In Partnership with

TODAY’S MAZE

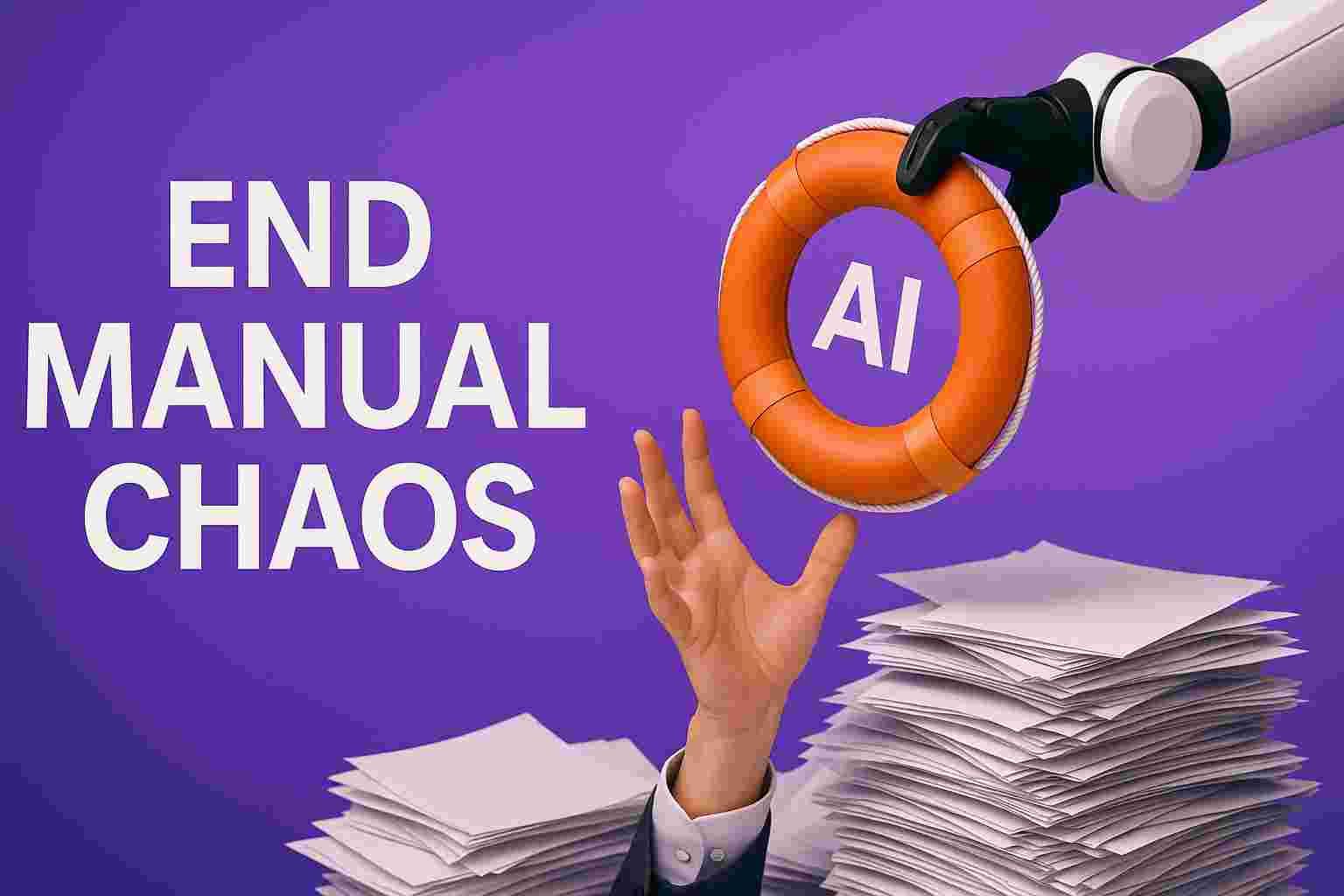

Manual busywork is eating margins while AI and social commerce sprint ahead. The 2026 Commerce Readiness Index shows leaders trying to automate, clean data, and move faster before loyalty leaks out of the funnel. Here’s the playbook: fix the plumbing, then floor the accelerator.

MAZE STORY🌀

🧠 Inside the Manual Data Trap

🚀 AI & Marketing’s Next Act

OUTSIDE THE MAZE🧠

🛒 Prime Big Deal Days: Growth Slows, Still Huge

💸 Single-SKU Millionaires: Rare and Risky

🧲 Social Commerce: Low Price Wins

🤖 Retail Traffic: AI Sets the Rules

🚦 Brands Slow on AI-Optimized PDPs

P.S.

