TODAY’S MAZE

Happy Tuesday! AI is rewriting retail faster than most brands can blink. Klarna now sells perks instead of credit, Criteo rewires its base for Wall Street, and PayPal moves directly into ChatGPT’s checkout lane. Meta and Shopee fuse livestreams, Pinterest builds a visual assistant, and Amazon’s ad machine keeps climbing. The maze of commerce is getting smarter, faster, and harder to escape.

Maze Focus🌀

💳 Klarna Goes Premium

🧭 Criteo Moves West

🧩 X’s $1 Ad Problem

📺 The Duopoly Shrinks

+

Last week handpicked news you need to know

📣 Ecommerce Marketing

🛠️ Ecommerce Software & AI

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

🌀 MAZE STORY

💳 Klarna Goes Premium

The Maze: Klarna just launched paid membership tiers that mimic Amex perks without credit debt. Starting at €17.99 a month, users get travel insurance, lounge access, rotating digital subscriptions, and cashback via Klarna Balance. It’s a direct strike at premium cards, trading revolving credit for recurring engagement.

Launched in Oct 2025, Klarna’s Premium (€17.99) and Max (€44.99) plans offer €400+ in monthly value, targeting one million early users with a U.S. rollout coming next.

Members earn 0.5–1% cashback when paying through Klarna Balance, pushing users to hold deposits instead of relying on costly credit card rails.

With 111M active users and revenue near $3B, Klarna’s shift toward subscriptions and ads supports a $13–14B IPO and a push to consistent profitability.

Why it matters: Klarna is building a “membership commerce” model that blends payments, perks, and shopping in one app. The move turns shoppers into subscribers and replaces interest income with predictable monthly fees. For e-commerce brands, it’s a new ecosystem to reach high-frequency buyers who already trust Klarna at checkout.

📣 FROM OUR PARTNERS

Want to get the most out of ChatGPT?

ChatGPT is a superpower if you know how to use it correctly.

Discover how HubSpot's guide to AI can elevate both your productivity and creativity to get more things done.

Learn to automate tasks, enhance decision-making, and foster innovation with the power of AI.

🌀 MAZE STORY

🧭 Criteo Moves West

The Maze: Criteo is leaving France for Luxembourg to pave the way for a future U.S. redomicile and possible acquisition. The change removes barriers to mergers and index eligibility, giving the ad-tech firm easier access to American capital. It’s not an exit from Europe, it’s a repositioning for Wall Street.

Announced on Oct 29, 2025, Criteo plans to swap ADRs for Nasdaq-listed shares, completing the move by Q3 2026 after a two-thirds shareholder vote.

Shareholders can cash out at €17.94 per share, capped at €94M, with the structure designed to cut listing costs and enable future cross-border mergers.

Q3 results showed $470M revenue, $105M EBITDA, and $67M free cash flow, backed by new retailer deals and a retail-media partnership with Google.

Why it matters: Criteo is aligning its corporate plumbing with its retail-media ambitions. A U.S. listing gives it the currency to chase growth, buy rivals, or partner deeper with tech giants. For ecommerce players, it signals how fast ad-tech is merging with marketplace infrastructure.

