TODAY’S MAZE

Welcome to MarketMaze, where the smartest moves in e-commerce are written before they hit the headlines. Today, Poland sets the pace for parcel delivery, and the UK’s next-gen shoppers are making lockers mainstream. We break down what’s fueling these shifts, plus fresh data on how people really shop, what sells best, and why payments and AI are going hyperlocal and hyperfast.

Maze Story

🧩 Poland’s Locker Boom

📦 Parcel Lockers Are the New Normal in the UK

Insights🧠

🔎 Shoppers Do Their Homework Before Shopping

👗 Fashion Remains the eCommerce King

💳 Payments Are Local And PayPal’s a German Power Tool

🤖 AI Investment to Double and Platforms Bet Big on the Future

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

🌀 Maze Story

Poland’s Locker Boom 🚀

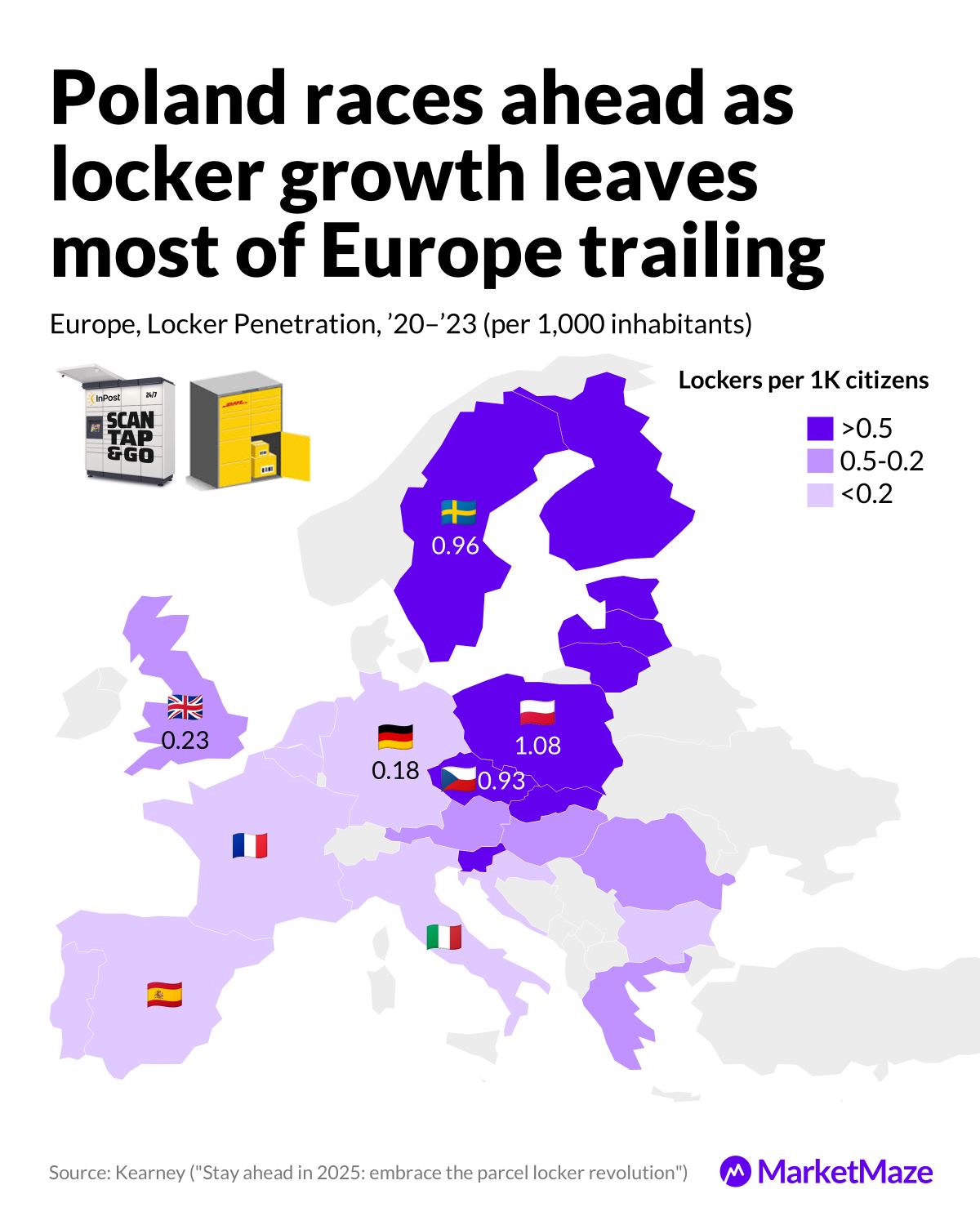

Europe’s locker revolution is being led by Poland, which now has more parcel lockers per person than any other country in the region. Kearney’s 2025 analysis, built on hard data from Eurostat and last-mile experts, tracks who’s surging and who’s still stuck in the slow lane. The story unfolds across Central Europe, with Western heavyweights left playing catch-up.

Poland’s locker growth leaves Europe trailing 📦

Poland has become the European capital of parcel lockers, with 1.08 per 1,000 citizens in 2023, far outpacing Sweden’s 0.96 and Czechia’s 0.93. The UK and Germany, despite their size and maturity, lag at just 0.23 and 0.18 per 1,000, respectively, with most of Southern and Western Europe remaining at less than 0.2. The fastest growth is in the CEE region, while Western nations haven’t yet caught up to the out-of-home delivery trend. The locker boom is changing the way Europeans receive online orders and setting a new standard for urban convenience.

