TODAY’S MAZE

Happy Wednesday! Holiday shopping just got smarter. Americans are set to spend a record $253B online this season, powered by mobile, AI, and Buy Now Pay Later. Cyber Week is no longer a weekend sprint… it’s a full-blown digital marathon of deals and data.

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

🌀 MAZE STORY

🎁US Holiday eCommerce to Break Records

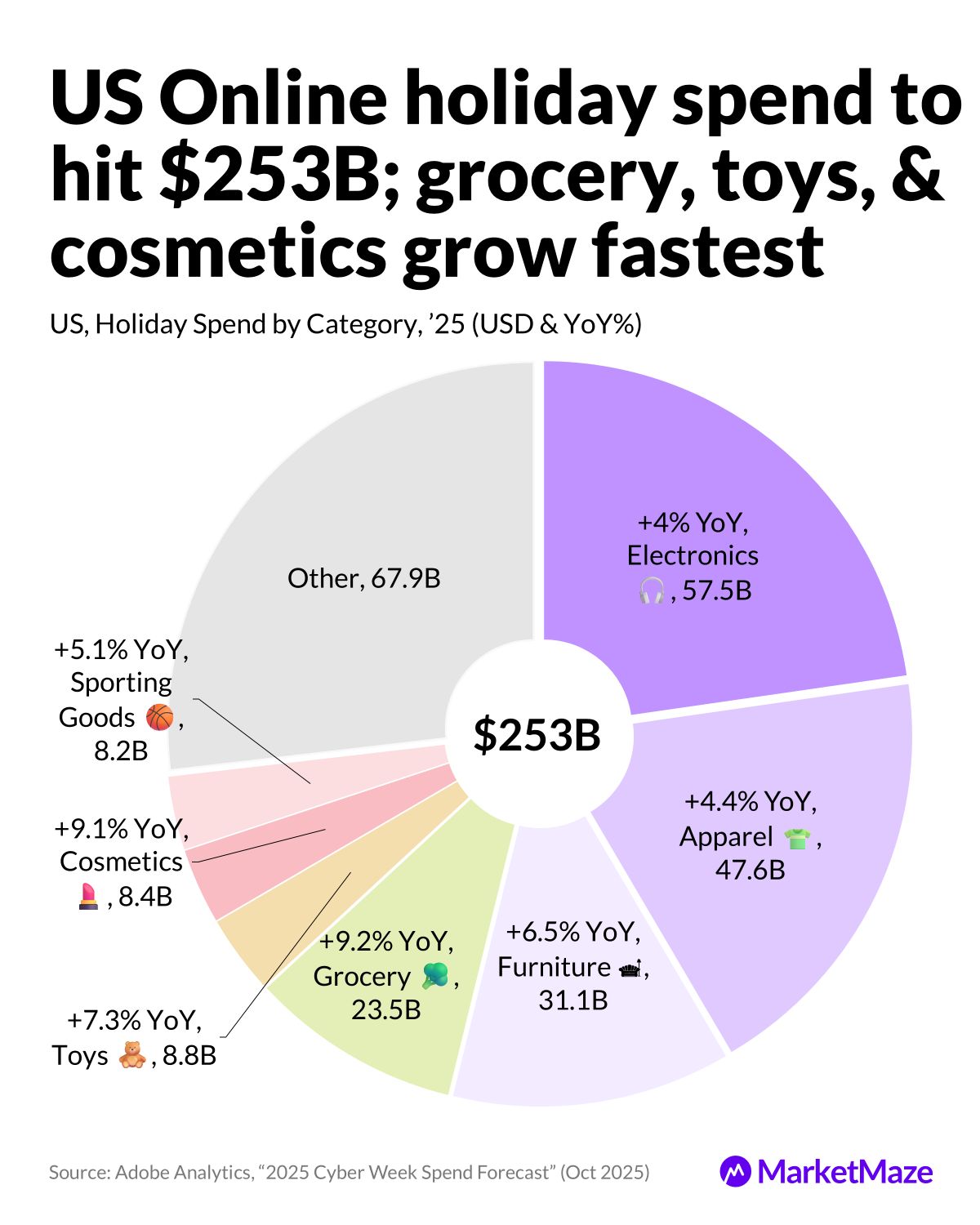

U.S. shoppers are set for another record-breaking holiday season. According to Adobe Analytics’ October 2025 forecast, online sales will climb to $253B, with mobile and AI-driven tools shaping how and when people buy. Cyber Week remains the centerpiece, but deeper discounts and new habits show how digital retail keeps evolving.

