Welcome to MarketMaze, the #1 newsletter on Ecommerce & Marketplaces.

Get all the insights you need in just 5 minutes!

Report Contents

In a world where online shopping is evolving faster than ever, livestream commerce is emerging as the bridge between the digital and physical realms. The industry’s rapid transformation—starting as an experimental niche and expanding into a global retail force—reflects how consumer behavior, technology, and social interaction are reshaping commerce. From its origins in China to its rapid adoption across North America and Europe, livestream shopping is giving consumers the ability to shop in real-time, interact with hosts, and experience the thrill of live purchases. As platforms evolve and markets mature, livestream commerce is poised to become a key player in the future of retail, driving engagement, increasing sales, and bridging the gap between physical and digital shopping experiences.

This is our second deep dive into Social commerce - if you missed the first one, catch up here:

P.S. Feel free to use and share any slide of this report!

Livestream’s Path

Summary: Live commerce connects digital and physical worlds, allowing real-time interaction with hosts. It evolved through three phases: Exploratory (2016-2017), Growth (2018-2020), and Regulated (2020-present), with platforms like Taobao leading early growth. The ecosystem involves upstream merchants, midstream hosts and platforms, and downstream consumers. Success depends on support services such as mobile payments and data marketing to enhance platform efficiency and boost conversions.

Real-Time Retail Gets Personal 🤳

Live commerce is bridging the digital and physical worlds, letting viewers feel like they’re browsing store aisles from the comfort of home. Shoppers connect with hosts in real time, ask questions, and get immediate feedback. Live shopping is one of four social commerce archetypes.

From Trials to Regulation 📺

The evolution of livestreaming e-commerce is marked by three key phases: Exploratory Phase (2016-2017), Growth Phase (2018-2020), and Regulated Phase (2020-present).

During the Exploratory Phase, platforms like Taobao, JD.com, and Mogujie introduced livestream shopping features, laying the groundwork for future expansion. Notable milestones included Taobao Live’s launch in March 2016 and Kuaishou’s entry into livestream e-commerce in mid-2017.

The Growth Phase saw rapid expansion driven by rising smartphone adoption, better internet infrastructure, and government support. Platforms like Douyin, Kuaishou, and Pinduoduo launched livestreaming features, while COVID-19 accelerated adoption as offline stores shifted online. By November 2018, total GMV exceeded 300 million.

In the Regulated Phase, authorities introduced policies to ensure stability and protect consumers. Key developments included national standards in July 2020 and further regulations in 2021 and 2022. Regions like Zhejiang, Guangdong, and Shanghai became livestream hubs due to strong infrastructure and talent.

This evolution highlights livestream e-commerce’s growth from a niche experiment to a mainstream sales channel, driven by platform innovation, policy support, and consumer adoption.

Consumers, Stars, and MCNs 📱

The livestream e-commerce ecosystem operates as an interconnected value chain comprising three key segments: upstream, midstream, and downstream, each playing a distinct role in driving consumer engagement and sales conversion. The upstream segment focuses on product supply and traffic generation, where merchants such as brands, agents, distributors, and manufacturers provide the inventory that fuels the ecosystem. Moving to the midstream, this layer is characterized by influential hosts and livestreaming platforms that act as intermediaries, promoting products and driving consumer demand. Hosts range from Key Opinion Leaders (KOLs) and celebrity influencers to brand representatives and executives, often supported by MCNs (Multi-Channel Networks) that cultivate talent and manage content creation. Livestream platforms—including short-video apps, social networks, and e-commerce sites—play a pivotal role in connecting hosts with their target audience. Finally, the downstream segment encompasses consumers, who engage with livestreams to gain detailed product insights or capitalize on promotional offers. Notably, successful livestream strategies rely heavily on robust support services, including technical solutions providers, e-commerce operations, mobile payment systems, supply chain services, and data marketing solutions, all of which enhance platform efficiency and improve conversion rates.

