TODAY’S MAZE

Happy Monday! Europe’s delivery game is splitting down the middle — East builds lockers, West clings to counters. In Italy, GLS dominates checkout real estate while InPost bets on visibility and cost.

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

📣FROM OUR PARTNERS

Wall Street Isn’t Warning You, But This Chart Might

Vanguard just projected public markets may return only 5% annually over the next decade. In a 2024 report, Goldman Sachs forecasted the S&P 500 may return just 3% annually for the same time frame—stats that put current valuations in the 7th percentile of history.

Translation? The gains we’ve seen over the past few years might not continue for quite a while.

Meanwhile, another asset class—almost entirely uncorrelated to the S&P 500 historically—has overall outpaced it for decades (1995-2024), according to Masterworks data.

Masterworks lets everyday investors invest in shares of multimillion-dollar artworks by legends like Banksy, Basquiat, and Picasso.

And they’re not just buying. They’re exiting—with net annualized returns like 17.6%, 17.8%, and 21.5% among their 23 sales.*

Wall Street won’t talk about this. But the wealthy already are. Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

🌀 MAZE STORY

Lockers vs Counters 📦

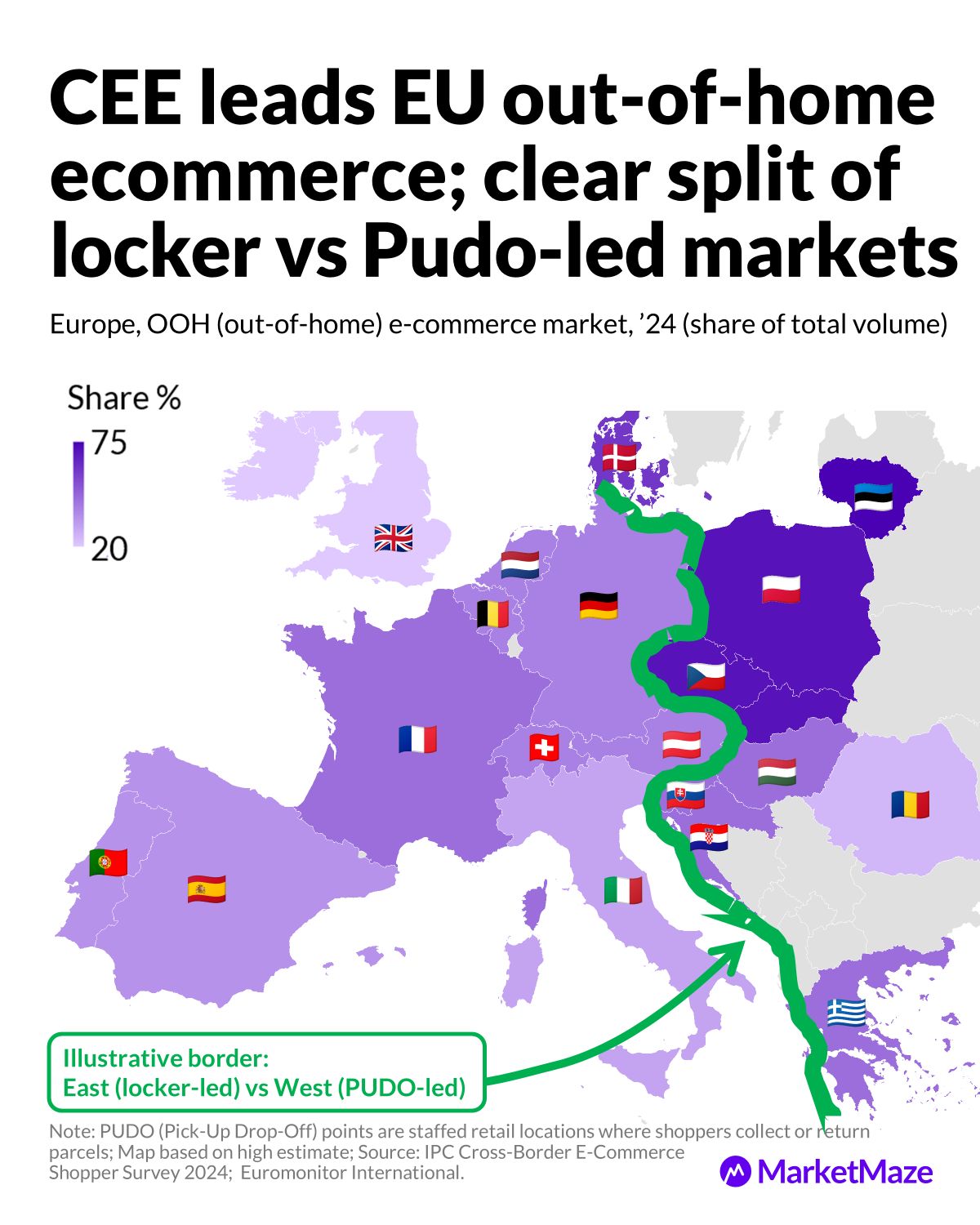

Out-of-home delivery is splitting Europe in two. Eastern countries are racing ahead with parcel lockers, while Western Europe stays tied to staffed pick-up points. The data from IPC’s 2024 and 2025 surveys show a sharp geographic divide shaping how shoppers receive e-commerce orders. The findings highlight a shift driven by cost, habit, and access to physical networks.

East-West Divide 🌍

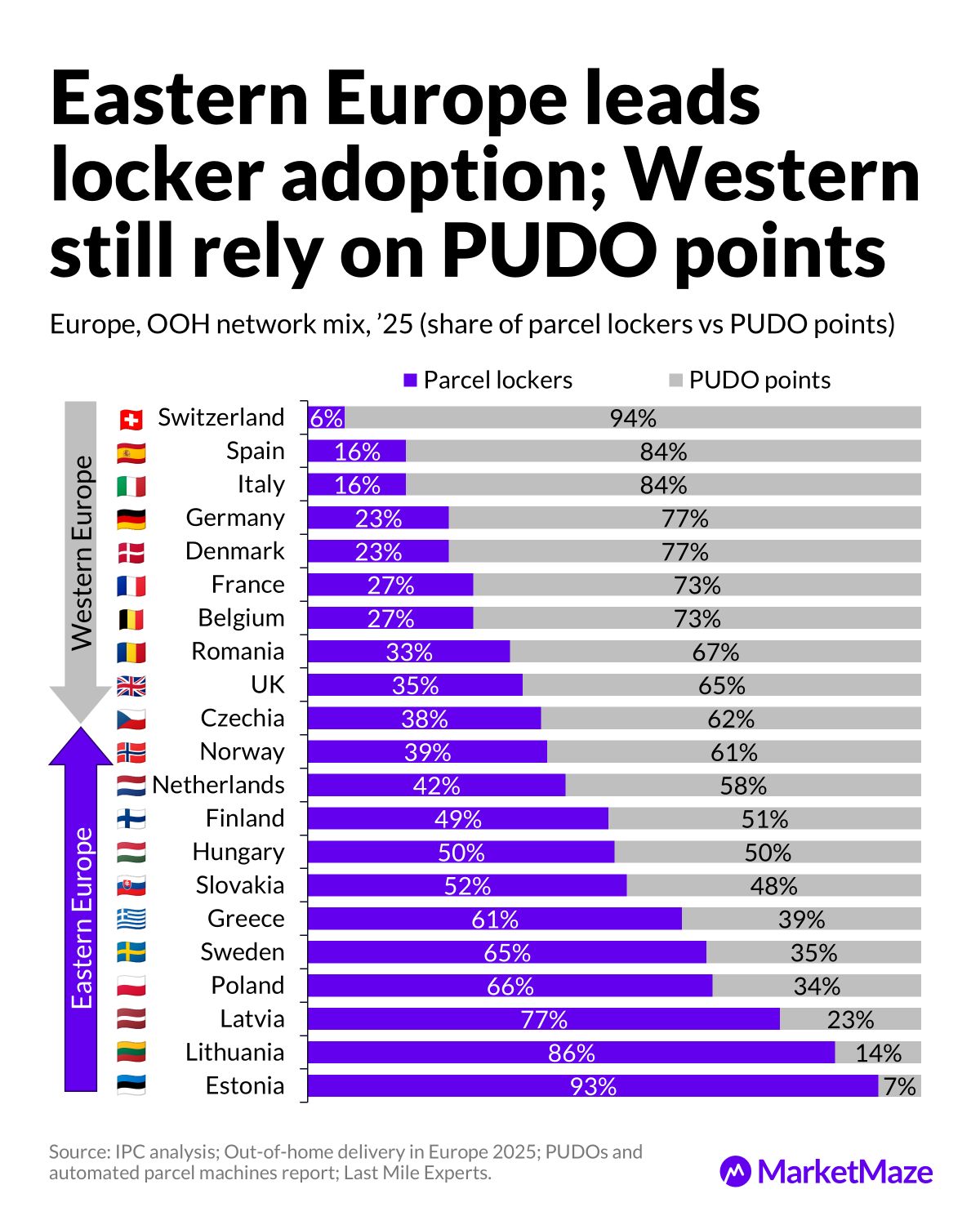

CEE dominates out-of-home delivery, taking a far larger share of e-commerce volume than Western Europe. A clear border runs from the Baltics through Austria to Greece, separating locker-led East from PUDO-led West. Countries like Poland, Lithuania, and Estonia rely heavily on automated networks, while France, Italy, and Spain depend on manned points. The pattern mirrors infrastructure maturity and national operator strategies.