💎 DATA TREASURE

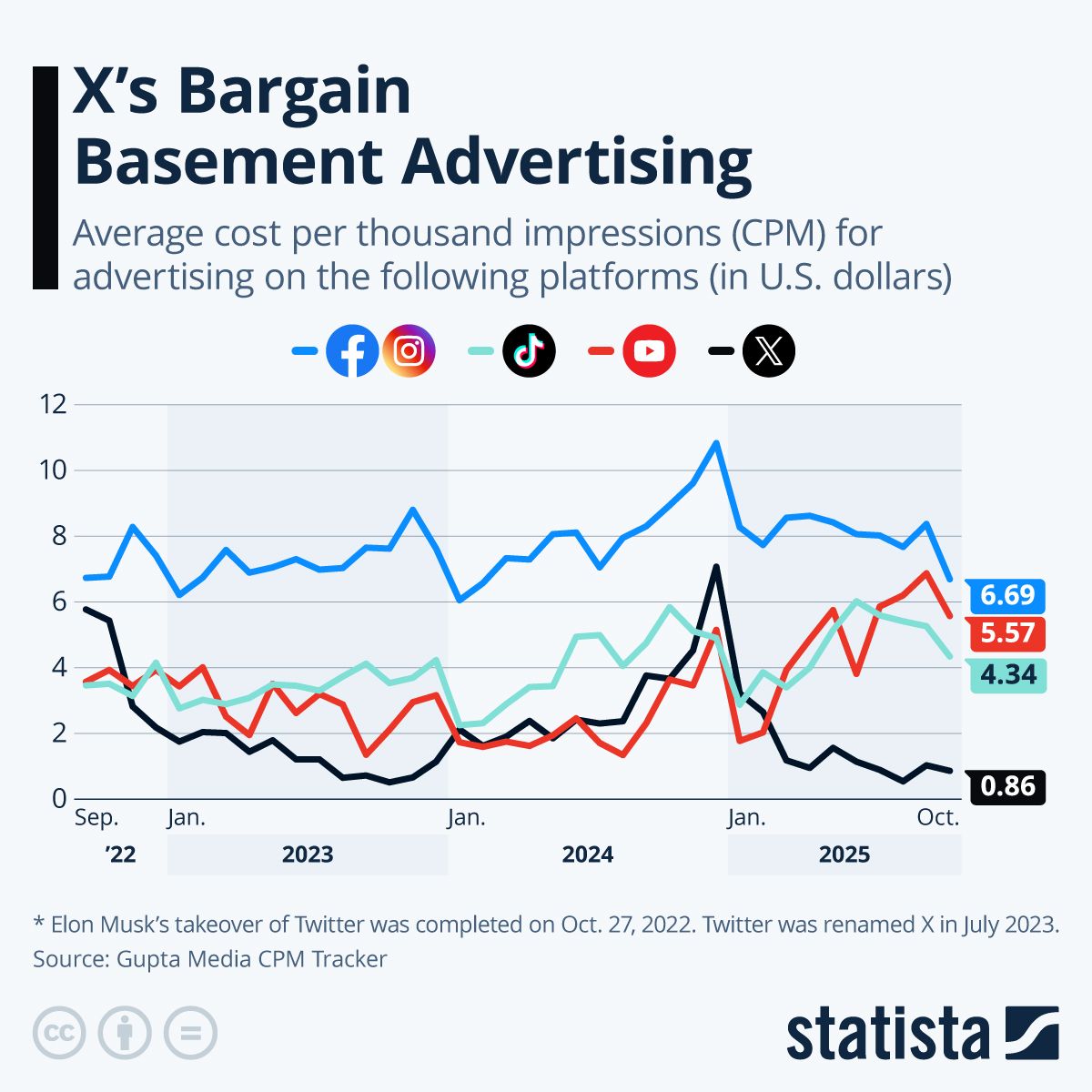

🧩 X’s $1 Ad Problem

The Maze: X has turned into the bargain bin of digital advertising, with CPMs below $1 while Meta and TikTok sit near $6. The platform’s ad value collapsed after big brands fled over safety concerns. Performance buyers love the cheap reach, but low trust keeps major budgets away. Cheap is now the strategy, not the side effect.

In 2025, X’s CPM dropped to $0.86, almost one-seventh of Meta’s, signaling how brand demand evaporated two years after Musk’s takeover.

U.S. ad revenue is expected to rebound 17% to $1.3B, mainly from election-year spend and small direct-response advertisers testing low-cost reach.

Meta and TikTok CPMs hold near $6–7, thanks to strong targeting tools, conversion data, and brand-safe environments advertisers can defend in boardrooms.