Asia’s Edge in Real-Time Retail

Summary: China leads livestream commerce adoption far surpassing the US and Europe. In contrast, the US and Europe are growing but remain smaller. Gen Z and millennials dominate globally, with China and Europe seeing stronger engagement from younger audiences, while Latin America and the US show more age diversity. Regional preferences vary, with groceries leading in China, and fashion topping the Americas and Europe.

China outpaces US in livestream 🇨🇳

According to Wunderman Thompson Commerce 2023, China leads in livestream commerce adoption with 81% of online shoppers engaging in this channel, more than twice the rate seen in the US (40%) and over three times higher than Germany (26%). India (75%), Thailand (73%), and the UAE (72%) also demonstrate high adoption, reflecting strong digital commerce growth in these markets. South Africa (54%), Colombia (52%), and Mexico (48%) show solid engagement, while European countries such as Spain (37%), Poland (36%), and the UK (35%) trail behind. Japan ranks lowest at just 15%.

Asia’s streaming revenue dominates 🌎

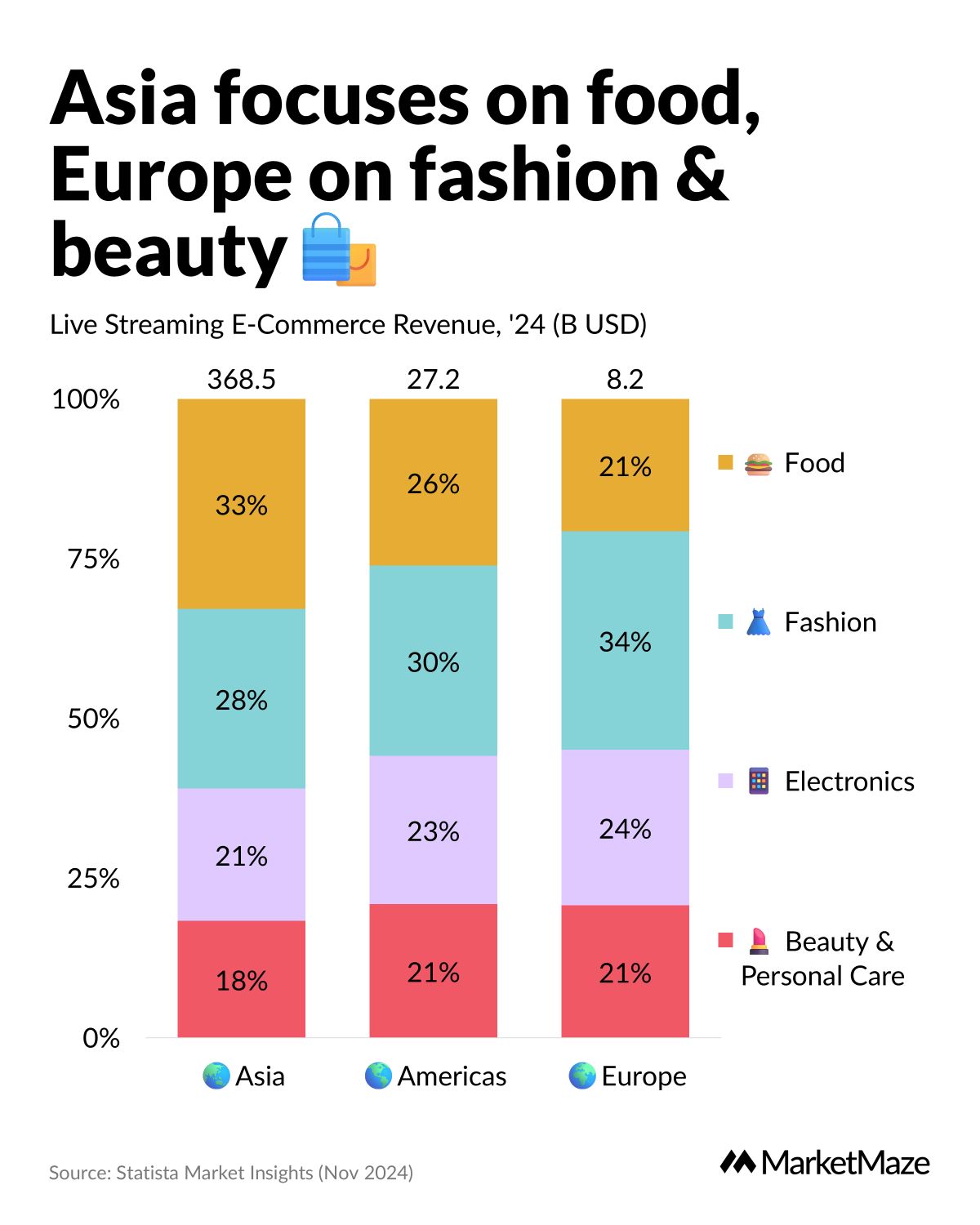

Data from Statista Market Insights (Nov 2024) shows Asia’s livestream e-commerce market is projected to generate $368.5 billion in 2024, making it 14 times larger than the Americas' market at $27.2 billion and 45 times larger than Europe’s at $8.2 billion. Food, fashion, electronics, and beauty & personal care are key segments driving this growth. Asia’s dominance reflects the region’s advanced digital ecosystem, high mobile commerce penetration, and strong consumer engagement with livestream platforms. In comparison, the Americas and Europe remain smaller but are showing growth potential as livestream shopping gains traction.