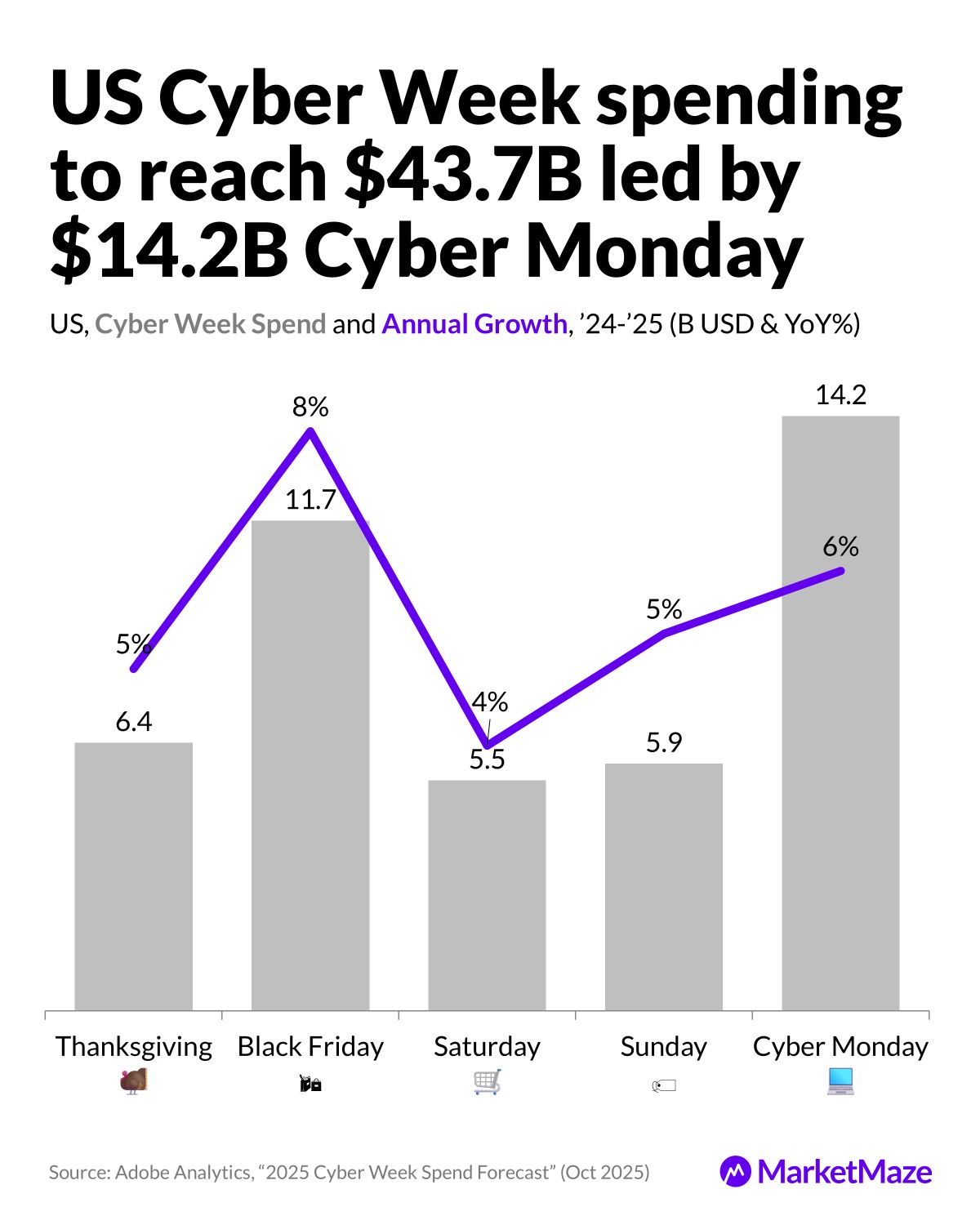

Cyber Week 💥

Cyber Week spending will reach $43.7B, up 6% from last year. Cyber Monday alone will generate $14.2B, while Black Friday hits $11.7B with 8% growth. Thanksgiving contributes $6.4B, proving consumers now shop before the turkey cools. Each day’s sales rise, reflecting how online events stretch across the full week rather than one retail peak.

