TODAY’S MAZE

Happy Tuesday! Amazon just proved the immediate, measurable value of personalized AI in ecommerce. The company’s new shopping assistant, Rufus, successfully doubled conversion rates for customers who interacted with it during the Black Friday peak.

This performance positions intelligence as a structural necessity for modern growth, demanding proactive, adaptive systems from platform operators. Can marketplaces afford to rely on static systems when real-time AI assistance is driving such massive sales uplift?

In today’s MarketMaze focus:

Amazon Rufus doubles BF conversions

Shopify suffers major outage

Costco sues US over tariffs

TikTok in US eats beauty

Returns Eat Margins

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Amazon's AI chatbot, Rufus, delivered an instant payoff by doubling conversion rates for Black Friday shopping sessions where users engaged with it, signaling the power of intelligent agents in customer discovery.

Intelligent agents are pushing digital commerce beyond task-based automation toward systems that anticipate customer needs and adapt in real time, according to Vogels’ recent outlook.

The company noted that 60% of the 250 million users who accessed Rufus became more likely to complete their purchases, emphasizing the immediate sales uplift from high-context assistance.

The underlying infrastructure supporting this scale is immense, exemplified by AWS Outposts sending over 524 million commands to fulfillment robots during a single Prime Day event.

Why it matters: This AI acceleration positions intelligence as a structural necessity for growth, requiring marketplace operators to move swiftly from simple automation to adaptive, proactive systems. Succeeding in this new era demands cultivating "renaissance developers" who blend domain expertise with systems thinking to govern billion-scale customer interactions responsibly.