Food vs. fashion: regional splits 🛍️

Asia’s livestream e-commerce market shows a strong focus on food, which accounts for 33% of total sales, followed by fashion (28%), electronics (21%), and beauty & personal care (18%). In the Americas, the market is more evenly distributed, with fashion (30%) leading, while food (26%), electronics (23%), and beauty & personal care (21%) follow closely. Europe emphasizes fashion (34%) and beauty & personal care (21%), with electronics (24%) and food (21%) playing smaller roles. These differences reflect regional preferences, with Asia’s market driven by practical purchases like food, while Europe shows stronger demand for fashion and beauty-related content.

Groceries or garments? A global snapshot 🌏

Live commerce preferences and adoption patterns vary significantly across regions, with distinct trends shaping consumer behavior. In China, groceries lead as the top category for live-commerce purchases, driven in part by the COVID-19 pandemic, which saw the rise of live-streaming farmers promoting fresh produce. This focus on groceries contrasts with Europe, LATAM, and the US, where clothing is the dominant category. Notably, while groceries thrive in China, bigger-ticket home items like furniture and large appliances remain less popular, with only 11-13% of live-commerce users in China purchasing them in the past 12 months. Beauty remains a go-to in the US and Europe, while Latin America’s gadget appetite hits 40%. Each market showcases distinct tastes, but the universal theme is a hunger for interactive, real-time deals.