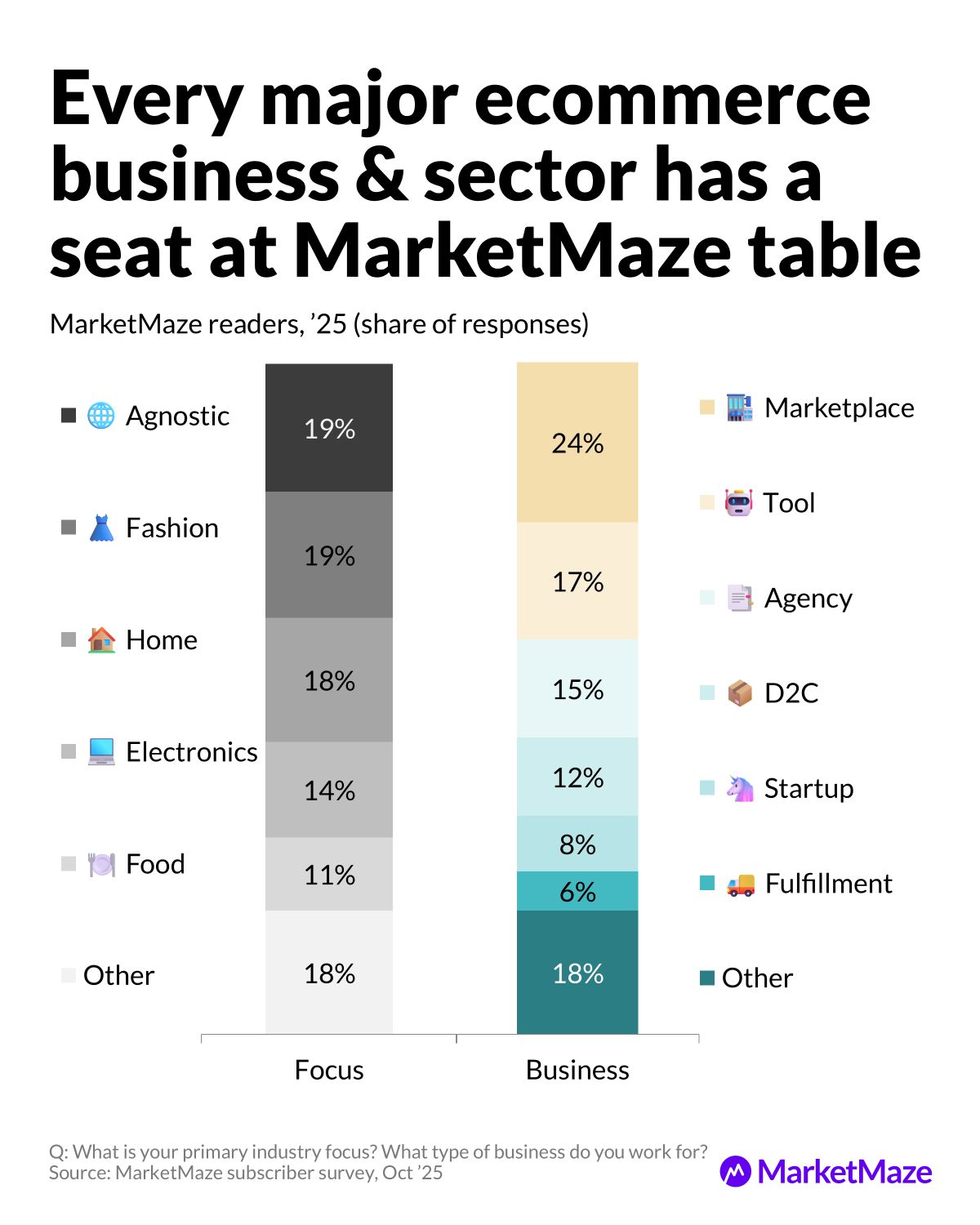

MarketMaze brings together top minds from every corner of ecommerce, spanning marketplaces, D2C, agencies, startups, and more. Directors, VPs, and C-level leaders across all sectors rely on MarketMaze to stay sharp and informed. We partner with the best in tech, SaaS, and fintech, just check out the trusted brands that advertise with us. Ready to reach this high-impact audience? Book your slot here.

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

📣FROM OUR PARTNERS

Stop grinding away at costly ads. The fastest-rising Amazon brands - Thrasio, Unilever, Magic Spoon, and Lenny & Larry’s - use a simpler loop:

Reimburse swarms of micro-influencers who buy the product

Influencers post authentically on social media and leave organic UGC.

Repurpose their UGC for social growth and advertising

Through Stack Influence, 1,560 influencers helped Lenny & Larry’s jump 🚀 11× sales, ⭐ 525 reviews, and 👀 2.3M impressions - momentum that ads can’t buy.

Automate thousands of collaborations hands-free. Dominate page-one search. Control TACoS this Q4 and own 2025 with durable, organic rank growth.

🌀 MAZE STORY

Manual Workflows Are Killing Growth 🧱

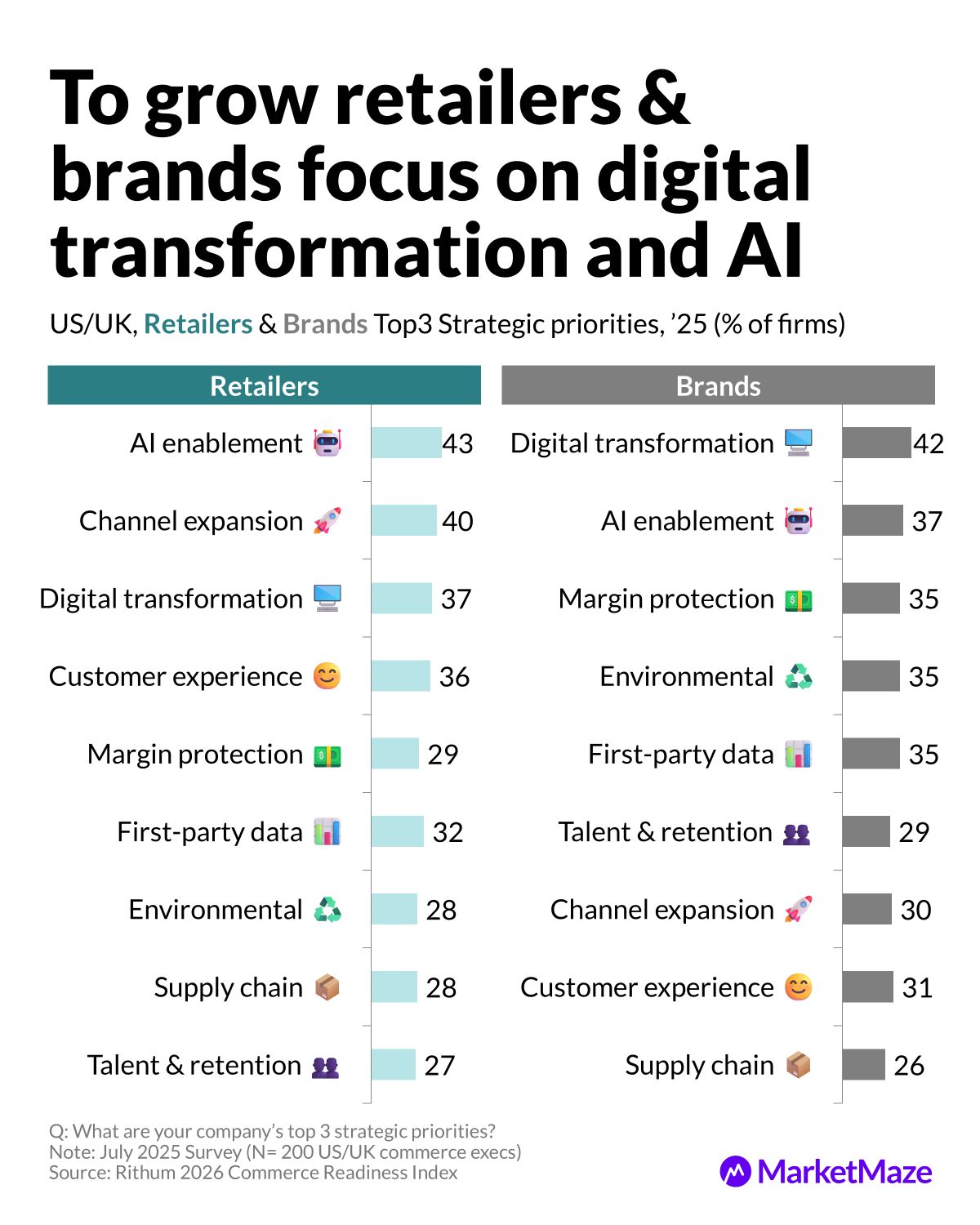

The road to growth starts with AI and digital transformation, but execution remains painfully analog. The 2026 Commerce Readiness Index shows that while AI enablement (43%) and channel expansion (40%) top retailer priorities, brands lean on digital transformation (42%) and margin protection (35%). Everyone’s investing in smarter infrastructure—yet most are still stuck doing dumb work.

