Welcome to MarketMaze, the #1 newsletter for staying on top of the latest in Ecommerce & Marketplaces.

TODAY’S MAZE

Welcome to MarketMaze, where AI is now the co-pilot of your life, not just your work. In this issue: secondhand is the new luxury in Europe, Google’s getting squeezed by AI, and Amazon’s losing its price crown to Walmart. Grab your coffee and let’s make sense of the maze.

INSIGHTS🧠

🛋️ AI Shopping Starts at Home

👖 Secondhand Goes Mainstream in EU

🛒 Amazon’s Not Leading Prices

💰 $100M Club on Amazon is Getting Crowded

🌍 Retail Media Goes Global

NEWS📖

🇺🇸 Amazon buys AI bracelet maker Bee

🇺🇸 Walmart bets on AI “super agents” for e-commerce leap

🇩🇪 MediaMarkt and Saturn: JD.com eyes €2.2B takeover

🇺🇸 Walmart locks down beauty sales to brands only

🇪🇺 Prosus Offers Remedies for Just Eat iFood Deal

🇩🇪 Lidl Faces Lawsuit Over Data Use in Loyalty App

+ 15 other handpicked news from the last week you need to know 🔥

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

🌀 Maze Story

AI Shopping Starts at Home 🛋️

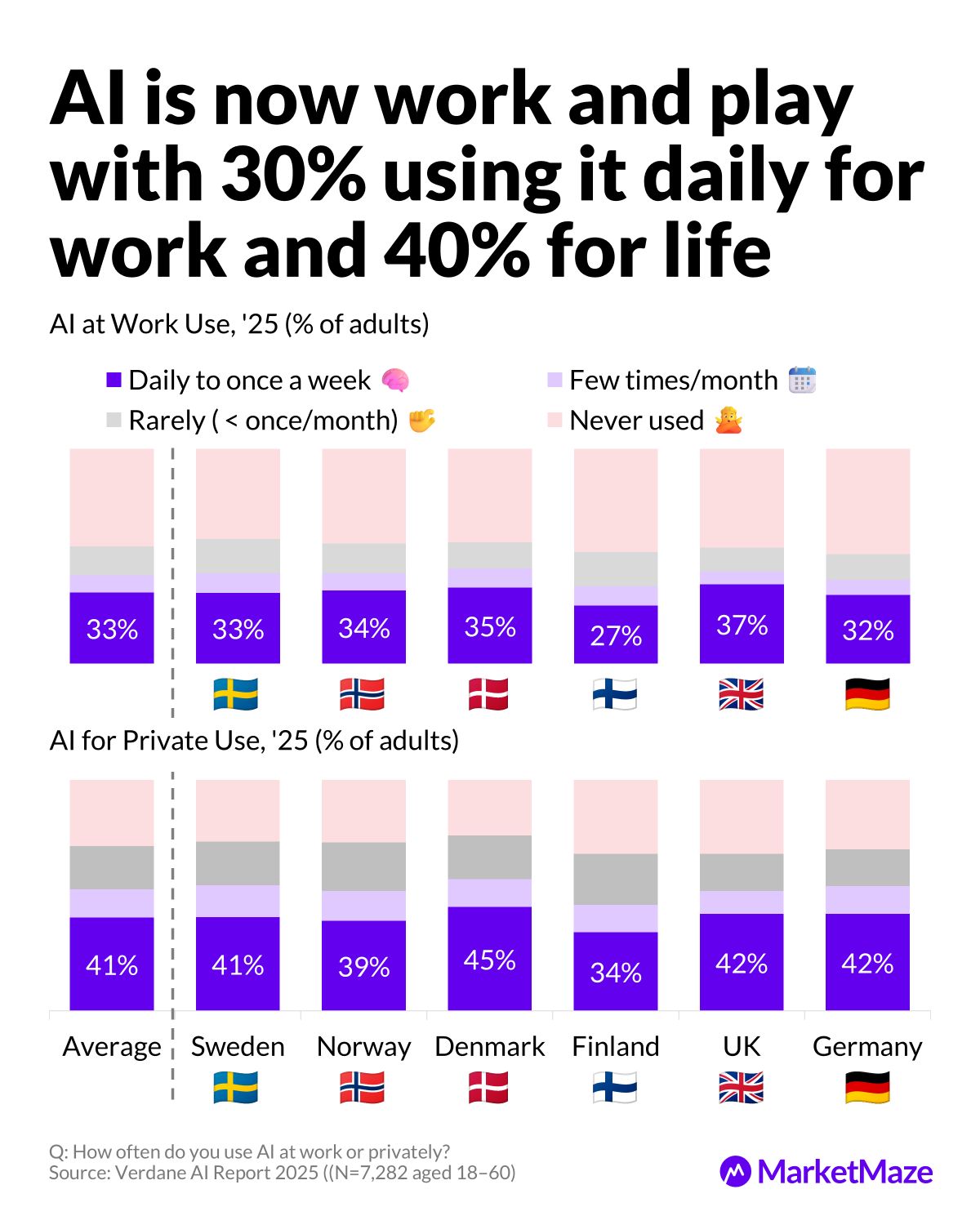

AI is no longer a workplace hack, it's a lifestyle upgrade. According to Verdane’s AI Report 2025 (N=7,282), private use of conversational AI now outpaces work use across all surveyed countries. The study covers usage habits in Sweden, Norway, Denmark, Finland, Germany, and the UK, and the data shows: AI is officially on your grocery list, travel itinerary, and holiday wishlist.

AI is more private than professional 🧠

AI is no longer just a workplace tool—it’s part of everyday life. 33% use conversational AI daily or weekly at work, while 41% use it that often in their private life. Private adoption leads across all six countries, with Denmark topping out at 45% daily personal use, and the UK leading in professional use at 37%. Work got AI first, but life made it stick.

