TODAY’S MAZE

Happy Friday! Andy Jassy is doubling down on infrastructure with a staggering financial commitment to secure the tech giant’s future dominance. It’s a high-stakes strategy that sacrifices short-term margins for long-term control.

With 300 million users already utilizing Rufus, the shift from manual search to algorithmic consumption is accelerating. The big question: can Amazon build its agentic future fast enough to justify the cost?

In today’s MarketMaze focus:

Amazon's $200B AI wager

Germany halts price algorithms

Shein drops green claims

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Amazon stunned Wall Street with a projected $200 billion CapEx plan for 2026 to build AI infrastructure, while Q4 sales pushed the tech giant to the brink of overtaking Walmart in total annual revenue.

CEO Andy Jassy defended the massive spend as an unusual opportunity, arguing that the "middle" of the AI market—enterprise production workloads—will eventually become the largest source of demand.

On the retail front, 300 million customers used the Rufus shopping assistant in 2025, with data showing these users are roughly 60% more likely to complete a purchase than those who don't engage.

Logistics investments delivered 8 billion items at record speeds last year, fueling a surge in Everyday Essentials that grew twice as fast as other categories in the U.S. store.

Why it matters: Jassy is trading short-term margin for long-term dominance, betting that agentic AI will fundamentally rewrite how consumers discover and buy products. The era of manual search is rapidly evolving into automated, algorithmic consumption where the interface itself makes the purchasing decisions.

If artificial intelligence assistants increasingly guide shopping decisions on platforms like Amazon, what buying model is most likely to dominate in the next five years?

- 🤖 Algorithm-led buying (automated recommendations selecting products with minimal human input, mainly in the US)

- 🔍 Hybrid choice (artificial intelligence narrows options but shoppers make the final decision in the US and EU)

- 🛒 Manual search (traditional search and filters remain dominant for most online purchases globally)

- 🏪 Category automation (automated buying for essentials, manual choice for discretionary categories in developed markets)

- 🌍 Region split (automation leads in the US, slower adoption across parts of Europe)

☝️ Vote to see results!

FROM OUR PARTNERS

The best marketing ideas come from marketers who live it.

That’s what this newsletter delivers.

The Marketing Millennials is a look inside what’s working right now for other marketers. No theory. No fluff. Just real insights and ideas you can actually use—from marketers who’ve been there, done that, and are sharing the playbook.

Every newsletter is written by Daniel Murray, a marketer obsessed with what goes into great marketing. Expect fresh takes, hot topics, and the kind of stuff you’ll want to steal for your next campaign.

Because marketing shouldn’t feel like guesswork. And you shouldn’t have to dig for the good stuff.

MAZE STORY

The Maze: Germany’s competition authority ordered Amazon to stop using algorithms to influence third-party prices and demanded a €59 million repayment for anti-competitive conduct.

Amazon utilized punitive algorithms that suppressed Buy Box visibility or removed listings entirely when independent sellers failed to meet the platform's pricing expectations.

Regulators argue the company should incentivize lower prices by reducing commissions rather than forcing merchants to absorb costs that threaten their business viability.

Third-party partners account for 60% of trade on Amazon.de, creating significant risk that manipulation hurts competition across the physical retail domain.

Why it matters: This decision forces marketplaces to stop treating third-party merchants like first-party suppliers. Losing algorithmic control removes a primary lever Amazon uses to ensure platform-wide price competitiveness.

FROM OUR PARTNERS

ECDB shows what actually happens in online retail. Real transactions. Real rankings. Real market shares. No surveys. No vague estimates.

Know who’s winning and why.

Track online sales performance across retailers, marketplaces, and categories worldwide.Compare like-for-like across markets.

Standardized data makes cross-country and cross-category analysis finally possible.Turn data into decisions.

Used for market entry, competitive strategy, investor analysis, and growth planning.Enterprise-ready by design.

APIs, exports, and robust data coverage built for serious teams.

MAZE STORY

The Maze: Shein has agreed to remove "climate-neutral" marketing from its German website following legal pressure from environmental group Deutsche Umwelthilfe regarding unsubstantiated sustainability promises.

The agreement bars the retailer from advertising a path to net-zero emissions by 2050 without evidence, avoiding a court battle but risking future financial penalties for violations.

Regulators challenged the credibility of these pledges, noting that Shein’s own sustainability reporting revealed that total emissions spiked by 23% in 2024 despite green messaging.

Critics argued the company lacked transparent measures to achieve its stated goals, forcing a strategic retreat rather than attempting to prove the validity of the claims in court.