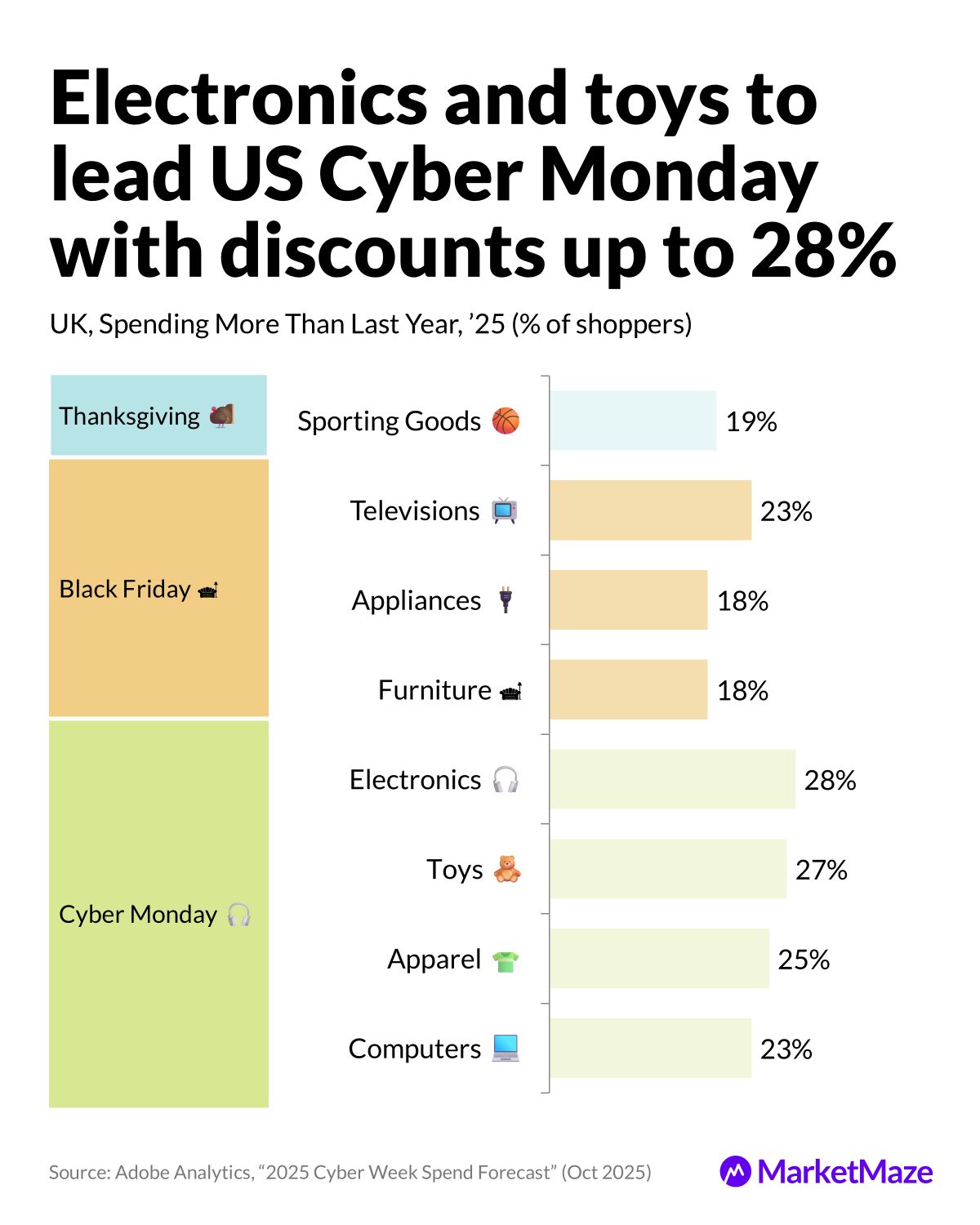

Deep Discounts 🧸

Discounts are expected to hit new highs this season. Cyber Monday leads with 28% off electronics and 27% off toys, followed by apparel at 25% and computers at 23%. Black Friday remains the best time for televisions and home goods, while Thanksgiving shines for sporting gear. The message is clear: shoppers are chasing value, not just timing.

Spending Leaders 🛒

Holiday spend will total $253B, driven by strong growth in grocery (+9.2%), cosmetics (+9.1%), and toys (+7.3%). Electronics still lead in volume at $57.5B, followed by apparel ($47.6B) and furniture ($31.1B). Despite inflation pressures, consumers continue to invest in both essentials and indulgences—proof that digital retail’s biggest season is far from peaking.

Editable Slides & Sources:

🔒 Available for MarketMaze+

📣FROM OUR PARTNERS

We don’t do “business as usual”

The world moves fast, but understanding it shouldn’t be hard.

That’s why we created Morning Brew: a free, five-minute daily newsletter that makes business and finance news approachable—and even enjoyable. Whether it’s Wall Street, Silicon Valley, or what’s trending at the water cooler, the Brew serves up the context you need in plain English, with a side of humor to keep things interesting.

There’s a reason over 4 million professionals read the newsletter daily—and you can try it for free by clicking below!

🌀 MAZE STORY

🤖Smarter, Faster Shopping

Holiday 2025 is where digital meets discipline. Adobe Analytics’ October forecast shows how consumers are blending convenience, credit, and AI to shop more strategically. From buy-now-pay-later to AI-assisted browsing, this season’s retail story is defined by smarter spending and faster tech adoption.