FROM OUR PARTNERS

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

MAZE DEEP DIVE

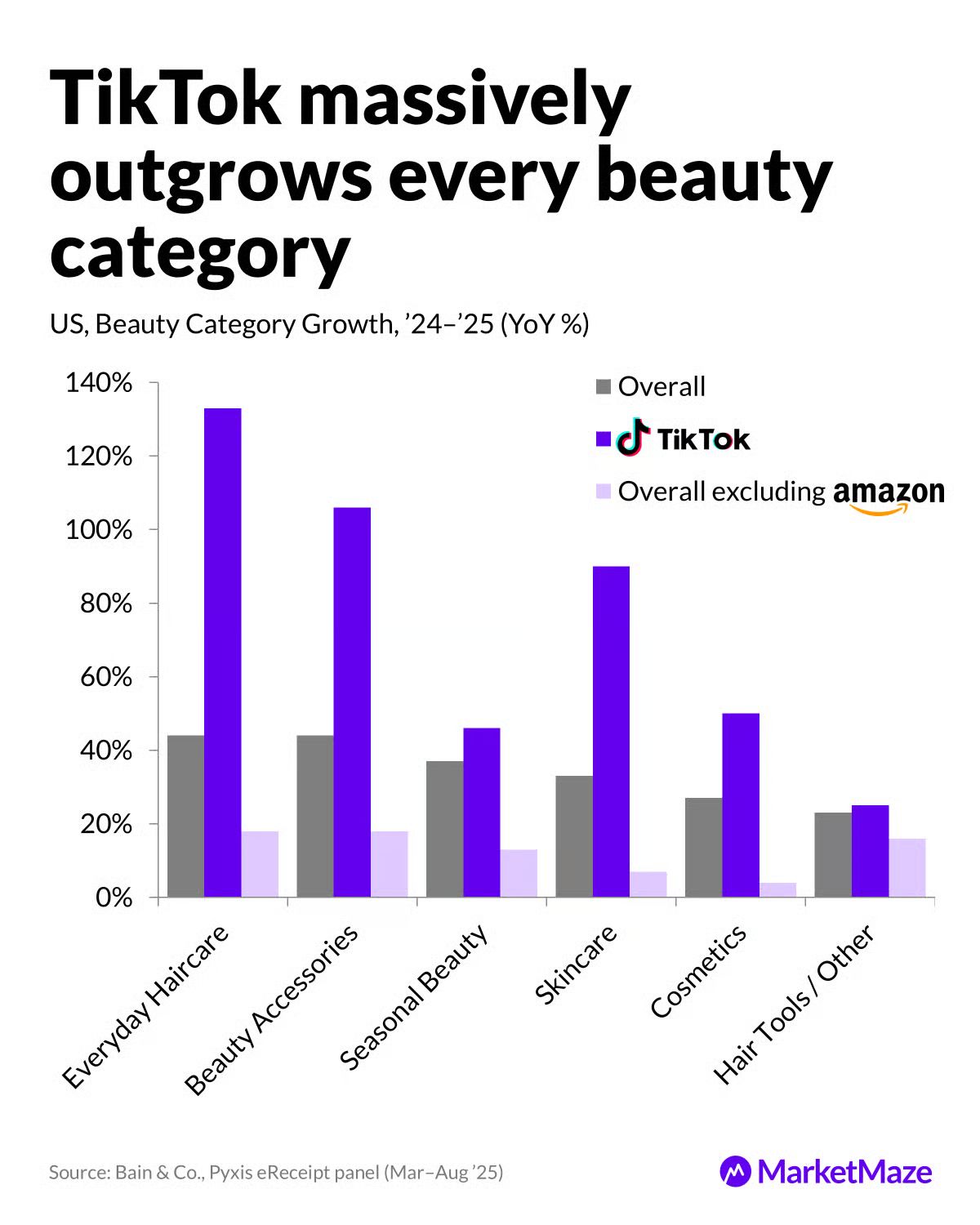

The Maze: Beauty is shifting from traditional retail to platforms built for speed, habit and cultural pull. The data shows category share concentrating with Ulta, TikTok and Target, while growth skews sharply toward algorithm-driven channels. The result is a market where discovery, purchase and repeat behavior merge into one loop.

Ulta, TikTok and Target dominate online beauty categories with 80–90% share across cosmetics, skincare and haircare, signalling a market consolidating around just three players.

TikTok outgrows the entire beauty sector in every category, delivering 133% in haircare, 106% in eye cosmetics and 120% in styling against overall category growth of only 23–44%.

Subscribe and Save grows far faster than one-time purchases, hitting 96% in trial items and 92% in fragrance, shifting beauty toward recurring buying.

Why it matters: Beauty habits are being rebuilt around platforms that combine discovery, low friction and repeat buying. Winners will be those who own the consumer’s impulse, not the shelf. As the line between content and commerce disappears, beauty’s future is defined by distribution, not brand heritage.real value, and win the early digital interface pull ahead in a market where trust

FROM OUR PARTNERS

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

MAZE STORY

The Maze: Wholesale giant Costco has filed a lawsuit against the US government and CBP, seeking a full refund of duties paid under the Trump administration's "reciprocal" tariffs imposed using emergency powers. The retailer filed the legal action to preempt the December 15 liquidation deadline that would otherwise finalize tariff entries and extinguish any chance of recovery, according to a complaint filed by Costco.

The lawsuit seeks to strike down tariffs issued under the International Emergency Economic Powers Act (IEEPA), which federal courts previously ruled IEEPA tariffs illegal based on the Constitution's exclusive grant of duty authority to Congress.

This separate action is necessary because even a favorable Supreme Court ruling does not guarantee refunds, which could potentially result in the government owing over $1 trillion in tariffs collected from importers.

CEO Ron Vachris noted earlier this year that about one-third of Costco’s US sales are imported from other countries, underscoring the retailer's massive exposure to this type of trade volatility.

Why it matters: Importers must closely monitor judicial rulings and liquidation deadlines, as securing tariff refunds requires specific judicial relief before CBP finalizes its review. The outcome of this high-stakes legal battle will redefine trade policy reliance on executive orders and stabilize or drastically reconfigure supply chain costing for massive retail operators.

MAZE STORY

The Maze: Shopify suffered a major platform failure on Cyber Monday, locking thousands of merchants out of their admin dashboards and POS systems for hours during the peak sales day; this incident undermined the platform’s recent claims of scalable infrastructure reliability.

The login authentication flow flaw locked out thousands of global retailers from their Admin and POS systems for approximately four hours on the key shopping day, peaking between 11:00 AM and 2:31 PM ET.

The company’s incident log confirmed issues with Admin, POS, mobile, and support login errors, although customer-facing checkout remained fully operational.

This poor timing undercut Shopify's recent recap characterizing its infrastructure as highly reliable, especially after its merchants generated a record $11.5 billion in GMV over the long Black Friday-Cyber Monday weekend.

Why it matters: Operational resiliency is no longer a footnote—it is a mandatory component of peak-season strategy, forcing platform-dependent executives to prioritize robust contingency plans. Ecommerce leaders must factor platform concentration risk into their growth models, demanding superior uptime transparency from partners who host their mission-critical infrastructure.