Digital Ambition, Manual Reality 💼

AI enablement, digital transformation, and customer experience dominate strategy decks, but manual workflows eat up the calendar. First-party data and sustainability (32–35%) are climbing in focus, yet both depend on clean, connected systems that too few companies have. Strategy without systems is just an expensive wish list.

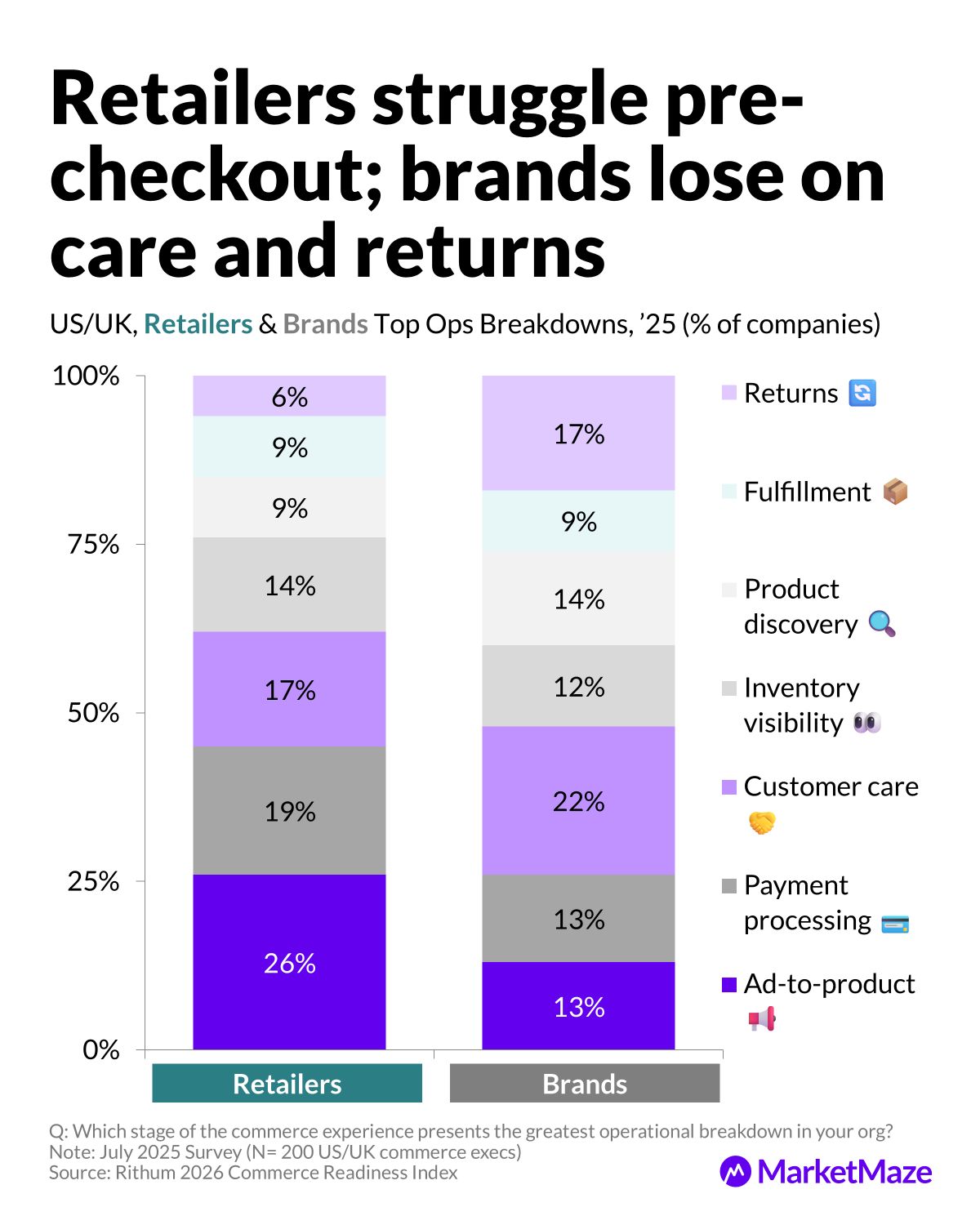

Friction Before and After Checkout 💔

Retailers struggle before conversion: 26% report ad-to-product breakdowns and 19% payment bottlenecks. Brands bleed post-sale: 22% cite customer care issues and 17% suffer from return management. Each broken step chips away at trust and drives shoppers elsewhere. Loyalty doesn’t die in marketing; it dies in operations.

