Welcome to MarketMaze, the #1 newsletter for staying on top of the latest in Ecommerce & Marketplaces. Get all the insights you need in just 5 minutes!

🧠 Big Story:

US Ecommerce Looks Abroad for Wins 🏆

📊 Key Data:

Temu Wins Over Europe’s Shoppers 💙

📖 Ecommerce players news:

🇺🇸 Trump’s Global Tariffs Ruled Unlawful by U.S. Court.

🇺🇸 TikTok Shop Cuts U.S. Staff After Weak Sales.

🇨🇳 Shein shifts IPO plans from London to Hong Kong.

🇪🇺 EU accuses Shein of violating consumer protection laws.

🇩🇪 Uber launches same-day courier delivery in Germany’s major cities.

🇨🇳 Alibaba’s instant commerce portal breaks 40M daily orders barrier.

+ over 15 handpicked hot ecommerce news from the last week you need to know 🔥

I’ll admit—today’s roundup and Wednesday’s deep dive are worth your time. If you haven’t already, hit share. Let’s build the biggest, boldest e-commerce community on the planet. The future of retail doesn’t wait—neither should you.

PDD Earnings Day Drama🎢

Think volatility is just a crypto thing? PDD’s (parent of Temu and Pinduoduo) latest earnings show China’s wildest e-commerce ride isn’t slowing down—just swerving in new directions. This is what happens when aggressive growth collides with an even more aggressive market. If you want to understand risk, reward, and chaos in retail, look no further.

PDD Shares Tank After Q1 Miss 📉

PDD’s stock staged another earnings-day drama, dropping 18% in a week and closing nearly 17% lower within two days of the Q1 2025 results. For PDD, volatility is a feature, not a bug—every earnings call is a live market experiment. With no CFO and minimal guidance, investors are left to decode the story from sparse clues. This time, results disappointed, throwing fuel on debates about transparency and future direction.

Profit and Revenue Miss—Here’s Why 🚦

PDD missed big on both the top and bottom line. Q1 profit plunged to $2.05B (down 47% YoY from $3.87B), and revenue growth slowed to just 11%—a shadow of 2024’s 100% jump. Why? Subsidies are eating the business:

Nearly $1.4B in extra sales & marketing for “smart vouchers”

Merchant subsidies booked as contra revenue, slashing net sales

State-backed electronics subsidies favored JD, not PDD

PDD is paying up to keep shoppers and merchants loyal, but at a steep price. These moves boosted GMV above the broader market but gutted profits and rattled nerves.

