Welcome to MarketMaze, the #1 newsletter for staying on top of the latest in Ecommerce & Marketplaces. Get all the insights you need in just 5 minutes!

🧠 Big Story:

US Ecommerce Looks Abroad for Wins 🏆

📊 Key Data:

3P is Eating eCommerce

📖 Ecommerce ecosystem news:

🇺🇸 Temu Showcased at Google I/O 2025 for Web UI Innovations.

🇺🇸 Google Launches AI Max for Enhanced Search Campaigns.

🇺🇸 Amazon launches low-code app builder for business users.

🇺🇸 Amazon slashes dev teams with Copilot AI, saving 4,500 years.

🇨🇦 Shopify and DHL seal cross-border shipping pact.

🇨🇳 Asia–US container rates jump as carriers restore capacity.

+ over 15 handpicked hot ecommerce news from the last week you need to know 🔥

US Ecommerce Looks Abroad for Wins 🏆

US e-commerce brands aren’t just looking for growth—they’re chasing it across oceans. A new Passport Global survey of industry execs shows American companies are all-in on international expansion, but crossing borders isn’t as easy as checking a box on Shopify. From Canada to Asia, the real race isn’t who goes global, but who survives the tariffs, tax traps, and TikTok takeovers along the way.

Global Hotspots: Canada Tops the List 🌎

US ecommerce brands are doubling down on international growth, with 71% naming Canada their top expansion target. The UK (52%), EU (48%), Asia-Pacific (46%), and Mexico (43%) are also in the spotlight. But expansion isn’t just about chasing demand—it’s about managing unpredictable tariffs and complex tax rules. Without robust compliance systems, brands risk getting tripped up by shifting regulations and surprise costs, putting ambitious global plans on ice.