Locker Momentum 🚀

Eastern Europe leads locker expansion. In the Baltics, lockers account for over 75 percent of OOH points, while Poland hits 66 percent. Western Europe remains service-heavy, with over 70 percent of locations still PUDO-based. The divide is structural, not cultural. Countries with early locker investments now see stronger e-commerce integration, faster deliveries, and higher consumer loyalty.

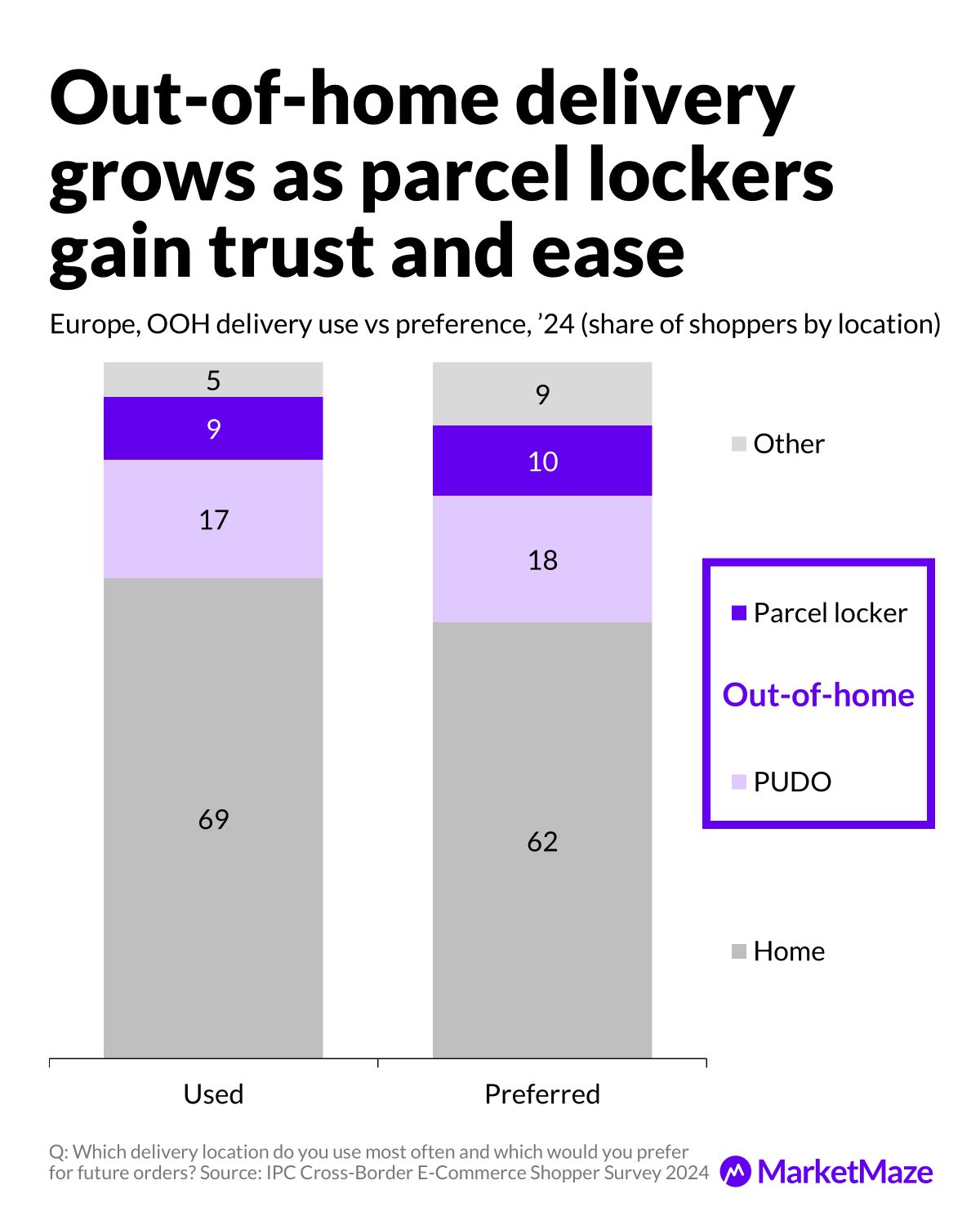

Shopper Behavior 🛍️

Use and preference are converging fast. About 26 percent of Europeans already use lockers or PUDO, but nearly 30 percent prefer them for future deliveries. Younger consumers, urban dwellers, and frequent online buyers are the growth engines. As lockers gain visibility in supermarkets and transport hubs, convenience and 24/7 access are turning out-of-home into a mainstream choice.