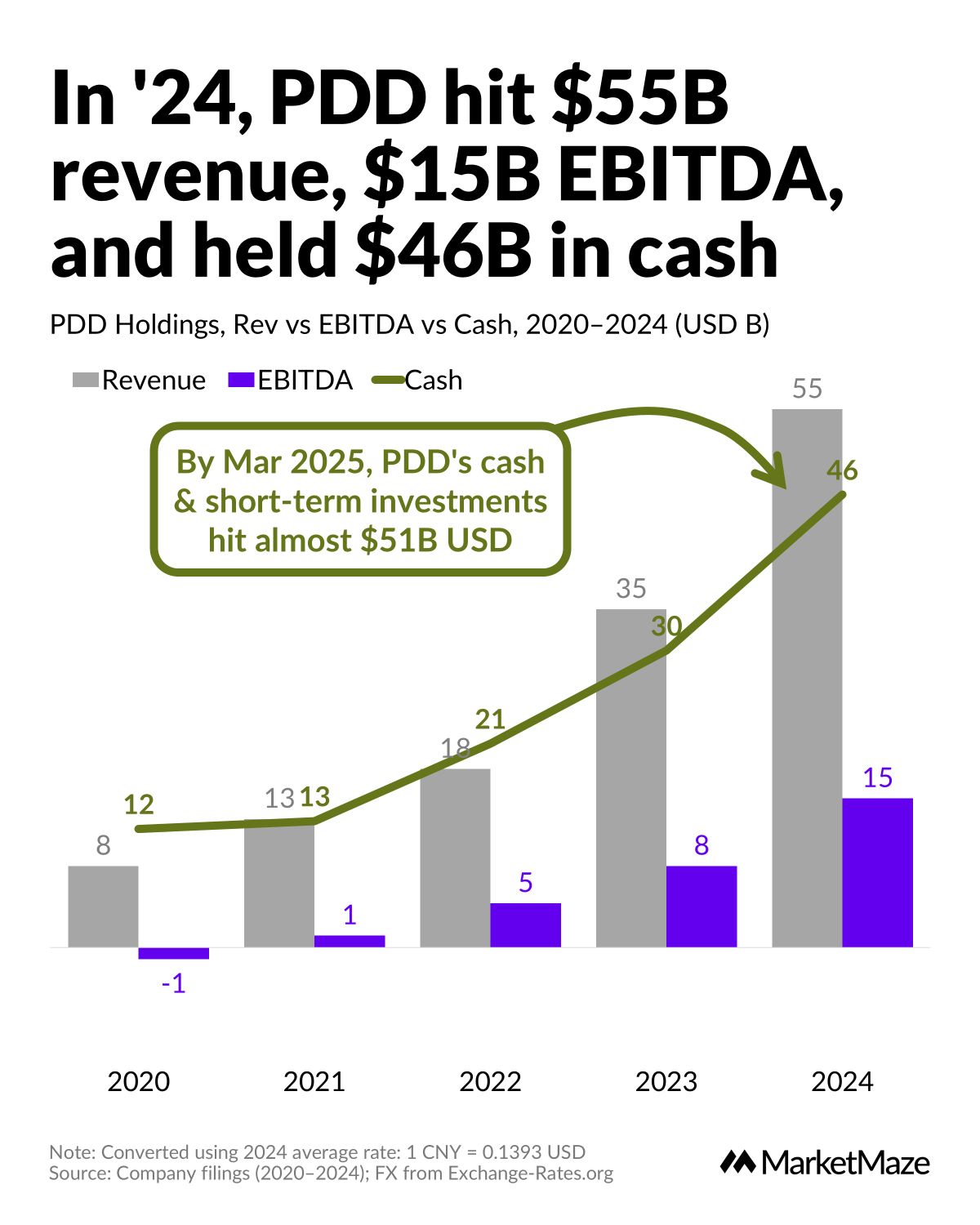

Still a Growth Machine, But Facing Global Headwinds 🌏

Zoom out and PDD still looks like a juggernaut: 2024 revenue reached $55B, EBITDA hit $15B, and cash reserves soared to $61B by March 2025—five times more than in 2020. But storm clouds are gathering:

Temu’s U.S. growth is losing speed as tariffs climb and “de minimis” tax breaks end

U.S. GMV is down, with a €2/item tax looming in Europe

PDD is doubling down in Southeast Asia, topping app charts and setting ambitious targets

Despite profit pain and global regulatory headaches, PDD has a war chest most companies would kill for. They say they’re “not conventional”—and with swings like these, no one disagrees.

Is your social strategy ready for what's next in 2025?

HubSpot Media's latest Social Playbook reveals what's actually working for over 1,000 global marketing leaders across TikTok, Instagram, LinkedIn, Pinterest, Facebook, and YouTube.

Inside this comprehensive report, you’ll discover:

Which platforms are delivering the highest ROI in 2025

Content formats driving the most engagement across industries

How AI is transforming social content creation and analytics

Tactical recommendations you can implement immediately

Unlock the playbook—free when you subscribe to the Masters in Marketing newsletter.

Get cutting-edge insights, twice a week, from the marketing leaders shaping the future.

Temu Wins Over Europe’s Shoppers 💙

UK loves Temu.

Germany really loves a deal.