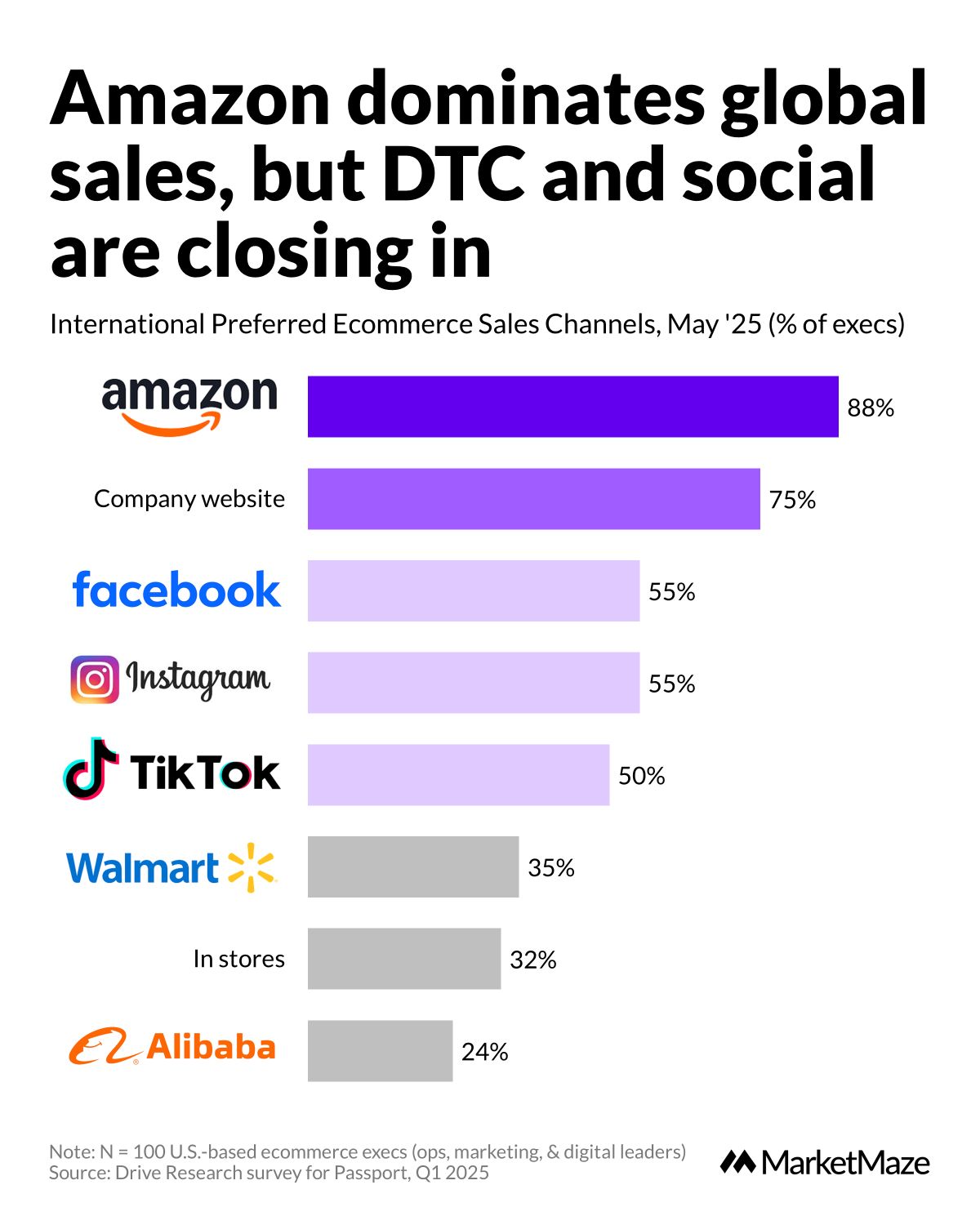

Amazon Rules, but DTC and Social Surge 🚀

Amazon is still king, with 88% of brands making it their go-to sales channel for global reach. Company websites are catching up, with 75% driving sales direct-to-consumer (DTC). Social platforms aren’t far behind—Instagram and Facebook each pull in 55%, and TikTok claims 50%. The message for brands: Don’t put all your eggs in one basket. Winning means mastering DTC and social commerce alongside marketplace muscle.