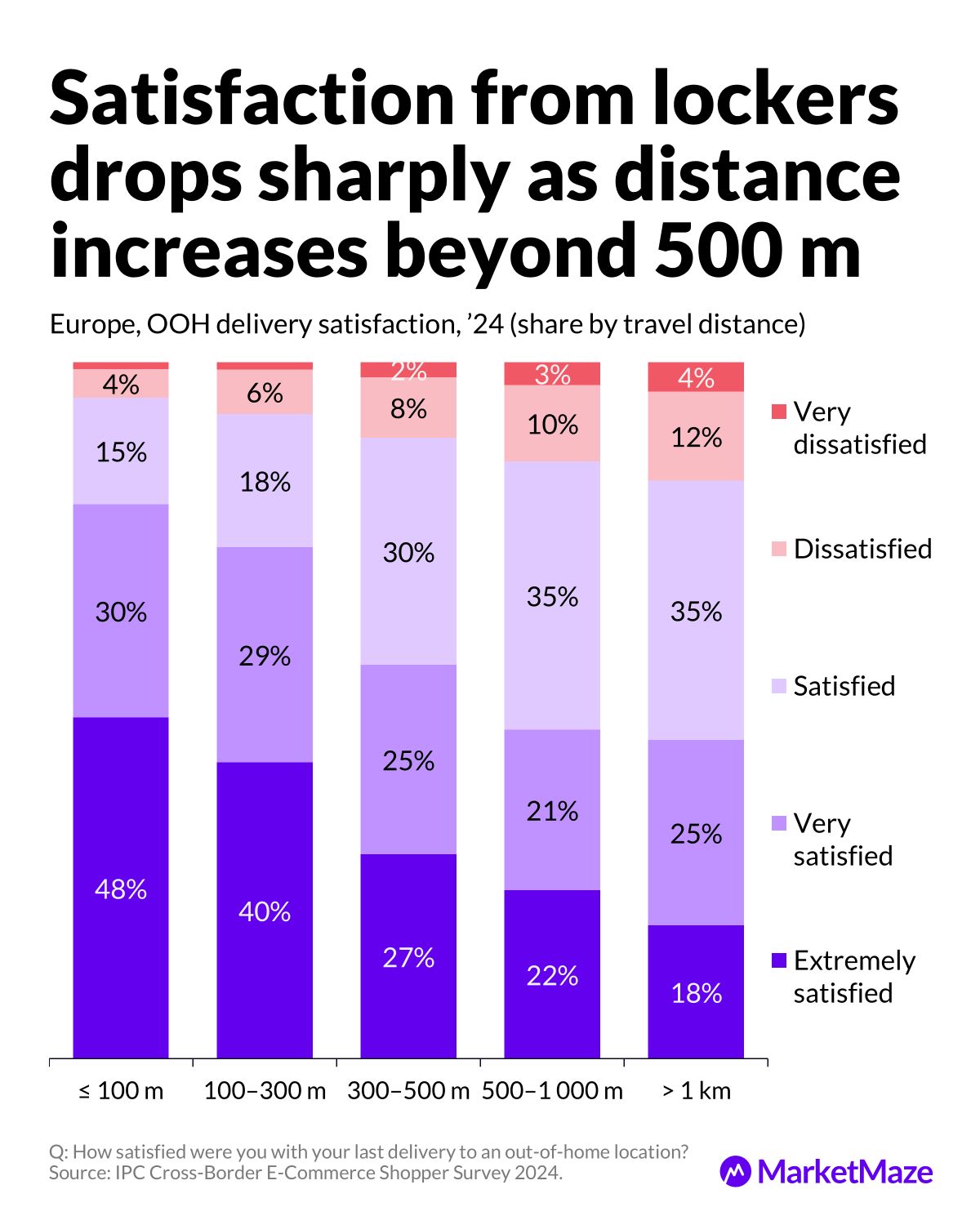

Distance Effect 📏

Satisfaction collapses when lockers are too far. When located within 100 meters, almost half of shoppers report being extremely satisfied. Beyond 500 meters, that drops below 25 percent. Convenience is everything. The data show that physical proximity drives both adoption and repeat use. For carriers, scaling local density may be more important than launching new formats altogether.