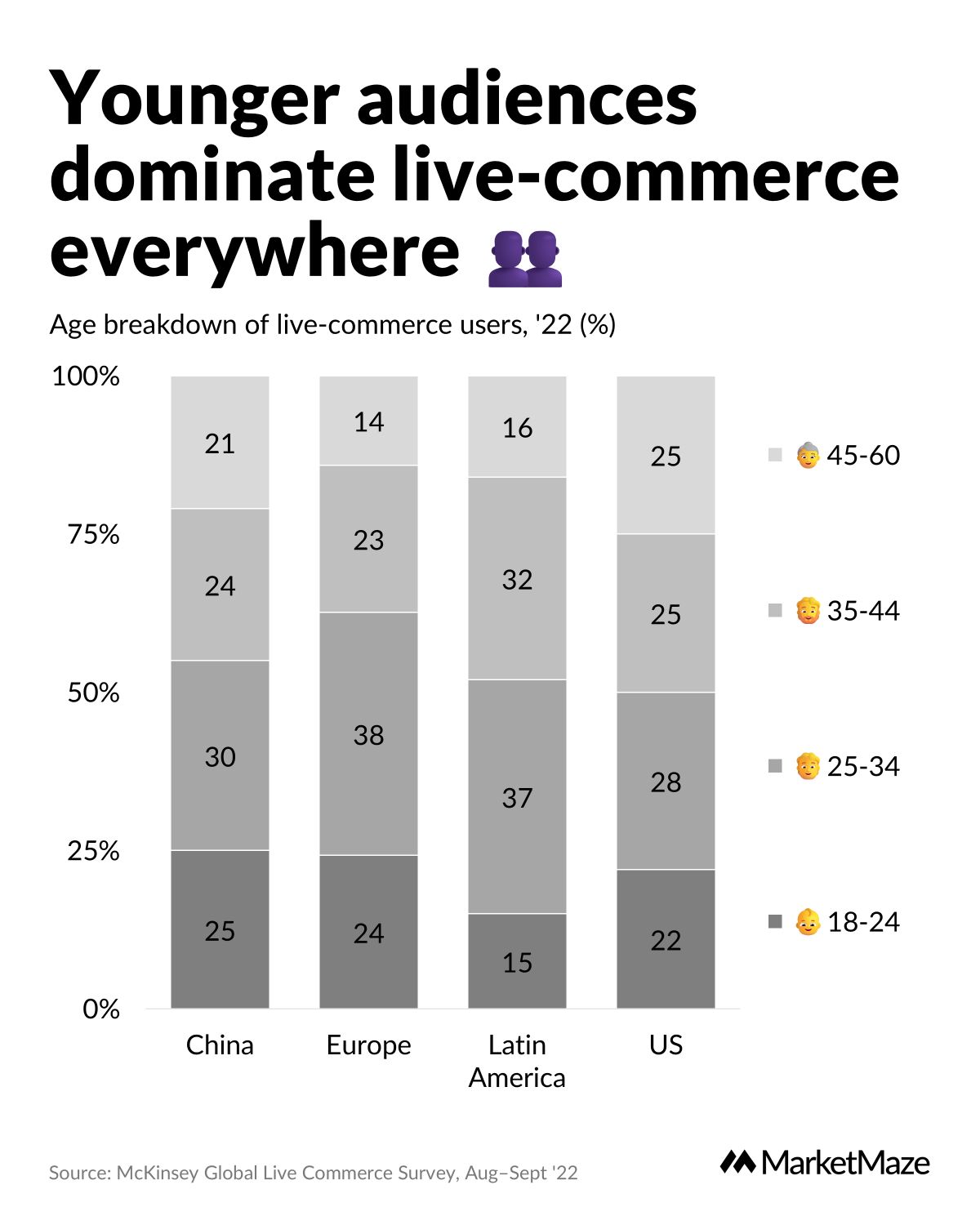

Gen Z and millennials steer the show 👫

Live-commerce adoption skews younger globally, with 25-34-year-olds representing the largest share of users. The average age of frequent live-commerce users ranges between 33 and 36 years old, though regional differences are notable. In China and Europe, live-commerce users are concentrated in the 18-34 age bracket, indicating stronger engagement from younger demographics. In Latin America, the core audience shifts slightly older, with the majority aged 25-44. The US shows a more balanced distribution across age groups, suggesting broader appeal across generations. These patterns highlight that while younger consumers dominate live-commerce globally, adoption trends vary based on local market dynamics.

Livestream Commerce Wave 🚀

Summary: China’s livestream e-commerce market has matured, with growth now driven by overall e-commerce expansion rather than rising penetration. Over half of Chinese internet users now watch live shopping, reinforcing its position as a mainstream channel. Meanwhile, US penetration is expected to hit 5% by 2026, with Europe trailing roughly three years behind. While Western markets are gaining momentum, they remain far behind China’s established ecosystem and consumer engagement levels.

Matured Market, New E-Commerce Heights 📈

China’s livestream e-commerce market has transitioned from rapid expansion to a more mature phase, with future growth primarily driven by overall e-commerce growth rather than increased penetration. Between 2019 and 2024, livestream e-commerce GMV surged from $61 billion to $779 billion, marking over a 12x increase. However, penetration growth slowed after early acceleration, rising from 3% in 2019 to 24% in 2024, with only modest increases projected — reaching 29% by 2026.

This shift reflects a maturing market where livestream adoption has stabilized, making future growth more dependent on the broader expansion of China’s e-commerce sector. While penetration continues to rise gradually, the industry’s focus is now on maximizing value within an already engaged user base.