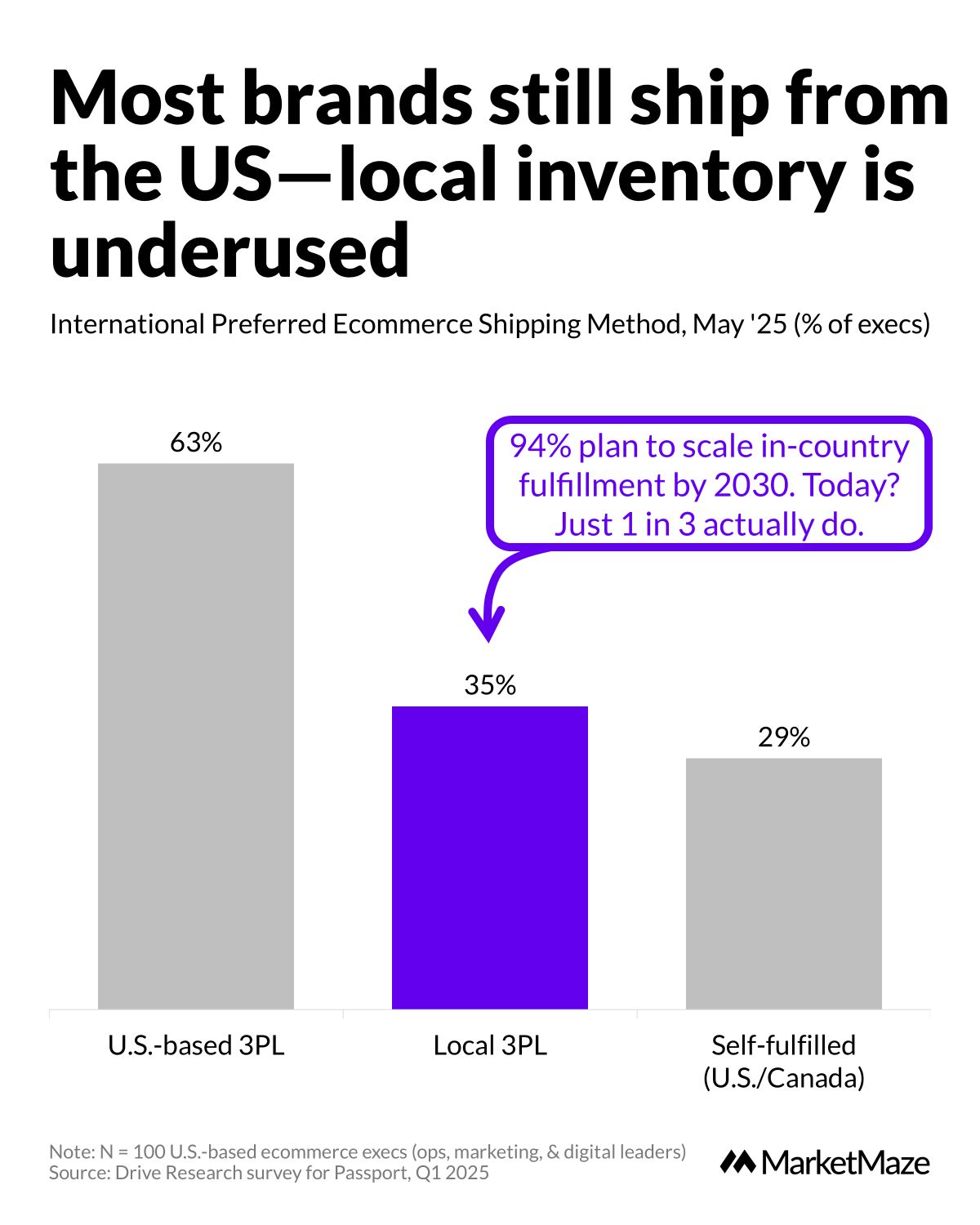

US Fulfillment Dominates, Local Lags 📦

Despite the global ambitions, 63% of brands still lean on US-based 3PLs for shipping orders abroad. Only 35% use local third-party logistics, and just 29% handle fulfillment themselves. The twist? 94% of leaders say they’ll scale in-country fulfillment by 2030, but only 1 in 3 actually does it now. Centralized US inventory is simple, but local fulfillment brings faster shipping, lower tariffs, and better customer experiences—if brands can pull it off.