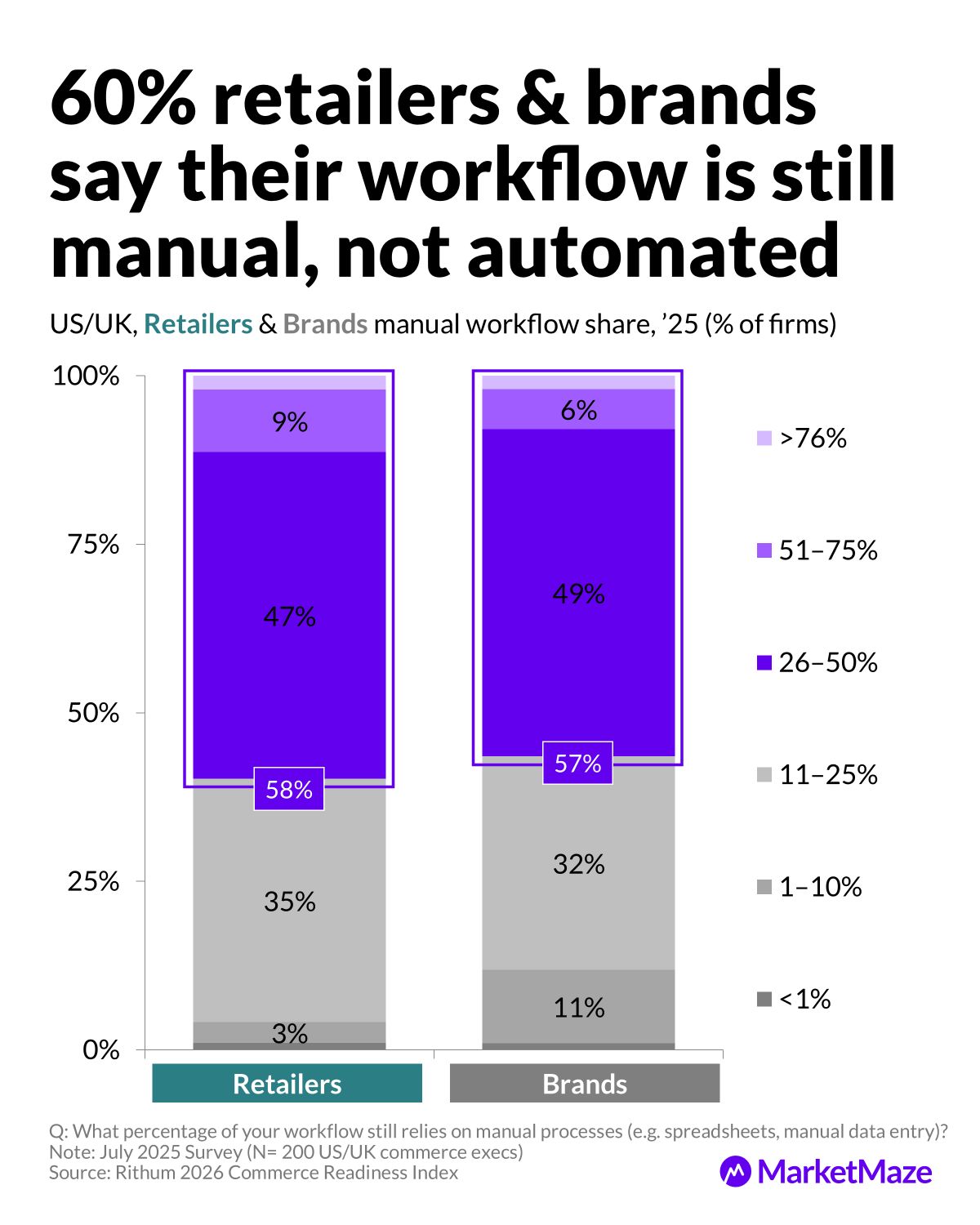

The Automation Gap ⚙️

Manual execution remains the silent growth killer. Almost half of retailers (47%) and brands (49%) still rely on manual workflows for 26–50% of tasks. Automation is no longer a technical problem… it’s a leadership one. Every day lost to spreadsheets is a day competitors move faster.

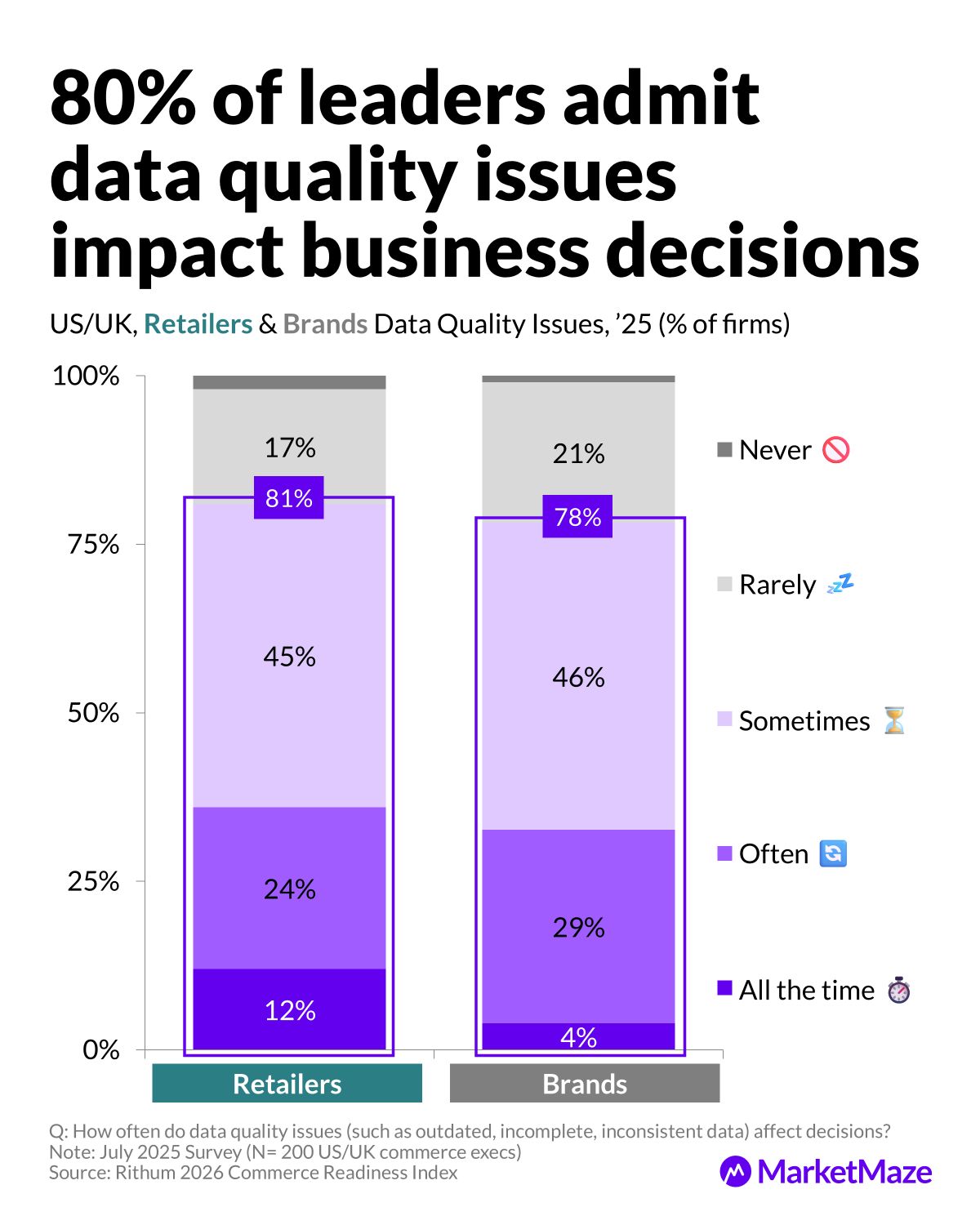

Bad Data, Bad Decisions 📉

Data quality issues plague nearly 80% of companies. Inaccurate or incomplete information drives poor decisions, wasted marketing, and missed revenue. Only 2% say they never face data errors. In the age of AI, human mistakes are the last inefficiency left to fix.

Sources: 🔒 Available for MarketMaze+

📣FROM OUR PARTNERS

Most DTC founders don’t need more traffic, they need more trust. Stamped turns happy customers into sales: photo and video reviews on your product page, stars pushed to Google Shopping, and a simple loyalty program that brings buyers back.

✔ Collect real reviews fast

✔ Show them where it converts (product pages and Google)

✔ Plug into Shopify, BigCommerce, WooCommerce, and Klaviyo

Add proof before you add spend. Your product pages will do the selling.

