TODAY’S MAZE

Happy Thursday! Online retail isn’t a sideshow anymore – it’s a daily ritual. Across Europe and the US, browsing from the sofa has become a national sport and Amazon is coaching the game. But just as flashy newcomers like Temu, Shein and TikTok Shop crash the field, the scoreboard isn’t moving in their favour.

P.S.

1. Starting this week, MarketMaze+ subscribers can download the slides used in each issue, giving C-level readers quick access to the data behind our insights. If you’d like slides from past editions, just let us know!

2. This is the last email before Sunday. Let us know what you think about the timing, new schedule, and format! We’re open to any feedback or suggestions. You can do it by replaying to this email, in the poll at the end or by writing to me at Linkedin

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

🌀 MAZE STORY

E-Shopping & Amazon Addiction 🛒

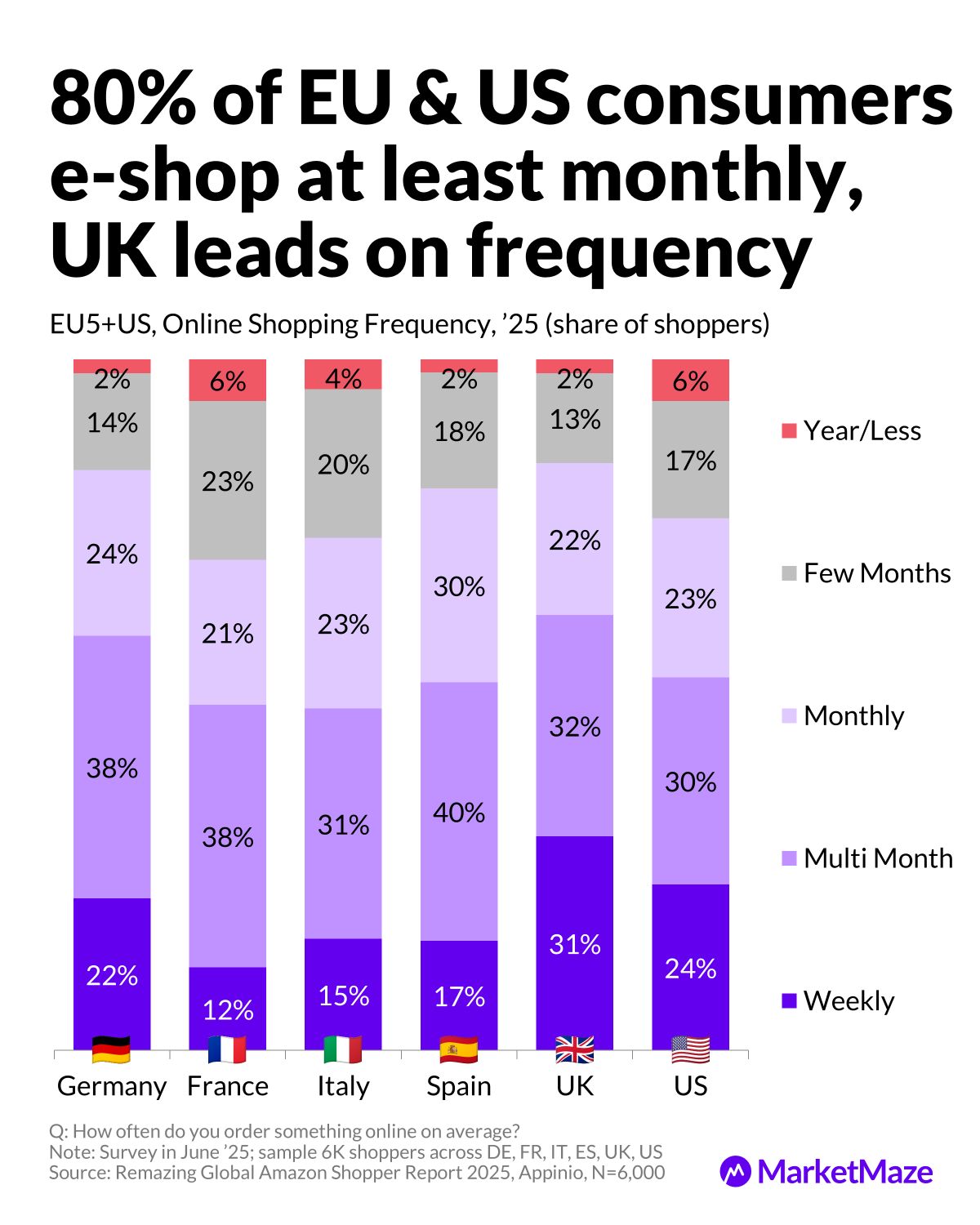

Almost 80% of EU5 and US consumers shop online at least once a month, and UK is setting the region’s pace with an unrivaled appetite for digital buying. What used to be “online shopping” has become a normal habit, deeply woven into daily routines, especially as younger shoppers take the lead. This isn’t a blip or a pandemic-driven bump… it’s a full lifestyle shift. For millions, “add to cart” is now as automatic as scrolling social feeds or texting a friend.

🇬🇧 UK Sets the Pace

Nearly 80% of consumers across the EU5 (Germany, France, Italy, Spain, UK) and the US shop online at least once a month, confirming that e-commerce has become a regular habit. The UK leads in shopping frequency, with 31% of consumers buying online weekly—well ahead of the EU average. Spain and Germany show the highest share of shoppers purchasing multiple times a month, at 40% and 38% respectively. Only a small minority, around 4–6%, shop online once a year or less, highlighting how deeply online retail has penetrated everyday life.

