TODAY’S MAZE

Happy Monday! Germany’s eCommerce engine just shifted back into gear. After three slow years, online sales are growing again… but the winners are bigger, faster, and fewer. Temu and Shein are storming Europe’s top charts, reshaping what “value” means for consumers. Local giants like Rewe and Otto are fighting back, but the gravity has clearly moved east.

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

🌀 MAZE STORY

German Power Reset 💶

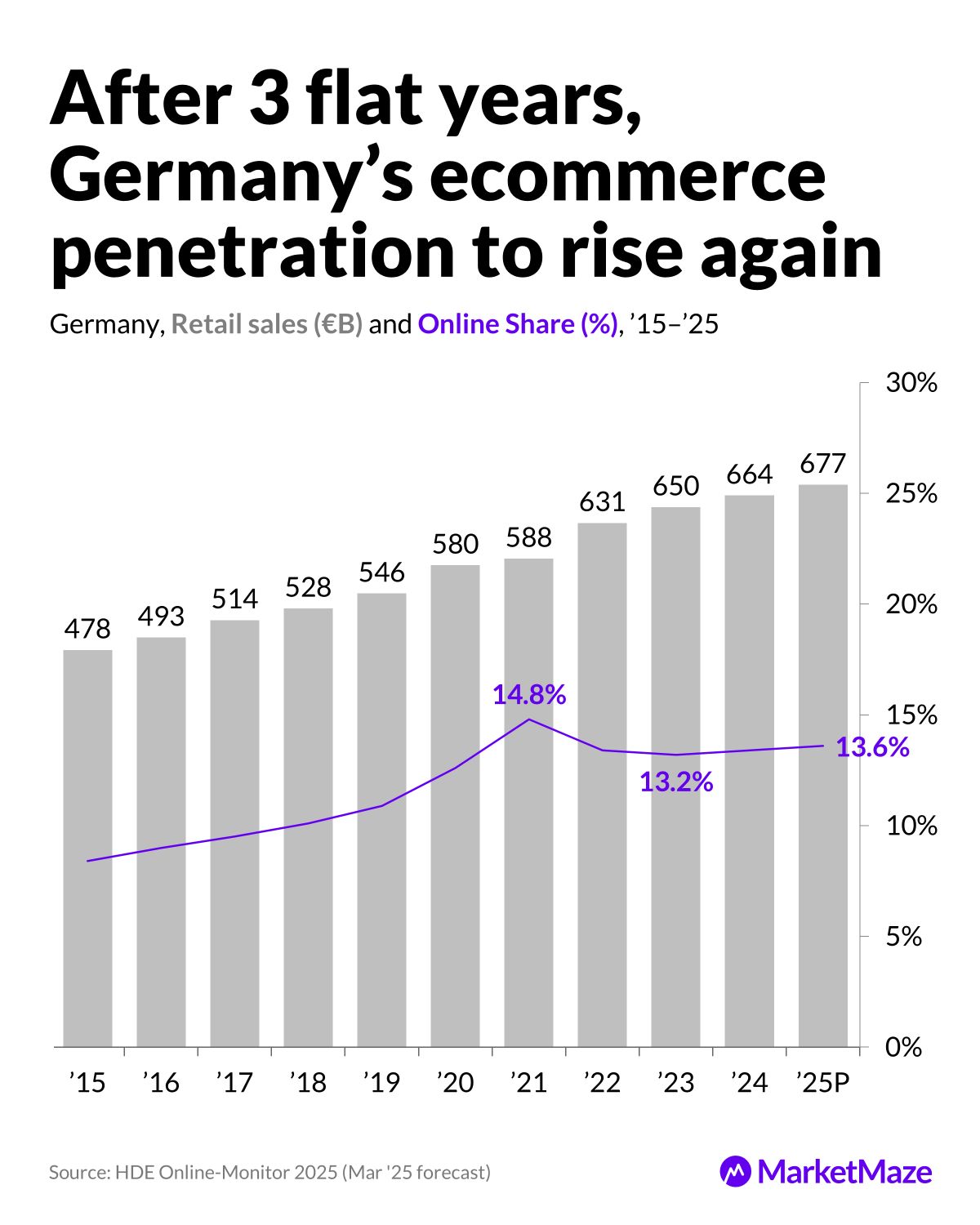

German retail is rebooting. After three flat years, eCommerce is finally climbing again. Online sales hit €80.4B in 2024, up 3.8% year over year, led by the top 10 shops grabbing nearly 39% of the market. The rest are crawling. Total retail will reach €677B in 2025, with online share rising to 13.6%. The lesson is blunt: scale wins, small stalls. As we noted before, growth now rewards operational muscle, not just reach or hype.