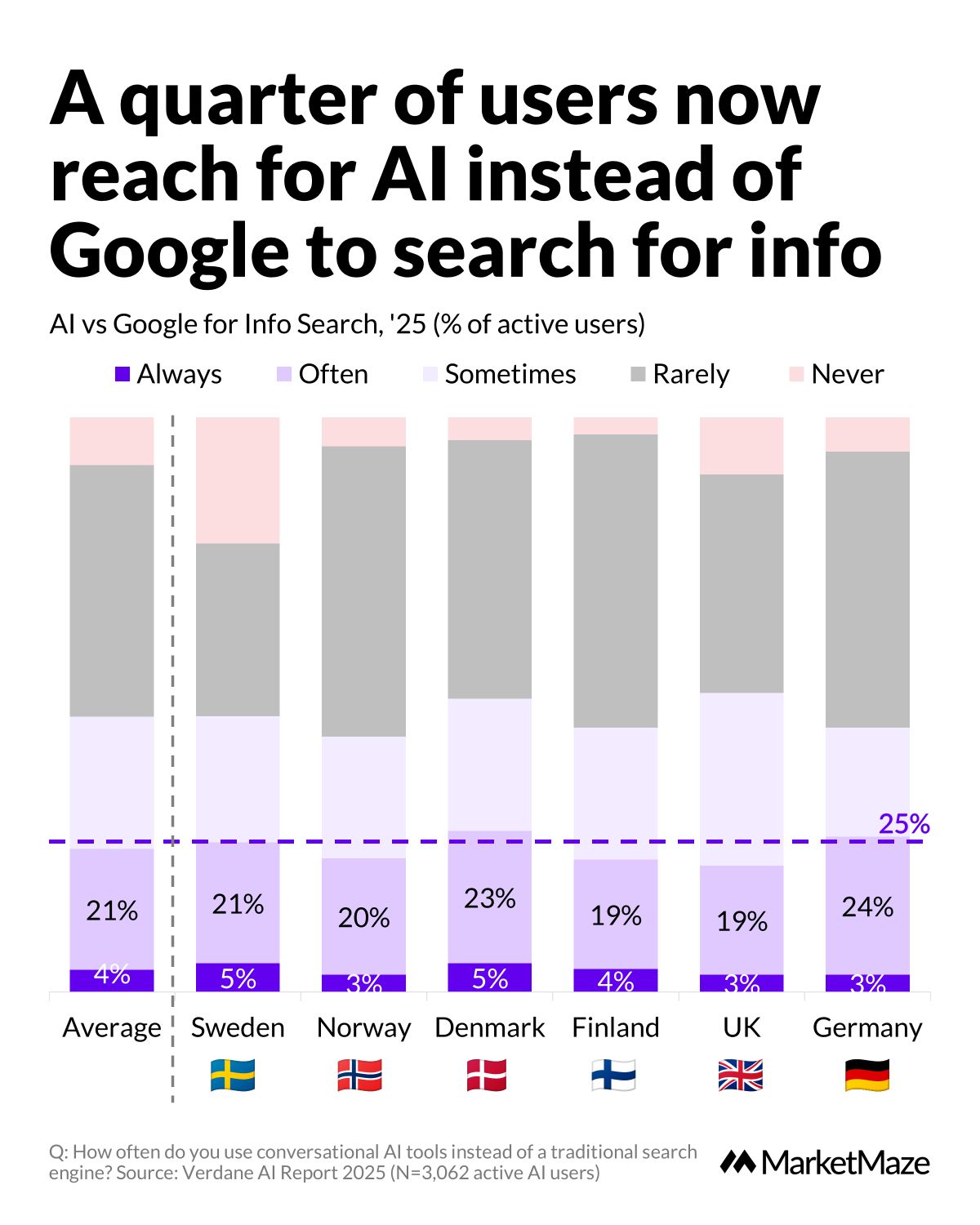

AI search muscles in on Google 🧭

Google is still king, but it’s looking over its shoulder. About 25% of users now lean on AI (ChatGPT, Gemini, etc.) either always or often to find information. In Germany, that number hits 27%. People want clarity, not 10 blue links. Conversational AI wins on follow-ups, context, and summarization. Google’s problem? These tools are not just search engines, they’re answer engines. That’s a different game entirely—and one Google didn’t script.