🏆 Amazon Still on Top

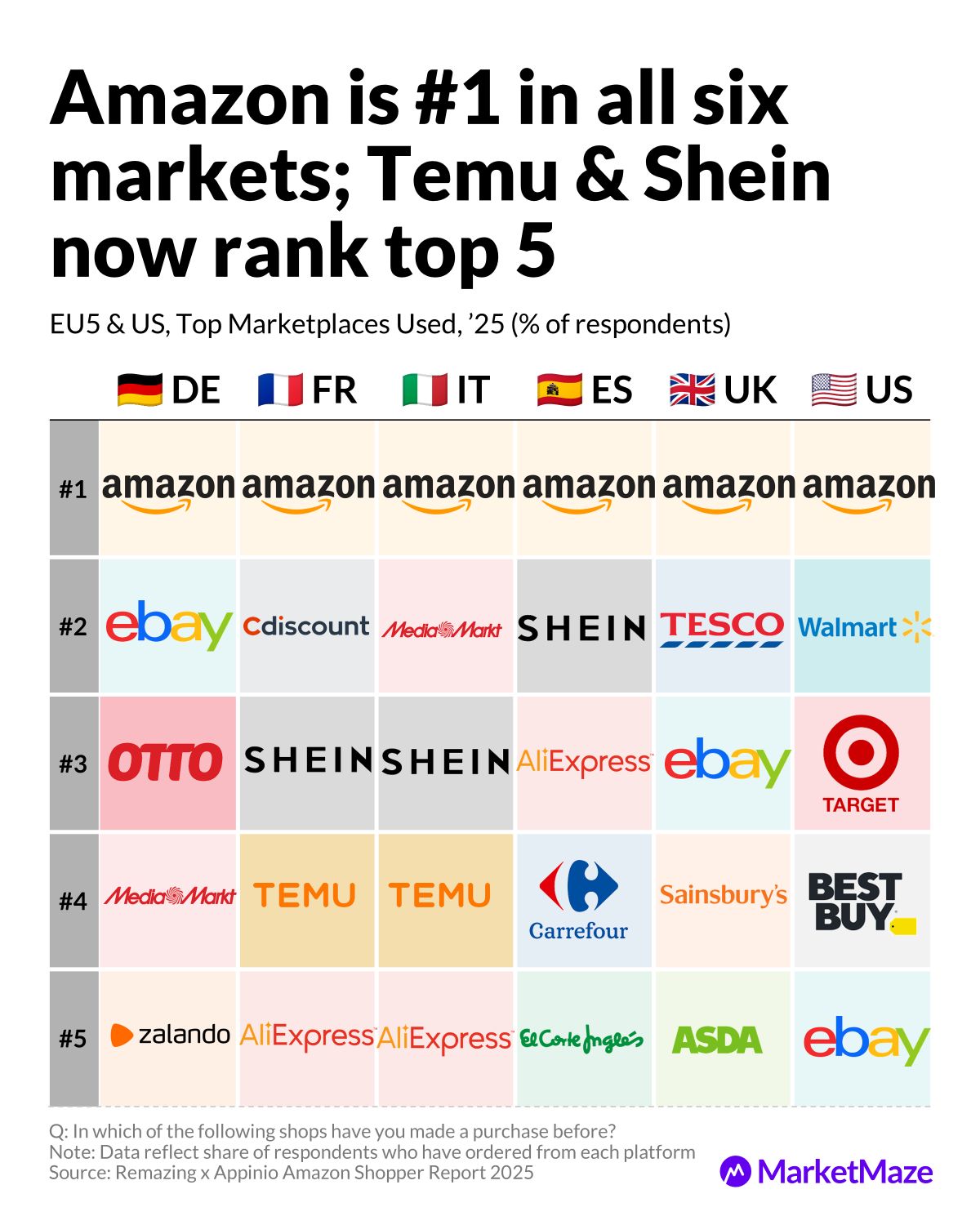

Amazon holds the #1 spot in every major market surveyed, with an astonishing 95% of consumers saying they’ve made a purchase there, spanning every age group from Gen Z to Boomers. Even as Temu and Shein muscle into the top five in France, Italy, and Spain, Amazon’s platform is still the foundation of e-commerce across Europe and the US. Notably, 67% of Spanish shoppers and 45% of French shoppers have bought from Alibaba, showing that local and Chinese players are gaining traction. Still, Amazon’s blend of price, speed, and trust keeps its lead secure… no wobble in the crown position yet across those markets.