DATA TREASURE

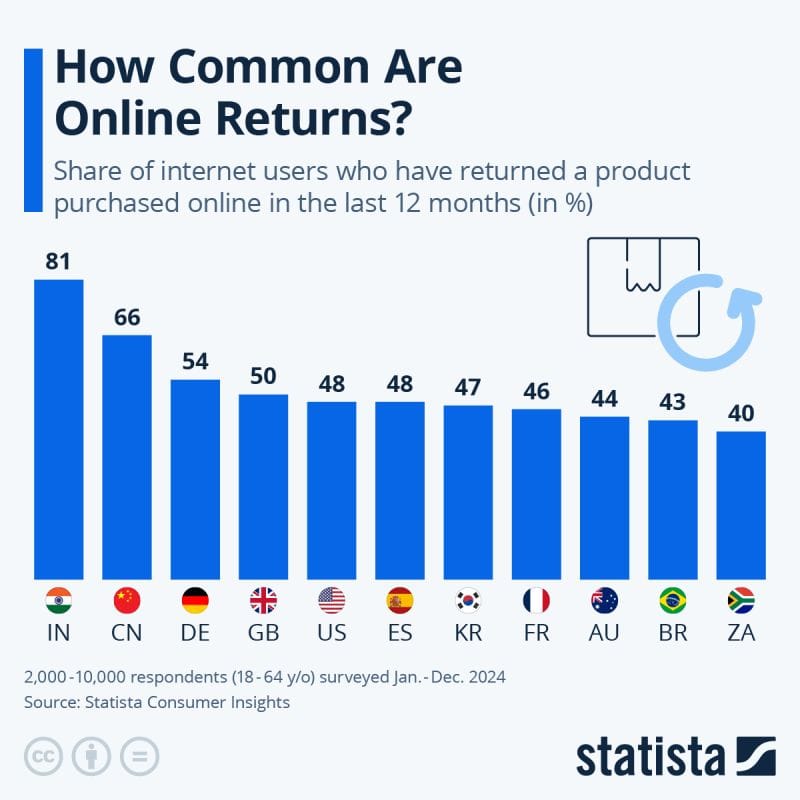

The Maze: Online shopping has a hidden tax and retailers pay for it every day. Most shoppers now treat returns as part of the buying journey, and in some markets the majority of buyers send something back each year. That behavior trains consumers to over-order and pushes sellers into a cycle where revenue goes up but profit leaks out. The real story is simple. Returns scale faster than margins.

• In 2024 as many as 81% of shoppers in India and 66% in China returned at least one online purchase, while the US and UK held near 50%, showing that returns are not a niche event but a global habit that shapes how consumers buy.

• Fashion leads the problem with return rates near a quarter of all online orders, and countries like Germany post some of the highest levels as easy policies and try-at-home culture push buyers to treat the doorstep as the fitting room.

• The cost is severe as global ecommerce returns add up to hundreds of billions each year, with handling, transport, and write-offs turning growth into a margin trap and putting real pressure on seller operations and customer service teams.

Why it matters: Returns decide who makes money in ecommerce. Sellers who fix product content, sizing accuracy and expectation gaps will turn fewer orders into costly reverse logistics. Marketplaces reward low-return sellers with better visibility, so reducing returns becomes a growth strategy, not just an operational fix.

BRIEFING

🏬 Everything else in Ecommerce & key players

🇺🇸 Amazon has officially secured the top spot for U.S. apparel sales by a wide margin, confirming its absolute market dominance in a crucial retail vertical.

🇺🇸 Amazon is escalating its anti-counterfeit efforts by utilizing a specialized unit of ex-prosecutors, AI tools, and enhanced brand partnerships to aggressively hunt and seize fake goods across its marketplace.

🇫🇷 Ultra-fast fashion players like Shein and Vinted now account for one in five online clothing purchases in France, highlighting the immense market disruption and pricing pressure on traditional retailers.

🇮🇳 E-commerce heavyweights Amazon and Walmart-owned Flipkart are aggressively expanding into India's financial sector, offering consumer loans and BNPL options to challenge traditional banking.

🇺🇸 The K-beauty trend, heavily fueled by TikTok, has vaulted into the American mainstream, causing major retailers like Ulta and Walmart to race to stock and market Korean brands.

BRIEFING

📣Everything else in Ecommerce ecosystem

🇺🇸 Google is testing a mobile search flow that directs users from AI Overviews into a continuous 'AI Mode' chat environment, a move likely to drastically reduce website clicks and organic visibility.

🌍 OpenAI launched key partnerships with Thrive Holdings and Accenture to accelerate the adoption of its AI platform across major enterprises, focusing initially on accounting and IT services.

🇬🇧 New research shows 60% of UK consumers are demanding AI-driven real-time tracking and simpler return processes from retailers during peak holiday shopping periods.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team