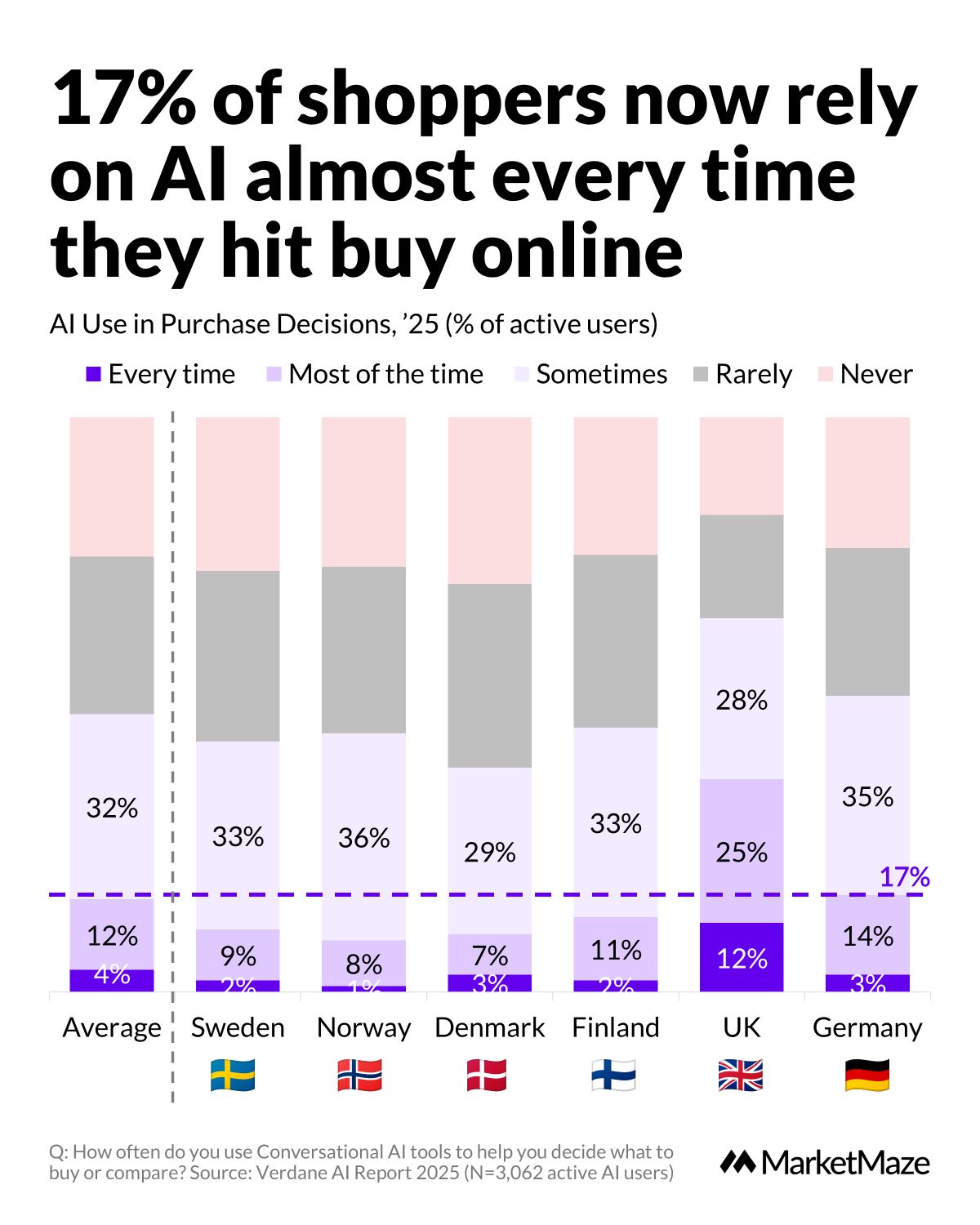

AI already influences your next purchase 🛒

AI isn’t just browsing—it’s buying. 17% of shoppers now use AI most or every time they consider a purchase. The UK tops the leaderboard with 30%, while even in Finland—one of the lowest overall adopters—over 10% now regularly shop with AI support. Across Europe, 76% have used AI in some part of their purchase journey. Shopping habits don’t change overnight, but they’re clearly changing every time someone asks ChatGPT “What’s the best smartwatch under €200?”