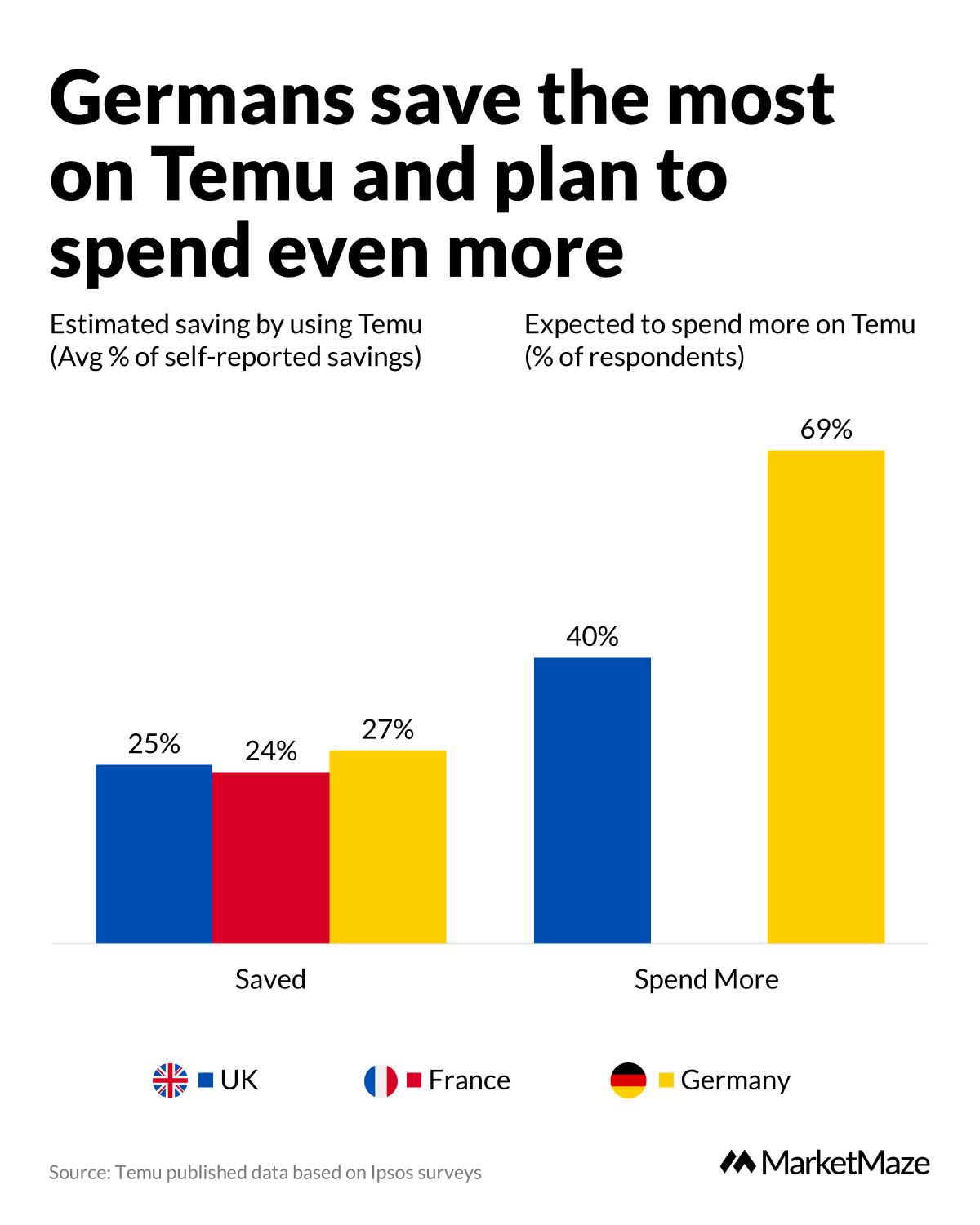

According to Temu self-published data (Ipsos, 2024/25):

Temu Advocacy (% likely to recommend):

🔹 UK – 74%

🔹 France – 71%

🔹 Germany – 65%

But what’s driving those numbers?

Temu Selection Drivers (% citing reason):

💸 Price: Germany (73%) > France (62%) > UK (60%)

📦 Free delivery: Germany (50%) > France (40%)

🛒 Product variety: France leads at 43%

Temu isn’t just winning traffic.

It’s winning wallets.

💶 Germans report the highest average savings at 27%

That’s not just a discount—it’s a habit-former.

📈 Even more revealing:

69% of Germans say they’ll spend more on Temu in 2025

(That’s nearly double the rate of UK shoppers at 40%)

Temu Moves Inventory to U.S. Warehouses Ahead of Rule Change.

