TODAY’S MAZE

Happy Wednesday! Last time we showed that Europe is split between Parcel lockers and pickup points. This time we show that Europe’s parcel wars are heating up…. and that InPost is building the continent’s largest locker network, turning convenience into a billion-parcel advantage.

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

🌀 MAZE STORY

Europe’s Textile Wake-Up Call ♻️

The global textile industry is spiraling toward a waste crisis. According to Boston Consulting Group’s 2025 report Textile Waste at a Tipping Point, global volumes are set to nearly double to 180 million tons by 2035. Europe sits at the heart of the problem and the solution: leading in policy, lagging in execution. The data shows a continent trying to stitch circularity into an industry still built on throwaway habits.

Global Surge 🌍

Textile waste is ballooning as consumption grows 4% yearly. From 102 million tons in 2020 to 180 million by 2035, the world is producing more fabric than it can manage. Europe accounts for just 12% of global waste yet mirrors the same linear model: make, use, dump. The rest of the world’s 160 million tons point to fast fashion and synthetic materials outpacing any circular progress.

Consumer Burden 👕

Europe’s waste problem is overwhelmingly driven by consumers. By 2035, post-consumer textiles will make up 90% of the region’s waste—up from 87% in 2024. Industrial scraps and unsold goods barely move the needle. Households are the main culprits, driven by short-lived fashion cycles and cheap imports. Without large-scale fiber-to-fiber recycling, Europe will keep throwing away value with every worn-out T-shirt.

System Breakdown ⚠️

Europe’s textile collectors are collapsing under financial pressure. France’s Le Relais halted collection in 2025, while Germany’s SOEX and Texaid went insolvent. The UK’s Textile Recycling International followed with layoffs and closures. Low resale prices, export bans, and underfunded collection fees have made recycling uneconomical. The result: a continent risking circularity failure before it begins.