Penetration Up 📈

Germany’s online share is inching back to life. After peaking at 14.8% in 2021, it fell to 13.2% in 2023 and now edges back up. Inflation cooled demand, but digital shopping has become habit. This is not a rebound driven by novelty—it’s efficiency. A mature base growing through necessity, not excitement. For investors, this is steady compounding on a large denominator. Treat it as foundation, not fireworks.

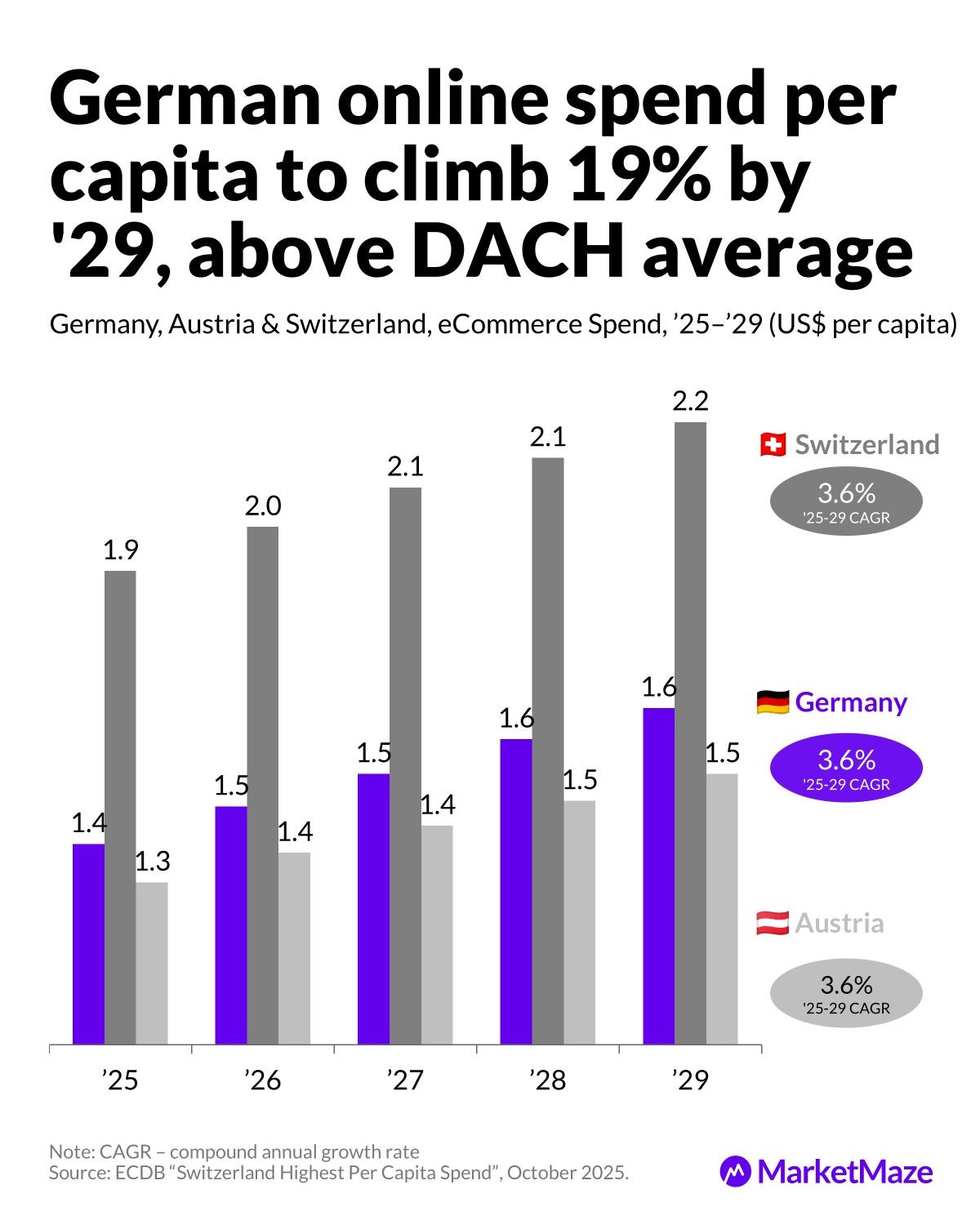

DACH Wallets 💳

Per capita spending across the DACH region shows Germany leading in growth but not wealth. By 2029, Germans will spend $1.65K per person online, up 19% from 2025. Switzerland tops the region with $2.2K, while Austria trails at $1.5K. Germany’s strength lies in volume, not affluence. The opportunity is in cross-border differentiation—target Swiss margins with German scale and Austrian precision. That is how to win regionally.

Where It Converts 🧲

Only electronics and fashion cross 40% online penetration. Office and hobby follow in the 30s, while home, wellness, and DIY lag behind. FMCG grows fastest but remains a niche. The insight: digital Germany is no longer about browsing, it’s about repeat behavior. The high-frequency categories define loyalty, not luxury. The next phase belongs to retailers who can turn routine orders into recurring revenue.

Cross-Border Heat 🌍

Foreign sellers now control 10% of German online spend, about €8.9B. Temu leads this surge, reaching 44% of all cross-border shoppers, followed by Shein at 26% and AliExpress at 20%. Price transparency and logistics efficiency have flattened borders. Local retailers still win traffic but lose checkouts. Competing now means faster delivery, localized pricing, and a smarter returns playbook. If you can’t beat China on price, beat them on time.