Why it matters: X’s pricing shows how trust directly translates to margin. In e-commerce, a similar pattern plays out: sellers with weak reviews discount heavily to move inventory. Cheap clicks may deliver volume, but premium conversions need credibility. Until X rebuilds that, it’s selling clearance space in a luxury mall.

📣 FROM OUR PARTNERS

Stop guessing what to sell. The fastest-growing entrepreneurs use Spocket’s simple loop to turn their ideas into income:

1️⃣ Find winning products from top US & EU suppliers — not random overseas listings.

2️⃣ Add them to your Shopify, Wix, or Amazon store in one click.

3️⃣ Deliver in days, not weeks — keeping customers happy and reviews glowing.

Spocket gives you access to thousands of high-quality, fast-shipping products, fully integrated with Shopify, Wix, WooCommerce, and BigCommerce.

No warehouses. No upfront inventory. Just premium items your customers will actually want.

Join 100,000+ sellers building real brands, not just stores. Test samples, automate fulfillment, and track everything from one dashboard.

💎 DATA TREASURE

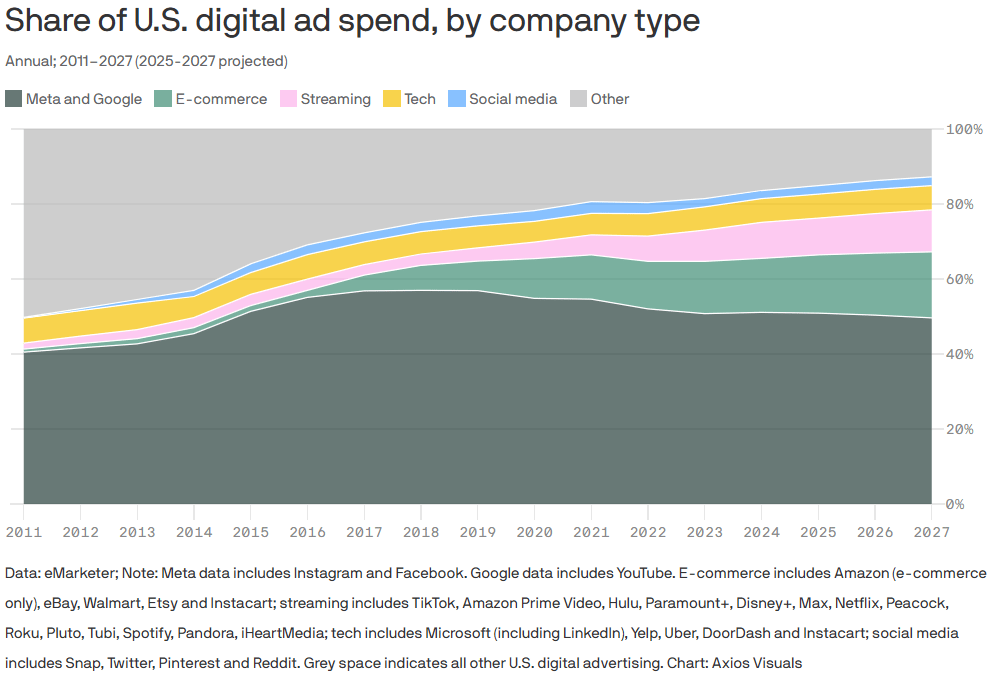

📺 The Duopoly Shrinks

The Maze: Google and Meta still dominate U.S. digital ads with nearly half the market, but their grip is slipping. Retail media and streaming are stealing share by connecting ads closer to purchase and to living-room screens. The duopoly isn’t dying, but it’s sharing the stage for the first time in a decade.

Amazon’s ad arm grew 20%+ in 2025, turning retail data into precision targeting that brands can directly link to sales.

Streaming platforms like Netflix, Disney+, and Max unlocked ad tiers, pushing connected TV ad revenue toward $50B by 2030.