Viewership Soars Among Online Shoppers 🚀

Over half of Chinese internet users now watch live shopping, with adoption rising steadily in recent years. Viewership grew from 39.2% in 2020 to 54.7% by 2023, reflecting the rapid integration of livestream commerce into consumer behavior. The consistent growth suggests that livestream shopping has become a mainstream channel in China, driven by engaging content, influencer promotions, and seamless purchasing experiences. As adoption nears saturation, further growth may rely on enhancing content quality, improving product discovery, and expanding audience demographics.

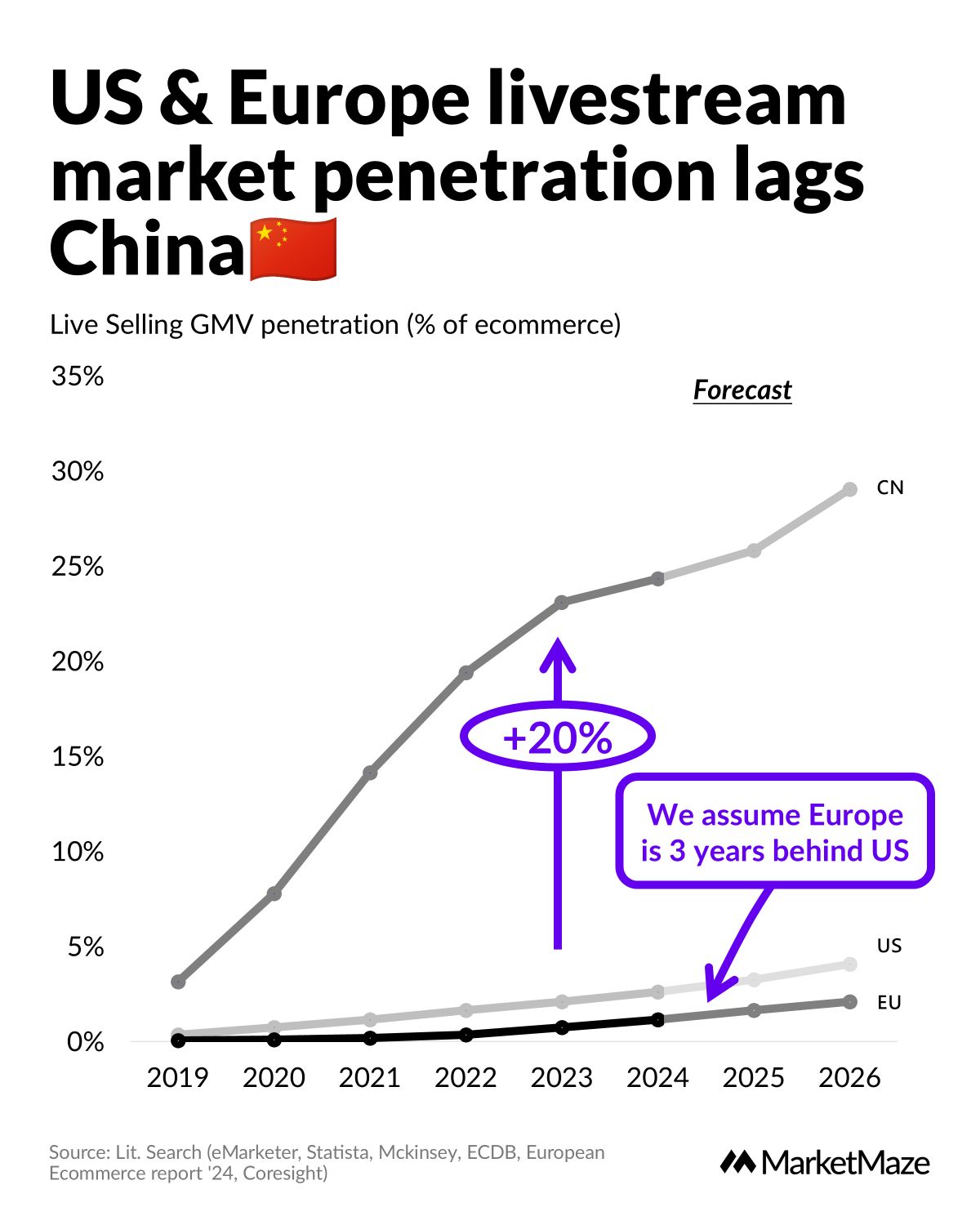

Catching Up Across the Pacific and Beyond 🇨🇳

Livestream e-commerce penetration in the US and Europe continues to lag behind China, where adoption has surged significantly. By 2023, China's livestream GMV penetration reached nearly 25% of total e-commerce, with projections to reach almost 30% by 2026. In comparison, the US is forecast to reach just 5% penetration by 2026, while Europe we expected to remain even lower, tracking roughly three years behind US adoption trends.

China’s rapid growth reflects its strong ecosystem of platforms, influencers, and consumer engagement. The US market is expanding steadily but remains far from China's scale, while Europe’s slower adoption highlights regional differences in shopping behavior, content consumption, and platform maturity. Growth in Western markets may accelerate as livestream formats improve and consumer trust builds, but significant gaps are likely to persist in the near term.

The Live Revolution🔥

Summary: Livestream e-commerce is expanding in North America and Europe, with the US market projected to reach $57 billion by 2026. Platforms like Facebook Live, YouTube Live, and Amazon Live are driving growth, with US shopper numbers set to rise from 41 million in 2024 to 60 million by 2028. In Europe, the market is expected to double to $24 billion by 2026, supported by platforms like Bambuser and HERO. While both regions lag behind China, livestream commerce is gaining traction through platform investment and improved content strategies.

Global Real-Time Retail Gains Momentum 🚀

Livestream shopping in North America and Europe is evolving across three platform types: social-first, niche vertical, and white-label solutions.

Social-first platforms like Popshop Live and Talkshop Live focus on broad, influencer-driven selling.

Vertical platforms such as NTWRK and Whatnot target niche audiences like collectibles and luxury.

White-label solutions like Bambuser and Hero allow brands to integrate livestream features directly into their platforms.

North America leads with platforms like NTWRK and Whatnot, while Europe sees growth in solutions like HERO and Livebuy. As the market expands, consolidation is expected, driving integrated solutions for brands and retailers.