🌀 MAZE STORY

AI Runs Faster Than Humans ⚡

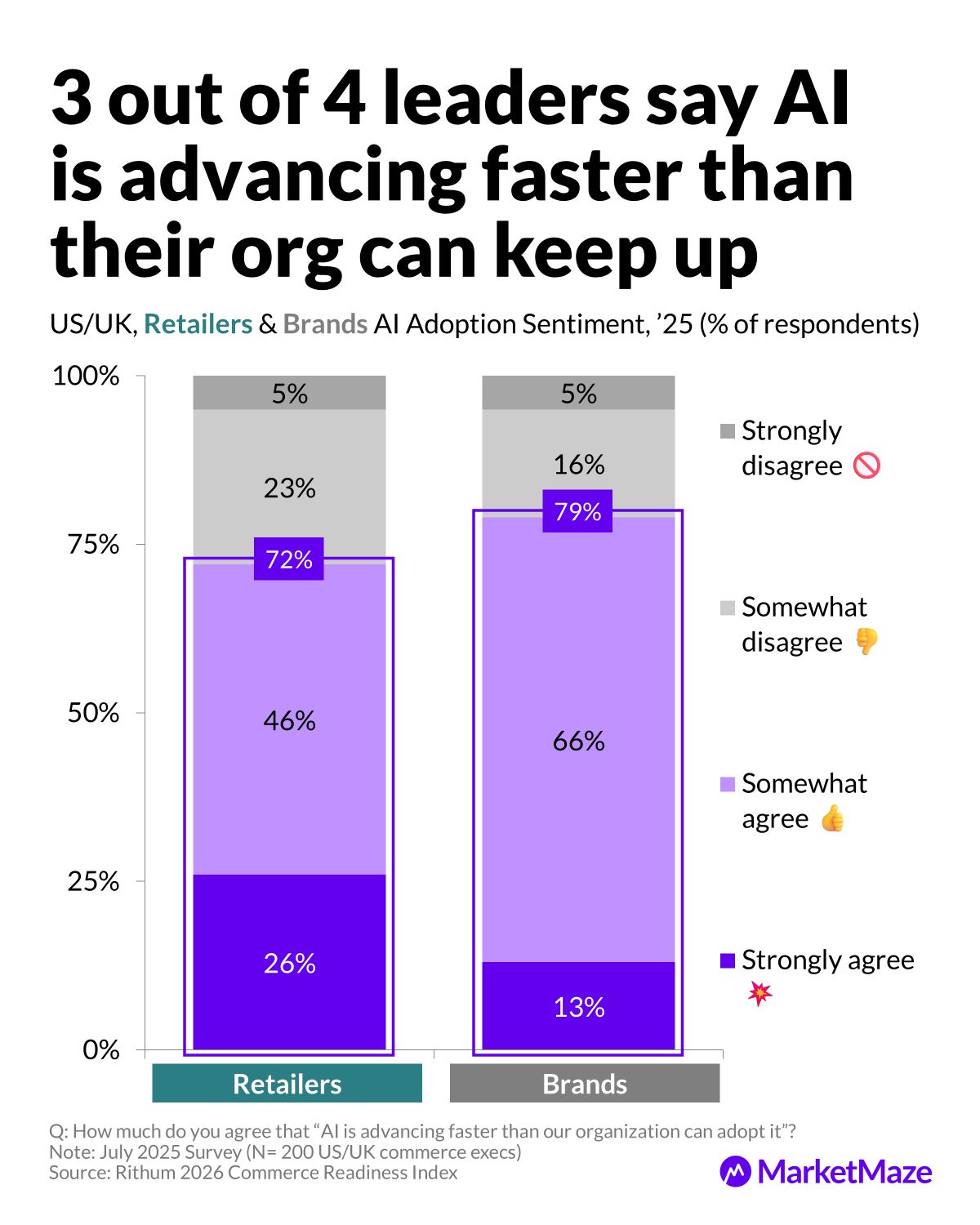

AI has gone from pilot to performance… but people can’t keep up. The 2026 Commerce Readiness Index shows brands and retailers embracing automation, yet most admit AI is advancing faster than they can adopt it. The technology race is on, and the gap is widening.