Why it matters: This signals a tougher regulatory environment for ecommerce brands using sustainability as a marketing lever. Companies must align public messaging with operational reality or face immediate legal backlash.

DATA TREASURE

🔥 Amazon Becomes A Utility

The Maze: Amazon is no longer optimizing for retail growth, it’s optimizing for capital efficiency. Q4 2025 confirms a clear shift from selling products to monetizing infrastructure, services, and demand, with profits concentrating far above the checkout page.

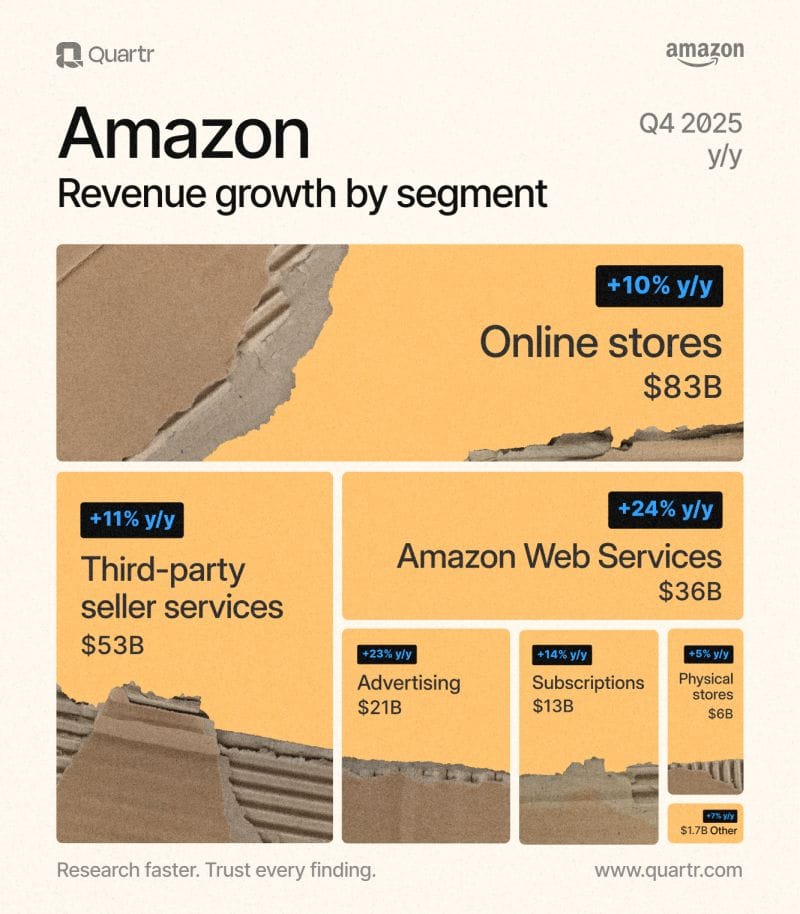

Source: Quartr

In Q4 2025, Amazon grew revenue +14% YoY, but the real acceleration came from AWS at +24% to ~$36B and Advertising at +23% to ~$21B, while Online Stores grew a slower +10% to ~$83B, showing where incremental profit is now generated.

Third party sellers drove 61% of all units sold, with seller services reaching ~$53B (+11% YoY), reinforcing Amazon’s low risk model where merchants carry inventory and capital, while Amazon monetizes logistics, fees, and visibility.