Editable Slides & Sources:

🔒 Available for MarketMaze+

📣FROM OUR PARTNERS

Make Every Platform Work for Your Ads

You’re running an ad.

The same ad. On different platforms. Getting totally different results.

That’s not random: it’s the platform effect.

So stop guessing what works. Understand the bit-sized science behind it.

Join Neuroscientist & Neurons CEO Dr. Thomas Ramsøy for a free on-demand session on how to optimize ads for different platforms.

Register & watch it whenever it fits you.

🌀 MAZE STORY

New Gravity 🛒

The German eCommerce hierarchy is being rewritten. Two new entrants—Shein and Rewe crashed the top 10 in 2024, while Temu rocketed into the top five marketplaces. The shift signals a deeper change in what German consumers value: immediacy, affordability, and discovery. This is not a side story… it’s the new center of gravity for European retail. We tracked this China-driven pressure before, and now it’s visible in every leaderboard.

Store Shake-up 🧱

Amazon remains dominant at €15B, but growth comes from the edges. Otto (€4.4B), Zalando (€2.6B), and MediaMarkt (€2.1B) are steady, while Rewe and Shein explode into relevance. Rewe jumped 33.5% on online groceries and click-and-collect. Shein entered with €1.1B in fast-fashion sales powered by social reach. Shop Apotheke climbed 29.1% as digital prescriptions went mainstream. The new German top 10 is a mix of old efficiency and new algorithms.

