TODAY’S MAZE

Etsy is trying to reinvent itself. Once the darling of handmade commerce, it now faces slowing sales, rising costs, and seller fatigue. This week we unpack Etsy’s earnings, global e-commerce rankings, and why Amazon is worth more than countries.

P.S. This is an extra issue this week since I didn’t send it out last week 🥲 Next ones come as before on Tuesday and Thursday

INSIGHTS🧠

🔄 Etsy’s Growth Machine Faces a Reset

📊 Etsy’s Q2’25: Fees Up, Growth Flat

👀 Outside the Maze

🛒 US & China Dominate Online Carts

📈 Vinted Cracks Europe’s Top 10 Rankings

🌍 Amazon Worth More Than Nations

🚀 Eastern Cities Outpace Europe’s Giants

📊 Latin America Tops Ad Spend Growth

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

🌀 Maze Story

Etsy’s Growth Machine Faces a Reset 🔄

Etsy built one of the most distinctive platforms in e-commerce by connecting niche sellers with buyers looking for uniqueness. MarketMaze’s review of Etsy’s Q2 2025 earnings deck highlights how the company’s flywheels, product strategy, and growth levers have evolved—and where momentum has slowed. The data shows both the strength of Etsy’s business model and the cracks emerging after years of rapid expansion.

Marketplace flywheel keeps turning ♻️

Etsy’s marketplace model thrives on network effects: more buyers drive higher gross merchandise sales (GMS), which attracts more sellers, leading to more revenue and reinvestment in the buyer experience. This self-reinforcing cycle has historically fueled Etsy’s growth, creating a differentiated ecosystem of small merchants and loyal customers. However, sustaining the flywheel now depends on deeper engagement and efficiency rather than just scale.

Personalization as the new engine 🤖

Beyond scale, Etsy leans on personalization and AI to create a second flywheel. By capturing richer buyer data, the platform builds more powerful models that enable tailored marketing and more browsable experiences. This generates higher conversion and engagement, reinforcing a loop of better experiences and more spend. In essence, Etsy is betting that smarter, not just bigger, will define its next phase of growth.

