TODAY’S MAZE

Happy Friday! Amazon is making a stark trade-off, cutting 16,000 roles to finance a massive $125 billion artificial intelligence infrastructure plan. It marks a decisive pivot from personnel to processors as CEO Andy Jassy declares war on bureaucracy. Can the retail giant maintain its legendary velocity while replacing human intuition with algorithmic execution?

In today’s MarketMaze focus:

Amazon cuts 16,000 jobs

Meta ads hit $58B

EU cheap imports surge

AI cost vs accuracy

US brands face distrust

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Amazon confirms the elimination of 16,000 roles globally as CEO Andy Jassy wages war on bureaucracy to fund a massive $125 billion AI infrastructure buildout.

The cuts hit AWS, Prime Video, and retail teams hardest, specifically targeting software engineers and middle management layers to flatten the organizational structure according to internal Slack messages.

AWS leadership explicitly urged staff to use technology to simplify work, signaling that employees who embrace AI-driven efficiency will survive the shift toward a culture of ownership detailed in this memo.

Retail operations face significant restructuring as the company moves to shutter Amazon Fresh and cashierless Go locations to redirect capital toward large-scale data centers, confirming media reports.

Why it matters: This restructuring sets a ruthless precedent for the industry, proving that profitability and automation now supersede headcount in the race for AI dominance.

Over the next three years, how will increased use of artificial intelligence inside companies like Amazon most affect corporate jobs globally?

- 🤖 Fewer Roles (net reduction in corporate and office-based jobs)

- ⚖️ Role Shift (same headcount, but different skills and responsibilities)

- 📊 Productivity Gain (fewer people managing more output per employee)

- 🌍 Polarization (job losses in mature markets, growth in lower-cost regions)

- 🧪 Short-Term Pain (cuts now, rehiring later once systems stabilize)

☝️ Vote to see results!

FROM OUR PARTNERS

Stop Duplicates & Amazon Resellers Before They Strike

Protect your brand from repeat offenders. KeepCart detects and blocks shoppers who create duplicate accounts to exploit discounts or resell on Amazon — catching them by email, IP, and address matching before they hurt your bottom line.

Join DTC brands like Blueland and Prep SOS who’ve reclaimed their margin with KeepCart.

MAZE STORY

The Maze: Low-cost ecommerce shipments entering the European Union jumped 26% last year to hit 5.8 billion units. That volume averages out to roughly one international package for every EU citizen each month.

Volume is now four times higher than in 2022, overwhelming customs authorities who estimate two-thirds of these small packages are undervalued to avoid customs duties.

Regulators are striking back by fast-tracking the end of VAT exemptions and introducing a fixed three-euro duty per product starting in July to level the playing field.

Giants like Temu and Shein are countering by aggressively building local fulfillment centers on the continent, with the former aiming to ship 80% of sales via European warehouses.

Why it matters: The era of friction-free cross-border arbitrage is closing, forcing discount giants to trade margin for physical infrastructure. Brands must prepare for a landscape where speed and compliance finally outweigh sheer price dominance.

FROM OUR PARTNERS

Someone just spent $236,000,000 on a painting. Here’s why it matters for your wallet.

The WSJ just reported the highest price ever paid for modern art at auction.

While equities, gold, bitcoin hover near highs, the art market is showing signs of early recovery after one of the longest downturns since the 1990s.

Here’s where it gets interesting→

Each investing environment is unique, but after the dot com crash, contemporary and post-war art grew ~24% a year for a decade, and after 2008, it grew ~11% annually for 12 years.*

Overall, the segment has outpaced the S&P by 15 percent with near-zero correlation from 1995 to 2025.

Now, Masterworks lets you invest in shares of artworks featuring legends like Banksy, Basquiat, and Picasso. Since 2019, investors have deployed $1.25 billion across 500+ artworks.

Masterworks has sold 25 works with net annualized returns like 14.6%, 17.6%, and 17.8%.

Shares can sell quickly, but my subscribers skip the waitlist:

*Per Masterworks data. Investing involves risk. Past performance not indicative of future returns. Important Reg A disclosures: masterworks.com/cd

MAZE STORY

The Maze: Meta delivered $58.1B in quarterly ad revenue as upgraded AI infrastructure drove significant performance gains across its family of apps. Mark Zuckerberg positioned these results as the foundation for a shift toward agentic shopping experiences.