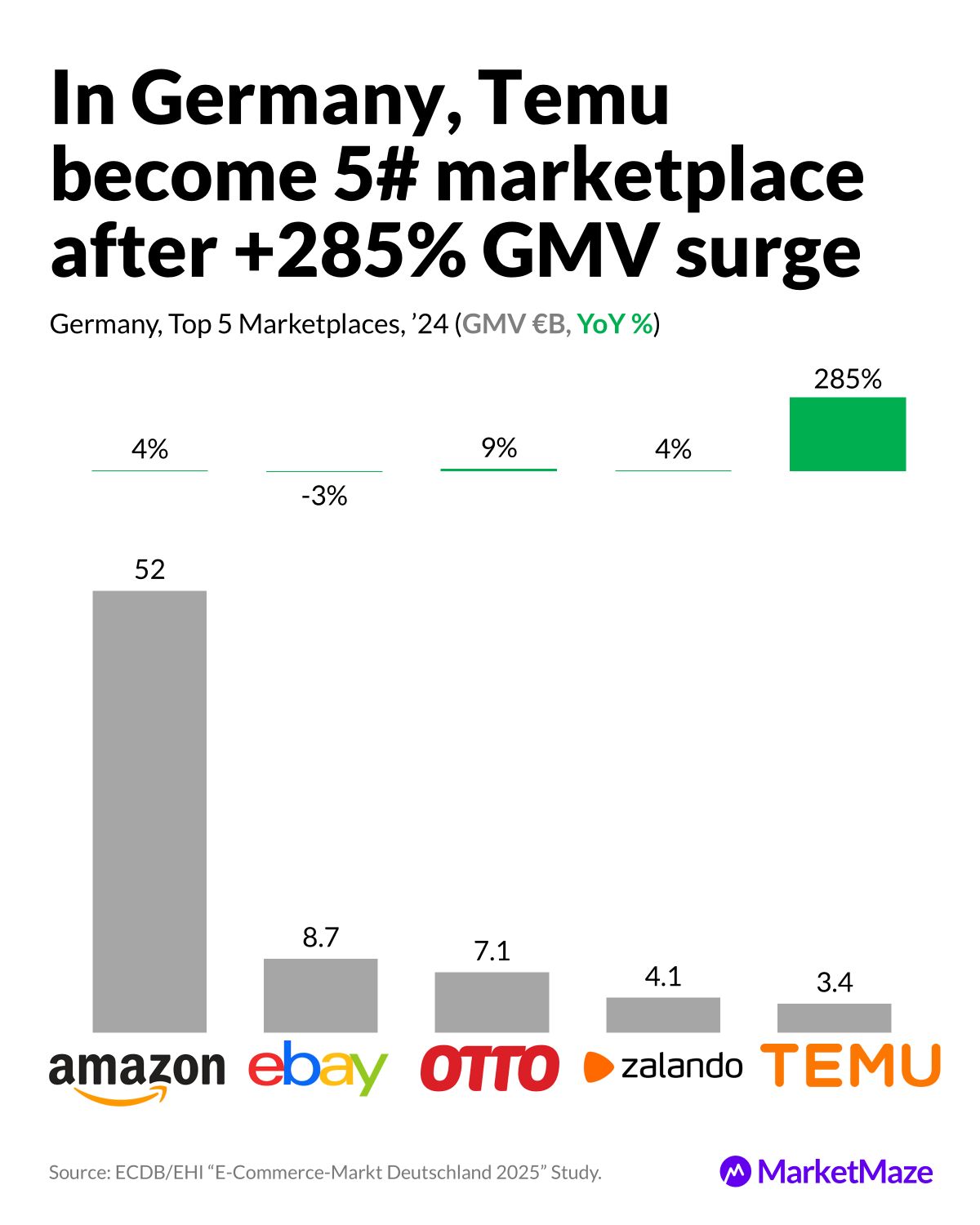

Temu’s Jump 🚀

Temu’s 285% surge to €3.4B GMV made it Germany’s fifth-largest marketplace in 2024. It trails only Amazon (€52B), eBay (€8.7B), Otto (€7.1B), and Zalando (€4.1B). Its success rests on endless SKUs, gamified shopping, and relentless pricing. This is not an app—it’s a behavioral machine. Local incumbents can’t outspend it, so they must outoperate it. Speed, trust, and inventory localization are the new weapons.

Marketplace Power ⚡

Marketplaces now drive 45% of Germany’s eCommerce—among the highest in Europe. Austria and Italy share the same dominance, while Spain and the UK follow near 40%. France and the Netherlands lag at 32%. The takeaway: the European shopper trusts ecosystems more than individual brands. For sellers, this is not about choice—it’s about survival. Build presence where the baskets are built.