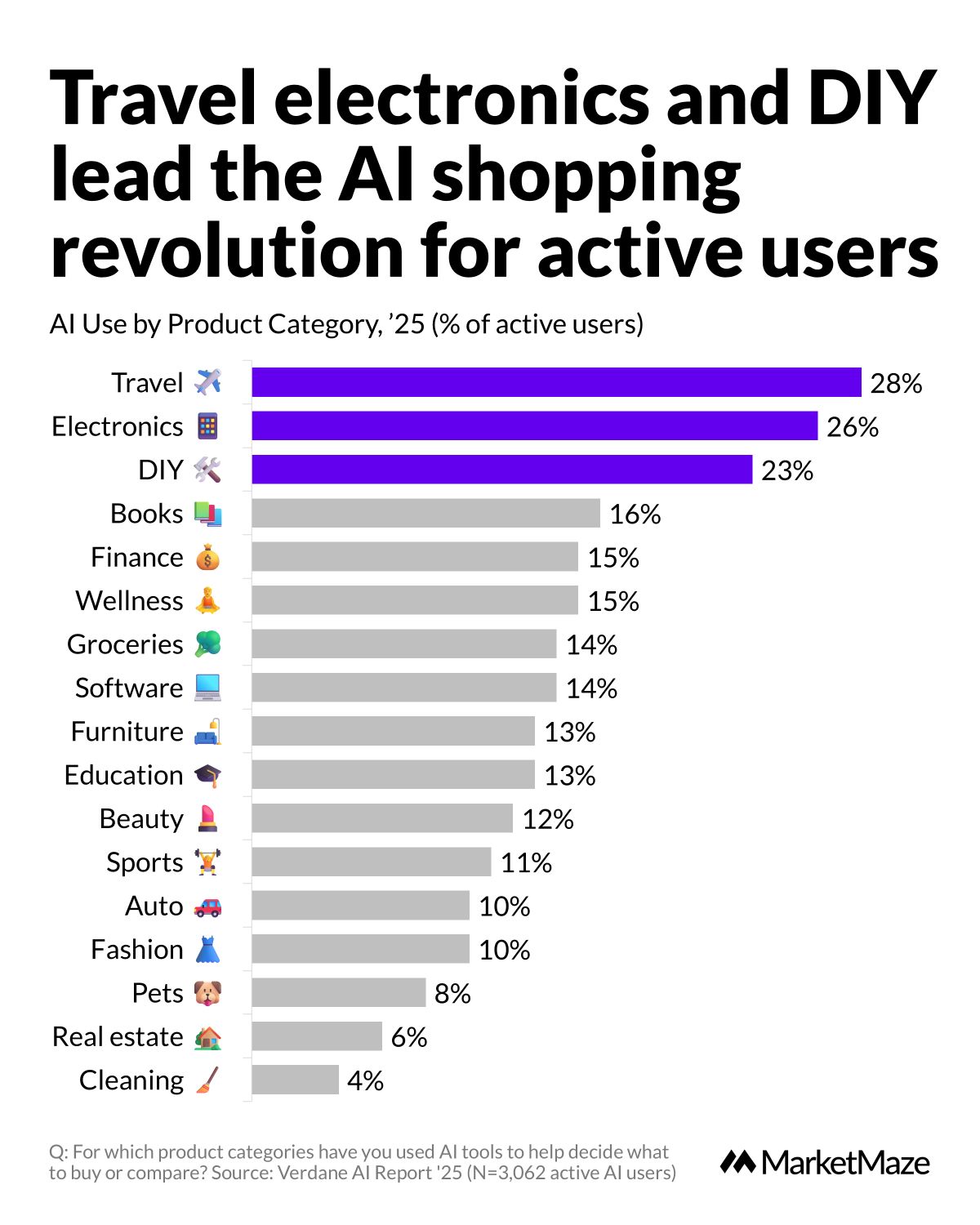

Travel & tech lead the AI cart 🧳📱

The most AI-impacted categories? Travel (28%), consumer electronics (26%), and DIY (23%). These are already research-heavy decisions, and now AI is just the smarter comparison engine. Lower down: groceries, software, and health (all ~14–15%). Real estate (6%) and cleaning services (4%) bring up the rear, proving some decisions still require a human touch—or a mop. If your brand plays in these higher-touch verticals, now’s the time to make yourself LLM-friendly. If not, you're already invisible.

From our partners

Find your customers on Roku this Black Friday

As with any digital ad campaign, the important thing is to reach streaming audiences who will convert. To that end, Roku’s self-service Ads Manager stands ready with powerful segmentation and targeting options. After all, you know your customers, and we know our streaming audience.

Worried it’s too late to spin up new Black Friday creative? With Roku Ads Manager, you can easily import and augment existing creative assets from your social channels. We also have AI-assisted upscaling, so every ad is primed for CTV.

Once you’ve done this, then you can easily set up A/B tests to flight different creative variants and Black Friday offers. If you’re a Shopify brand, you can even run shoppable ads directly on-screen so viewers can purchase with just a click of their Roku remote.

Bonus: we’re gifting you $5K in ad credits when you spend your first $5K on Roku Ads Manager. Just sign up and use code GET5K. Terms apply.

💎 Data Treasure

Secondhand Goes Mainstream in EU 👖

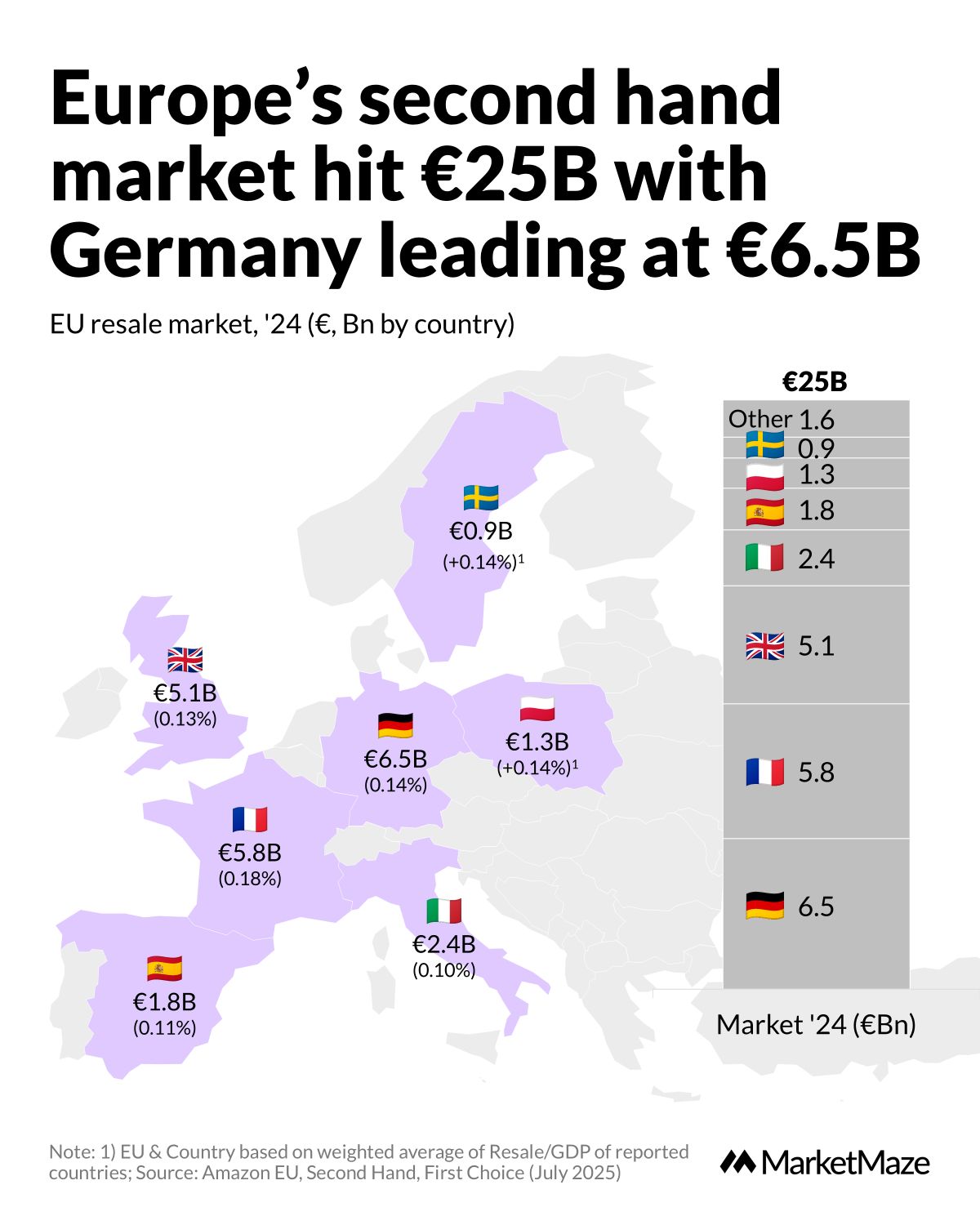

Europe’s secondhand economy isn’t fringe anymore—it’s a €25B market powered by digital resale and shifting values. According to new research by the Centre for Economics and Business Research (CEBR), commissioned by Amazon (July 2025), resale spending jumped across the EU, driven by refurbished tech, used fashion, and pre-loved home goods. Data is based on reported resale volumes and GDP-weighted estimates.