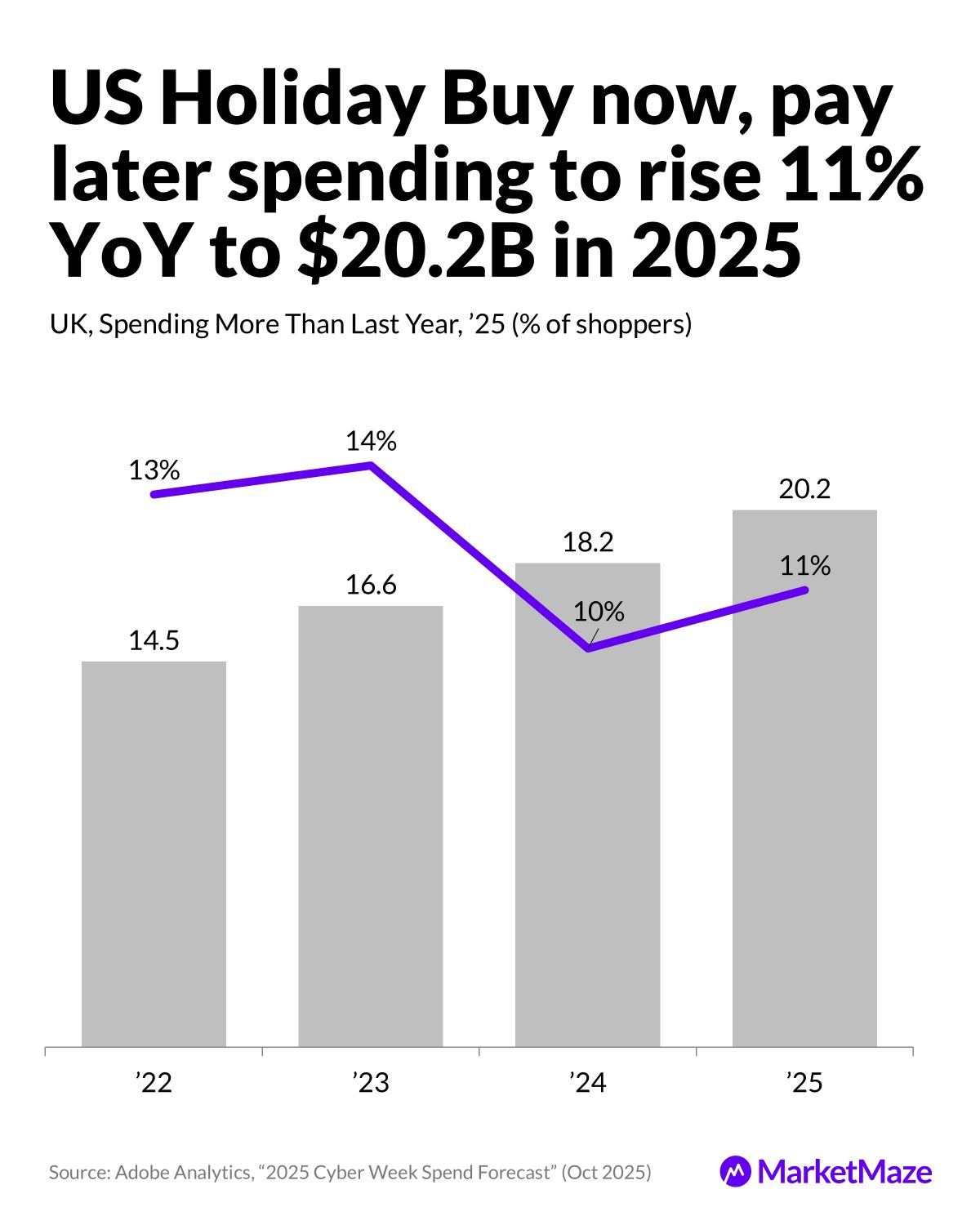

BNPL Boom 💳

Buy Now, Pay Later is set to hit $20.2B in the U.S. holiday season, up 11% from 2024. After peaking at 14% growth in 2023, adoption steadied yet stayed strong, reflecting shoppers’ reliance on flexible payments amid tight budgets. Over three years, BNPL spend rose 39%, becoming a mainstream checkout option, especially for big-ticket categories.