Recent investments to double GPU training capacity enabled a new sequence learning architecture, delivering a 3.5% lift in ad clicks on Facebook and a 3% conversion increase on Instagram.

Management teased new agentic commerce tools that will help users locate specific products within catalogs, building on early success in Mexico and the Philippines where business AI conversations now top 1 million weekly.

The search for inventory growth continues as Threads ads roll out to the UK, EU, and Brazil, complementing a WhatsApp paid messaging segment that just surpassed a $2 billion annual run-rate.

Why it matters: Meta is successfully leveraging its massive data moat to evolve from a passive display engine into an active transaction layer where AI agents close the loop between discovery and purchase.

DATA TREASURE

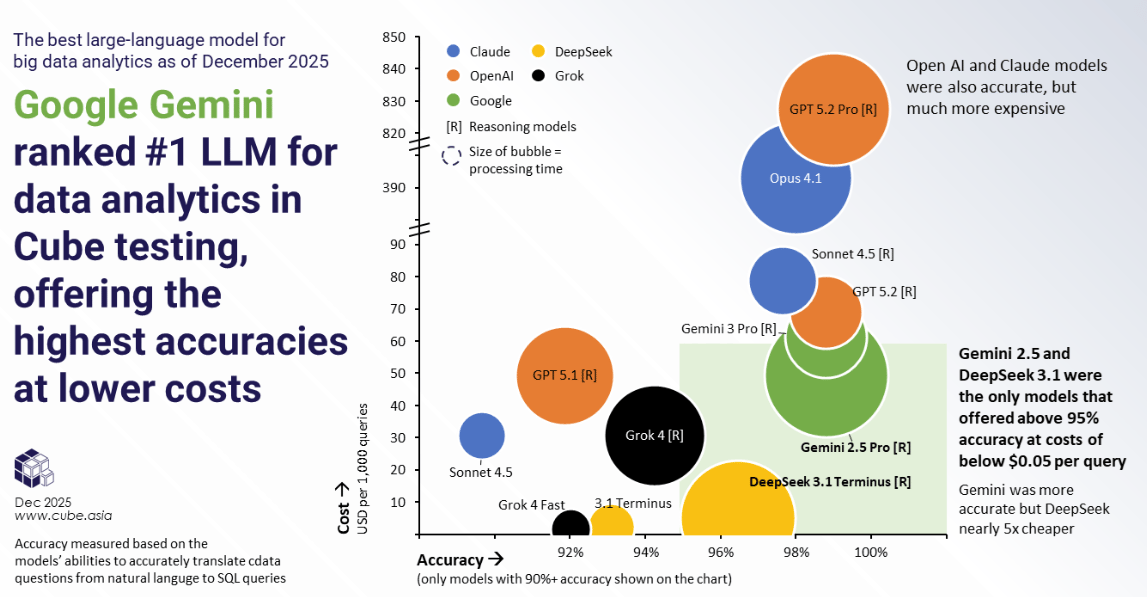

The Maze: Model quality is converging, economics are not. When accuracy differences narrow, cost and speed decide which AI tools scale across real business workflows.

Top models now cluster above ~95% accuracy on analytics tasks, but cost ranges from cents to fractions of a cent per query, a 10x spread.

Faster models win adoption even if marginally less accurate, because analysts value flow over perfection in daily work.

The real risk is silent error, so teams pay premiums only where wrong answers break decisions, not dashboards.

Why it matters: AI in ecommerce ops is a cost curve story. The winners will be accurate enough, fast enough, and cheap enough to deploy everywhere.