Germany tops resale charts at €6.5B 🇩🇪

Germany leads Europe’s resale/ second hand market at €6.5B, followed closely by France (€5.8B) and the UK (€5.1B). The five biggest economies represent €21.6B of the €25B total. Sweden, Poland estimated by MarketMaze at 0.14% of GDP (average penetration of reported countries), adding another €3.5B combined. Spain trails with €1.8B despite being resale-hungry. Eastern and smaller EU markets round out the remaining €1.6B.

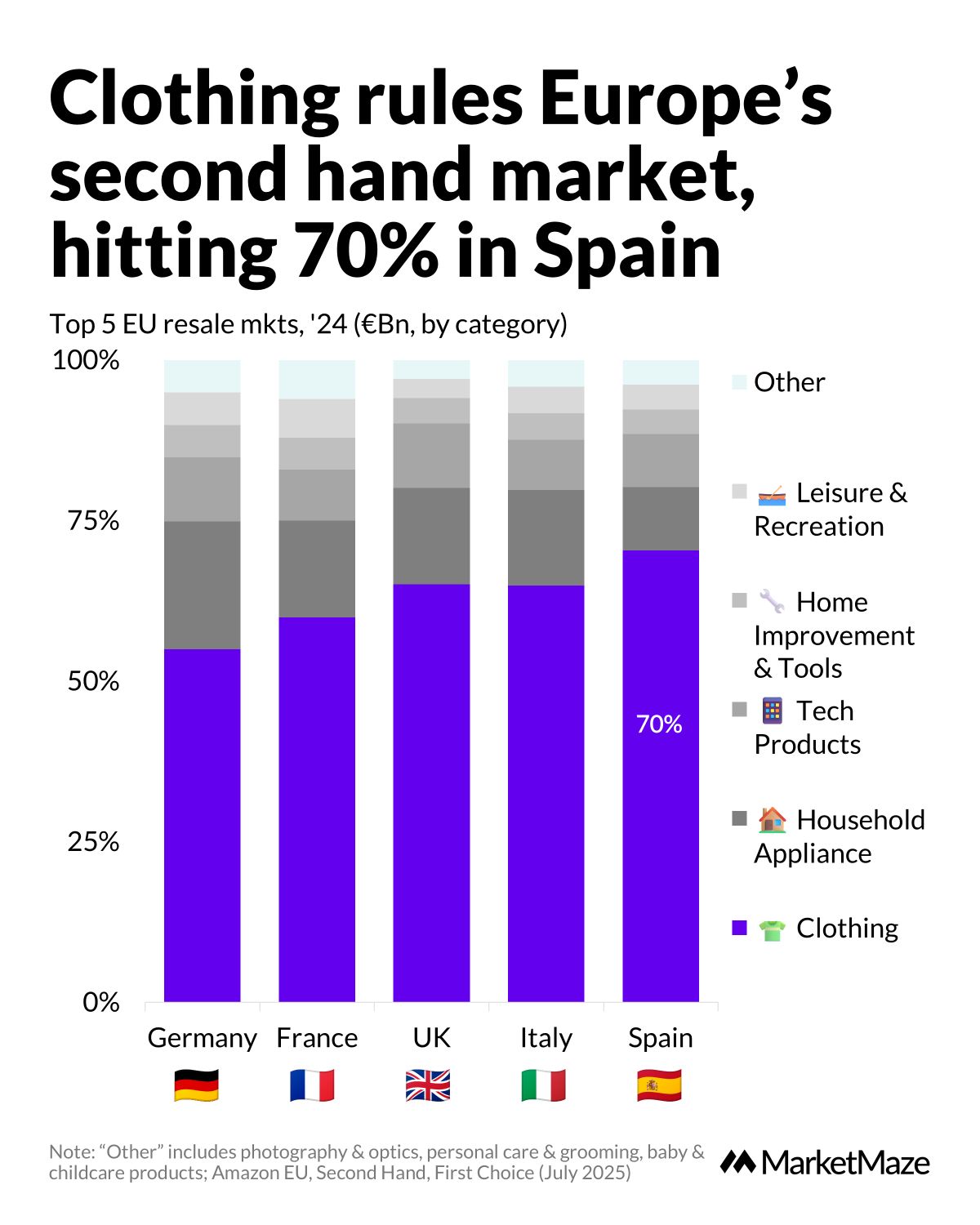

Clothing dominates resale, especially in Spain 👗

Fashion is the gateway drug to secondhand. Clothing makes up over half of all resale volume in every country shown, peaking at a wild 70% in Spain. Germany’s resale is more evenly split, with big shares for appliances and tech. France and the UK are heavy on clothing too, with smaller slices going to home tools and leisure gear. It’s fashion-first, function-second.

From our partners

Launch Your Amazon Product to $100K+ in Revenue—Fast!

Stack Influence helps you scale your new Amazon product launches into six-figure success stories. Automate thousands of micro-influencer collaborations monthly—no influencer fees, just authentic content paid with your products. Trusted by top brands, Stack Influence boosts external traffic, organic rankings, and delivers engaging UGC, all fully managed so you can focus on growth.