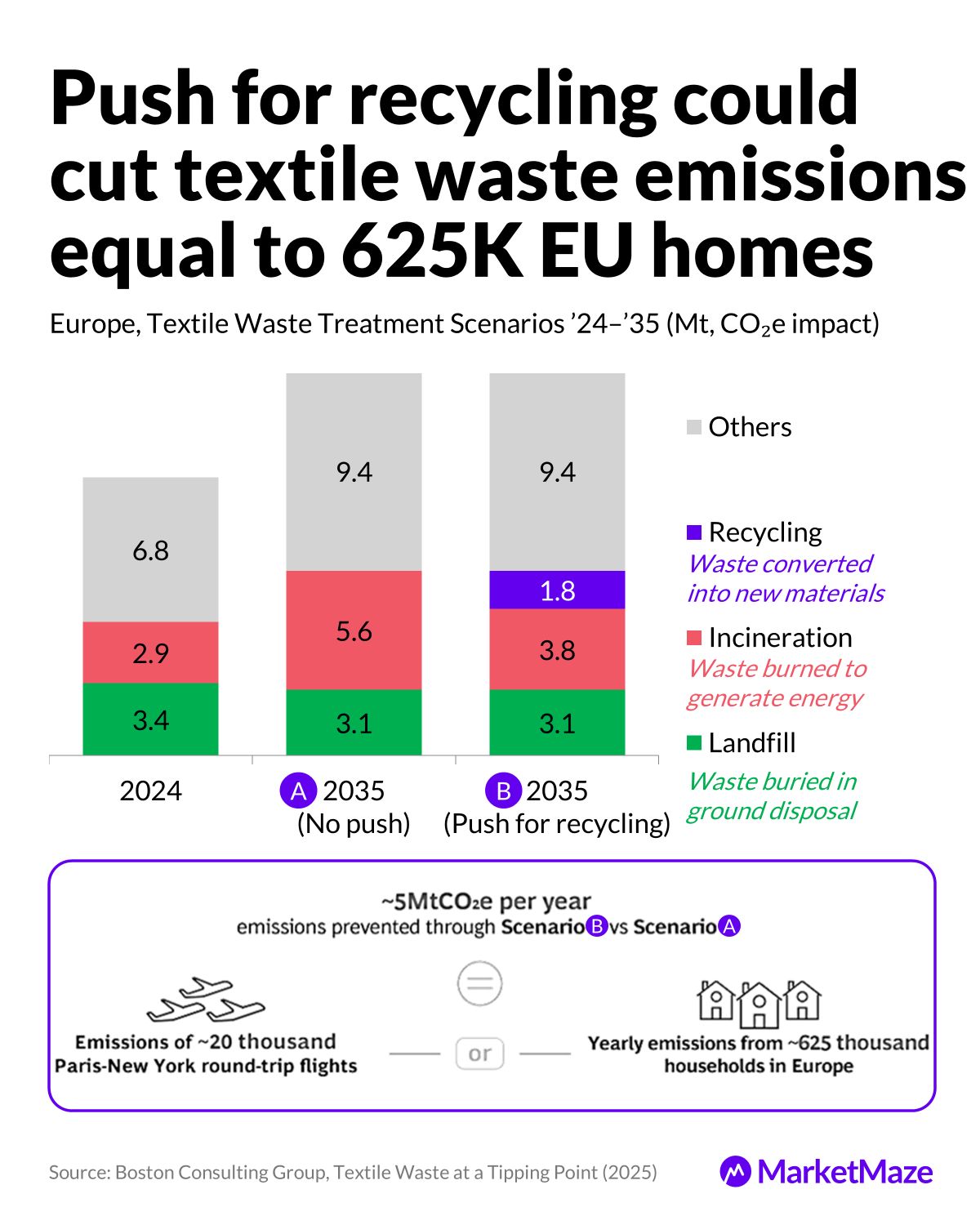

Recycling Fix 🔁

Recycling isn’t just an option… it’s the only viable escape hatch. BCG’s modeling shows that pushing recycling could cut emissions by five million tons of CO₂ a year, the same as 625,000 European homes. Without that shift, most waste heads to incineration, turning a trash problem into a carbon one. Investing in recycling infrastructure could redefine textile waste from liability to economic engine.

Editable Slides & source links:

🔒 Available for MarketMaze+

📣 FROM OUR PARTNERS

Where to Invest $100,000 According to Experts

Investors face a dilemma. Headlines everywhere say tariffs and AI hype are distorting public markets.

Now, the S&P is trading at over 30x earnings—a level historically linked to crashes.

And the Fed is lowering rates, potentially adding fuel to the fire.

Bloomberg asked where experts would personally invest $100,000 for their September edition. One surprising answer? Art.

It’s what billionaires like Bezos, Gates, and the Rockefellers have used to diversify for decades.

Why?

Contemporary art prices have appreciated 11.2% annually on average

…And with one of the lowest correlations to stocks of any major asset class (Masterworks data, 1995-2024).

Ultra-high net worth collectors (>$50M) allocated 25% of their portfolios to art on average. (UBS, 2024)

Thanks to the world’s premiere art investing platform, now anyone can access works by legends like Banksy, Basquiat, and Picasso—without needing millions. Want in? Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

🌀 MAZE STORY

Resale Goes Mainstream ♻️

Secondhand fashion has gone from fringe to front-row. A new BCG and Vestiaire Collective report reveals that resale now makes up more than a quarter of wardrobes worldwide. Fueled by affordability, sustainability, and the thrill of discovery, shoppers are shifting from fast fashion to smart circulation. This isn’t a trend, it’s a structural change reshaping how brands, consumers, and value intersect.

