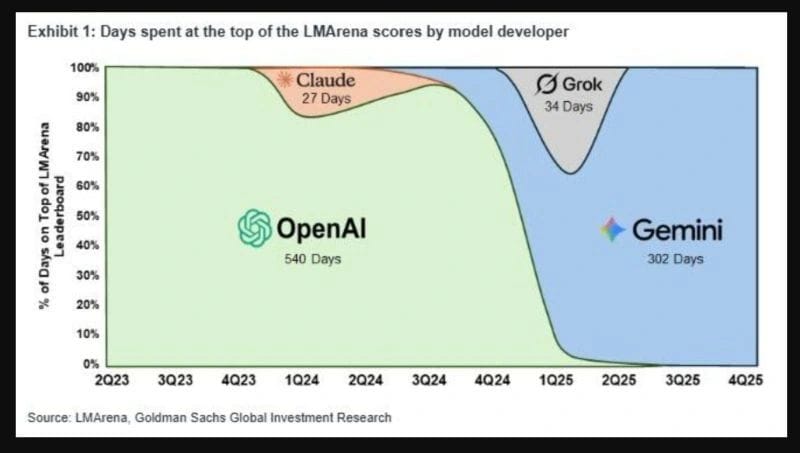

The Maze: Artificial intelligence has no permanent leader. The top spot changed hands multiple times in under three years, moving from OpenAI to others and now to Gemini. Speed matters more than status when the baseline resets every few months.

One company led for over 500 days, others briefly spiked for weeks, and leadership flipped again, showing how close frontier models are in real user performance.

Small changes in tuning, product release timing, or task focus can swing rankings fast, making yesterday’s leader today’s follower without warning.

The gap between top models is often narrow, which shifts competition from pure research into execution, cost, reliability, and how quickly new capabilities reach users.

Why it matters: Ecommerce and software teams betting on one model are betting wrong. The winning strategy is flexibility. Build systems that switch fast, test constantly, and treat intelligence as a moving input, not a moat.

MAZE STORY

The Maze: The US Trade Representative (USTR) announced it is ready to impose fees and restrictions on European companies, escalating the trade war over what it calls "discriminatory" EU regulations against major US tech platforms. This dramatic move targets EU service providers like DHL and SAP, threatening disruption for global ecommerce operations and cross-border logistics.

The USTR asserted on X that it must respond if the EU continues what it called a “discriminatory and harassing” course of action against US service providers who support $100 billion in direct investment in Europe.

This conflict arises from EU policies like the Digital Services Act (DSA), which recently led to a €140 million fine against X, targeting US tech giants that exceed specific user-based thresholds.

European Commission spokesman Thomas Regnier affirmed that the bloc will continue to enforce its rules fairly and equally, emphasizing that their mandates apply to all companies operating within the EU.

Why it matters: This looming trade battle creates instability for supply chain and ad-tech services that rely heavily on cross-Atlantic partnership and free data flow. Ecommerce teams must monitor these developments closely, as retaliatory fees on EU logistics firms could raise operational costs and increase pricing volatility for consumers.

BRIEFING

🏬 Everything else in Ecommerce

FullBeauty and Destination XL (DXL) announced a merger, creating a combined $1.2 billion company aimed at dominating the size-inclusive apparel market.

🇬🇧 VF Corporation (parent of Vans and The North Face) is cutting jobs across its UK and Ireland arm following profit slips, citing ongoing economic uncertainty.

Fluency secured $40 million in funding to accelerate its centralized, AI-driven platform for automating the creation and management of digital advertising campaigns.

Google's increasing focus on large AI products is reportedly weakening traditional spam enforcement, reshaping risk for publishers relying on organic traffic.

Google is experimenting with displaying detailed real estate listings directly in search results via key partners, threatening property portals like Zillow.

🇪🇺 Wix partnered with Stripe to expand its local payment options for merchants across Europe, marking the first partnership expansion outside North America.

Square expanded its partnership with Thrive inventory management, enabling retailers to synchronize catalogs and stock levels across in-store and eCommerce channels, including Shopify.

🇮🇳 86% of Indian consumers plan to increase luxury spending over the next 12 months, the highest figure globally, confirming a massive geographical and demographic shift in the luxury market.

🇬🇧 The UK retail sector anticipates a sharp late surge of £3.43 billion in sales on the final weekend before Christmas, with offline retail significantly outpacing online spend due to delivery cut-offs.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team