👀 Outside the Maze

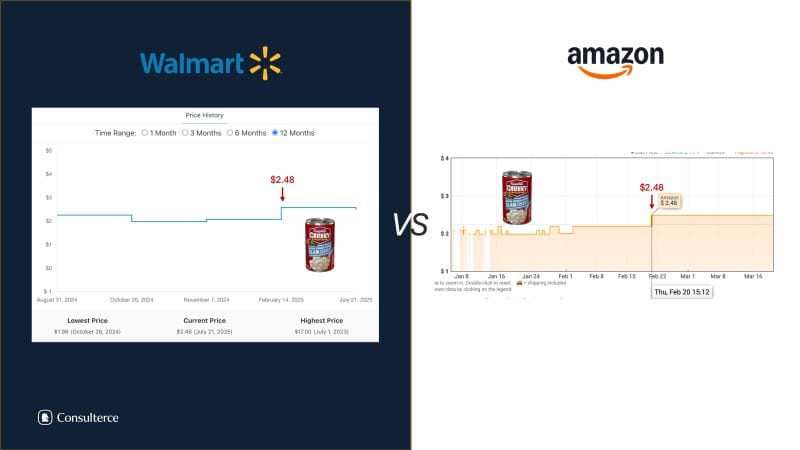

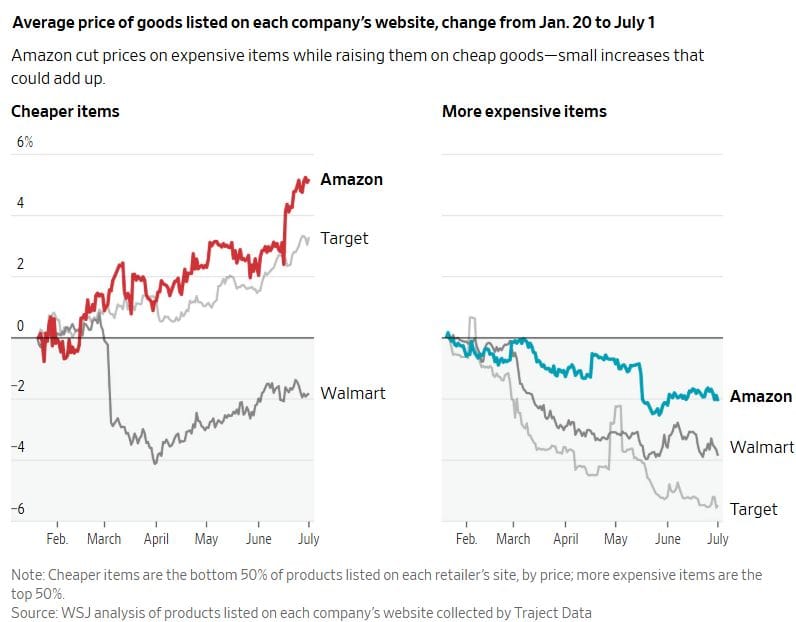

Amazon’s Not Leading Prices 🛒

Despite what headlines say, Amazon isn’t setting the price agenda—Walmart is. A WSJ article blames tariffs for rising costs on Amazon, but price history of items like Campbell’s Soup shows Walmart moved first. Amazon followed six days later. This isn’t pricing power, it’s tag-along inflation. 👉 The Wall Street Journal