Growth momentum stalls 📉

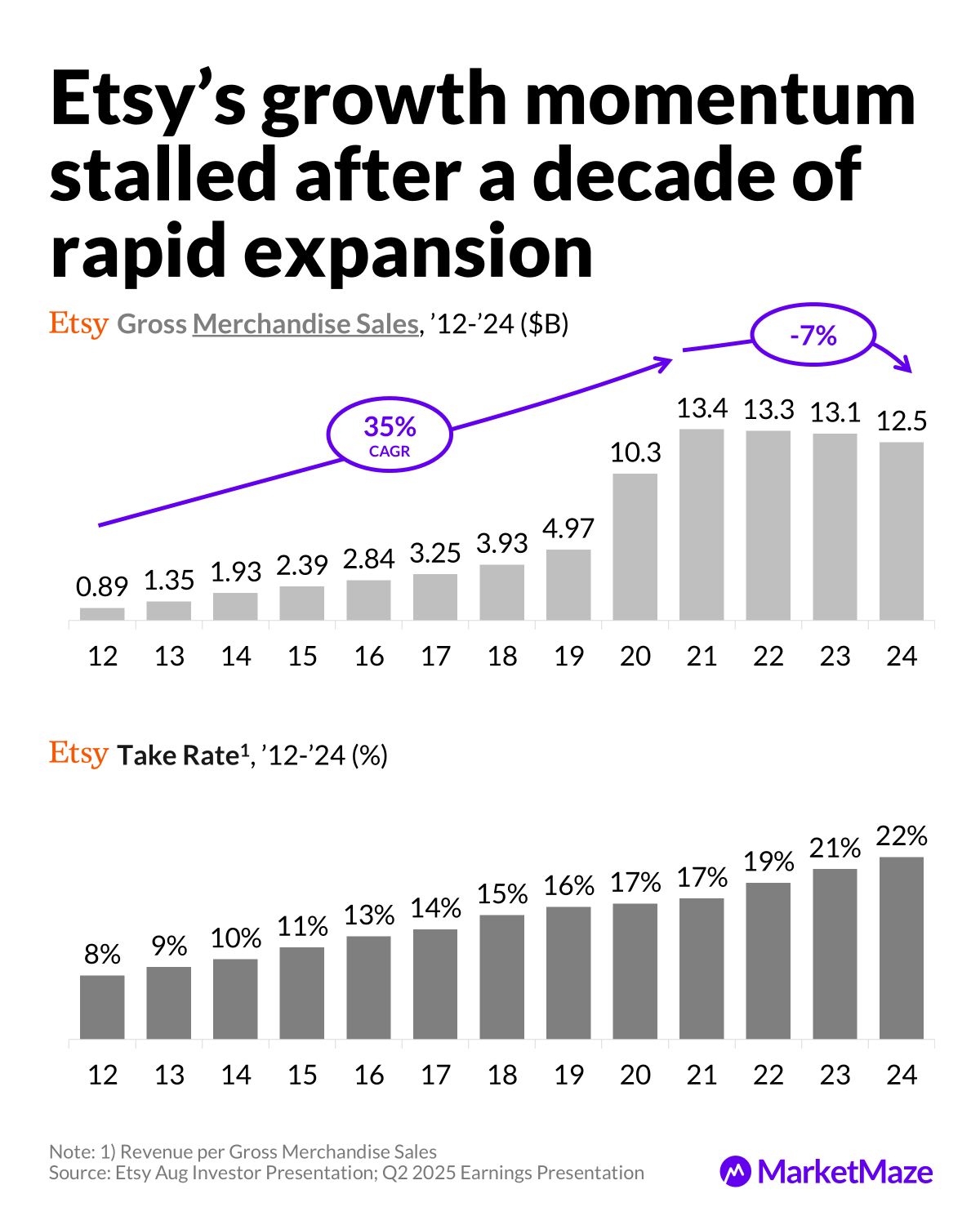

From 2012 to 2020, Etsy delivered a 35% compound annual growth in GMS, peaking at $13.4B. But since then, sales plateaued, slipping to $12.5B in 2024. The post-pandemic normalization hit hard: while offline retail also struggled, Etsy’s digital promise proved less durable than expected. One bright spot is monetization—take rate climbed from 8% in 2012 to 22% in 2024, cushioning revenue despite flat sales.

Sellers dilute productivity 🛠️

Active sellers soared from under 1M in 2012 to over 8M in 2024. But sales per seller dropped 36% from the 2020 peak, falling to just $1.5K annually. This suggests Etsy’s supply growth outpaced demand, making it harder for individual sellers to sustain meaningful income. For the platform, it raises the question of whether sheer seller expansion remains a viable lever or whether Etsy must refocus on boosting seller success.