Meta and Google still earn $300B+ combined, but their share is falling as advertisers shift to “closed-loop” ecosystems that prove every dollar sells.

Why it matters: The next wave of ad growth moves from clicks to carts. Marketplaces and retail media give e-commerce brands the holy grail—proof that ads sell. The duopoly will fight back with AI and automation, but the future of performance marketing now lives where the checkout button does.

📰 Briefing

📣Last week in Ecommerce Marketing

🇸🇬 Shopee links Meta for Live and Reels shopping. Creators tag Shopee products in posts, Reels, and Live, with affiliate perks and catalog sync; the pilot runs in Thailand, Indonesia, Vietnam, and the Philippines, with more markets coming.

🇺🇸 Pinterest launches Assistant for visual shopping. A voice multimodal aide uses your boards to return shoppable picks; beta starts in the US for adults, advertisers can request access as Pinterest leans into agentic discovery.

🇺🇸 Amazon Q3 shows ads and AWS acceleration. Net sales hit 180.2B dollars with ads up 24 percent to 17.7B and AWS up 20 percent to 33.0B, while Q4 guidance lands at 206 to 213B as Amazon pours capex into AI infrastructure.

🇺🇸 Instacart Carrot Ads lift retailer results. Over 240 retailers use the stack; Schnucks posts 2.6 percent CTR, 5.7x ROAS, and a 7x retail media revenue jump with aisle and inventory aware formats across web, app, and smart carts.

🇵🇱 Google Ads tightens pricing rules globally. From Oct 28, ads must show true total prices and avoid bait tactics; repeat violations risk suspension as consent and parity checks get stricter across EEA, UK, and Switzerland.

🇺🇸 Meta AI tools spark odd ad outputs. Marketers report off brand images and hidden toggles in Advantage Plus while Meta cites broad gains, and buyers ask for transparent defaults and a reliable global off switch.

🇬🇧 Meta offers low cost ad free option in UK. First account costs £2.99 on web and £3.99 in apps with no less personalized option, so expect smaller but more engaged ad audiences as users self select.

📰 Briefing

🛠️Last week in Ecommerce Software & AI

🇺🇸 Pay inside ChatGPT with PayPal. OpenAI’s agentic checkout will surface saved PayPal methods in chat, onboarding merchants automatically so orders complete in conversation and PayPal defends wallet share inside AI shopping flows.

🇺🇸 PayPal unveils Agentic Commerce Services. Merchants sync catalog, inventory, and orders to AI channels, enabling fast in-chat payments while keeping refunds and taxes aligned to the merchant of record and extending PayPal’s role as agent-era middleware.

🇭🇰 FundPark raises $71M for AI lending. The firm funds cross-border sellers using real-time store and logistics data, building on multi-billion advances and securitizations to speed working-capital access and smooth inventory cycles.

🇺🇸 AI platform joins alcohol ecommerce. Big Thirst and Pour Now link DTC sites, retailers, and delivery apps, using AI to manage assortments, compliance routing, and pricing so wineries and spirits brands reduce stockouts and lift conversion.

🌐 WSPN launches stablecoin Checkout. A standardized API lets merchants accept major stablecoins, settle to fiat, and cut cross-border costs while PSP partners handle compliance, reconciliation, and chargeback-style workflows.

🇺🇸 Moonshot AI secures $10M seed. The no-code engine continuously ships site changes, learns from conversions, and promises CRO gains without manual tests, funding integrations and guardrails for commerce and CMS stacks.

🇺🇸 Enterpret debuts agentic feedback. Signals from 50 plus channels are clustered and actioned as tickets or stories, tying issues to revenue and churn so product and marketing teams act on customer evidence instead of static dashboards.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

🧠 RECOMMENDED NEWSLETTERS

Craving more sharp reads? Check out these MarketMaze-recommended newsletters.

THAT’S IT FOR TODAY

Before you go we’d love to know what you thought of today's maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team