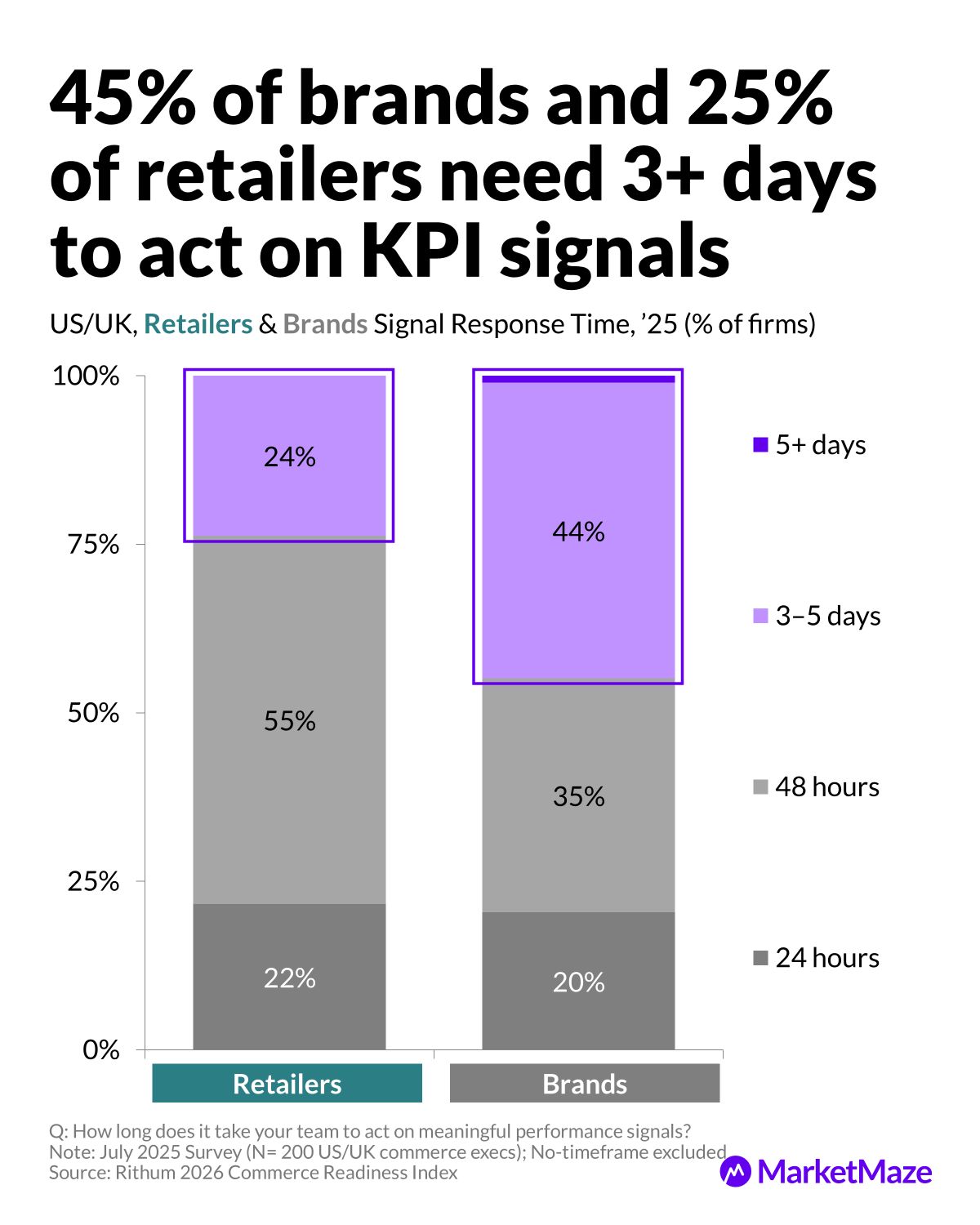

Slow Reactions, Lost Revenue ⏱️

Performance signals are flashing faster than teams can respond. A quarter of retailers (25%) and nearly half of brands (45%) need three or more days to act on key metrics. Retailers fare better, with 77% responding within 48 hours, but even that pace leaves money on the table in a market that rewards instant action.

AI Moves to the Core 🤖

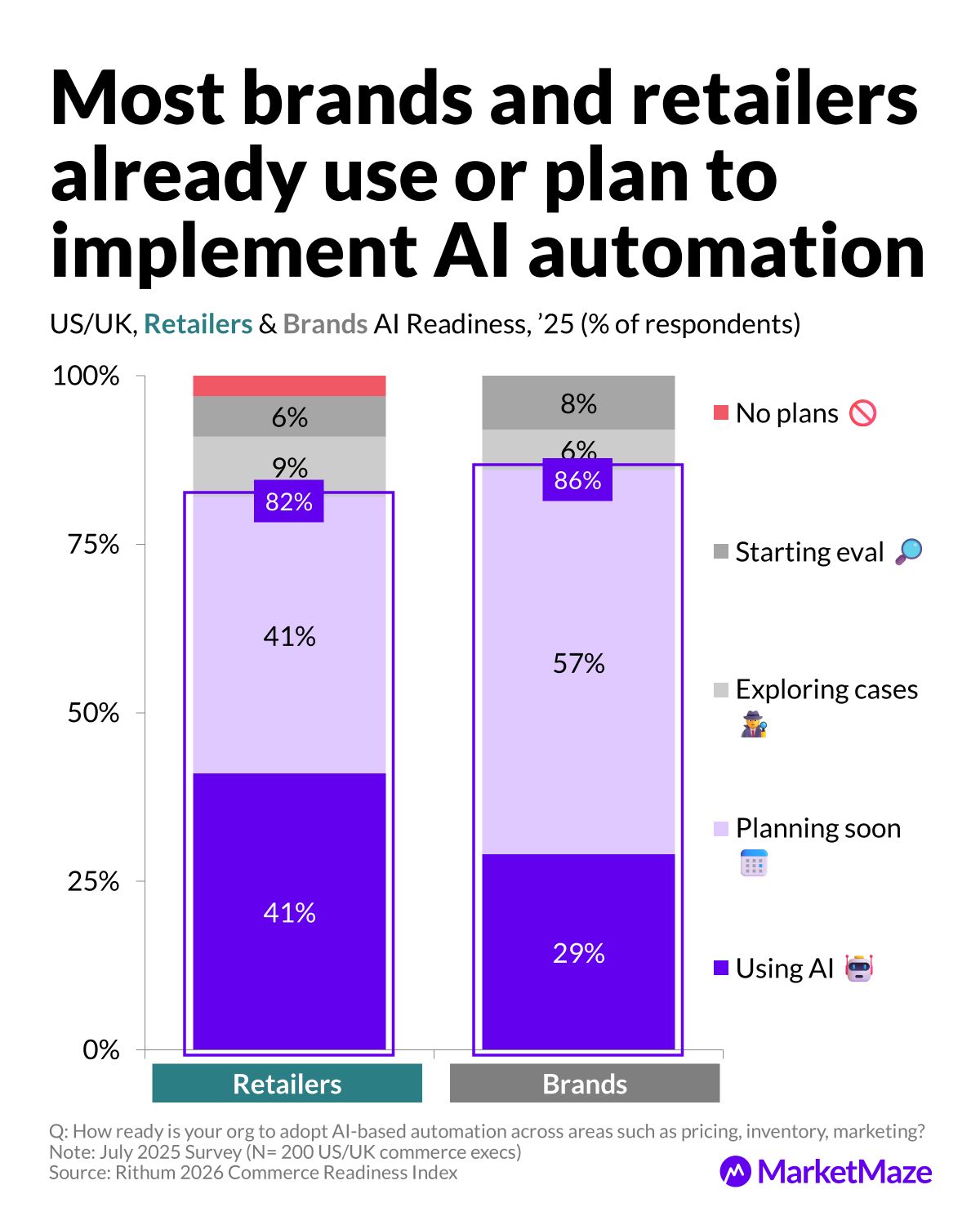

Automation is no longer experimental. 41% of retailers and 29% of brands already use AI across operations, while another 57% of brands and 41% of retailers are preparing to implement soon. The message is simple: AI isn’t the future—it’s the infrastructure.

Leaders Overwhelmed by Speed 🔥

Three in four executives admit AI is advancing faster than their organizations can adapt: 72% of retailers and 79% of brands feel behind. The fear isn’t losing to competitors; it’s losing to the pace of progress itself.

