Welcome to MarketMaze, the #1 newsletter for staying on top of the latest in Ecommerce & Marketplaces.

TODAY’S MAZE

Welcome to MarketMaze, where we break through the noise and make sense of fashion’s post-pandemic hangover. This week, we’re charting the real winners and losers as e-commerce returns to earth, luxury stumbles, and sportswear runs laps around the competition. Plus, Gen Z rewrites the rules while Amazon cements its role as America’s fitting room.

Insights🧠

🌀 Fashion’s Digital Sugar Rush is Over 🏁

🎢 Online Fashion’s Wild Ride: Growth Then Collapse

💸 Luxury Marketplaces: From Hype to Hurt

🤑 The Rich Got Richer, Then Growth Stalled

🏃♂️ Sportswear: The Only Sure Bet for 2024-2029

🛒 Gen Z Shops, Amazon Wins, Returns Hurt

📦 Returns gut profits—sizing is the silent killer

Outside the Maze👀

🛒 Zara.com Pulls Ahead with 12.6M Shoppers in 2024

🚀 Zalando Breaks Records: 52.9M Customers & 7% Growth

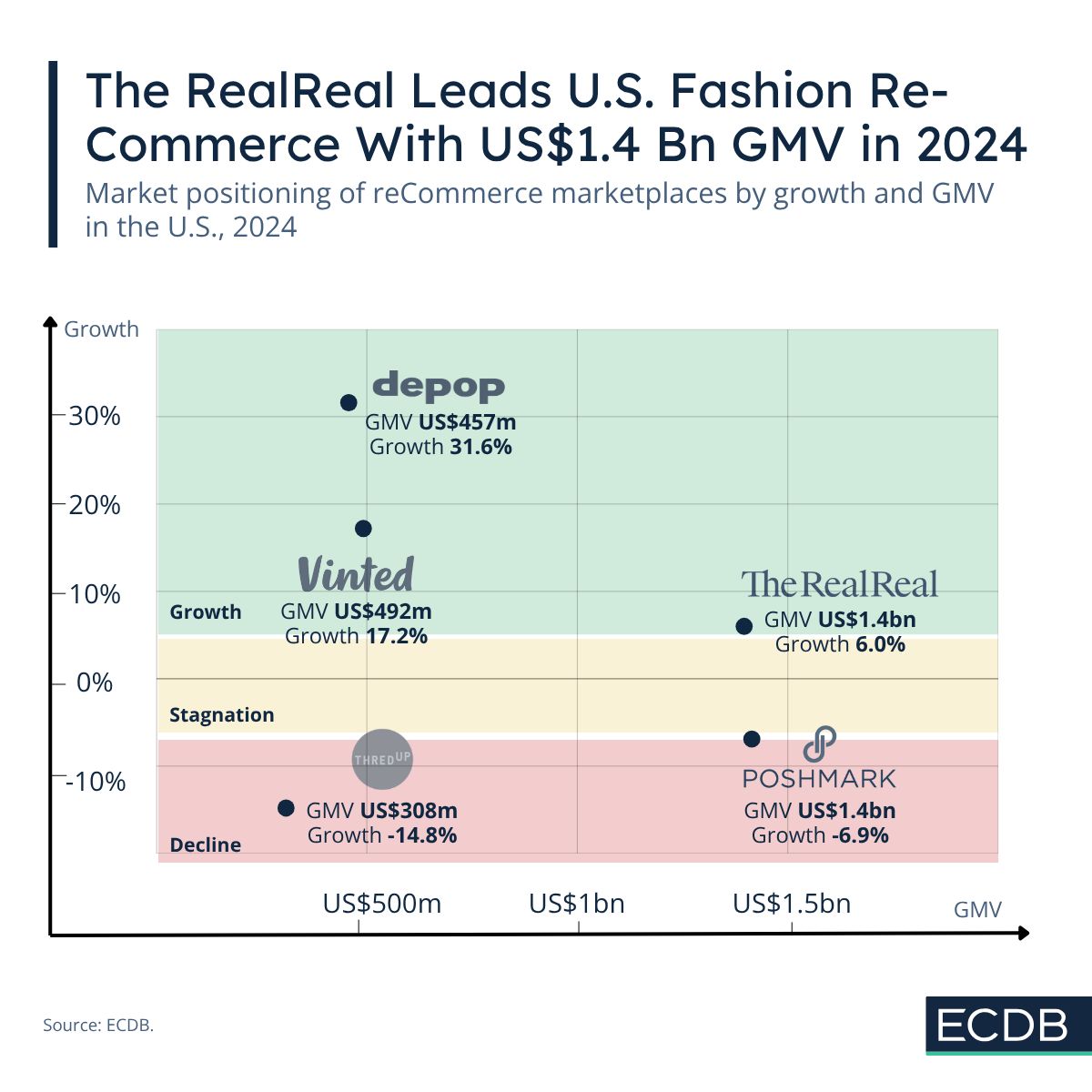

🔄 US ReCommerce: Depop Rockets, Vinted Up, Poshmark Sinks

👖 Casual beats coats: Comfort wins the cart

👾 Gen Z turns online shopping into a weekly routine

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

🌀 Maze Story

Fashion’s Digital Sugar Rush is Over 🏁

The pandemic sent fashion e-commerce into orbit, but gravity has returned. MarketMaze’s analysis of Euromonitor data and industry charts reveals an industry moving from chaos to a new, slower normal. From sportswear’s runaway growth to luxury’s sudden crash, here’s how fashion’s winners and losers are being reshuffled.

Online Fashion’s Wild Ride: Growth Then Collapse 🎢

During the pandemic, online fashion sales exploded. Global e-commerce growth peaked above 25%, while Germany’s e-com market hit a high of 15%. But that rocket ride didn’t last—by 2023, growth for both global and German fashion e-commerce had sunk to just 3–5%, barely above sluggish offline retail. The digital gold rush was a one-off: COVID’s shock forced adoption, but post-pandemic, most shoppers went back to old habits. Physical retail never bounced back, leaving the whole sector with lower highs and stickier lows. The promise of endless double-digit growth for e-commerce has evaporated.

