TODAY’S MAZE

Greetings, MarketMaze readers! The era of machine-led transactions is rapidly approaching the mainstream. Projections indicate that agentic commerce will soon influence hundreds of billions in US online sales, completely reshaping how retailers compete for customer acquisition.

This massive shift is forcing platforms like Shopify to rapidly adapt their infrastructure to feed structured data directly to buying agents. But the central question remains: how can brands ensure their products are prioritized when AI is doing the shopping?

P.S.

Merry Christmas 🎄 Wishing you a calm break and a sharp 2026 ahead.

May your conversion rates stay high, customer acquisition costs stay low, and inventory finally behave!

In today’s MarketMaze focus:

AI agents drive sales

Google monetizes AI search globally

TikTok Shop launches gift cards

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Autonomous AI agents are poised to take over the shopping cart, with Bain & Company predicting agentic commerce will drive up to $500 billion in U.S. online sales by 2030, reshaping competition and forcing brands to build strategies around machine-led transactions.

The market already shows momentum, with autonomous agents influencing about $3 billion in Black Friday sales in 2025, signaling an early commercial impact on high-volume shopping days.

Payment networks are adapting by establishing a trust layer, as Visa rolled out its Trusted Agent Protocol (TAP) and 'Know Your Agent' (KYA) to ensure secure, authorized, and continuously validated transactions. Shopify is responding by launching Agentic Storefronts in its Winter ’26 Edition, enabling merchants to feed structured product data directly to major generative AI platforms for in-chat purchases.

Why it matters: This trend puts immediate pressure on retailers to define an agentic commerce strategy or risk ceding ownership of customer data and checkout to third-party AI platforms. Businesses must prioritize optimizing for Answer Engine Optimization (AEO) over traditional SEO to ensure their products remain visible when AI agents choose where to spend money.

FROM OUR PARTNERS

Easy setup, easy money

Making money from your content shouldn’t be complicated. With Google AdSense, it isn’t.

Automatic ad placement and optimization ensure the highest-paying, most relevant ads appear on your site. And it literally takes just seconds to set up.

That’s why WikiHow, the world’s most popular how-to site, keeps it simple with Google AdSense: “All you do is drop a little code on your website and Google AdSense immediately starts working.”

The TL;DR? You focus on creating. Google AdSense handles the rest.

Start earning the easy way with AdSense.

DATA TREASURE

The Maze: Amazon is not occasionally cheaper in Germany, it is structurally cheaper. Across 15 categories new Profitero+ study analysed, Amazon prices averaged ~15% lower, with gaps reaching 29% in household goods. This is strategy, not coincidence.

Consistent price leadership trains German shoppers to start on Amazon, reinforcing Prime habits and pushing competitors into narrower defensive positions.

MediaMarktSaturn stays closest in electronics, while dm and Rossmann remain competitive in daily essentials, showing where category strength still matters.

Ultra cheap cross border players are absent here, meaning Amazon dominates within the “standard retail” expectation set of speed and returns.

Why it matters: When price leadership is systemic, not tactical, competitors must win on service or specialization. Middle ground retail slowly disappears.

FROM OUR PARTNERS

Turn AI into Your Income Engine

Ready to transform artificial intelligence from a buzzword into your personal revenue generator

HubSpot’s groundbreaking guide "200+ AI-Powered Income Ideas" is your gateway to financial innovation in the digital age.

Inside you'll discover:

A curated collection of 200+ profitable opportunities spanning content creation, e-commerce, gaming, and emerging digital markets—each vetted for real-world potential

Step-by-step implementation guides designed for beginners, making AI accessible regardless of your technical background

Cutting-edge strategies aligned with current market trends, ensuring your ventures stay ahead of the curve

Download your guide today and unlock a future where artificial intelligence powers your success. Your next income stream is waiting.

MAZE STORY

The Maze: Google quietly expanded AI Overview ads to 11 new English-speaking countries on December 19, accelerating the monetization of generative AI summaries for millions of users worldwide across mobile and desktop devices. This deployment solidifies AI Overviews as a primary revenue stream while search publishers struggle with declining referral traffic.

The paid feature remains restricted to English-language searches across the 12 countries, even though AI Overviews are live in 200-plus countries across over 40 languages.

Google maintains strict controls, preventing ads from appearing in AI summaries for searches related to sensitive verticals including gambling, finance, and healthcare.

While AI Overviews drive 10% additional queries globally, Google executives insist monetization remains stable, claiming volume increases offset documented click reductions Liz Reid asserted in October 2025.