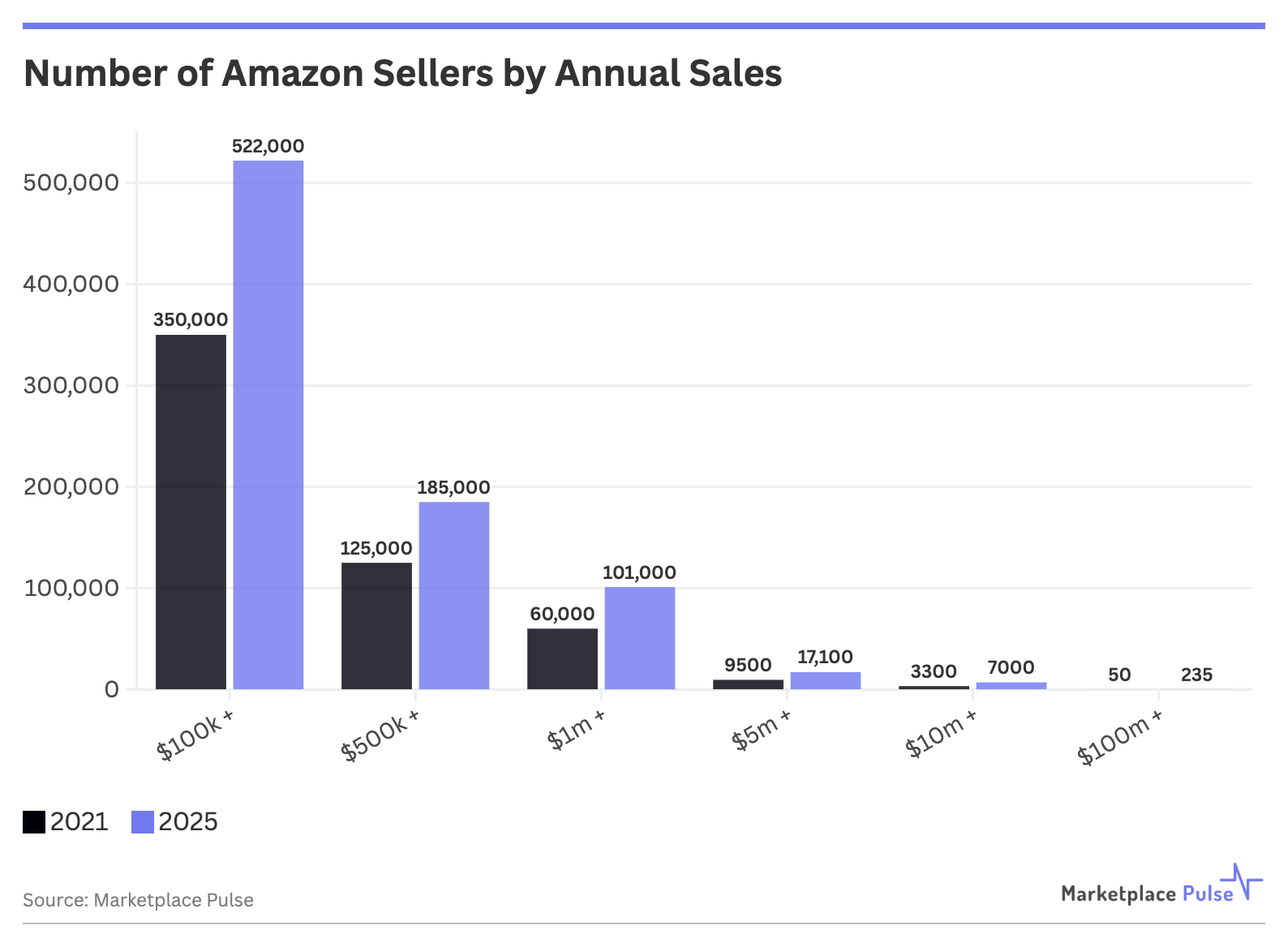

$100M Club on Amazon is Getting Crowded 💰

Marketplace Pulse just dropped a stat bomb: 235 Amazon sellers will hit $100M+ in sales this year, up from just 50 in 2021. Across all tiers, seller count is exploding—17K now make $5M+, up from 9.5K in 2021. Amazon isn’t just a platform. It’s a factory for digital empires. 👉 Marketplace Pulse

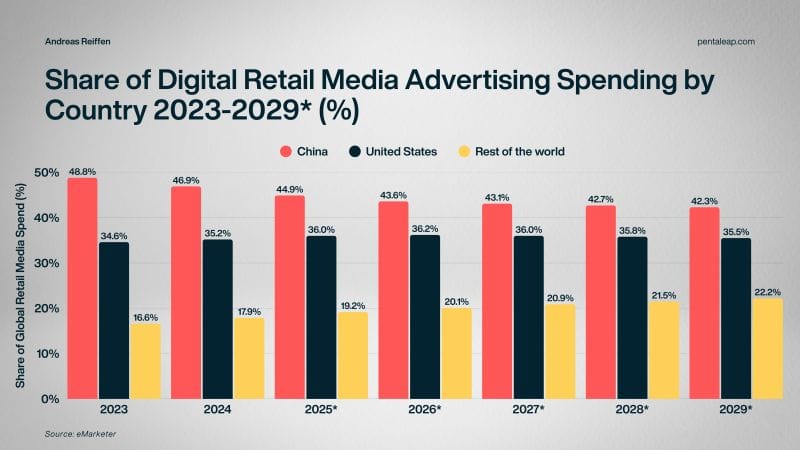

Retail Media Goes Global 🌍

eMarketer data shows China’s dominance in retail media is slipping—from 49% global share in 2023 to 42% by 2029. Meanwhile, the U.S. holds at 35-36% and "rest of world" is slowly catching up. But here's the red flag: retail media spend is projected to grow faster than ecommerce. Feels like over-forecasting unless retailers figure out how to shift real media dollars. 👉 LinkedIn post

Amazon’s Price Tweaks Could Fuel CPI 📈

Amazon is playing pricing jiu-jitsu. It's bumping prices on cheap essentials (+4% Jan–July) while cutting on big-ticket items—electronics, appliances. This move skirts shopper pushback and helps margins. But if competitors follow, expect retail-led inflation: small hikes on high-volume goods that sneak into the CPI. Smart for margins, risky for the economy. 👉 LinkedIn post

📰 Maze Briefing

🛒 Mass merchant platforms

🇺🇸 Amazon buys AI bracelet maker Bee for next-gen wearables. Amazon agreed to acquire Bee, a San Francisco startup known for its $50 AI-powered Pioneer bracelet with $19/month subscription, which records and transcribes conversations. Deal terms weren’t disclosed. Bee will join Amazon’s Devices division as part of a bigger AI hardware push. 👉 PYMNTS

🇺🇸 Bezos eyes CNBC in cable shake-up, no deal yet. Jeff Bezos is considering a bid for CNBC, which is part of Comcast’s upcoming Versant spinoff, with $7B in annual revenue. Insiders say Bezos wants a “neutral voice” to balance his media assets, but no formal offer has been made and regulatory delays are possible. 👉 Syracuse.com

🇺🇸 Walmart bets on AI “super agents” for e-commerce leap. Walmart launched four new AI “super agents” for customers, staff, sellers, and developers, aiming to generate 50% of sales online in five years. The tools automate tasks, improve catalog access, and boost efficiency as Walmart races Amazon for digital dominance. 👉 Retail Economic Times

🇮🇳 India hits Walmart’s Myntra with $200M compliance claim. India’s financial crime watchdog has launched a $200M GST case against Walmart’s Myntra, alleging it broke foreign investment rules by selling direct to consumers. It’s part of a wider crackdown on global e-commerce platforms. Myntra has not commented yet. 👉 TechCrunch

🇺🇸 Walmart outpaces Amazon on Prime Week delivery. During Prime Week, 48% of Walmart grocery shoppers used same-day delivery, beating Amazon’s 36%. Walmart’s dense store network gives it an edge for instant orders, while Amazon leads in next-day and two-day shipping lanes. 👉 PYMNTS