Locker numbers are rising fast across the EU 📈

Poland’s lead isn’t just a static number—the last four years have seen rapid acceleration. From 2020 to 2023, Poland’s penetration jumped from 0.31 to 1.08, while Sweden and Czechia also closed in on one locker per 1,000 inhabitants. By contrast, the UK and Germany made modest gains, failing to break above the 0.2–0.3 range. Locker adoption in Central and Eastern Europe has outpaced the rest of the EU, making home delivery just one option among many. New shopping habits are solidifying, and the data shows the shift isn’t slowing down.

InPost’s Polish network overtakes DHL, the pioneer 🇵🇱

InPost has rewritten the rules of last-mile delivery, building a network in Poland that overtook Germany’s DHL—the original parcel locker pioneer—back in 2017. Since then, InPost’s growth has gone vertical, hitting over 21,000 units in 2023, compared to 15,800 for DHL’s German network. The UK’s InPost rollout is finally gaining momentum, but the scale is still much lower. The map has been redrawn: Poland is now the locker leader, while Western Europe tries to keep up.

InPost’s profits and network scale surge 💸

This locker explosion isn’t just about reach—InPost’s bottom line is following the same curve. Between 2019 and 2023, the company’s EBIT soared from €30M to €351M, while its Polish locker network quadrupled. International expansion accelerated too, with non-Polish APMs jumping from 0.7K to 13.5K. Margin pressure from rapid growth bottomed out at 13% in 2022 but rebounded to 17% as scale kicked in, with 2024 profits forecast to hit nearly €500M. InPost is now both the continent’s biggest locker operator and one of its most profitable.

Sources: 🔒 Available for MarketMaze+ subscribers

🌀 Maze Story

Parcel Lockers Are the New Normal in the UK 📦

Younger shoppers are changing how the UK receives parcels—and they're pulling the rest of the market with them. According to new data from InPost and Retail Economics, locker adoption is surging across all demographics, but the gap between generations, shopping habits, and income groups is staggering. The research, based on a nationally representative survey of 2,000 UK adults, digs into who’s using lockers, how often, and where the next wave of growth will come from.

Gen Z and Millennials lead locker adoption 🚀

Younger generations have turned parcel lockers into a delivery default. Over half of Gen Z (18-28) use lockers every month, with 66% using them at least once a year. Millennials aren’t far behind, but Gen X and especially Baby Boomers lag way back, with only 7% of Boomers using lockers monthly. The message is clear: the future is digital, flexible, and on younger shoppers’ terms. For retailers, targeting under-45s is the shortcut to winning in the locker economy.

Locker use spikes with frequent online shopping 🛒

Frequency is destiny: the more you shop online, the more likely you are to ditch doorstep delivery for a locker. Among those who buy online at least twice a week, 69% use lockers—a rate that drops steadily as shopping frequency falls, bottoming out at 24% among those who shop once per quarter. Even casual online shoppers are getting in on the action, but the heaviest buyers are driving the adoption wave and setting the pace for everyone else.

Young Brits plan even more locker use in 2025 🧑🎤

Locker enthusiasm isn’t slowing down. Three out of four Brits aged 18–34 expect to use lockers in 2025, and nearly 1 in 3 plan to ramp up usage further. Even among those over 65, 15% expect to use lockers and 6% plan to use them more. The generational gap remains, but the trajectory is up everywhere. Lockers are quickly moving from “nice to have” to “must have”—especially for digital natives.

Middle-income Brits are the next locker growth engine 💸

Locker growth isn’t just about age—it’s about economic firepower. Middle-income Brits (those earning £40k–£80k) have both the online order volume and the strongest intent to increase locker use: 37% of upper-middle income and 29% of lower-middle income shoppers plan to use lockers more. The highest and lowest income groups show much less appetite for growth. For brands and carriers, targeting these middle-income segments is the next big unlock—because that’s where tomorrow’s locker adopters are coming from.

Sources: 🔒 Available for MarketMaze+ subscribers

👀 Outside the Maze

Shoppers Do Their Homework Before Shopping 🛒

Locala & EMARKETER’s May 2025 research lays it out: 73.5% of US adults check prices or inventory online at least “sometimes” before hitting a store. Only 8.5% say “never.” This means digital price-checking is now table stakes. Miss on price or inventory transparency, and you’re basically handing customers to your competitor. Omnichannel isn’t just a buzzword—it’s how people actually shop. 👉 Locala & EMARKETER

Fashion Remains the eCommerce King 👗

ECDB’s 2024 market share data puts Fashion at the top of global eCommerce, grabbing 27% of revenue. China leads at 35.2%, UK at 29.2%. Even as markets differ—Spain, for example, is all about Electronics—Fashion is the universal eCommerce glue. Hobby, leisure, and electronics also have a big bite, but apparel wins on reach, frequency, and marketing pull. 👉 ECDB

Payments Are Local—And PayPal’s a German Power Tool 💳

Global eCommerce payments are a patchwork: In Germany, PayPal owns 64% of web store payments. In the Netherlands, iDEAL is king at 68%. The UK loves Apple Pay (37%), while Canada clings to credit cards (55%). Poland barely touches PayPal (2%)—so don’t expect a one-size-fits-all solution. For global growth, brands need to play the local payment game, or risk dropping the basket at checkout. 👉 Report via LinkedIn

AI Investment to Double—Platforms Bet Big on the Future 🤖

A new FT visual drops the bomb: Meta, Google, Amazon, and Microsoft will double their AI capital investment by 2026 compared to 2024. Meta alone has burned through $50B+ since 2021, and after a brief market dip, investors are now all-in on the AI gold rush. In Q1, the big three tacked on $350B in value, with AI-first strategies now market-approved. For brands, this means new frontiers in personalization, ad formats, and conversational commerce—welcome to the era of “endless AI companions.” 👉 FT via LinkedIn

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

That's it for today! Before you go we’d love to know what you thought of today's maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team