🏬 Why Touch Still Matters

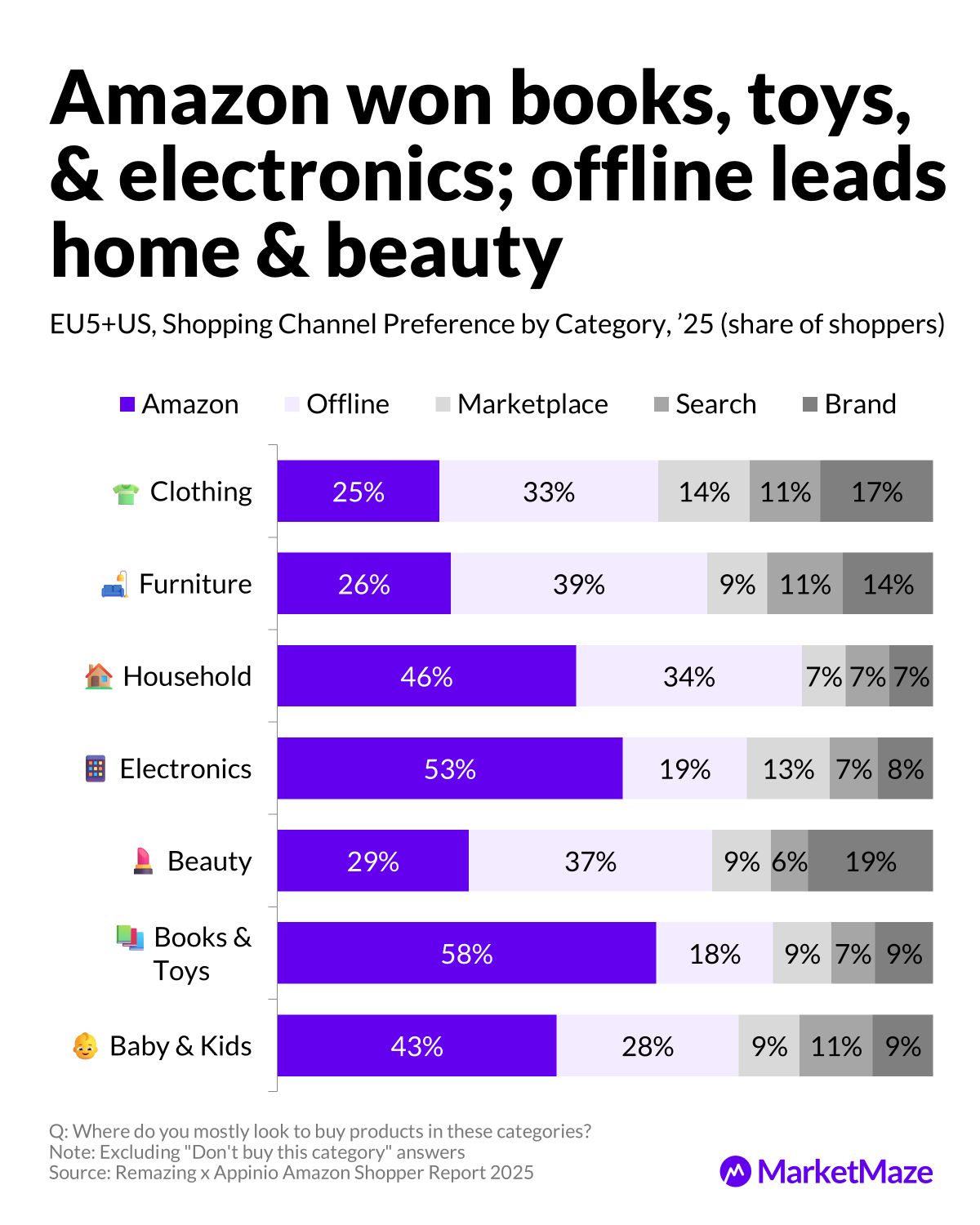

Not all categories are Amazon’s playground. It dominates Books & Toys (58%), Electronics (53%), and Household Goods (46%), making it the clear pick for commodity products and convenience. But for fashion, beauty, and big-ticket items like furniture, offline stores still lead: 33% prefer physical shops for clothing, 39% for furniture, and 37% for beauty. These categories are all about trust, fit, and feel. In fact, the “Baby & Kids” segment stands out, with 46% not buying these products at all… proving some categories resist even Amazon’s pull.

Editable Slides & Sources:

🔒 Available for MarketMaze+

📣FROM OUR PARTNERS

Stop wasting time on endless drafts. The world’s fastest-growing brands use a simpler creative loop:

1️⃣ Generate high-converting ad visuals from product shots — no designers needed.

2️⃣ Turn static photos into video ads in seconds.

3️⃣ Score each creative with predictive AI trained on 450+ data points before launch.

From AI Stock Images and Fashion Photoshoots, to Video Generators and Compliance Checkers, AdCreative.ai helps you create, test, and launch polished campaigns at scale — without creative teams or costly shoots.

Join 5,000+ businesses automating their ad production.

Get visuals that sell — not just look good.

🌀 MAZE STORY

Temu & Shein Big Hype & Small Cart 🧐

Everyone’s heard of Temu and Shein, but far fewer actually buy exposing the difference between buzz and true adoption. TikTok Shop, meanwhile, faces an even tougher road: half of its users see it negatively, and only a handful buy regularly. In today’s e-commerce game, fame comes fast, but loyalty and trust still take time… and most new platforms are finding the real barrier isn’t recognition, but conversion.

