TODAY’S MAZE

Happy Tuesday! Amazon is embedding generative AI into the shopping journey via Alexa+. The update brings agentic tools to the web to handle complex buyer requests.

This shift moves discovery toward autonomous assistants that manage multi-step tasks. Can retailers survive when AI agents control the purchase journey?

In today’s MarketMaze focus:

Amazon’s new Alexa+ assistant

Coupang’s $1.2B cyber settlement

“Buy-For-Me” Breaks Trust

Europe's local marketplace wins

Rapid app download growth

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Amazon is expanding Alexa into a cross-surface assistant that uses generative models to simplify how customers purchase products. This move brings Alexa+ to web browsers and integrates agentic capabilities directly into its redesigned mobile interface.

The newly launched web interface at alexa.com enables early access users to upload documents and manage calendars through a traditional desktop workflow for the very first time.

Amazon updated the platform with Fire TV upgrades that make the interface operate 30% faster while organizing content into dedicated hubs for sports and movies.

The Bee wearable now utilizes automated templates to format summaries for meetings or lectures based on context from captured conversations to surface behavioral patterns.

Why it matters: This shift toward agentic AI reduces the friction of choice by allowing assistants to complete multi-step tasks like booking reservations and evaluating products. Retailers must prepare for a future where autonomous agents manage the entire discovery journey on behalf of the consumer.

FROM OUR PARTNERS

ECDB shows what actually happens in online retail. Real transactions. Real rankings. Real market shares. No surveys. No vague estimates.

Know who’s winning and why.

Track online sales performance across retailers, marketplaces, and categories worldwide.Compare like-for-like across markets.

Standardized data makes cross-country and cross-category analysis finally possible.Turn data into decisions.

Used for market entry, competitive strategy, investor analysis, and growth planning.Enterprise-ready by design.

APIs, exports, and robust data coverage built for serious teams.