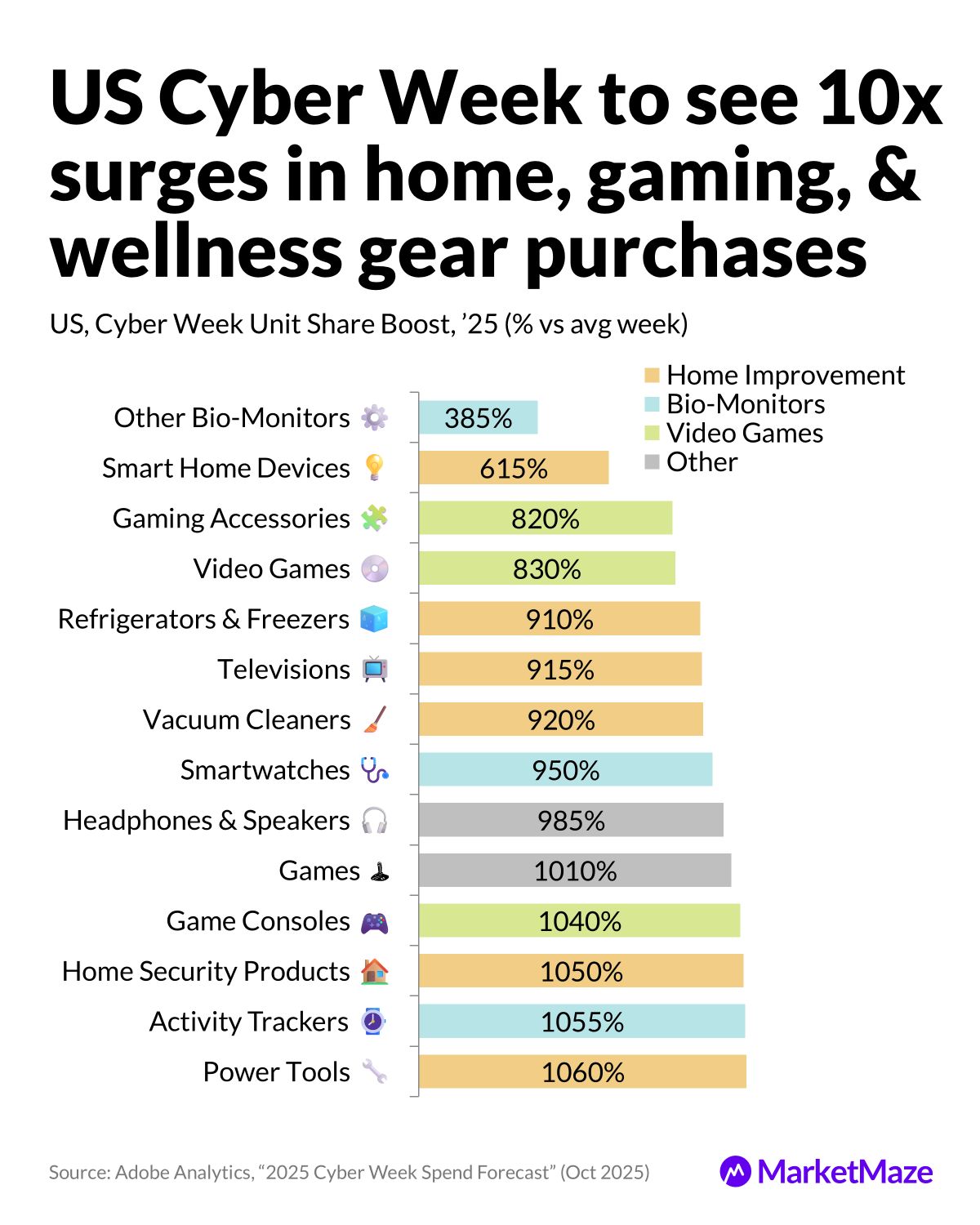

Cyber Surge ⚡

Cyber Week 2025 will trigger 10x spikes in online unit sales across multiple categories. Power tools and activity trackers soar over 1,050%, while gaming consoles jump 1,040%. Smartwatches, TVs, and home security gear also see massive lifts. The surge underlines how Americans turn Cyber Week into a cross-category shopping festival, not just a tech sale.