Sources: 🔒 Available for MarketMaze+

👀OUTSIDE THE MAZE

Prime Big Deal Days: Growth Slows, Still Huge 🛒

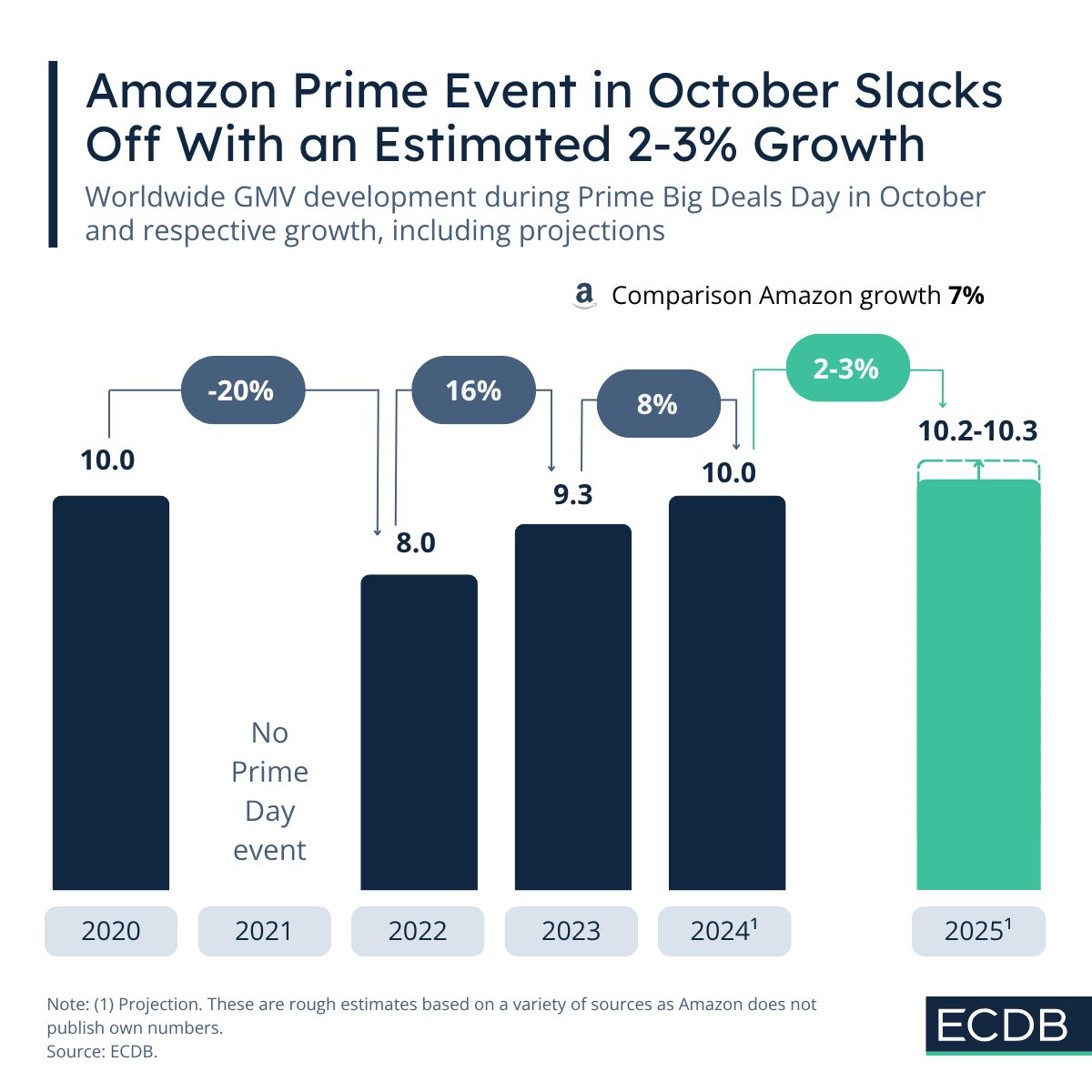

Amazon’s October Prime Big Deal Days is projected to hit $10.2–10.3B in GMV for 2025, up just 2–3% from last year. That’s a slower pace than Amazon’s 7% annual growth and well below July Prime Day’s gains. The October event is squeezed by other mega-sales like Black Friday and Singles’ Day, making shoppers less eager to splurge early. Competition from Shein, Temu, and AliExpress also keeps pressure high. 👉 ECDB

Single-SKU Millionaires: Rare and Risky 💸

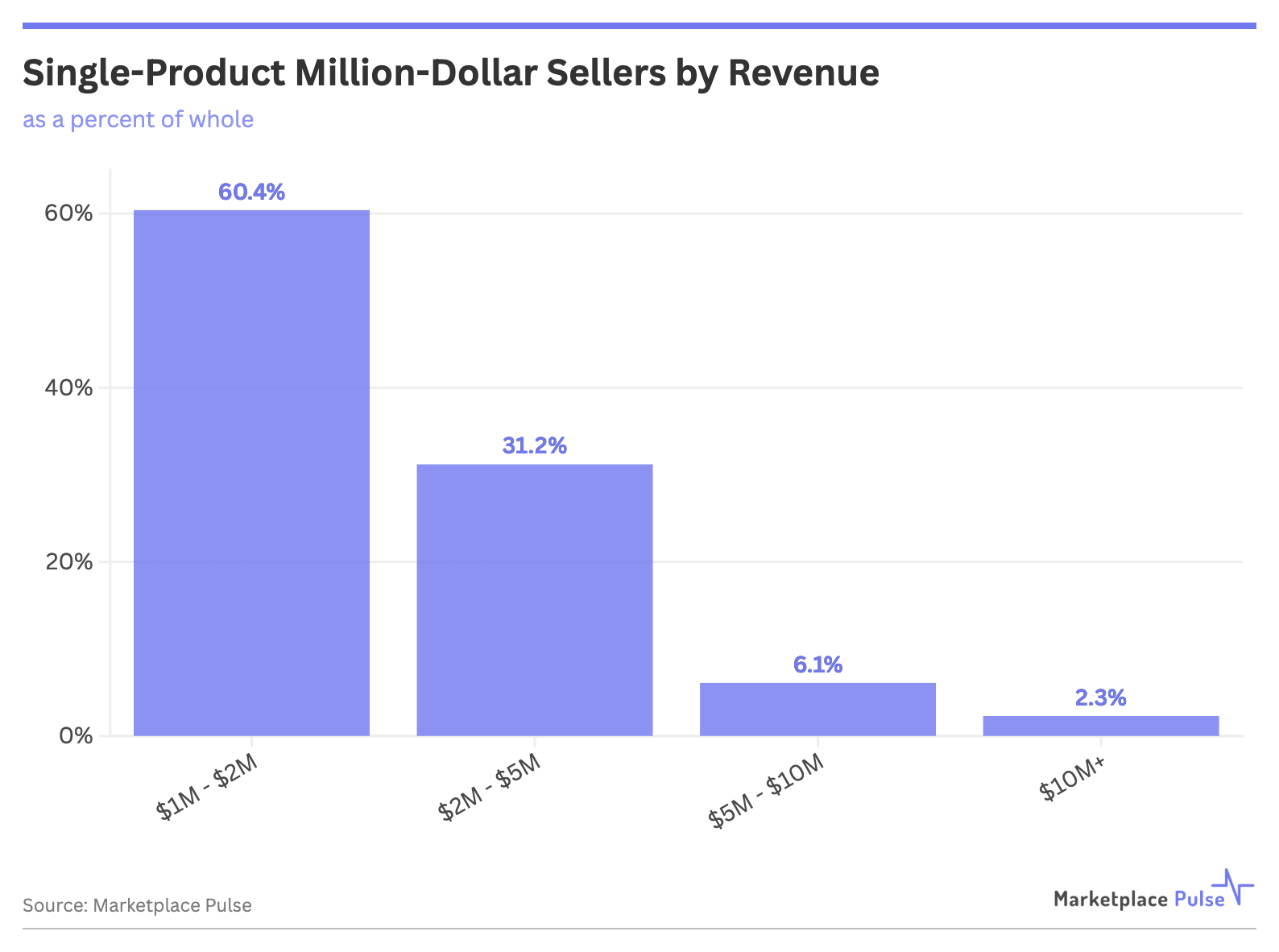

Over 800 Amazon sellers earn $1M+ per year with just one product, but most (60%) stay between $1–2M. Only 19 break $10M, and the risk is huge—one supply or algorithm hit could sink the entire business. Hero Cosmetics used a single SKU to start, then diversified and sold for $630M. This model wins on focus but loses on resilience. 👉 Marketplace Pulse