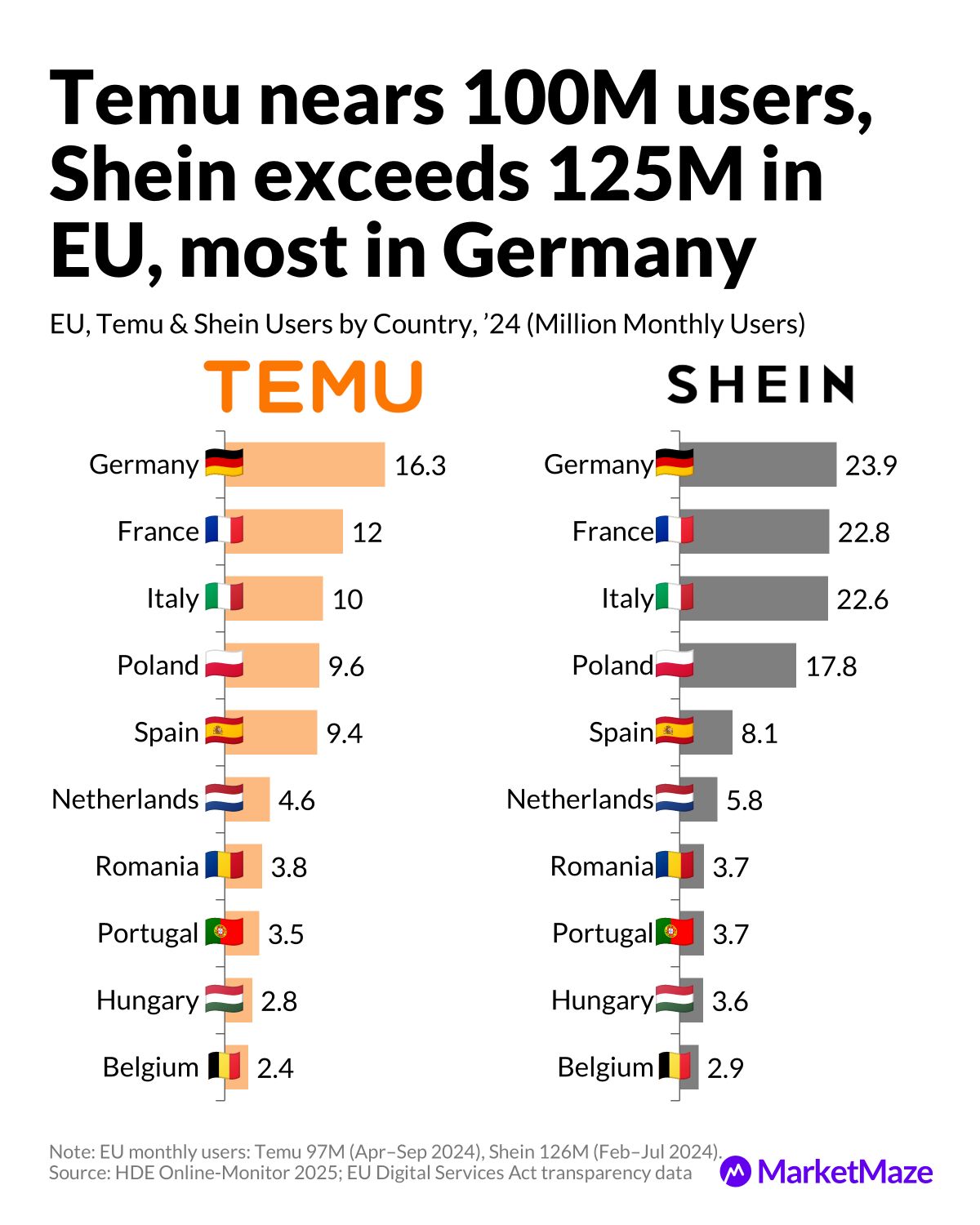

Asian Giants 🌍

Temu and Shein have reshaped Europe’s shopping habits. In 2024, Temu had 97M monthly users across the EU, while Shein surpassed 125M. Germany led in both, with 16M on Temu and 24M on Shein, followed by France and Italy. Together, they’ve turned Chinese apps into European household names.