Luxury Marketplaces: From Hype to Hurt 💸

Luxury e-commerce platforms surfed the COVID wave straight into the stratosphere—Farfetch soared over 70% in 2020, Net-a-Porter hit 51%, and Matchesfashion briefly looked unstoppable. The crash was just as spectacular. As stores reopened and inflation bit into spending, growth for the leaders cratered. Matchesfashion tumbled from 38% growth in 2017 to -18% by 2023, a near-total reversal. Investors got burned, big valuations evaporated, and platforms scrambled to survive. The luxury gold rush exposed just how brittle these models were once physical stores and cost-of-living reality returned.

The Rich Got Richer, Then Growth Stalled 🤑

Post-pandemic, the number of wealthy adults—ultra-high-net-worth and high-net-worth alike—skyrocketed worldwide. Growth for these segments hit double digits in 2021 as stock markets rebounded and asset prices soared. But the party didn’t last. By 2023, annual growth for UHNWIs, HNWIs, and affluent adults slid back to a sluggish 5–7%. Luxury’s hope for an endless parade of new rich buyers faded as quickly as the stimulus checks. The top of the pyramid is still growing, but not enough to save every struggling luxury marketplace.

Sportswear: The Only Sure Bet for 2024-2029 🏃♂️

Forget catwalks—running shoes and hoodies are now the real growth engines. Sportswear is projected to leap 14.9% globally from 2024 to 2029, outpacing every other apparel and footwear category by a mile. Outerwear, womenswear, and menswear will limp along below 4% growth, while footwear edges ahead at 5.9%. This isn’t just a trend—it’s a rewiring of what we wear, with casualisation and wellness dominating global style. Any brand clinging to the old rules is about to get lapped.

Sources: 🔒 Available for MarketMaze+ subscribers

From our partners

The credit card experts have spoken

And you’ll wanna hear what they’re saying about this top-rated cash-back card.

The analysts at Motley Fool Money unlocked the secret to a one-card wallet, thanks to an unmatched suite of rewards and benefits that potentially give this card the highest cash-back potential they’ve seen.