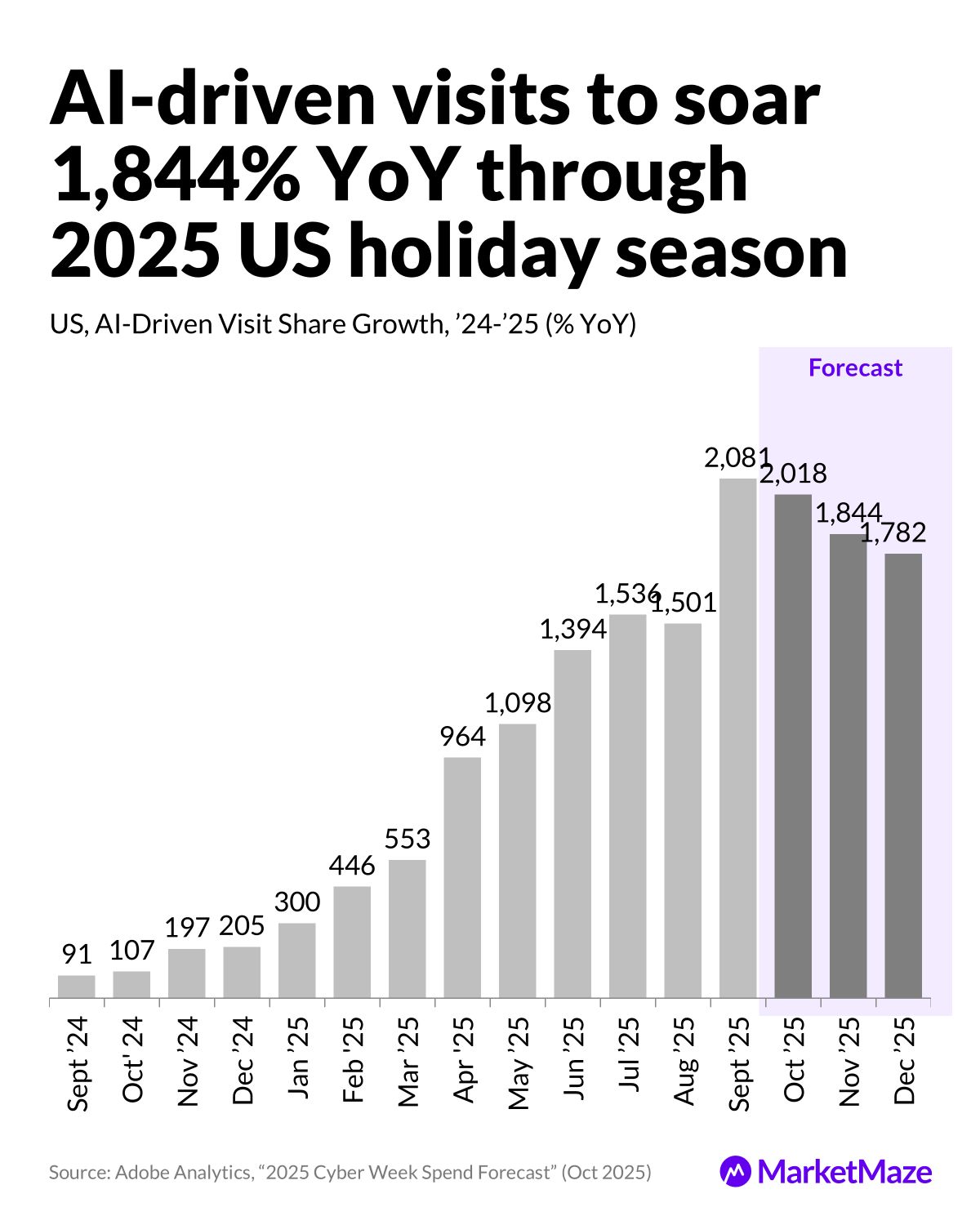

AI Takeover 🧠

AI-driven shopping traffic has exploded—up 1,844% YoY by November 2025. Shoppers increasingly depend on AI for search, price comparisons, and tailored recommendations. Growth accelerated every quarter through 2025, transforming discovery and decision-making. Even post-holiday, traffic remains 1,782% above last year, proving AI isn’t seasonal hype but a lasting habit.