MAZE STORY

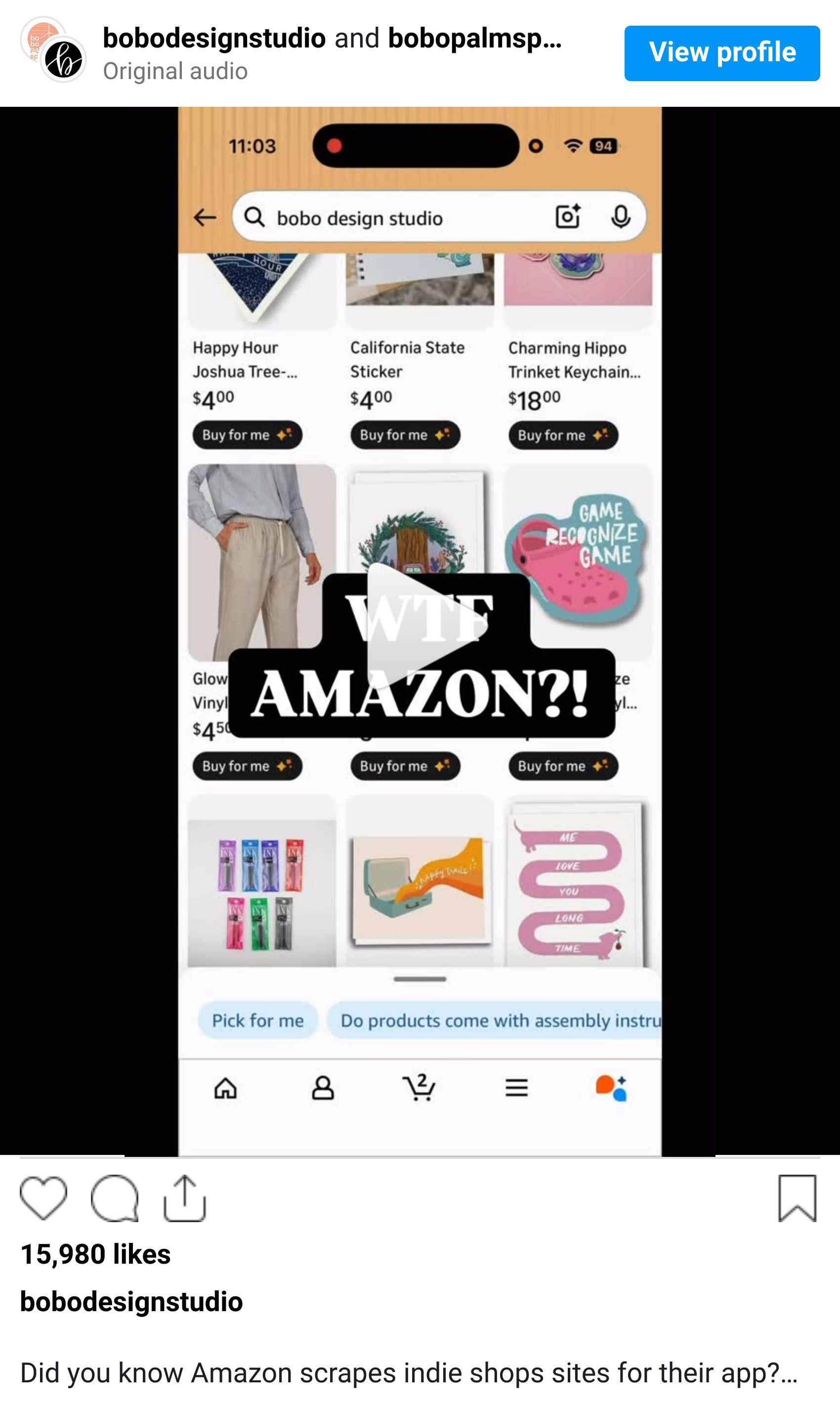

The Maze: Amazon is quietly inserting itself as a buying agent on independent ecommerce sites, completing purchases on shoppers’ behalf while many brands never opted in. What looks like convenience is actually a control move. Amazon owns discovery, triggers checkout, and leaves brands to deal with inventory errors, support chaos, and brand dilution.

In late 2024 and early 2025, multiple Shopify brands reported first learning about Buy-For-Me only after orders arrived with anonymized Amazon emails, including for deleted or out-of-stock SKUs, creating operational risk the merchant never approved.

Amazon blocks external AI agents and sued rivals for automated buying on its own marketplace, yet now runs an agent that places orders across independent stores, redefining “permission” as public visibility rather than consent.

In the Instagram video, a small brand shows its entire catalogue appearing in Amazon’s app with Buy-For-Me links, including products it never listed, and AI-generated images that don’t match the actual items, leaving the merchant confused and unable to easily remove the listings.

Why it matters: Agentic commerce shifts power from stores to interfaces. If Amazon becomes the default buying layer, brands lose control even when they own checkout. Ecommerce margins, trust, and differentiation erode when the platform owns intent and the merchant owns the mess.

FROM OUR PARTNERS

AI in CX that grows loyalty and profitability

Efficiency in CX has often come at the cost of experience. Gladly AI breaks that trade-off. With $510M in verified savings and measurable loyalty gains, explore our Media Kit to see the awards, research, and data behind Gladly’s customer-centric approach.

MAZE STORY

The Maze: Coupang, the South Korean retail giant and parent of Farfetch, prepares to distribute a massive $1.2 billion settlement following a major security breach. This record-breaking payout addresses a cyber incident that exposed sensitive data for over 33 million user accounts across its global commerce platform.

Impacted shoppers receive store vouchers starting January 15 through a specialized compensation programme designed to restore brand loyalty and resolve grievances stemming from the recent unauthorized account access.

The former CEO resigned his position amid intense public outcry over the corporate decision to delay the breach disclosure for four months after the initial intrusion occurred in July.

Interim leader Harold Rogers currently manages a class-action lawsuit brought by South Korean customers in the US legal system as the firm seeks to resolve the fallout from this significant data security failure.

Why it matters: This massive payout sets a high-stakes precedent for how marketplace giants must handle data security and user privacy. It signals that delayed transparency carries heavy financial and leadership costs that can destabilize even the most dominant players in the global ecommerce landscape.

DATA TREASURE

The Maze: Europe does not shop as one market. Global giants are strong, but local marketplaces still dominate where they fit habits, payments, and delivery better. Scale alone is not enough.

In countries like Poland, Czechia, the Netherlands, and Türkiye, local platforms hold ~87–88% preference despite Amazon’s presence.

These leaders win on logistics fit, language, returns, and trusted seller ecosystems built over years.

Sweden stands out with lower concentration, showing fragmentation where no single model fits perfectly.

Why it matters: Expanding in Europe means country strategies, not a single rollout. Brands that ignore local champions miss demand. Logistics and returns often matter more than homepage traffic.

DATA TREASURE

The Maze: Distribution is now the product. Reaching one billion downloads used to take a decade. Some platforms now do it in under three years, reshaping how demand is captured.

ChatGPT reached 1B downloads in 27 months, faster than any app before it.

Temu followed in 32 months, fueled by aggressive pricing and relentless acquisition.

SHEIN took 124 months, proving endurance can still win, just on a slower curve.

Why it matters: Whoever owns discovery owns demand. As AI tools and commerce apps become starting points, brands must optimize data, availability, and trust to stay visible upstream.

BRIEFING

🏬 Everything else in Ecommerce

🇺🇸 Amazon introduced shifts in product discovery via Rufus and COSMO AI, moving search optimization away from traditional keywords toward semantic intent.

🇺🇸 Google Ads upgraded its Creator Partnerships suite with new search and management tools to help brands identify and manage YouTube influencers at scale.

🇬🇧 The UK implemented new HFSS marketing restrictions, including a total ban on online advertising for food and drink products high in fat, salt, or sugar.

🇺🇸 Stord acquired Shipwire from CEVA Logistics, adding 12 global fulfillment nodes to its AI-driven end-to-end commerce infrastructure.

🇻🇳 Vietnam reported 8% GDP growth in 2025, driven by a 17% increase in exports even as the US imposed new tariffs on footwear and apparel.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team