Editable Slides & Sources:

🔒 Available for MarketMaze+

📣FROM OUR PARTNERS

Turn AI into Your Income Engine

Ready to transform artificial intelligence from a buzzword into your personal revenue generator?

HubSpot’s groundbreaking guide "200+ AI-Powered Income Ideas" is your gateway to financial innovation in the digital age.

Inside you'll discover:

A curated collection of 200+ profitable opportunities spanning content creation, e-commerce, gaming, and emerging digital markets—each vetted for real-world potential

Step-by-step implementation guides designed for beginners, making AI accessible regardless of your technical background

Cutting-edge strategies aligned with current market trends, ensuring your ventures stay ahead of the curve

Download your guide today and unlock a future where artificial intelligence powers your success. Your next income stream is waiting.

🌀 MAZE STORY

Italy’s Last-Mile Race 🚚

Italy’s delivery market is splitting into two camps. GLS dominates home delivery and checkout control, while InPost is pushing lockers and low-cost options. The 2025 data from Tembi’s “Italy Last-Mile Delivery Market Analysis” reveals how pricing, retailer mix, and exclusivity define carrier power. What’s emerging is a contest between reach, loyalty, and affordability in one of Europe’s fastest-evolving e-commerce arenas.

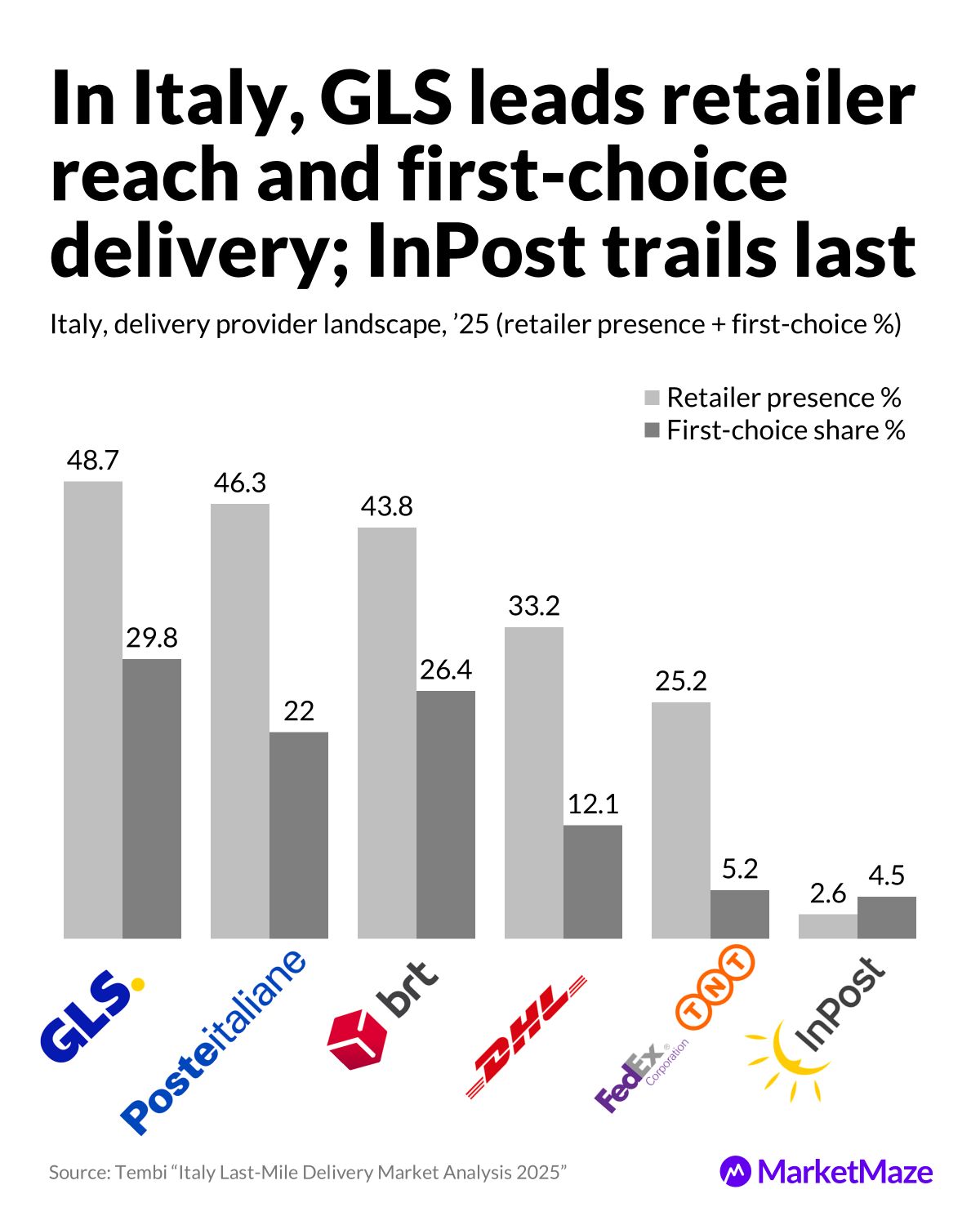

GLS on Top 🥇

GLS holds the broadest retailer footprint in Italy, appearing in nearly half of all checkouts and serving as the first choice in 30 percent. Poste Italiane follows closely with 46 percent visibility but trails in conversion. DPD and DHL occupy the middle, while InPost lags with less than 5 percent retailer presence. GLS’s advantage lies in both coverage and trust, positioning it as Italy’s default carrier in a fragmented delivery ecosystem.

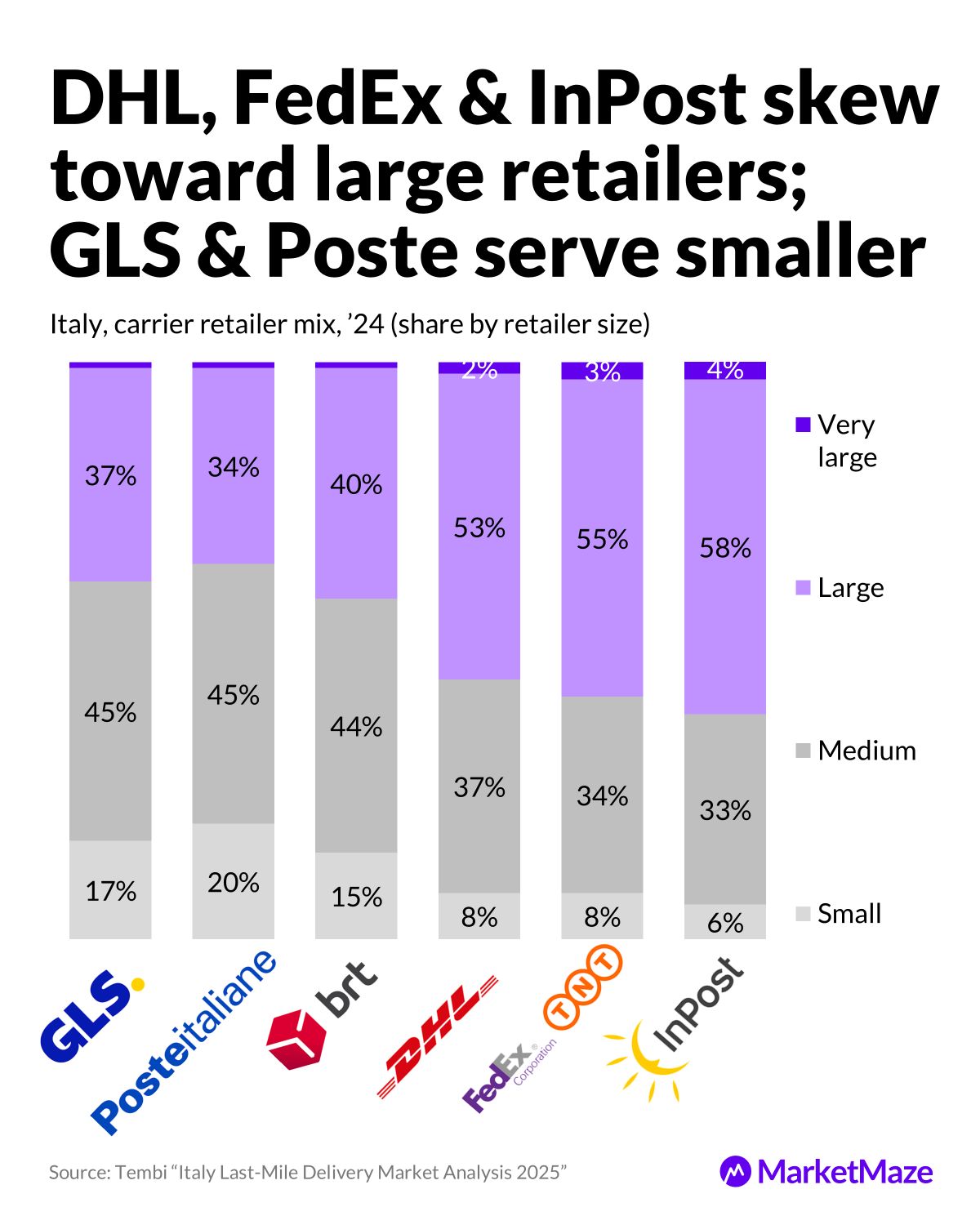

Size Matters 🏢

Carrier portfolios reveal who serves which retailer tier. GLS and Poste Italiane work mostly with small and mid-sized merchants, anchoring their networks in mass coverage. DPD strikes a balance, while DHL, FedEx, and InPost lean heavily toward large and enterprise clients. Over half of InPost’s partners are major retailers, showing how premium scale and automation attract volume. The divide signals diverging strategies: local breadth vs corporate depth.