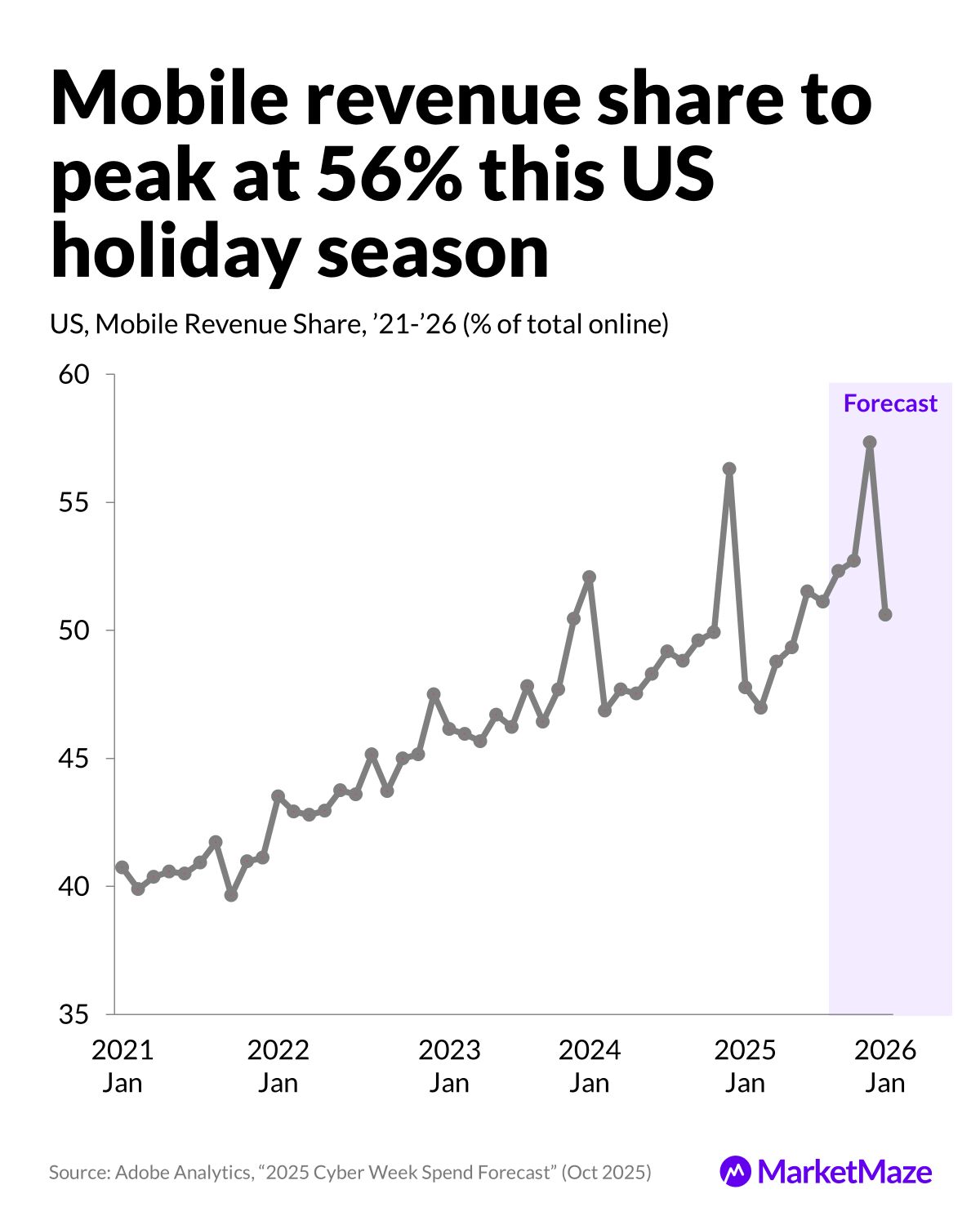

Mobile Majority 📱

Mobile commerce will command 56% of total online revenue this holiday season, up from 52% in 2024. The rise reflects better apps, smoother checkout flows, and social shopping integration. Since 2021, mobile share has climbed 16 percentage points, cementing its dominance. Retailers that ignore mobile-first experiences risk missing where consumers now live and spend.

Editable Slides & Sources:

🔒 Available for MarketMaze+

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

🧠 RECOMMENDED NEWSLETTERS

Craving more sharp reads? Check out these MarketMaze-recommended newsletters.

THAT’S IT FOR TODAY

Before you go we’d love to know what you thought of today's maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team