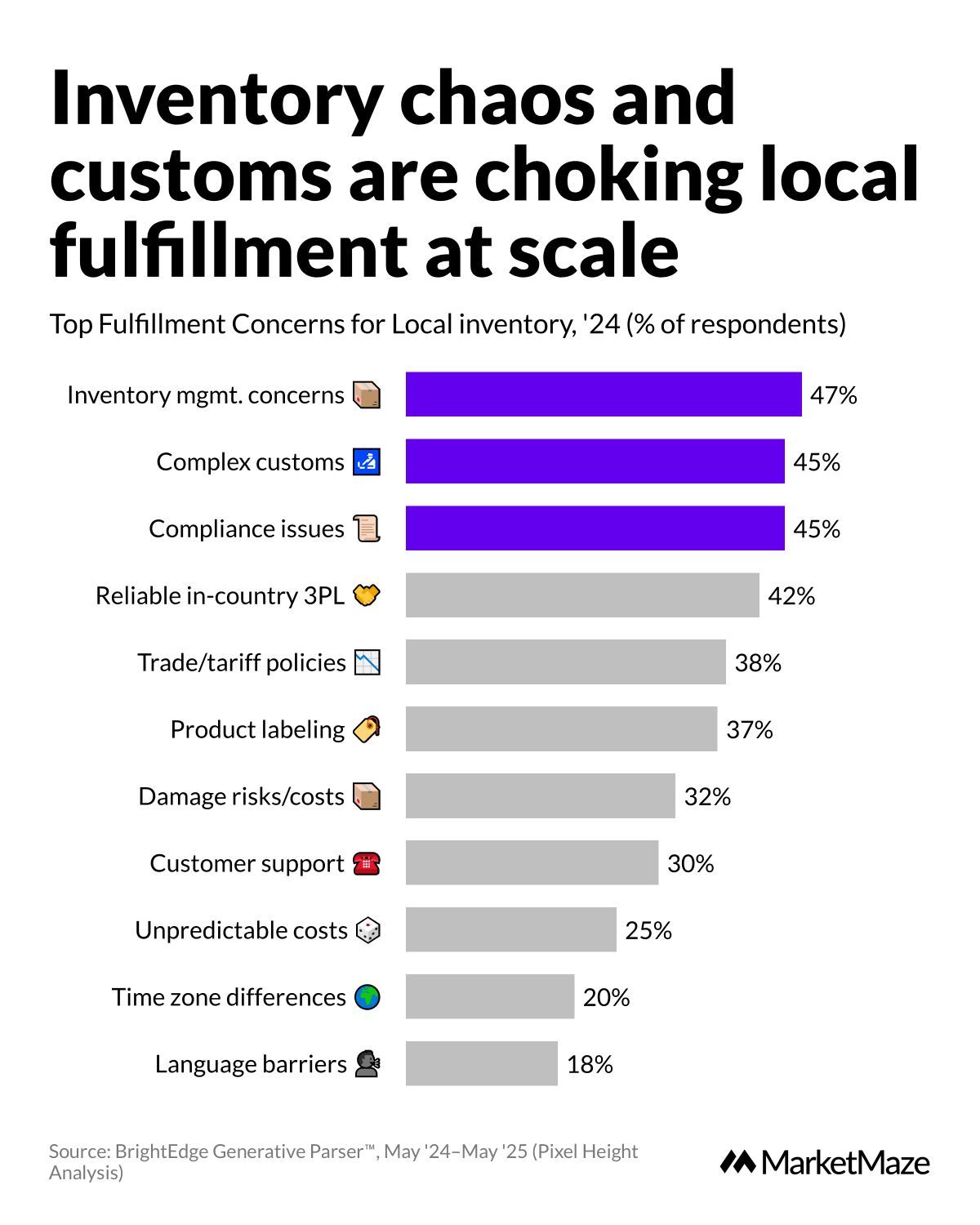

Chaos at the Border: Local Fulfillment Pain 🛃

Moving inventory closer to international customers sounds great, but execution is rough. Nearly half of brands (47%) struggle with inventory management, while customs (45%) and compliance (45%) cause plenty of headaches. Reliable local partners are tough to find (42%), and trade policies (38%) keep everyone guessing. The secret sauce? Brands who blend cross-border with local fulfillment stay nimble, meet rising consumer expectations, and keep chaos in check.