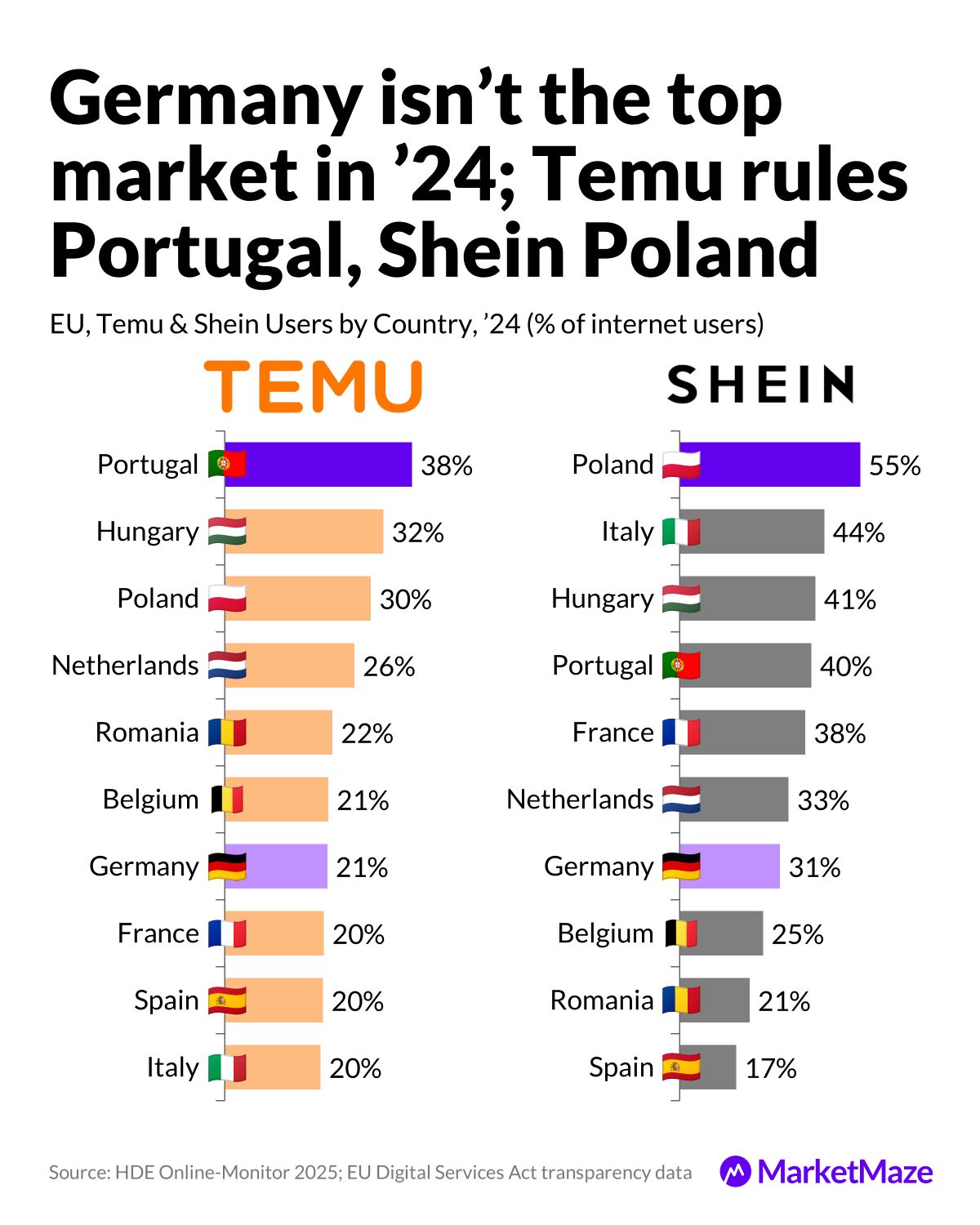

Users in Motion 📱

Germany seems to lead in total users but not penetration. Temu rules Portugal with 38% of internet users, while Shein reigns in Poland at 55%. Germany’s shares—21% for Temu and 31% for Shein—reflect scale, not saturation. Southern and Eastern Europe drive the excitement, Western Europe drives the volume. Smart marketers will chase both: go east for growth, go Germany for profit. The future of retail belongs to whoever balances the two.

Editable Slides & Sources:

🔒 Available for MarketMaze+

📣FROM OUR PARTNERS

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

🧠 RECOMMENDED NEWSLETTERS

Craving more sharp reads? Check out these MarketMaze-recommended newsletters.

THAT’S IT FOR TODAY

Before you go we’d love to know what you thought of today's maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team