Temu pre-shipped three months of inventory by sea, stocking U.S. hubs before the May 2 de minimis exemption ended. The move, planned since last November, helped Temu maintain sales after a sharp drop in U.S. site traffic (down 33%) and daily GMV (down 50%). Now, 80% of sales are from semi-managed orders, and Temu is ramping up local seller recruitment in Mexico, Australia, and Poland. 👉 Chinese Sellers Substack

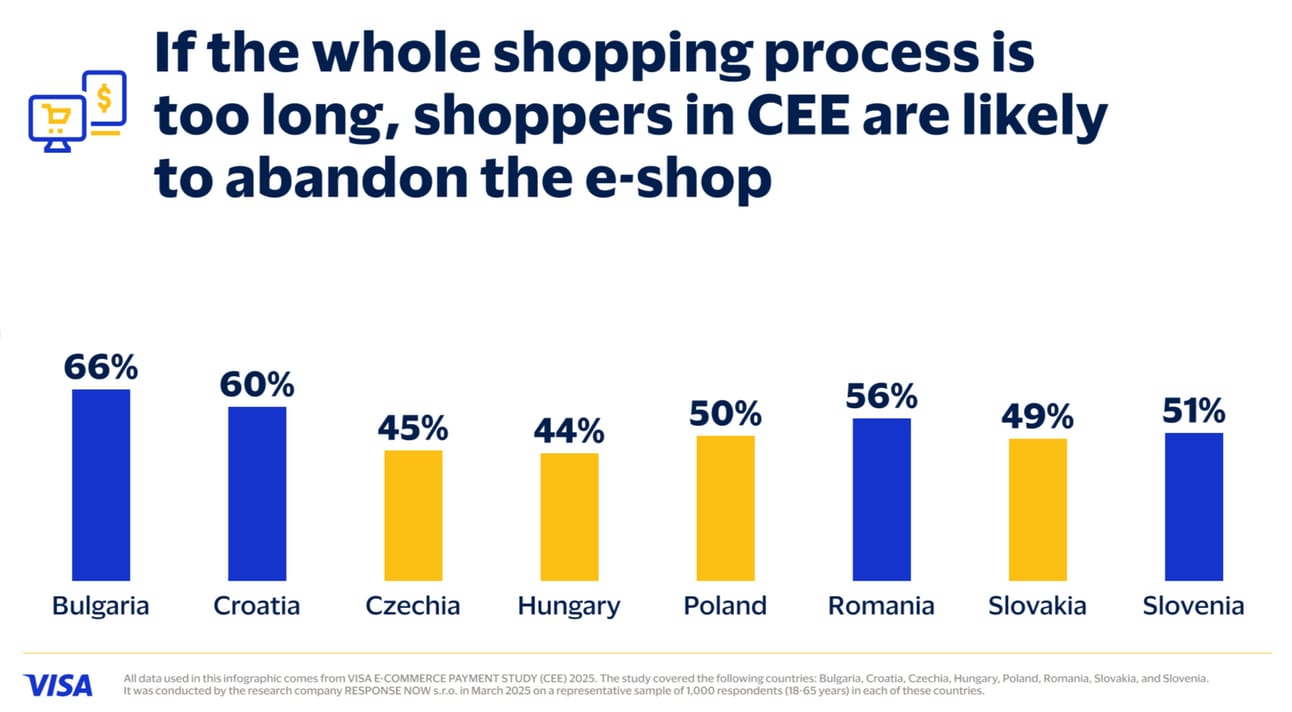

Visa Study: Security and Speed Drive CEE E-commerce Payments.

Visa’s 2025 E-commerce Payment Study surveyed shoppers across Central and Eastern Europe. Four out of five respondents ranked payment security as their top priority, and over half say they’ll abandon checkout if it takes too long. Visa Mobile and Click to Pay use tokenization for fast, secure payments, showing convenience and safety now go hand-in-hand for shoppers. 👉 Visa LinkedIn

Temu Surges to #2 E-commerce Site in Brazil, Adds 56 Million Visits.