Why it matters: Ecommerce operators must now aggressively model how reduced organic traffic and rising competition within AI summaries impacts their CAC, recognizing that the long-term trend favors paid placement. Merchants need to optimize their conversion history because the integrated Smart Bidding algorithms increasingly use this rich data to determine optimal placements within these **AI-generated responses}.

DATA TREASURE

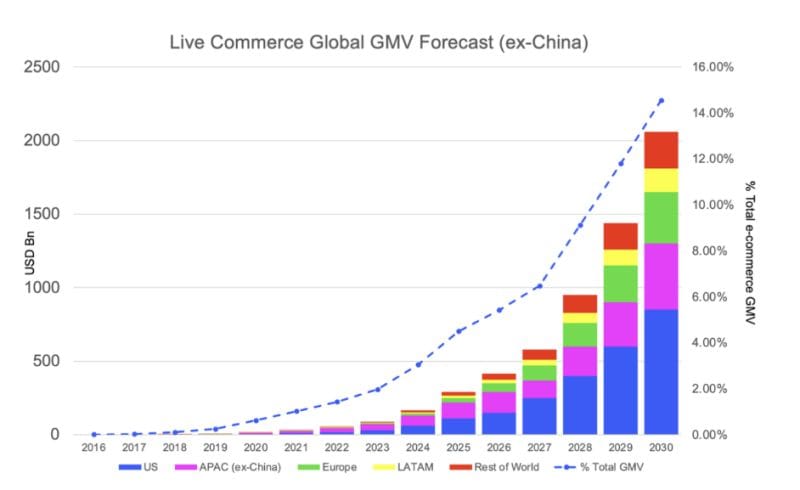

The Maze: Live commerce outside China is heading toward $2 trillion by 2030, but China still operates on a different planet. The gap is structural, not technological. Infrastructure built years earlier unlocked scale later.

China crossed ~$562B in live commerce GMV and is heading toward ~$1T by 2026, powered by national wallets, dense logistics, and mobile first behavior.

By 2023, over 765M people participated in livestream shopping, with heavy users rarely buying on brand websites at all.

Outside China, growth concentrates in categories where demonstration matters and where payment and delivery friction is close to zero.

Why it matters: Live commerce is not a format, it is a system. Ecommerce players that build rails first will capture value. The rest will copy features and miss scale.

MAZE STORY

The Maze: TikTok Shop launched digital gift cards in the U.S., strategically positioning the platform to challenge established rivals like Amazon and eBay by securing a crucial monetization and customer acquisition channel during the holiday push.

The cards allow customers to load amounts between $10 and $500, offering customizable animated designs, with plans to add personalized video messages by early 2026.

This move follows significant sales success, as the platform recorded over $500 million in U.S. sales during the Black Friday and Cyber Monday four-day period, validating its marketplace traction.

Why it matters: Introducing gift cards creates an essential friction reducer, enabling brands and sellers to harness existing TikTok user trust and drive immediate cash flow, loyalty, and new customer acquisition into the platform's ecosystem. E-commerce leaders must recognize that social platforms continually invest in engagement mechanics that blur the line between content, gifting, and core transactions, forcing traditional retailers to adapt quickly.

BRIEFING

🏬 Everything else in Ecommerce

🇨🇦 Shopify rolled out 'Agentic Storefronts,' integrating its platform with LLMs like ChatGPT and Copilot, allowing merchants to sell directly through external conversational AI agents.

🇺🇸 The USPS is seeking expanded pricing power by attempting to drop the Market Dominant price cap system, raising concerns about larger rate increases starting in 2027.

🌍 Alphabet is acquiring data center firm Intersect for $4.75 billion to accelerate the necessary energy infrastructure buildout for its expanding AI and cloud operations.

🇺🇸 Walmart & PepsiCo face a new class action lawsuit alleging price fixing, stemming from an unsealed FTC suit that claimed PepsiCo unfairly granted the retailer preferred pricing.

🇺🇸 Nike CEO Elliott Hill launched a new strategic turnaround plan focusing on higher pricing, senior leadership restructuring, and mending key wholesale partnerships to combat declining sales.

🌍 Google expanded Performance Max (PMax) channel reporting to Multi-Client Center (MCC) accounts, offering large advertisers clearer, cross-account insight into spend allocation.

🇺🇸 US merchants absorbed nearly half of all debit card fraud losses, highlighting how payment economics continue to shift risk away from banks and onto sellers.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team