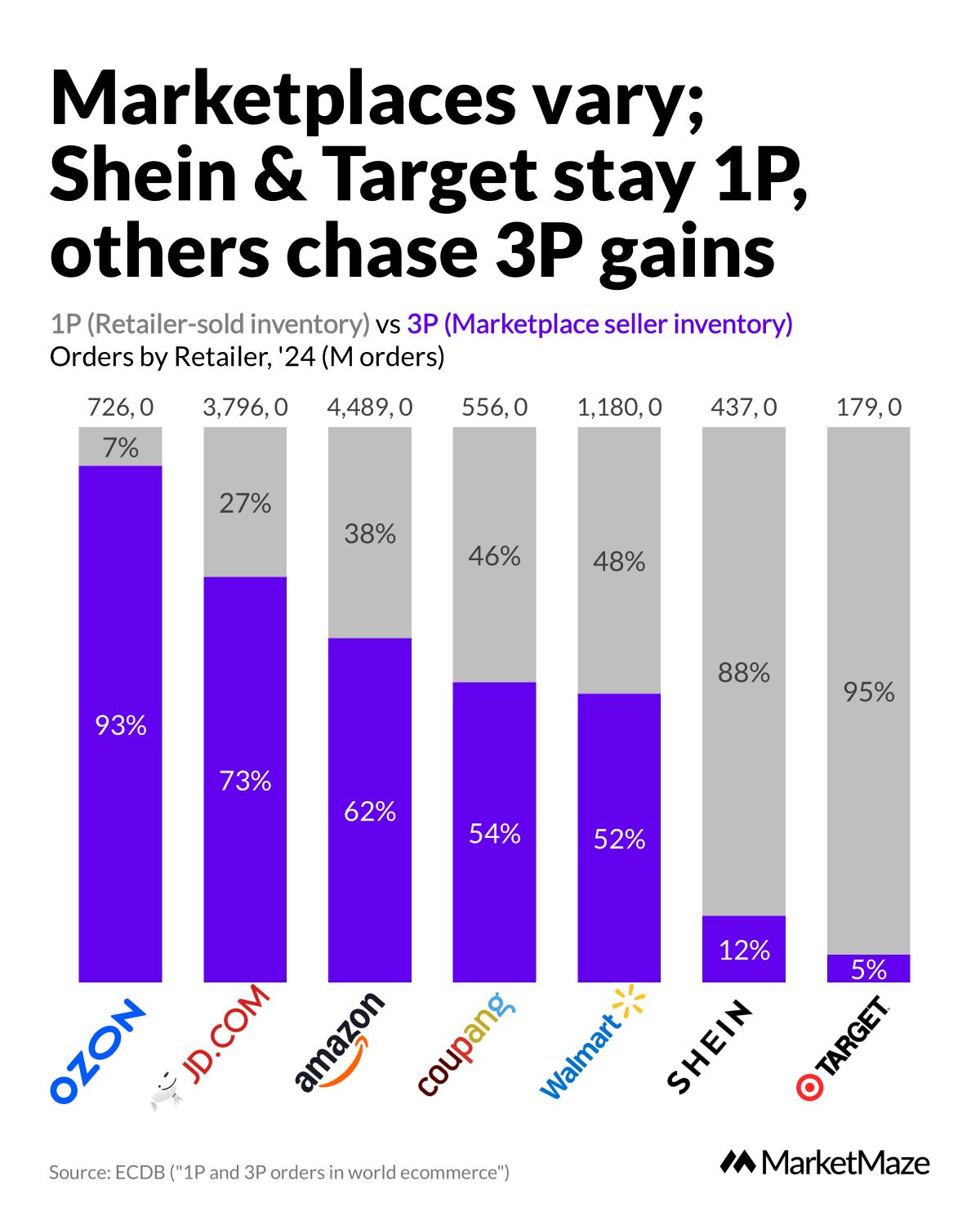

3P is Eating eCommerce

Most people misunderstand eCommerce models.

(Here’s what actually drives platform strategy)

There are two types of online orders:

• 1P = Retailer sells from its own inventory

• 3P = Sellers list and sell via the platform

The mix between the two? Tells you everything.

Here’s what ECDB data shows:

→ Ozon.ru → 93% 3P

→ JD.com → 73% 3P

→ Amazon → 62% 3P

→ Walmart → 52% 3P

→ Coupang → 54% 3P

→ Shein → 12% 3P (launched marketplace in 2023)

→ Target → 5% 3P

Why it matters:

• 3P = more selection, less inventory risk

• 1P = more control, slower to scale

• Everyone’s moving toward 3P

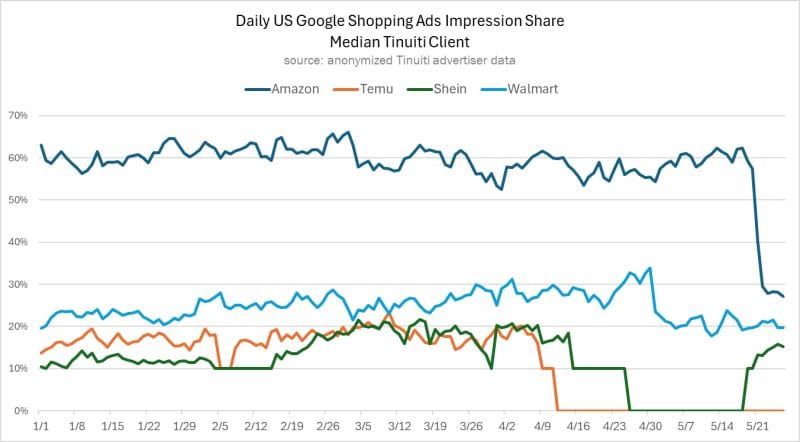

Amazon’s Pullback Shakes Up Google Shopping Ads.

Andy Taylor highlights a rare move: Amazon slashed its Google Shopping Ads share in May, dropping from above 60% to just over 30% for Tinuiti advertisers. Shein has jumped back in, while Temu and Walmart hold steady. This sudden drop follows a court ruling striking down Trump-era global tariffs, so everyone’s waiting to see if Amazon’s ad pause is tactical or a sign of bigger changes in play. 👉 Andy Taylor on LinkedIn

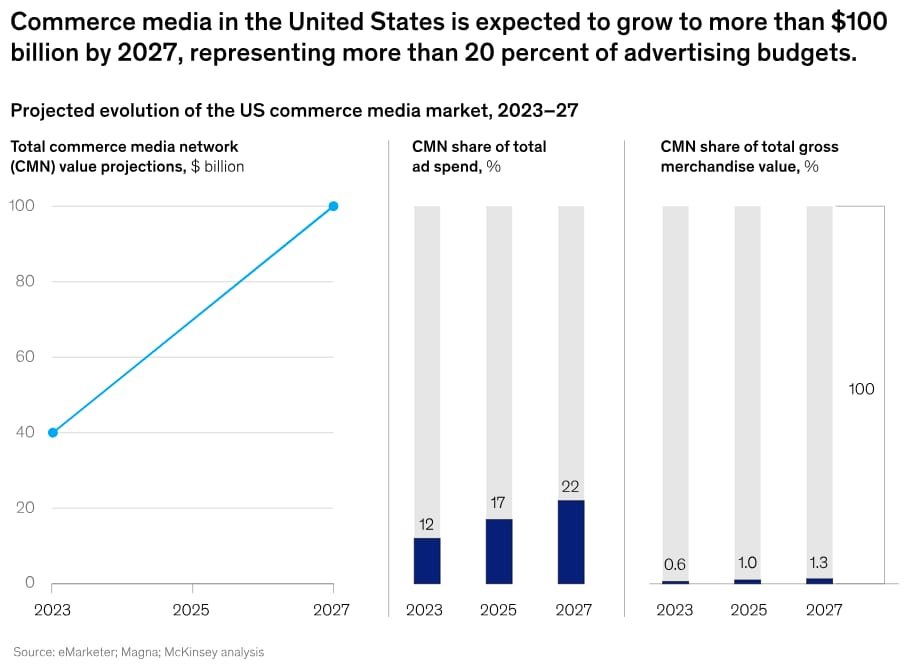

Commerce Media Networks to Top $100B by 2027 in the U.S.

McKinsey breaks down the explosive growth of commerce media networks (CMNs)—think ad networks built on first-party transaction data, now used well beyond retail. CMNs are set to grab over 20% of U.S. advertising budgets by 2027, outpacing connected TV and search. Expect $100 billion in spend, with brands moving dollars out of social and classic display to chase performance and direct sales. 👉 McKinsey – The Evolution of Commerce Media