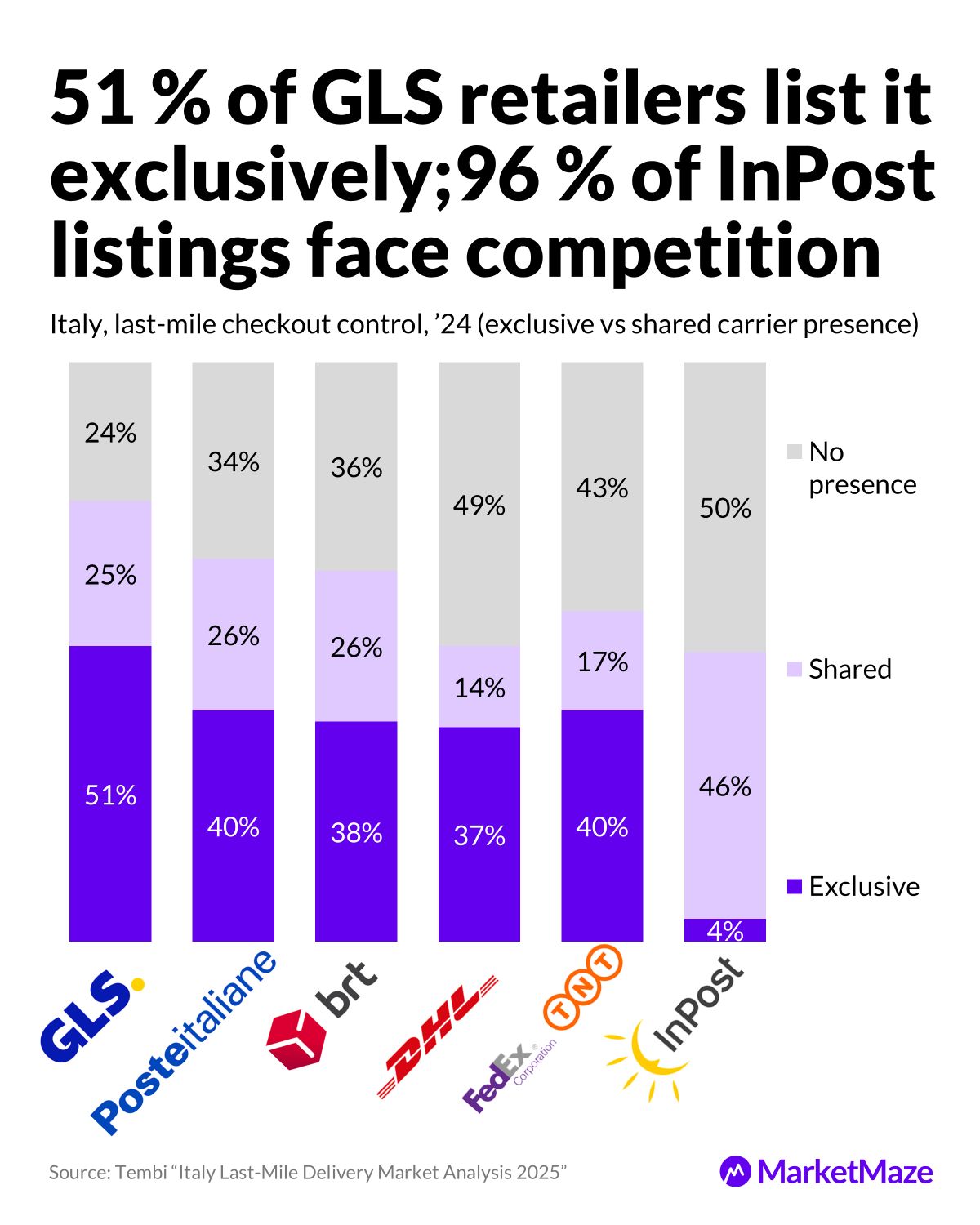

Checkout Power 💳

Control over the checkout defines brand dominance. GLS enjoys exclusivity in 51 percent of its client base and still leads in another quarter where competition exists. InPost’s model is the opposite, competing in 96 percent of cases and rarely being the only choice. That contrast captures two paths to growth: GLS wins through network scale and reliability, InPost through visibility and user experience in shared checkouts.