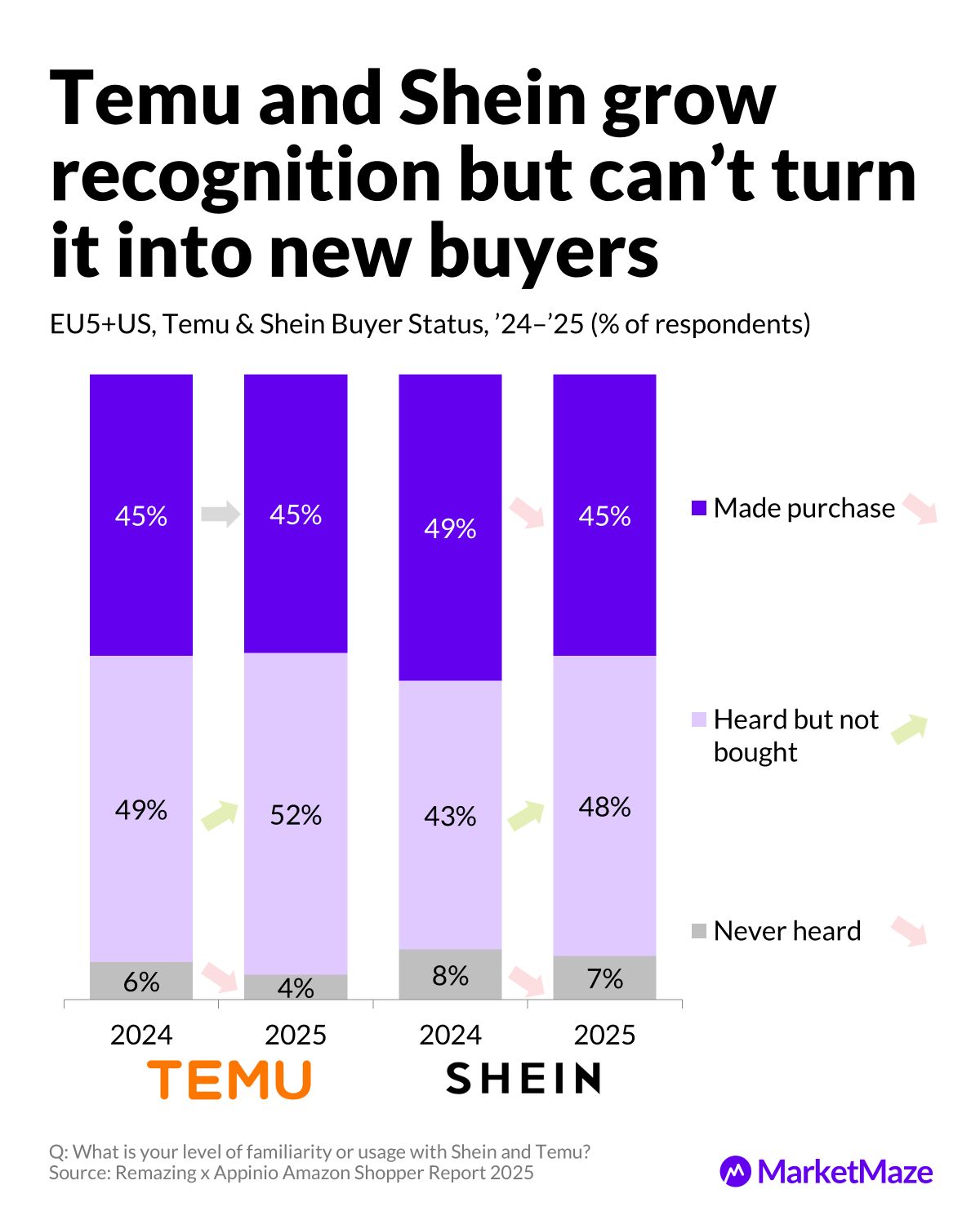

👀 Curiosity Doesn’t Convert

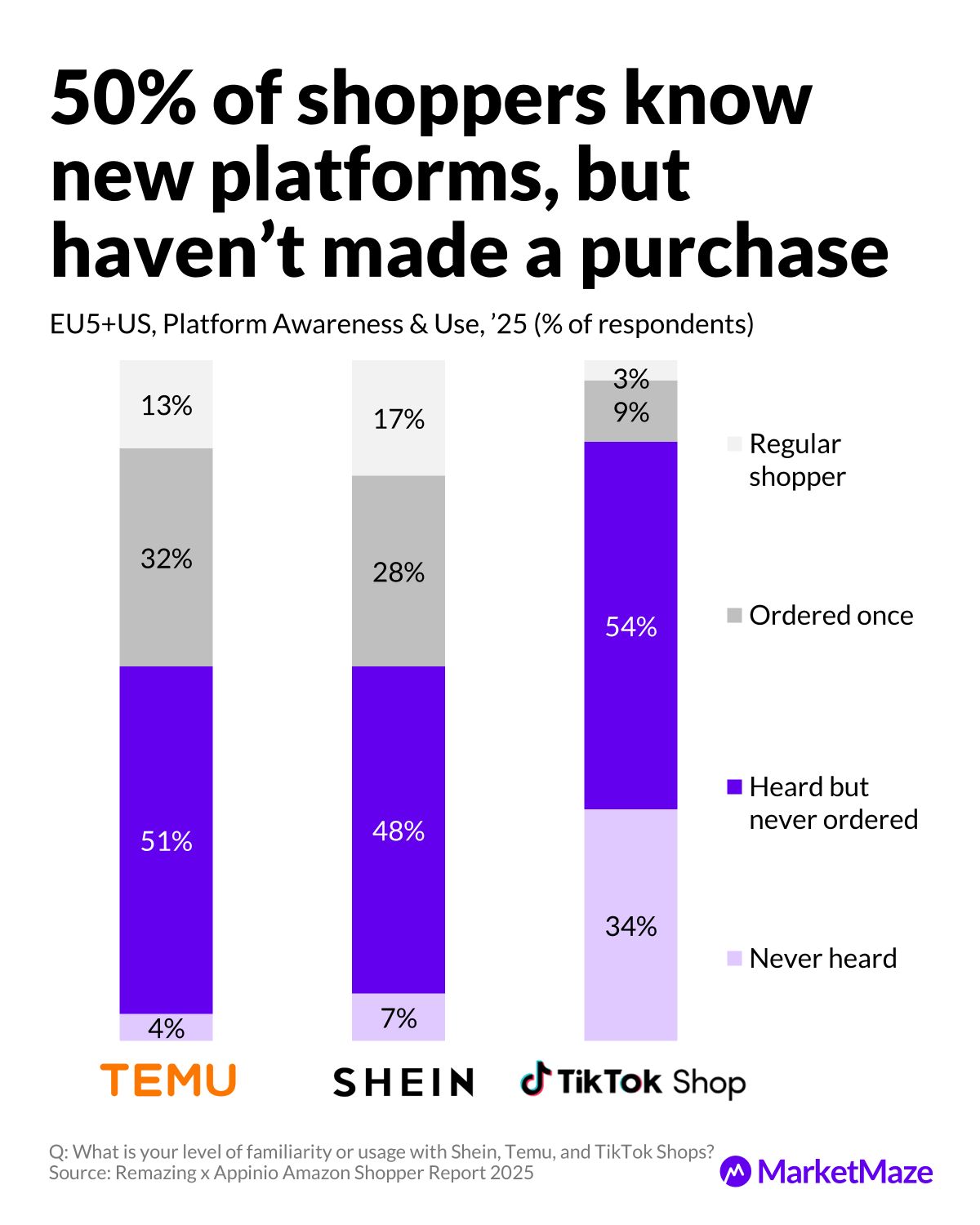

Temu and Shein have invested heavily in brand awareness, reaching the point where just 4% and 7% of shoppers respectively haven’t heard of them. But that visibility hasn’t paid off: 51% (Temu) and 48% (Shein) of aware consumers have never made a purchase. Just 13% are regular Temu shoppers, while Shein does slightly better at 17%. TikTok Shop is even more niche—34% of consumers have never heard of it, 54% know the name but have never bought, and only 3% shop regularly. For these upstarts, big ad budgets build fame, but the checkout line stays short.