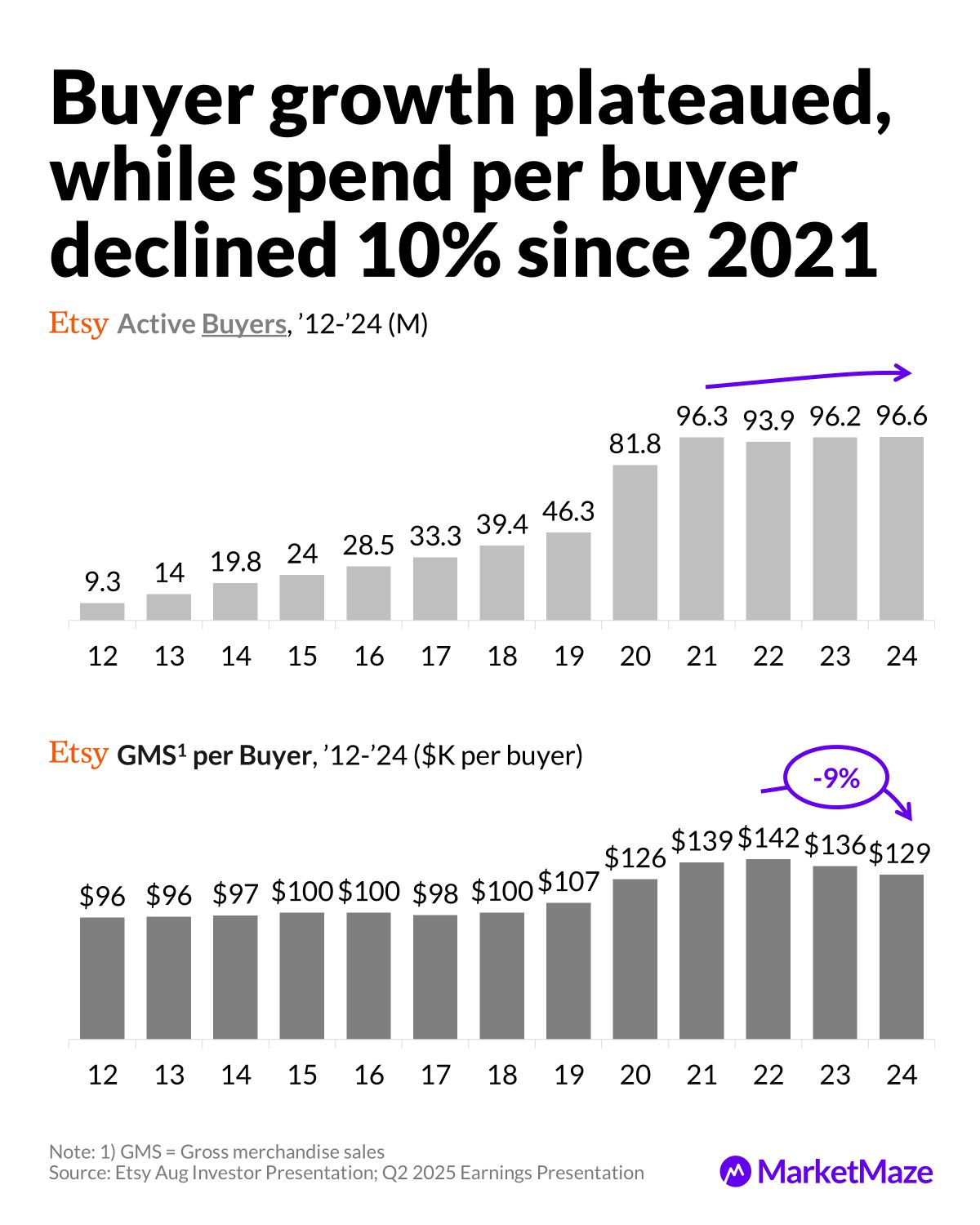

Buyers spend less per head 🛒

Active buyers climbed above 96M, showing Etsy’s broad reach, but spend per buyer has slipped 10% since 2021 to $129. After the pandemic’s surge, engagement normalized, leaving Etsy struggling to lift frequency and basket size. While scale remains impressive, the stagnation in spend signals that Etsy’s growth challenge is now about depth of engagement, not breadth of reach.

Sources: 🔒 Available for MarketMaze+ subscribers

From our partners

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

🌀 Maze Story

Etsy’s Q2’25: Fees Up, Growth Flat 📊

Etsy’s latest earnings presentation shows a platform caught between monetization gains and volume headwinds. MarketMaze reviewed Q2’25 results, with a focus on category performance, take rate, marketing intensity, product development, and growth levers. The numbers reveal both structural risks and untapped headroom in Etsy’s global expansion.

Categories shrink, U.S. drives sales 🇺🇸

In Q2’25, Etsy’s six largest categories contracted, with Home & Living (33%), Jewelry & Accessories (19%), and Apparel (13%) still dominating share. Craft Supplies, Paper & Party, and Toys & Games all remained single-digit contributors. Geography mix showed heavy reliance on the U.S., which accounted for 74% of GMS versus just 26% internationally. This concentration limits resilience if U.S. demand weakens further.