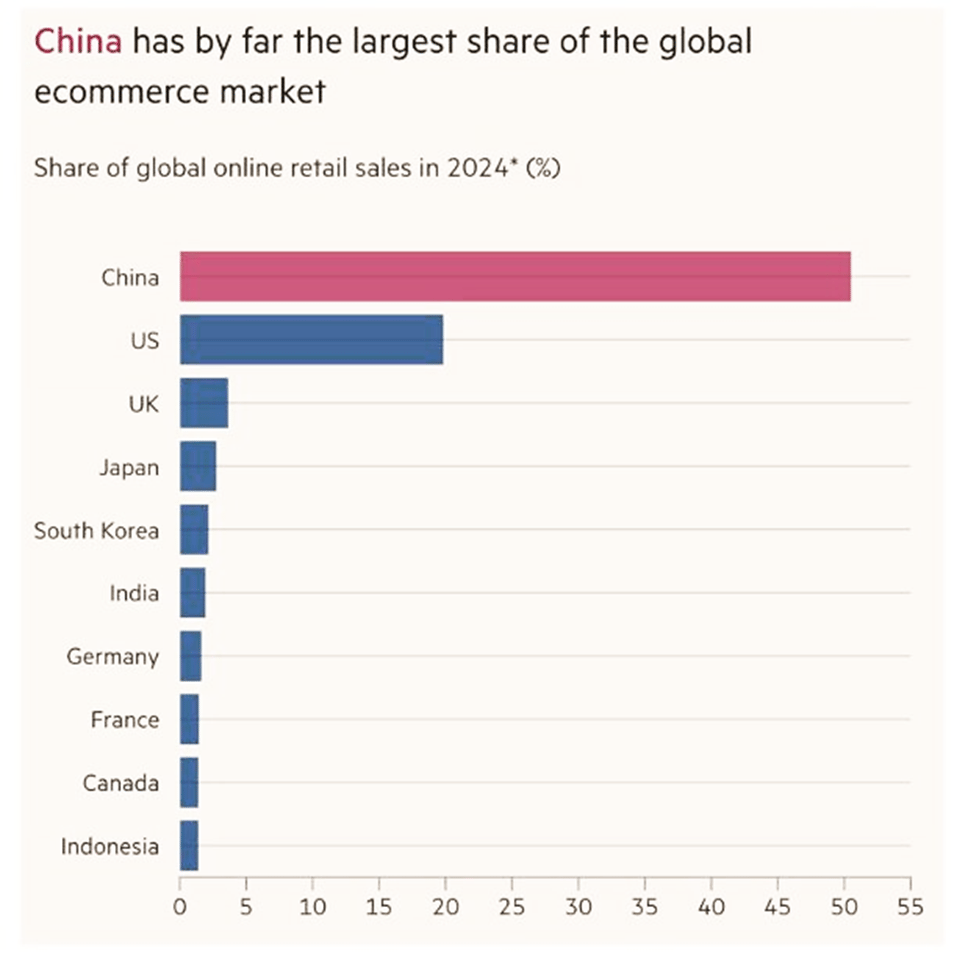

China Dominates Global Ecommerce—Everyone Else Plays Catch-Up.

The Financial Times spotlights the scale: China will command over half of all global online retail sales in 2024—more than the next nine markets combined. The U.S. follows at a distant second, with the UK, Japan, and South Korea trailing far behind. If you want to see tomorrow’s retail, look east. 👉 Financial Times: China’s Global Ecommerce Share

🇺🇸 Temu Showcased at Google I/O 2025 for Web UI Innovations.

Temu was featured at Google I/O 2025 as a leading adopter of Google's new Web UI primitives, enhancing interactivity and performance in web applications. Implementing these APIs led to a 10% increase in user session duration and a 15% rise in page views. 👉 ChannelX

🇺🇸 Google Launches AI Max for Enhanced Search Campaigns.

Google introduced AI Max for Search campaigns, offering AI-driven enhancements to improve ad performance. Early adopters like L'Oréal reported a 2x higher conversion rate and a 31% reduction in cost-per-conversion. 👉 Search Engine Land

🇺🇸 Meta Plans Expansion of Physical Retail Stores.