Temu leapfrogged Shopee to become Brazil’s second-largest e-commerce site, reaching 9.9% share of traffic and closing in on Mercado Livre at 12.3%. The sector for imported goods boomed, jumping 132% year-over-year to over 450 million visits, while Temu’s marketing and promo blitz fueled its rise. Brazilian shoppers are flocking to mobile: 79% of traffic comes from smartphones, and organic search now drives 27% of all visits. 👉 Mercado e Consumo

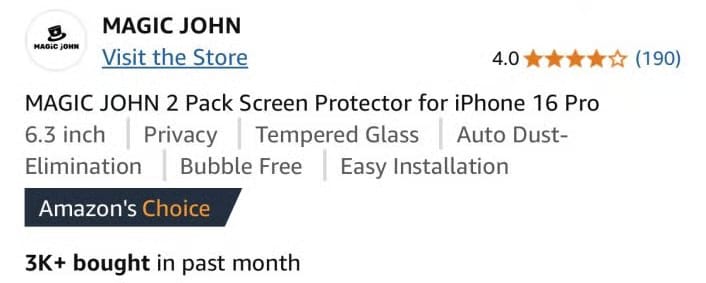

Amazon Experiments with Dual-Title Listings, Ending Keyword Stuffing.

Amazon is testing a new A/B feature that splits product listings into a short mobile title and a bulleted key features list, rolling out in Q3. GenAI is already rewriting bloated titles, and the days of keyword stuffing are over—Rufus doesn’t reward it. Sellers should prepare for a shift where clarity and relevance win over keyword-heavy tactics. 👉 Marketplace Mastery

Smarter Growth for DTC Brands on Amazon

Ad spend keeps climbing. ROAS? Not so much.

The smartest Amazon sellers aren’t spending more—they’re spending smarter.

The Affiliate Shift Calculator models what could happen if you reallocated a portion of your ad budget into affiliate marketing.

Built for sellers doing $5M+ on Amazon.

🇺🇸 Trump’s Global Tariffs Ruled Unlawful by U.S. Court.

A U.S. court blocked former President Trump’s global tariffs, stating he overstepped legal authority by using emergency powers to impose them without Congress. The ruling puts billions in trade duties at risk and the Trump team is appealing the decision. 👉 Retail Gazette

🇺🇸 TikTok Shop Cuts U.S. Staff After Weak Sales.

TikTok Shop is laying off employees in the U.S. following lower-than-expected sales, with GMV (gross merchandise value) hitting $9B in 2024. Free shipping perks are ending, and the new U.S. lead is Mu Qing, ex-VP of Douyin’s e-commerce. 👉 Momentum Asia

🇮🇱 eBay to Shut Down Israel Operations, 200+ Jobs Lost.

eBay will close its Israel R&D center by early 2026, impacting over 200 staff. The move comes after years of cuts, ending its presence launched with the $620M buyout of Shopping.com in 2005. 👉 Calcalistech

🇵🇱 Allegro Bets on Local to Outrun Asian Competition.

Poland’s Allegro is removing long-shipping Asian listings to focus on local sellers, keeping 38.8% market share—far ahead of Amazon (3.9%) and AliExpress (3.4%) in Poland. The move sharpens Allegro’s local advantage. 👉 FashionNetwork

🇺🇸 Amazon’s Third-Party Sellers Hit $290K+ in Annual Sales.

Independent sellers now drive 60% of Amazon’s sales, employing 2M people and seeing a 16% sales jump year-over-year. Over 55K sellers crossed $1M in sales. New AI listing tools are used by 900K sellers to improve product pages. 👉 PYMNTS

🇨🇳 AliExpress Grows European Reach with Local Warehouses.

AliExpress launched a certified local warehouse program in Europe, working with 10+ partners and giving top products a “Local+” badge. Its German site now welcomes local sellers, pushing further EU expansion. 👉 KR Asia

🇨🇳 China to Cap E-Commerce Platform Commissions.

China’s new draft rules would force platforms to lower or publish commission fees, easing costs for small and midsize merchants. Rules target more transparency and fairer practices for millions of sellers. 👉 SCMP

🇺🇸 Amazon Tests AI Audio Highlights for Shopping.

Amazon is piloting AI-generated audio summaries of product highlights for U.S. shoppers. The feature pulls info from reviews and product details, aiming to make shopping faster and easier for mobile users. 👉 AboutAmazon

🇨🇳 Shein shifts IPO plans from London to Hong Kong.