The details:

up to 5% cash back at places you actually shop

no interest until nearly 2027 on purchases and balance transfers

A lucrative sign-up bonus

no annual fee

💎 Data Treasure

Gen Z Fashion in US🛒

Online fashion has gone mainstream—almost 1 in 3 Americans now shop for clothes online every week, and Gen Z is leading the stampede. These insights come straight from Podean’s 2025 US Apparel Consumer Behavior Survey, which tracked how, where, and why Americans are buying, discovering, and returning apparel online. The study surveyed 1,000 US consumers to pinpoint what’s hot, what’s not, and what’s breaking brands’ bottom lines.

Gen Z turns online shopping into a weekly routine 👾

Nearly a third of US consumers shop for apparel online weekly, but among Gen Z, that number jumps to 59%. Even more shocking, 16% of Gen Z shop online for clothes every single day, with women aged 18–24 the most devoted—1 in 4 are daily shoppers. If you think online fashion is a niche channel, think again: for the next generation, it’s just shopping. Retailers not tuned into Gen Z’s buying power and relentless digital habits are already irrelevant.

Casual beats coats: Comfort wins the cart 👖

Americans want comfort, not couture. Jeans, t-shirts, and sweaters top the list, with 84% saying casualwear is their online go-to. Sneakers and boots (63%) and activewear (53%) dominate as well, while sleepwear and accessories land around 40%. But outerwear barely makes a dent at 31%. The takeaway? Unless your product is cozy, easy, and fits the work-from-couch life, it’s probably gathering dust in digital warehouses.

Amazon is America’s fashion scout 🛍️

Brand discovery in 2025 isn’t happening on TikTok or Instagram—it’s on Amazon. Marketplaces drive 64% of new apparel finds, crushing social media (39%) and even Google searches (38%). Friends and family still matter (36%), but celebrity influencers and online communities barely register. Forget the hype: for real-world reach, the algorithm beats the influencer every time.

Returns gut profits—sizing is the silent killer 📦

Returns are the hidden tax of online apparel: 24% of orders get sent back, draining $48B from the sector every year. And 38% of those returns are simply because the fit was wrong. That’s nearly 1 in 10 items bouncing back to the sender just for being the wrong size. Brands that ignore better size guides, real customer photos, and honest descriptions are quietly setting fire to their margins. Online fashion has scale, but until it gets fit right, it’s fighting with one hand tied behind its back.

Sources: 🔒 Available for MarketMaze+ subscribers

From our partners

Stay Ahead of the Market

Markets move fast. Reading this makes you faster.

Every weekday, you’ll get a 5-minute Elite Trade Club newsletter covering the top stories, market-moving headlines, and the hottest stocks — delivered before the opening bell.

Whether you’re a casual trader or serious investor, it’s everything you need to know before making your next move. Join 160k+ other investors who get their market news the smart and simple way.

👀 Outside the Maze

Zara.com Pulls Ahead with 12.6M Shoppers in 2024 🛒

Zara.com keeps breaking records, pulling in 12.6M online buyers in 2024 and clocking $6.6B in revenue—leaving H&M’s $5B in the dust. The average Zara customer made 4.6 purchases last year, holding steady from 2023, showing that while more people are shopping, buying habits haven’t changed much. Bottom line: more shoppers, same frequency, more revenue. 👉 ECDB

Zalando Breaks Records: 52.9M Customers & 7% Growth 🚀

Zalando hits an all-time high with 52.9M active customers, adding 3.1M in a year and pushing Q2 revenue up 7% to €4B+. Adjusted EBIT landed at €186M. The secret sauce? AI-powered discovery, ramped-up B2B fulfillment, and the About You acquisition fueling momentum. Sports category gets a special nod for juicing results. Zalando’s not just coasting—it's gunning for €17–17.6B GMV and €12.1–12.4B revenue in 2025. 👉 LinkedIn

US ReCommerce: Depop Rockets, Vinted Up, Poshmark Sinks 🔄

US re-commerce is a tale of winners and losers. Depop is on fire with $457M GMV and 32% growth, while Vinted logs $492M and jumps 17%. The RealReal stays steady at $1.4B GMV, but Poshmark stumbles, dropping nearly 7%. ThredUp’s pivot to a pure marketplace model isn’t working—GMV fell 15%. Bottom line: Gen Z’s thrift revolution is rewarding the agile and punishing the stale. 👉 ECDB

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress:

That's it for today! Before you go we’d love to know what you thought of today's maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team