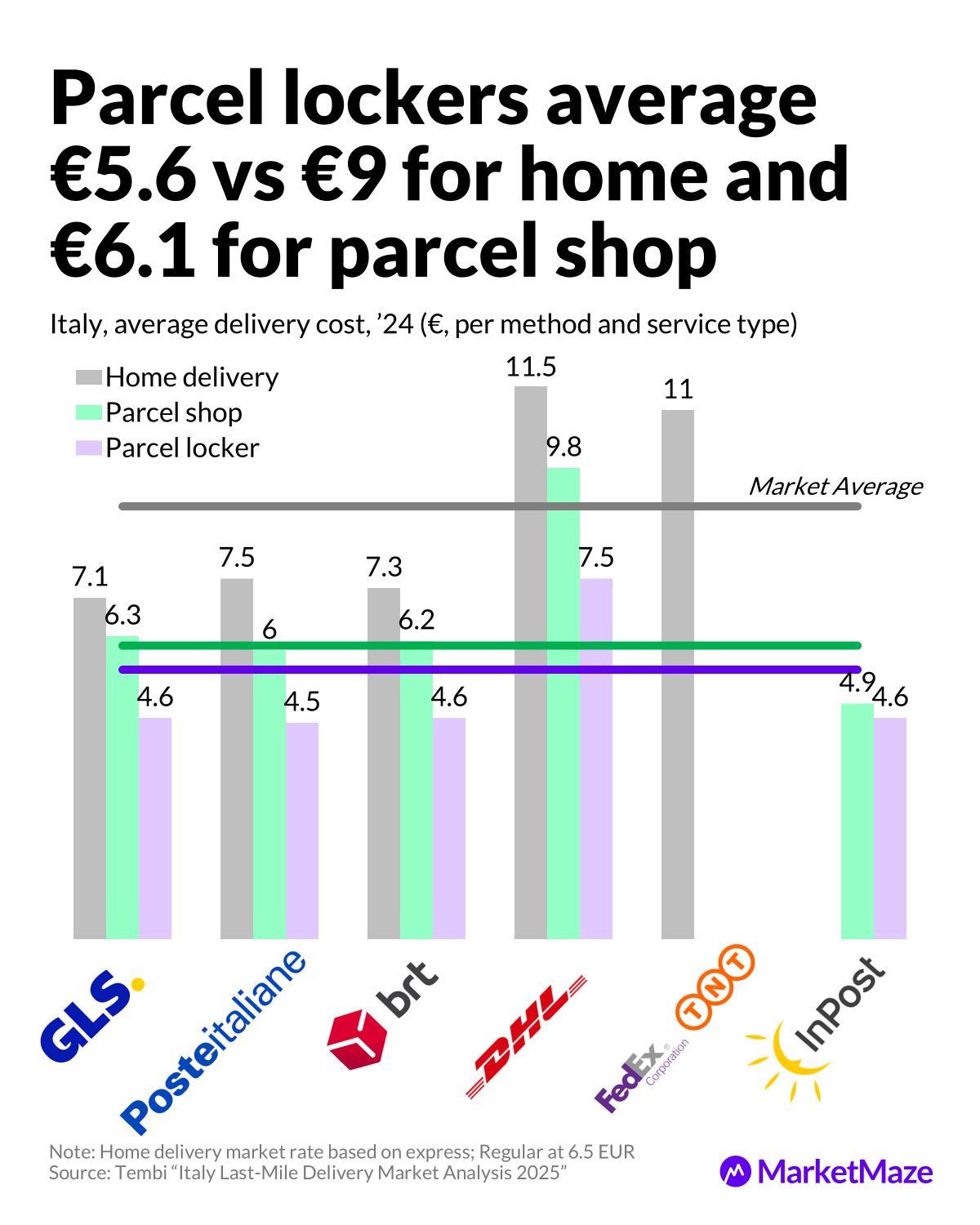

Price Divide 💶

Costs tell the final story. Parcel lockers average €5.6 per shipment, cheaper than home delivery at €6.5 and parcel shops at €6.1. Home express options climb above €9, making OOH models increasingly appealing to both merchants and shoppers. Lower locker costs and better predictability are reshaping Italy’s logistics economics. For carriers, efficiency is no longer optional—it’s the new competitive edge.

Editable Slides & Sources:

🔒 Available for MarketMaze+

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

🧠 RECOMMENDED NEWSLETTERS

Craving more sharp reads? Check out these MarketMaze-recommended newsletters.

THAT’S IT FOR TODAY

Before you go we’d love to know what you thought of today's maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team