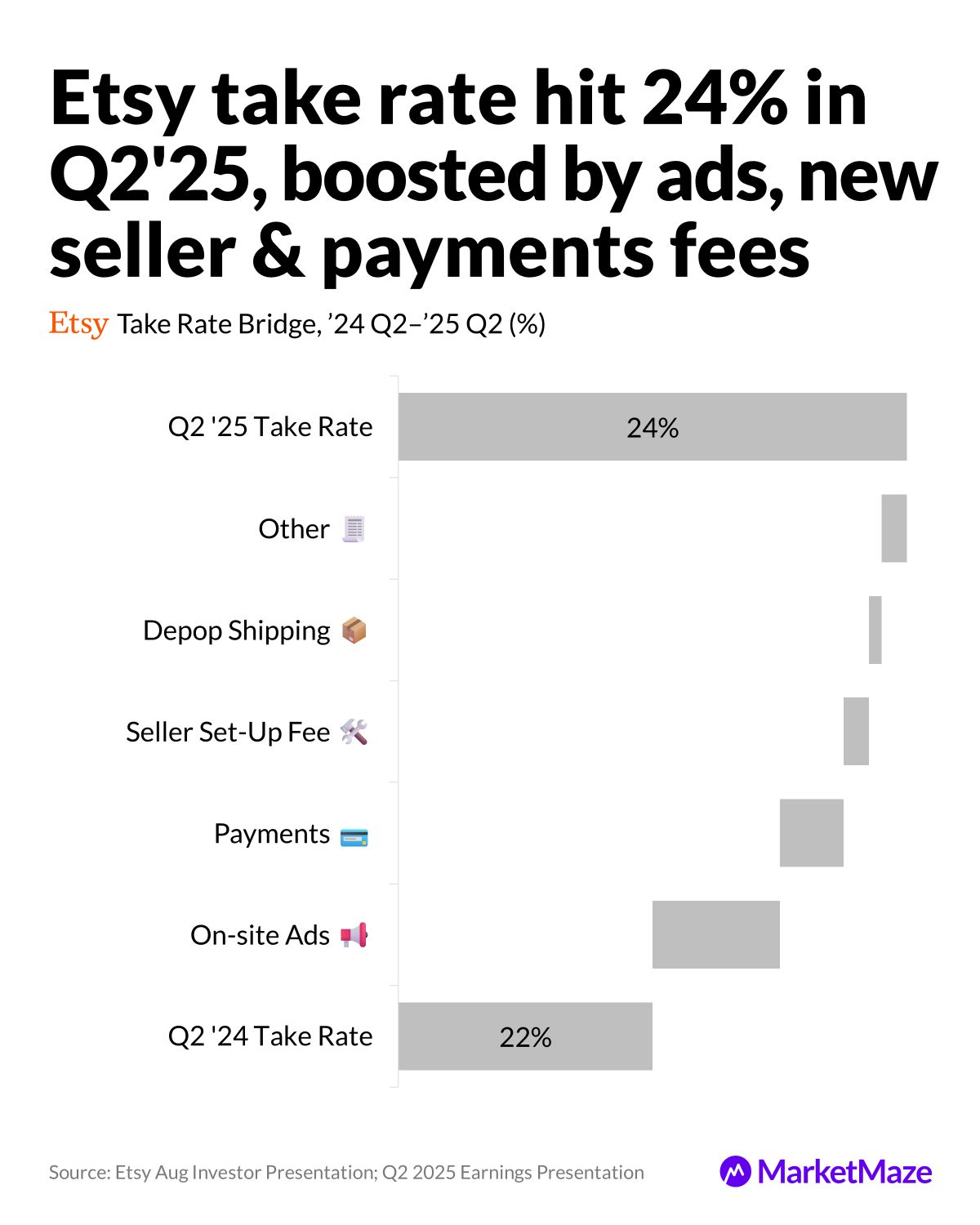

Take rate climbs to 24% 💰

Etsy’s Q2’25 take rate reached 24%, up from 22% a year earlier. The uplift came mainly from higher monetization levers: more on-site ads, increased payment fees, new seller setup charges, and Depop shipping. While the higher take rate supports revenue, it risks seller pushback as their margins thin. Sustaining growth now depends on balancing monetization with retention of top sellers.

Marketing spend intensifies 📢

Marketing represented 31.5% of sales in Q2’25, compared to 28.3% in Q2’24. Performance marketing spend jumped 26% YoY, while brand marketing fell 11%, showing a pivot to near-term ROI. Paid social’s share of performance spend rose from 18% to 22% in one year. The strategy builds traffic but raises customer acquisition cost risks if ad pricing inflates.

Disciplined product investment ⚙️

Product development spending fell to 16.6% of revenue in Q2’25, down from 17.7% in Q2’24. Despite the reduction, Etsy continued to prioritize six areas: buyer and seller experience, trust & safety, search and ads, payments, member support, and fulfillment. The disciplined allocation shows a push for efficiency, but leaner spend may limit differentiation versus rivals innovating faster.

Headroom for growth 📈

Etsy highlights untapped levers: capturing more TAM, boosting purchase frequency, geographic expansion, and reactivating lapsed buyers. With ~$550B core online TAM and ~$2T including offline, Etsy’s 2% share leaves large runway. Half of active buyers shop only once per year, while penetration outside the U.S./UK

Sources: 🔒 Available for MarketMaze+ subscribers

From our partners

Rank #1 on Amazon—Effortlessly with Micro-Influencers!

Stack Influence automates micro-influencer marketing to boost your Amazon ranking and revenue. Trusted by brands like Unilever and Magic Spoon, our platform drives external traffic and authentic content at scale, effortlessly.

👀 Outside the Maze

US & China Dominate Online Carts 🛒

US (34%) and China (31%) nearly double the global online shopping average of 17%. Europe lags at 10–25%, while emerging markets sit untapped, waiting for better logistics and payments. 👉 Visual Capitalist

Vinted Cracks Europe’s Top 10 Rankings 📈

The resale app now ranks top 10 in 10 countries, from France (3rd) to Poland (5th). Zero seller fees, cross-border reach, and a sustainability hook make it Europe’s fastest-moving marketplace story. 👉 ECDB

Amazon Worth More Than Nations 🌍

Amazon’s $1.7T market cap beats South Korea’s GDP ($1.6T) and doubles Switzerland’s. One company now rivals economies of entire countries, raising tough questions for regulators and governments. 👉 LinkedIn

Eastern Cities Outpace Europe’s Giants 🚀

Warsaw, Prague, and Sofia will grow over 4% in 2025, while Paris and Madrid cool. Oxford Economics shows Europe’s growth engine shifting east as Western hubs slow. 👉 Oxford Economics

Latin America Tops Ad Spend Growth 📊

Brazil leads retail media’s boom: iFood +462%, Casas Bahia +287%, GPA +157%. 11 of the 15 fastest-growing global ad players in 2024 were retailers, showing the channel’s unstoppable rise. 👉 LinkedIn

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and click here to the hub to check your progress

That's it for today! Before you go we’d love to know what you thought of today's maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team