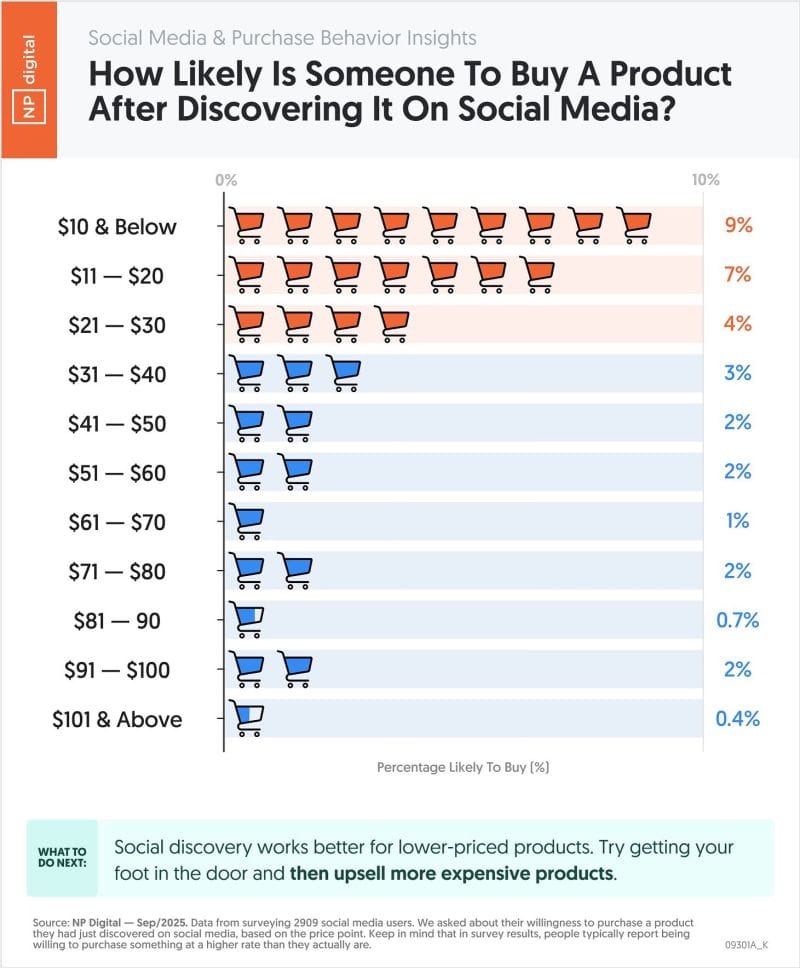

Social Commerce: Low Price Wins 🧲

NP Digital found that 9% of social media users would buy products under $10 they see online, but willingness plummets to just 0.4% for items over $100. Price is the main barrier… interest fades fast as cost rises. Social is best for cheap impulse buys, not big-ticket conversions. Brands should use low prices to hook buyers, then upsell after the first sale. 👉 LinkedIn

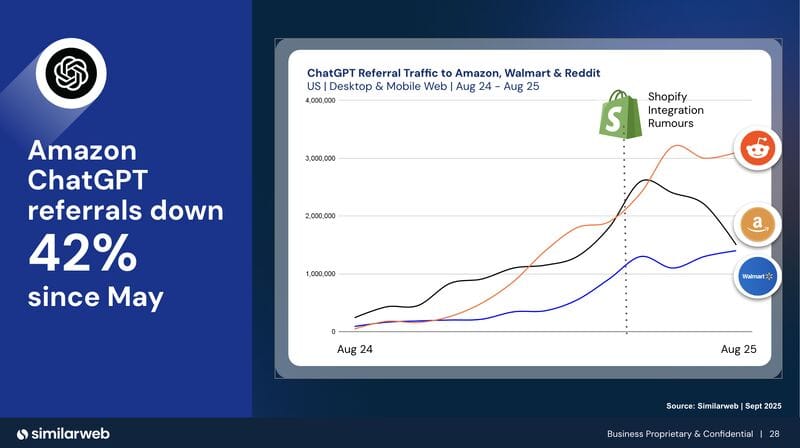

Retail Traffic: AI Sets the Rules 🤖

Amazon’s referral traffic from ChatGPT dropped 42% since May, even as ChatGPT became the world’s 5th largest site. Etsy’s ChatGPT referrals tripled in the same time. AI platforms now drive instant checkouts and convert at 12%, outpacing most marketing channels. The future battleground is AI controlling the entire shopper journey from discovery to checkout. 👉 LinkedIn

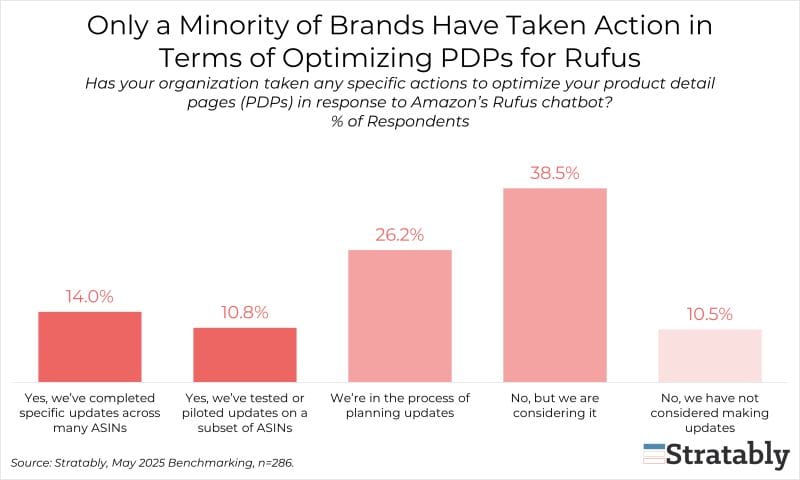

Brands Slow on AI-Optimized PDPs 🚦

Only 14% of brands have fully updated their product detail pages (PDPs) for AI-driven discovery, according to Stratably. Another 26% are planning changes, but nearly half are either just considering it or ignoring it. This gives early movers a big edge in AI-powered retail search. Brands that lag risk getting left behind as shopping goes conversational. 👉 LinkedIn

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY

Before you go we’d love to know what you thought of today's maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team