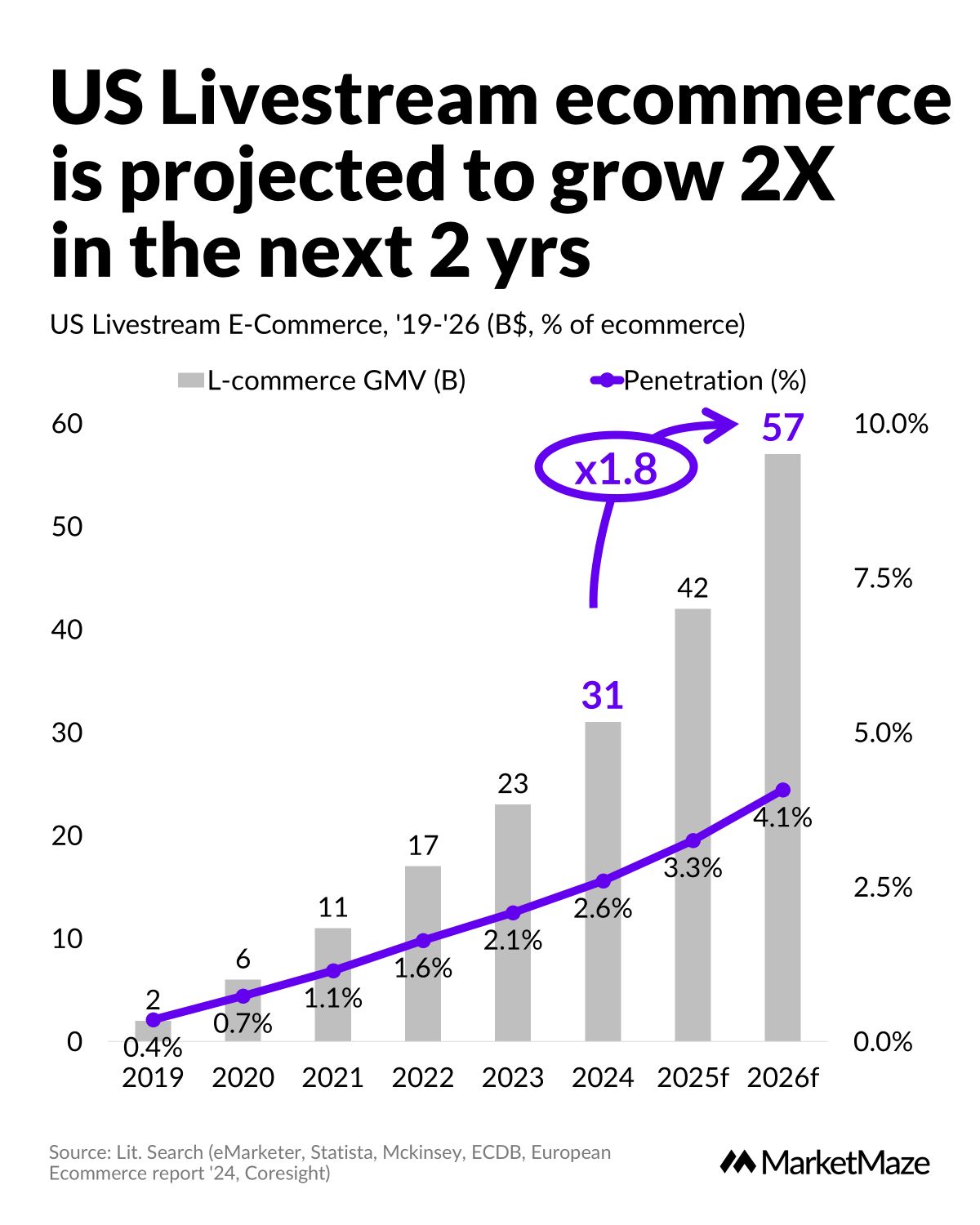

Rapid Growth Poised to Hit 5% of E-Commerce 🚀

US livestream e-commerce is projected to nearly double in size within the next two years, growing from $31 billion in 2024 to $57 billion by 2026. During this period, penetration is expected to rise from 2.6% to 4.1% of total e-commerce sales. While still far behind China, this growth reflects increasing consumer adoption and platform investment. The forecast suggests that livestream commerce is gaining momentum in the US.

Leading the Pack in Live Shopping

Facebook Live leads US livestream shopping with 55% of respondents using the platform, followed by YouTube Live at 52% and Instagram Live at 46%. Amazon Live is the top e-commerce-specific platform with 30% usage, while company websites/apps and X/Twitter each have 28% participation. Platforms like Snapchat (26%) and Twitch Live (24%) also play a role, while TikTok (22%) and Pinterest TV (14%) are less prominent.

This distribution highlights the dominance of established social platforms in driving US livestream commerce, with e-commerce-specific and emerging platforms steadily gaining traction. Facebook, YouTube, and Instagram’s strong position reflects their broad audience reach and familiar user experience, while Amazon’s growing presence underscores its role as a key player in product-driven live shopping.

