Welcome to MarketMaze, the #1 newsletter for staying on top of the latest in Marketplace and E-commerce. Get all the insights you need in just five minutes a week!

This MarketMaze report integrates data from global sources (Worldometer, Statista, World Bank) and local entities (Derzhstat, War.Ukraine), supplemented by insights from industry blogs like newage. , Yespo, and Signifyd. It examines Ukraine's e-commerce trajectory before, during, and after the 2022 invasion, highlighting key trends and shifts. The analysis provides a comprehensive view of the sector's resilience and adaptation amid conflict.

Russia's aggression escalated over years, culminating in a full-scale invasion in February 2022, severely disrupting Ukraine's economy.

E-commerce faced significant challenges due to logistical breakdowns and infrastructure damage.

Despite adversity, Ukraine's resilience, bolstered by international support, sustained some digital operations.

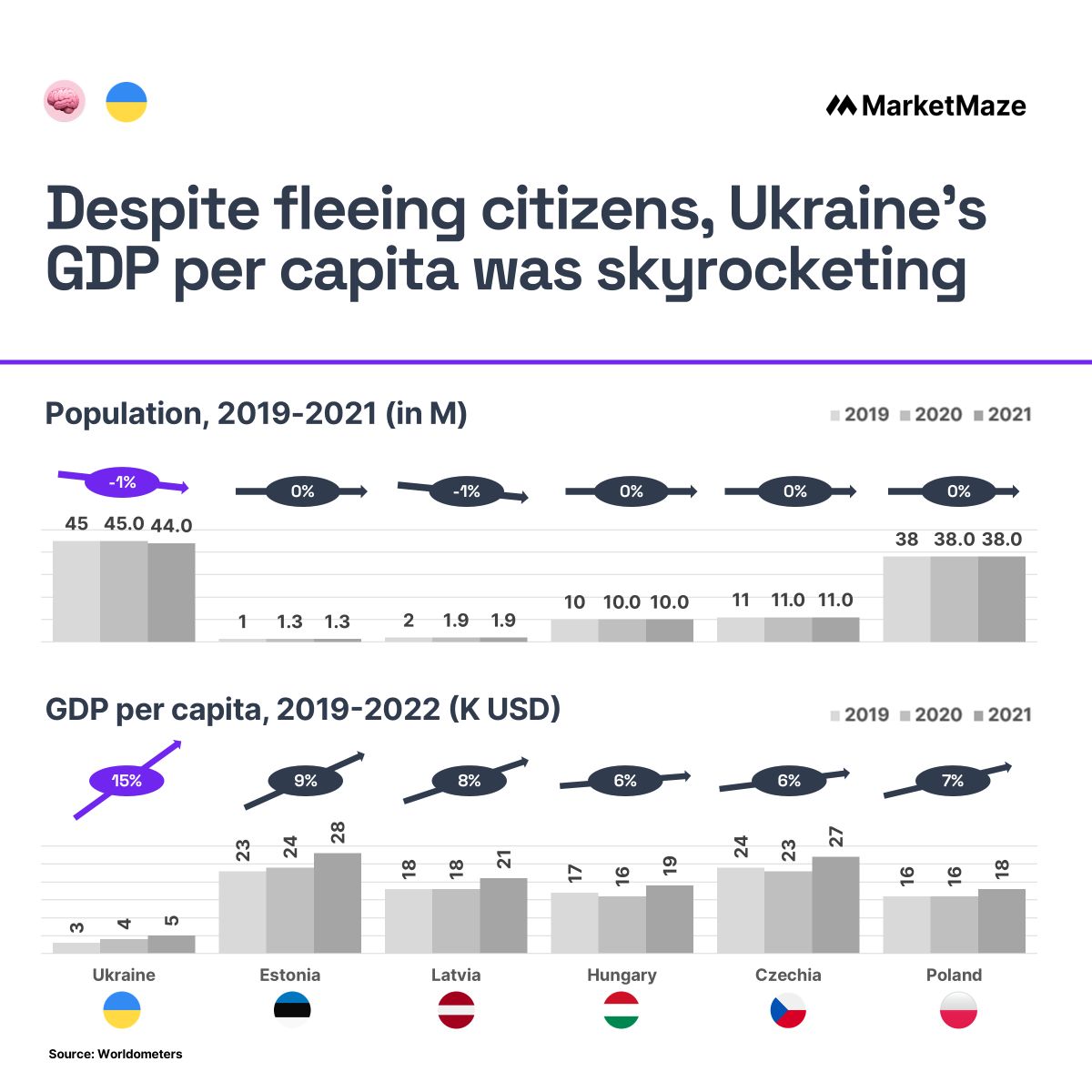

Pre-war, Ukraine's GDP grew by 14% (2019-2021), outpacing regional peers like Poland (+7%) and Estonia (+9%).

This economic momentum attracted international interest, with platforms like Trendyol aiming to tap into Ukraine's market despite risks.

The robust growth underscored the country's potential as a key player in Eastern Europe's digital economy.

Ukraine's GDP per capita rose by 15% (2019-2021), surpassing Estonia (+9%) and Latvia (+8%), even amid a 1% population decline.

This growth highlighted strong economic fundamentals, attracting global e-commerce platforms and investors.

The war temporarily halted this progress, but the consumer market's potential remained evident.

In 2020, Ukraine's e-commerce market expanded by 41% year-over-year, reaching $4 billion, one of the highest growth rates in Eastern Europe.

This surge was driven by increased internet penetration and consumer trust in online shopping, with significant contributions from electronics and fashion sectors.

The rapid growth attracted attention from international platforms seeking to enter the burgeoning market.

By 2021, 79% of Ukrainians were internet users, with e-shoppers comprising 64% of them, and an average spend per shopper of €183, indicating market maturity.

This digital adoption laid the groundwork for e-commerce resilience during the invasion.

The growing consumer base presented unique opportunities, drawing the attention of global e-commerce platforms.

Subscribe to MarketMaze+ to read the rest.

🔐 Dominate the Maze: For the price of a coffee, go ad-free, access exclusive research & shape MarketMaze’s future. Cancel anytime

🌀 Unlock MarketMaze+A subscription gets you:

- 🚫 Ad-Free Access: Pure insights without distractions.

- 📖 Exclusive Research: Deep dives into companies, countries & trends.

- 📈 Growing Resources: New tools added every week.

- 📊 Priority Input: Influence upcoming research topics.

- 💪 Support the Mission: Power MarketMaze’s growth.