🇺🇸 Walmart cracks down on marketplace fraud with new AI. Walmart is removing thousands of suspect products from its 500M+ marketplace listings, targeting fakes and false “Made in USA” claims. New AI tools and tighter seller checks aim to protect buyers, as Walmart works with agencies like the FTC and FBI. 👉 Retail Dive

🇺🇸 Temu rebounds in App Store as ad spend returns post-tariff. Temu jumped to #1 in the U.S. App Store after resuming ad spending, which paused during new tariffs on Chinese goods. The move follows the U.S. closing the “de minimis” loophole for cheap imports, but Temu’s low-cost playbook is proving resilient. 👉 Modern Retail

🇪🇺 EU warns Shein, Temu over millions of unsafe imports. EU Commissioner Michael McGrath says millions of unsafe goods, from toxic baby products to faulty sunglasses, enter the bloc via Shein and Temu. The EU logged a record 4,137 product alerts, and McGrath calls for scrapping the €150 duty-free rule. 👉 The Guardian

🇨🇳 Temu joins INTA to boost global trademark protection. Temu has joined the International Trademark Association to step up its fight against counterfeits and improve global IP compliance. This follows mounting pressure from regulators and brands over knockoffs and IP infringement on the platform. 👉 PR Newswire

👗 Fashion, Home & Beauty Ecommerce

🇩🇪 MediaMarkt and Saturn: JD.com eyes €2.2B takeover. Ceconomy, owner of MediaMarkt and Saturn, is in advanced talks to sell to China’s JD.com for €2.2B, offering €4.60 per share. This move would give JD.com a big presence in Europe with 1,000+ stores and €22.4B in annual sales. 👉 Delano

🇺🇸 Walmart locks down beauty sales to brands only. Walmart now allows only brand owners or official resellers to sell beauty and personal care products. Sellers must prove they are authorized, show real invoices, and meet strict safety and FDA rules to stay on the marketplace. 👉 ChannelX

🇸🇬 Shein calms investors after U.S. import crackdown. Shein’s executive chairman, Donald Tang, is reassuring investors as new U.S. rules end tax breaks on small China imports. The move may raise Shein’s costs and slow shipments as it prepares for a London IPO. 👉 Business Times

🇺🇸 Google brings AI try‑on and smarter price alerts. Google’s new AI tool lets shoppers upload a photo to virtually try on clothes and get size-specific price alerts. Coming upgrades will let users describe a look and get AI-driven shopping matches. 👉 Search Engine Land

🇩🇪 Happy Size launches plus-size marketplace with Mirakl. Happy Size rolls out a plus-size fashion marketplace built on Mirakl tech, offering top brands like Ulla Popken and YOEK. Over 25M annual visits show strong demand for inclusive sizing in Europe. 👉 Mirakl

🇫🇷 Fnac Darty online sales rise 8% in 2025. Fnac Darty reports €4.48B in H1 sales, with online sales up 8% and now 21% of revenue. Click-and-collect drives growth as digital investments and services boost the bottom line. 👉 Ecommerce News EU

🇸🇪 H&M founding family speeds up share buys. The Persson family, founders of H&M, increased their stake to 64% of shares and 85% of votes. This accelerates speculation about a possible future buyout as they tighten control of the fashion giant. 👉 Fashion Network

🇬🇧 BoohooMan launches marketplace with 500+ brands. BoohooMan opens the Brand Locker marketplace, featuring over 500 brands in streetwear, fitness, and accessories. The move shifts the company from single-brand to multi-brand, matching trends seen at Boohoo and Debenhams. 👉 Retail Gazette

🍔 eGrocery & Food Delivery

🇪🇺 Prosus Offers Remedies for Just Eat iFood Deal. Prosus offered solutions to the EU to address antitrust issues over its €1.8B plan to buy Just Eat’s stake in Brazil’s iFood. The European Commission will decide by August 30 if the move, which strengthens Prosus in Latin America food delivery, gets the green light. 👉 Economic Times

🇩🇪 Lidl Faces Lawsuit Over Data Use in Loyalty App. Consumer group VZ Baden-Württemberg sued Lidl, claiming its Lidl Plus app collects too much personal data from millions of users. The case could set new rules for digital retail and data protection in Germany’s booming loyalty market. 👉 SWR Aktuell

🇬🇧 Deliveroo Uses Flexible Work to Boost ROI. Deliveroo’s agile workforce model lets riders choose shifts and routes in real time, helping the company cut delivery times and costs. With 150K+ riders, this move improves satisfaction and lets Deliveroo scale fast in the UK and Europe. 👉 Supply Chain Digital

🇸🇬 WeRide Debuts Fully Driverless Bus in Singapore. China’s WeRide launched Southeast Asia’s first driverless bus service at Singapore Science Park, using AI and LiDAR with no human driver. The move, backed by partners like ST Engineering, marks a milestone for regional smart mobility. 👉 SCMP

🇺🇸 Uber Launches Women-Only Driver Option in US. Uber now lets US women riders match only with women drivers, following success in India and Latin America. The change aims to boost safety and attract more female drivers in major cities, rolling out from August. 👉 TechCrunch

🇬🇧 Atelier Society Modernizes Fashion Logistics. Startup Atelier Society, founded by ex-Farfetch and YNAP execs, connects luxury brands to 400+ global tailoring and repair shops. The firm raised $7M to streamline post-sale services for high-end retailers in Europe and the US. 👉 Fashion Dive

🇺🇸 Etsy Switches Delivery Partners for US Sellers. Etsy is updating its US shipping partners, dropping some providers and adding new ones to improve costs and reliability. The change affects thousands of sellers, with no public details on which partners will stay or go. 👉 ChannelX

That's it for today! Before you go we’d love to know what you thought of today's maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team