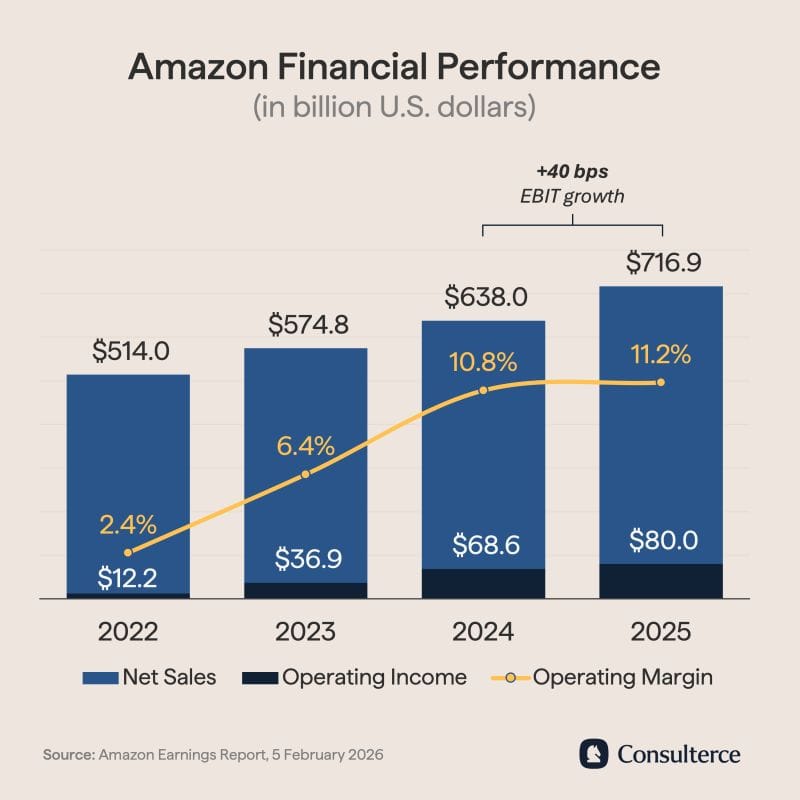

Source: Consultere

From 2022 to 2025, net sales rose from ~$514B to ~$717B, but operating income jumped from ~$12B to ~$80B, lifting operating margin from 2.4% to 11.2%, a structural profitability reset driven by automation and services.

AWS alone delivered ~$129B revenue in 2025 and nearly $46B operating income, enabling Amazon to fund aggressive AI investment, even as ~$200B of planned 2026 capex pressures near term free cash flow.

Why it matters: Ecommerce scale is no longer the advantage. Platforms that control infrastructure, data, and monetization layers will out earn those that just move boxes. Amazon already crossed that line.

DATA TREASURE

🚀 Retail Scales, Fast

The Maze: Amazon grows by compounding, TikTok Shop by acceleration. One platform adds hundreds of billions slowly at scale, the other races from zero to global relevance in years, reshaping how commerce and media blend into one system.

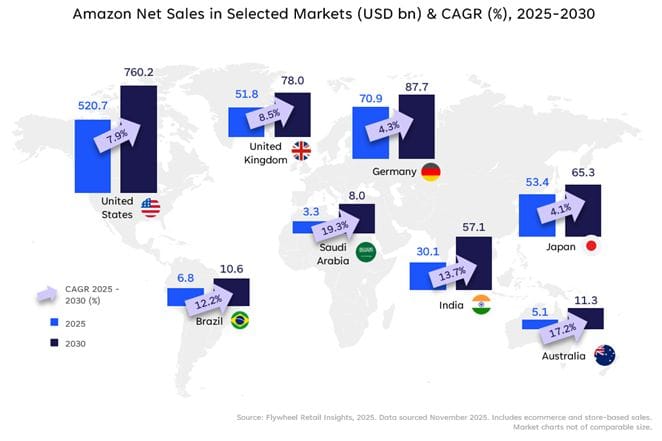

• Amazon US expands from ~$521B in 2025 to ~$760B by 2030, proving that even mature ecommerce can add massive absolute dollars with mid single digit growth.

• Faster growth shifts to markets like India at ~14% CAGR and Saudi Arabia near ~19%, where ecommerce penetration is lower but momentum is structural.

• TikTok Shop targets ~$87B GMV by 2026, compressing discovery, influence, and checkout into one session and challenging the idea of a linear funnel.

Why it matters: Ecommerce is no longer a channel, it is an ecosystem. Brands must plan for a world where content creates demand and platforms monetize intent instantly, or risk optimizing yesterday’s funnel.

BRIEFING

🏬 Everything else in Ecommerce & Big Tech

🇬🇧 Frasers Group snapped up a majority stake in Italian retailer Maxi Sport, accelerating its European expansion and premium elevation strategy.

🇫🇷 Vestiaire Collective projected its first annual profit in 2026, setting the stage for aggressive expansion into the US secondhand market.

🇫🇷 Criteo debuted commerce-grade recommendation infrastructure that uses transaction data to outperform traditional text-based matching by 60%.

🇺🇸 Affirm reported a 30% revenue jump as BNPL usage surges, signaling that split payments are becoming routine for US consumers.

🇺🇸 OpenAI launched 'Frontier', a platform to help enterprises deploy and govern autonomous AI agents effectively treating them like digital employees.

🇺🇸 USPS posted a massive quarterly loss of $1.3B, raising fresh questions about solvency and the viability of its modernization plan.

🇺🇸 GrubMarket hit a $4.5B valuation after raising $50 million to expand its AI-powered B2B ecommerce platform.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team