Meta is planning to expand its physical retail presence beyond its existing California store to boost sales of hardware products like Ray-Ban Meta smart glasses and Meta Quest VR headsets. The move aims to enhance customer engagement and product accessibility. 👉 TechCrunch

🇺🇸 New York Times Enters AI Licensing Deal with Amazon.

The New York Times has signed a multi-year AI licensing agreement with Amazon, allowing the tech giant to use its editorial content in products like Alexa and to train its AI models. Financial terms were not disclosed. 👉 CNBC

🇺🇸 Amazon launches low-code app builder for business users.

Amazon rolled out “Q Apps” on AWS, letting staff build workflow apps by chatting with AI, no code needed. Competing with Microsoft and Google, Amazon wants to slash dev time and cut IT costs for big companies. 👉 PR.com

🇺🇸 Amazon slashes dev teams with Copilot AI, saving 4,500 years.

Amazon’s engineers use Copilot AI to write code and run tests, shrinking team sizes by half. Amazon says this move freed up 4,500 developer years and boosted speed for projects across the company. 👉 DeepNewz

🇩🇪 Zalando taps Cozero for greener supply chain tracking.

Zalando joined forces with Cozero to use its carbon management tech across Zalando’s logistics. This will help Zalando track emissions, get better climate data, and aim for its 2025 climate targets. 👉 Cozero.io

🇩🇪 eBay Germany and YouLend launch instant seller loans.

eBay Germany partners with YouLend to let sellers access loans in under 24 hours, with loan sizes based on sales history. It’s a push to help sellers grow, manage cash, and drive more sales on eBay’s platform. 👉 The Paypers

🇺🇸 Bluehost brings easy open-source e-comm for creators.

Bluehost launches new tools for creators and SMBs to set up WooCommerce sites with simple plugins, bundled hosting, and payments. The update makes it easier for small brands to launch and run online stores without heavy tech support. 👉 PR Newswire

🇻🇳 Vietnam to block Telegram over security concerns.

Vietnam plans to block Telegram nationwide in early June, blaming scams and regulatory issues. The move will push millions of users and local firms to find new platforms as Vietnam tightens internet controls. 👉 Tech in Asia

🇨🇦 Shopify and DHL seal cross-border shipping pact.

Shopify teams up with DHL to boost international shipping for its 2.1M merchants, giving small businesses better rates and faster cross-border delivery. Merchants can now use DHL Express and eCommerce directly in Shopify, streamlining customs and tracking worldwide. 👉 eCommerce News EU

🇨🇳 Asia–US container rates jump as carriers restore capacity.

Shipping rates from China to the US West Coast jumped from $3.2K to $4.4K for a 40-foot container as carriers like Maersk and MSC brought ships back after a tariff pause. US importers face higher costs, and demand swings remain likely as trade policy changes. 👉 Hellenic Shipping News

🇵🇹 Lisbon’s Bloq.it raises €28M in one of Portugal’s biggest Series Bs.

Bloq.it, a smart locker startup serving DHL, DPD, and CTT, closed a €28M Series B led by Atomico. The funding will fuel expansion and 10K+ new lockers across Europe, meeting demand from the boom in e-commerce deliveries. 👉 EU-Startups

🇨🇳 Chinese imports to US rebound as tariff rate drops.

Containerized imports from China to US ports rose 12% after a tariff drop, as Walmart and Target quickly restocked. April saw a dip, but the rebound shows retailers move fast when trade policy shifts, keeping supply chains flexible. 👉 Modern Retail

🇹🇷 Arvato launches major logistics center in Turkey for e-commerce.

Arvato opened a 25K sq m fulfillment site near Istanbul, supporting 2M parcels a month for brands like H&M and Inditex. Turkey’s e-commerce market surged 60% to $40B, so Arvato’s expansion keeps pace with booming demand. 👉 eCommerce News EU

❤️ Your Opinion matters!

Share your thoughts on today’s email with just 1 click in the poll—it’s quick and helps us improve.

What do you think of this issue?

For questions or more feedback, reply to this email.

Best,

MarketMaze team