After facing regulatory hurdles in the UK, Shein is now targeting a public listing in Hong Kong. The move follows the Chinese Securities Regulatory Commission's refusal to approve the London IPO and reflects Shein's strategy to find a more favorable regulatory environment. 👉 Retail Gazette

🇪🇺 EU accuses Shein of violating consumer protection laws.

The European Union has given Shein a 30-day deadline to address alleged breaches, including fake discounts and misleading product information. Failure to comply could result in fines up to 6% of Shein's global revenue. 👉 Euronews

🇨🇭 Branded products on Temu raise authenticity concerns.

Temu's listings for Nike, Adidas, and Puma products, sold by various small vendors without official brand authorization, suggest potential counterfeit or unauthorized resales. This highlights challenges in brand protection on online marketplaces. 👉 Carpathia Blog

🇨🇭 Action enters Swiss market, challenging discount retail.

Dutch retailer Action has launched its first store in Switzerland, offering over 6,000 products, including 1,500 items priced under CHF 2. The company plans to expand to 30–50 locations, positioning itself as a competitor to Migros, Coop, Aldi, Lidl, and IKEA. 👉 Carpathia Blog

🇬🇧 Holland & Barrett launches personalized wellness app.

The H&B&Me app tracks users' biological age and offers 21-day health plans with daily lifestyle recommendations. It's part of a £96.3M investment in digital transformation to become a health and wellness destination. 👉 Retail Gazette

🇪🇸 Zara introduces 'Travel Mode' in mobile app.

Zara's new app feature offers travel guides and local recommendations in countries like Italy, the UK, and Japan. Users can explore attractions, locate nearby stores, and make purchases within the app, even offline. 👉 Fashion Network

🇩🇪 The Platform Group reports strong Q1 2025 results.

The company achieved a 30% increase in gross merchandise volume, reaching €1.3B, and saw a substantial rise in EBITDA. This reflects the success of its diversified e-commerce platforms and strategic acquisitions. 👉 Retail News DE

🇬🇧 Oh Polly launches pre-loved resale marketplace.

In partnership with Treet, Oh Polly's new platform allows customers to buy and sell pre-owned items, aligning with sustainable fashion trends. The resale marketplace is fully integrated with the brand's website. 👉 Internet Retailing

🇩🇪 Uber launches same-day courier delivery in Germany’s major cities.

Uber’s new “Direct” service lets retailers offer instant same-day delivery nationwide. Retailers like MediaMarkt and dm can now send packages directly to customers, as Germany’s last-mile market heads for €12B by 2025. 👉 Ecommerce Germany

🇨🇳 Alibaba’s instant commerce portal breaks 40M daily orders barrier.

Alibaba’s new on-demand platform—run by Taobao and Ele.me—hit 40M daily orders. Orders arrive in as little as 30 minutes, as Alibaba bets “instant” shopping could top $15B GMV in 2025. 👉 Reuters

🇩🇪 Amazon claims $100B food sales—excluding Amazon Fresh division.

Amazon says it now moves over $100B in food worldwide, thanks to Prime and third-party marketplace sellers. Fresh grocery delivery is still limited, but Amazon’s share threatens local players like Edeka and Lidl. 👉 Exciting Commerce

🇲🇦 Glovo under antitrust probe in Morocco’s food delivery market.

Morocco’s Competition Council is investigating Glovo, now 60% market share, for high commissions and exclusivity clauses. Delivery Hero’s bet on Africa faces a test as market GMV heads to $400M in 2025. 👉 Morocco World News

🇮🇳 Flipkart to hire 5,000 as quick commerce, AI, and fintech ramp up.

Walmart-owned Flipkart plans to add 5,000 jobs, doubling down on 10-minute grocery delivery and AI-driven payments. The company targets 350M users and $50B GMV by 2026. 👉 YourStory

🇮🇳 Instamart drops Swiggy branding, sets out as standalone player.

Instamart rebrands, ditching Swiggy’s name to compete directly with Zepto and Blinkit. India’s quick commerce race now heads for $5.5B GMV, with Instamart handling millions of monthly orders. 👉 YourStory

❤️ Your Opinion matters!

Share your thoughts on today’s email with just 1 click in the poll—it’s quick and helps us improve.

What do you think of this issue?

For questions or more feedback, reply to this email.

Best,

MarketMaze team