😬 TikTok Shop: All Eyes, Lukewarm Hearts

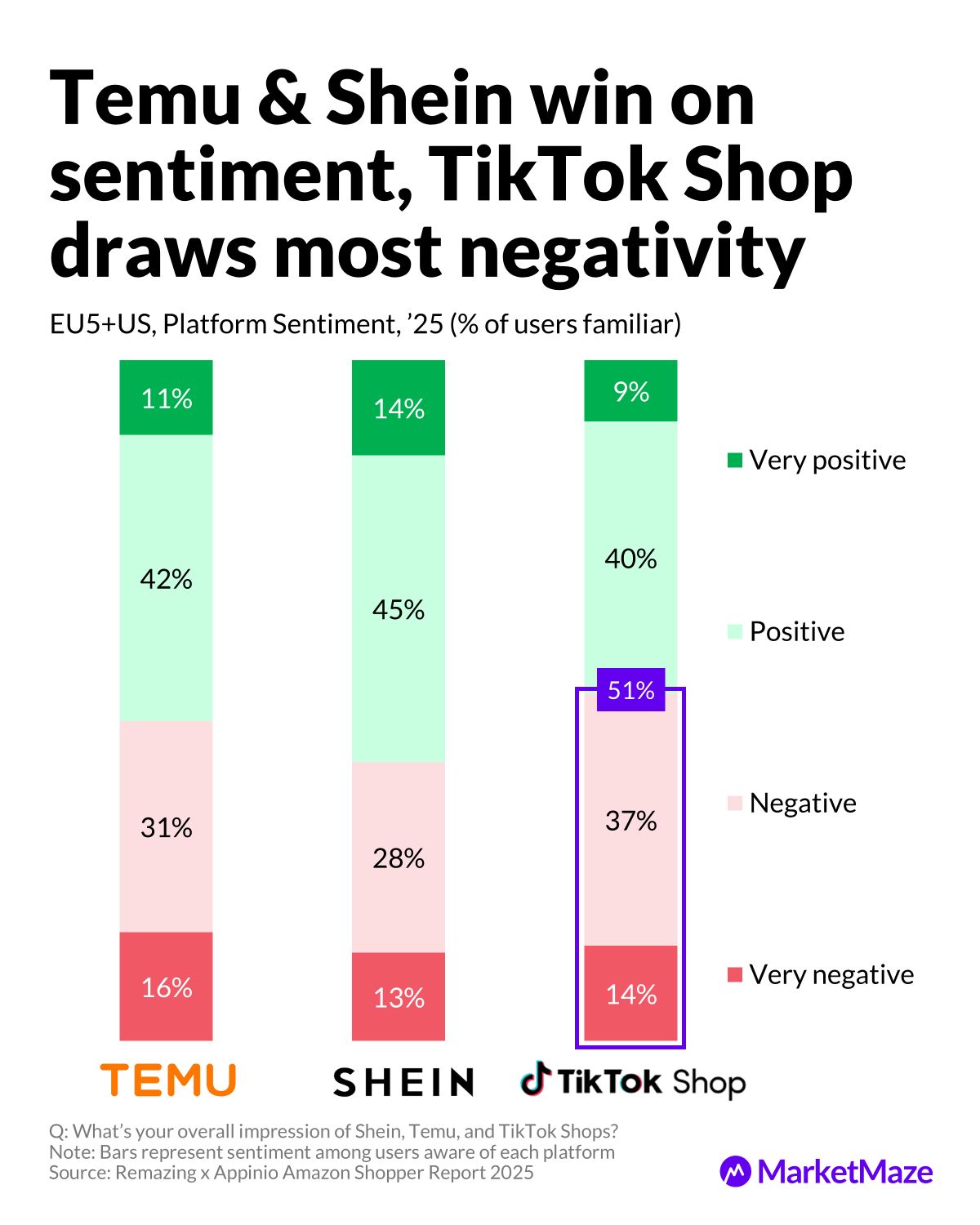

Sentiment reveals the challenge. Temu gets 53% positivity, Shein edges ahead with 59%, yet skepticism remains high: 16% view Temu “very negatively,” 13% for Shein, and both have nearly a third of users feeling “negative.” TikTok Shop stands out for all the wrong reasons: 51% see it negatively, with just 9% “very positive.” Despite being everywhere, TikTok Shop can’t shake consumer wariness, especially in older demographics and Western markets. Hype alone can’t build trust.

🧱 Conversion Wall for Upstarts

Even as awareness soars, regular buyers remain rare. Temu’s customer share flatlined at 45% from 2024 to 2025, and Shein’s actually fell from 49% to 45%, despite more people knowing the brand. The share of “heard but never bought” users climbed for both. As one Remazing expert put it: both brands are now mainstream in awareness, but not in wallets. Until these platforms can turn recognition into routine, they’ll stay stuck on the wrong side of the conversion wall.

Editable Slides & Sources:

🔒 Available for MarketMaze+

📣FROM OUR PARTNERS

Stop guessing what drives your sales. The fastest-scaling marketplace brands — Nestlé, Hero Cosmetics, Pattern, and Pharmapacks — use one smarter loop:

1️⃣ Centralize every Amazon and Walmart data point into one command center.

2️⃣ Analyze your performance, ads, and competitors with daily D-1 accuracy.

3️⃣ Optimize listings, bids, and pricing to capture the Buy Box and grow profits.

With DataHawk, teams replace spreadsheets with automated insights — connecting Snowflake, Power BI, and Looker in minutes.

No data engineers. No chaos. Just clear, unified visibility across marketplaces.

🚀 Users have seen faster decision-making, 30 % stronger ROAS, and double-digit margin lifts — powered by alerts that catch problems before they cost you.

This Q4, don’t react — predict. Turn raw marketplace data into your competitive edge with DataHawk’s AI-driven intelligence suite.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY

Before you go we’d love to know what you thought of today's maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team