DATA TREASURE

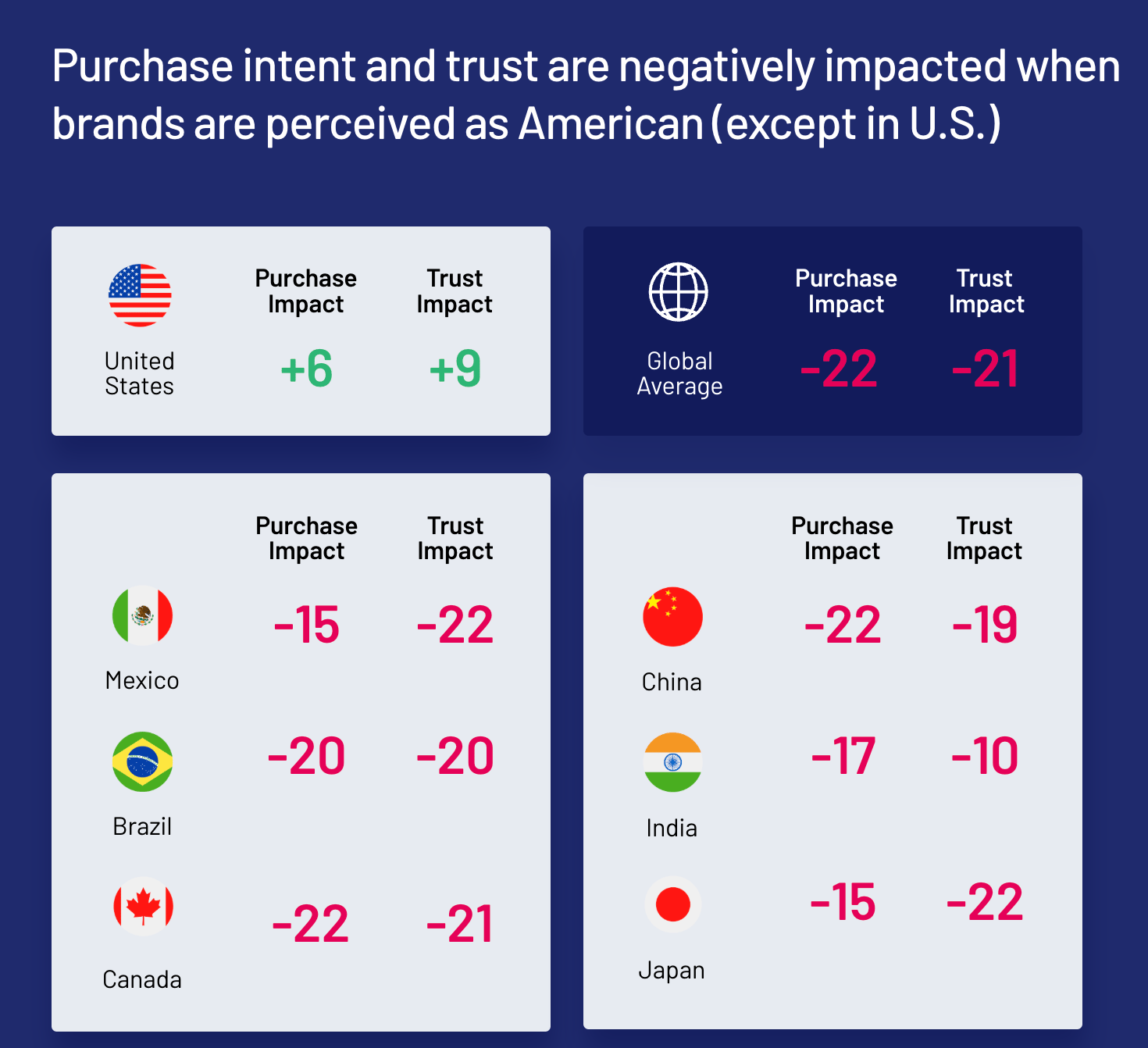

The Maze: Being American helps at home and hurts abroad. Outside the US, the label now lowers trust and purchase intent across most major markets.

In the US, American brands see positive lift in trust and intent, but internationally scores drop by ~20 points on average.

Markets like China, Japan, Canada, and Brazil all show double digit declines in trust when brands are perceived as American.

The penalty cuts across categories, suggesting sentiment, not product quality, drives the effect.

Why it matters: Global ecommerce brands must sell value before identity. Origin is now a variable that can quietly drag conversion.

BRIEFING

🏬 Everything else in Ecommerce & Big Tech

🇺🇸 Amazon reportedly discusses investing up to $50 billion in OpenAI, a move that would deepen its stake in the AI infrastructure race and rival Microsoft's dominance.

🇸🇪 H&M Group posted a rise in annual operating profit driven by strict cost controls, despite a 3% dip in sales caused by currency headwinds and consumer caution.

🇺🇸 Pinterest is laying off roughly 780 employees to redirect resources toward AI-driven performance tools, even as its stock slides on competitive pressures.

🇺🇸 Paramount+ is developing interactive shopping features and short-form video feeds, revealed in leaked documents, to monetize attention beyond traditional ads.

🇺🇸 Google updated Chrome with AI features that automatically track price drops and group shopping history, aiming to keep product discovery within the browser.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team