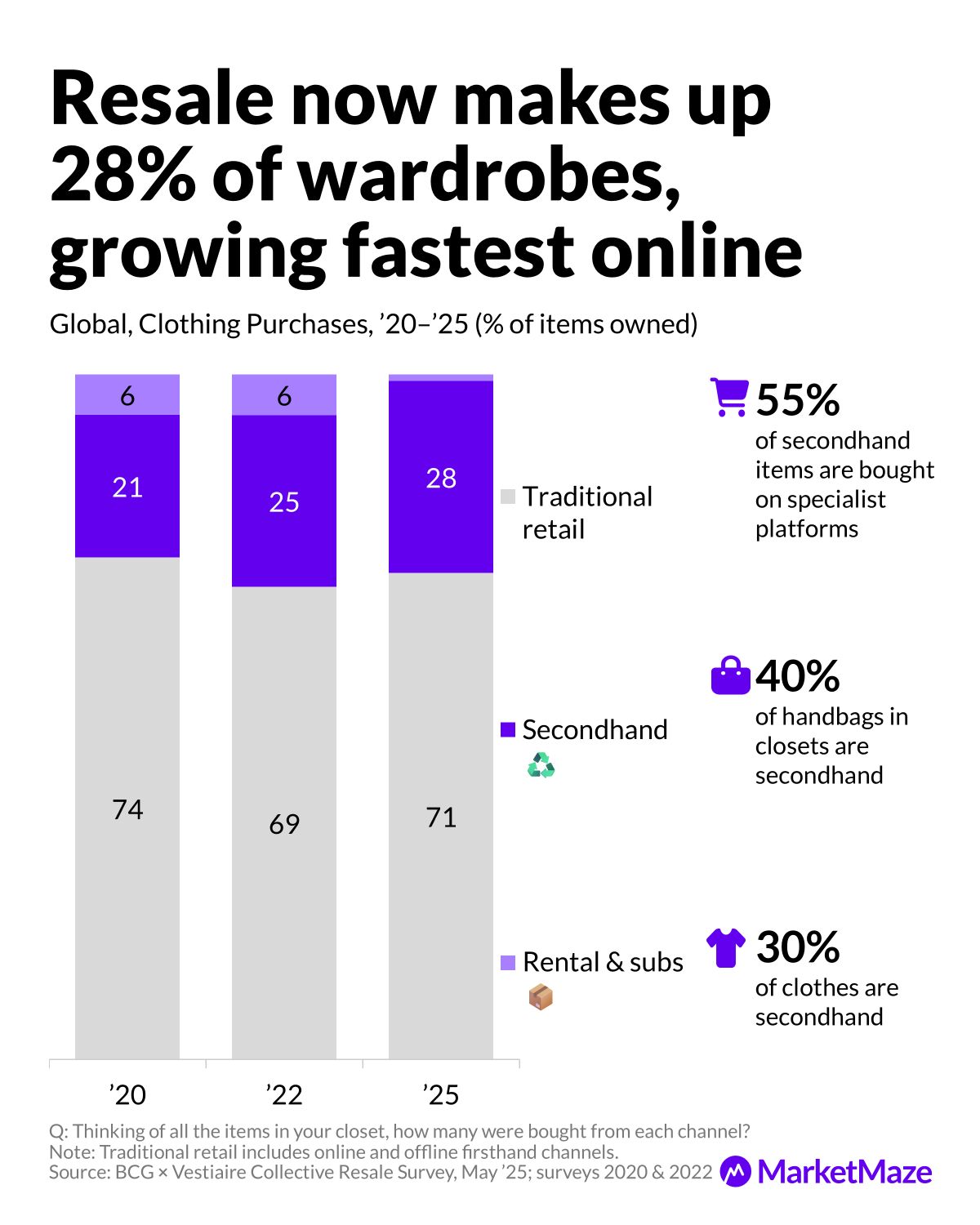

Resale Surge 🌍

By 2025, 28% of wardrobes will be filled with secondhand items, up from 21% in 2020. Traditional retail is losing share, while over half of resale purchases now happen on specialized platforms. Luxury handbags and clothing lead the charge, with 40% of handbags and 30% of apparel already secondhand. Resale is now where style, savings, and sustainability meet—and where new brand loyalties are formed.

Gen Z Shift 👟

No generation is driving resale faster than Gen Z. About one in three Gen Z items is pre-owned, a higher share than any other age group. Nearly 80% discover brands for the first time through resale, proving it’s a key brand gateway. For them, shopping is not just consumption—it’s a hunt. The thrill of finding a rare piece at the right price makes resale feel more expressive than traditional retail ever did.

American Hustle 🇺🇸

Resale is no longer about frugality—it’s about opportunity. 32% of US wardrobes are now secondhand, compared with 27% in Europe. Americans are four times more likely to treat resale as income, and a quarter always factor in resale value before buying new. With two-thirds of US handbags being pre-owned, affordability has become both a lifestyle and a side hustle. The circular economy is becoming entrepreneurial.

Playbook Emerges 📘

Brands are professionalizing resale. Some build owned resale channels, while others partner with platforms or run light-touch pilots like consignment or pop-ups. The next leap comes from digital product passports, which log authenticity and enable one-click resale. These models reduce cost, build trust, and turn circular fashion into a long-term growth strategy rather than a marketing footnote.

Passport to Trust 💼

The next luxury must-have isn’t a bag—it’s a digital product passport. Almost 80% of consumers want one for handbags, followed by clothing and shoes. Authentication and product data top the wish list, helping buyers verify items instantly. For brands, passports create a direct data link between primary and secondary sales. In fashion’s next chapter, trust, traceability, and technology will be the new status symbols.

Editable slides and source links: 🔒 Available for MarketMaze+

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

🧠 RECOMMENDED NEWSLETTERS

Craving more sharp reads? Check out these MarketMaze-recommended newsletters.

THAT’S IT FOR TODAY!

Before you go, we’d love your feedback on today’s Maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team