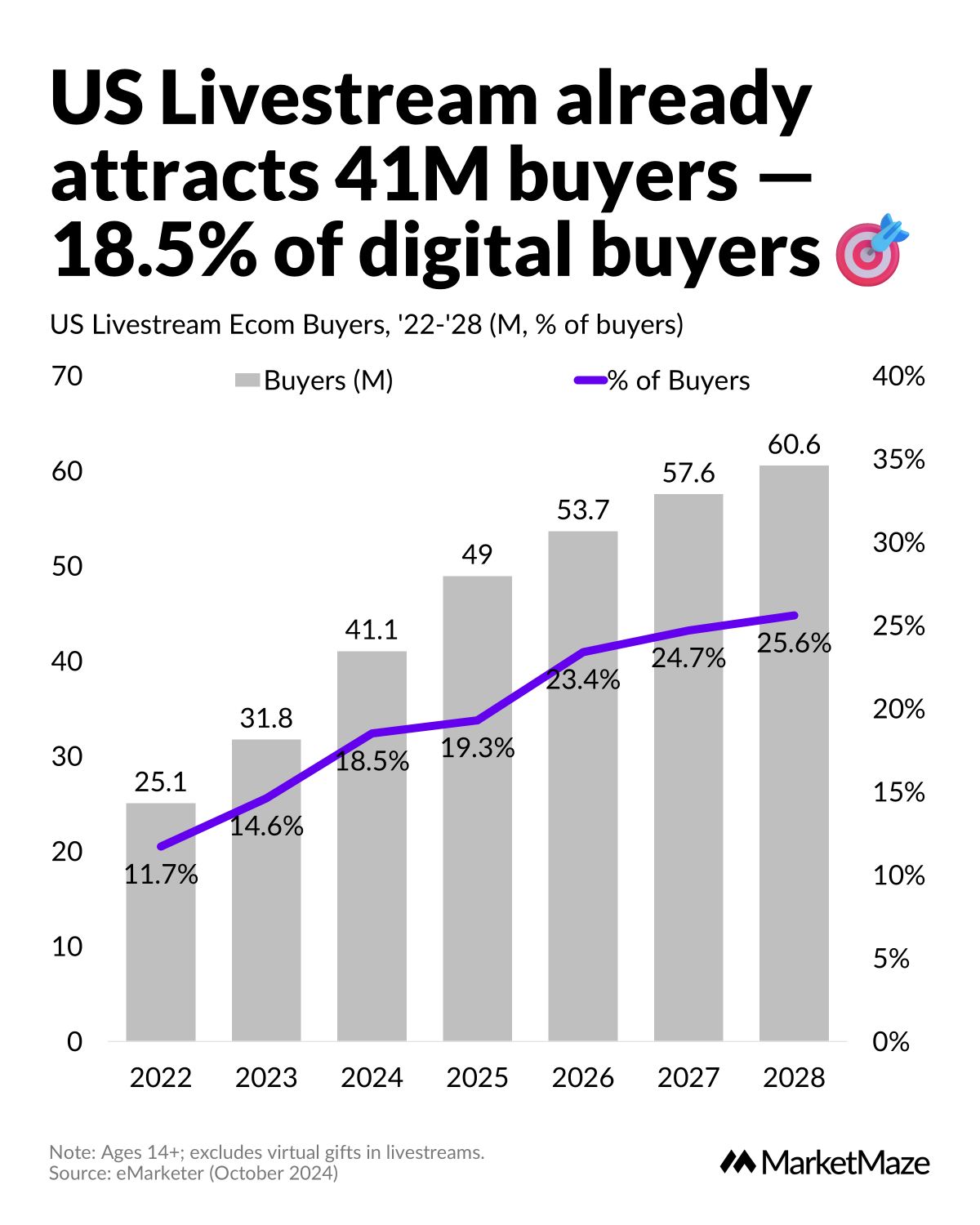

Steady Rise Toward 60M Shoppers 🎯

The US livestream e-commerce market has already attracted 41 million buyers, representing 18.5% of digital buyers in 2024. This figure is projected to grow steadily, reaching 60.6 million buyers by 2028, with penetration rising to 25.6%. The market has seen rapid expansion since 2022, when just 11.7% of digital buyers engaged in livestream shopping.

A Doubling Trend Sweeps Europe 📊

Europe’s livestream e-commerce market is projected to double by 2026, reaching $24 billion with penetration rising to 2.1% of total e-commerce. Growth is accelerating steadily, with GMV expanding from $12 billion in 2024 to $24 billion by 2026. Despite this growth, livestream shopping penetration in Europe remains relatively low compared to the US and significantly behind China. Localized services like Bambuser, Livebuy, and HERO are forging partnerships with luxury brands and mainstream retailers to catch up with US peers. With demand rising, Europe’s real-time retail space could soon mirror North America’s rapid trajectory.

If you found this insight valuable, you’ll love the rest of our research.

Dive into the full collection here ⬇️

For questions, suggestions or feedback, write email to [email protected]

Best,

MarketMaze team