TODAY’S MAZE

Welcome to MarketMaze. Every week, retail’s future gets rewritten—sometimes by a single data point, sometimes by a trillion-dollar trend. This edition dives into the global race between ecommerce and stores, why physical retail is morphing instead of dying, and how the biggest winners keep getting bigger. Let’s get into it.

Main Story

🏃♂️ Ecommerce Outruns Physical

🚀 Retail Retail’s $1T Growth Race

News📖

🇺🇸 Ecommerce Takes Retail Crown

🇨🇳 Pureplay Giants Face New Threats

🇧🇷 Small Stores Drive Brick Revival

🇺🇸 Top 10 Markets Capture Growth

🌏 Digital Pure-Plays Rewrite Top 10

🇯🇵 Winner-Take-All: 10 Firms Own Retail Growth

Insights🧠

🌊 Ecommerce Defies the AI Traffic Dropoff

🏬 In-Store Retail Media: Hidden Giant or Missed Shot?

🧊 Nordics: One Region, Four Marketplace Winners

🔍 Search Engines: Still the Retail Trust Champion

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

🌀 Maze Story

Ecommerce Outruns Physical Retail 🏃♂️

Global retail is being rewritten at record speed. Flywheel’s August 2025 “Global Retail Budget Planner” pulls back the curtain on where the next trillion dollars will flow and who gets left holding the bag. Their data dives into chain retail sales, subchannel shifts, and store formats worldwide, tracking every decimal so you don’t have to.

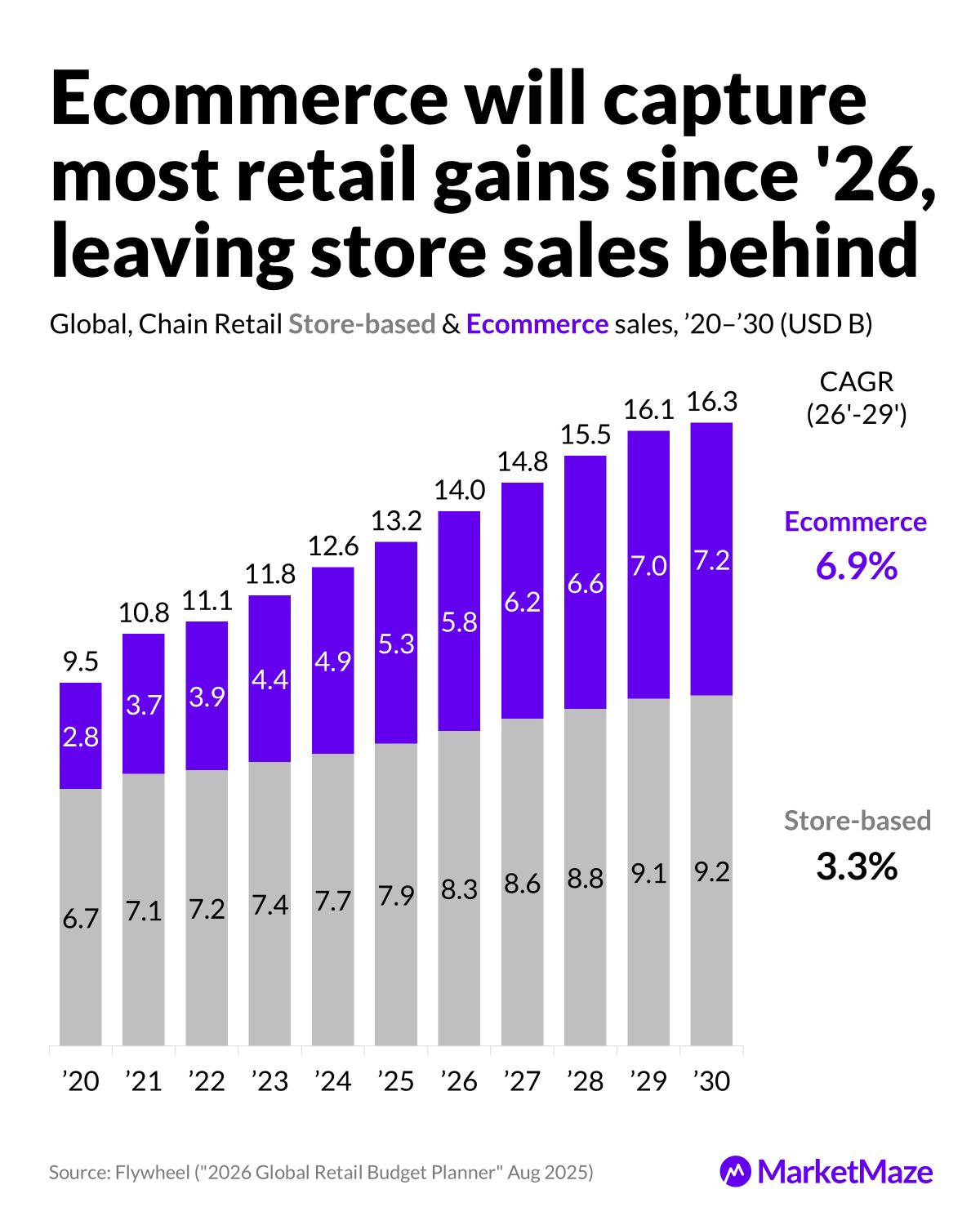

Ecommerce captures the retail crown 👑

Since 2026, ecommerce has eaten the lion’s share of global retail growth, adding over $7T by 2030—while store-based gains lag behind. Chain retail sales surge past $16T, but nearly all net new growth goes to digital. With ecommerce’s CAGR at 6.9% (double that of stores), the verdict is clear: online is the new battleground, and physical stores are fighting for scraps.

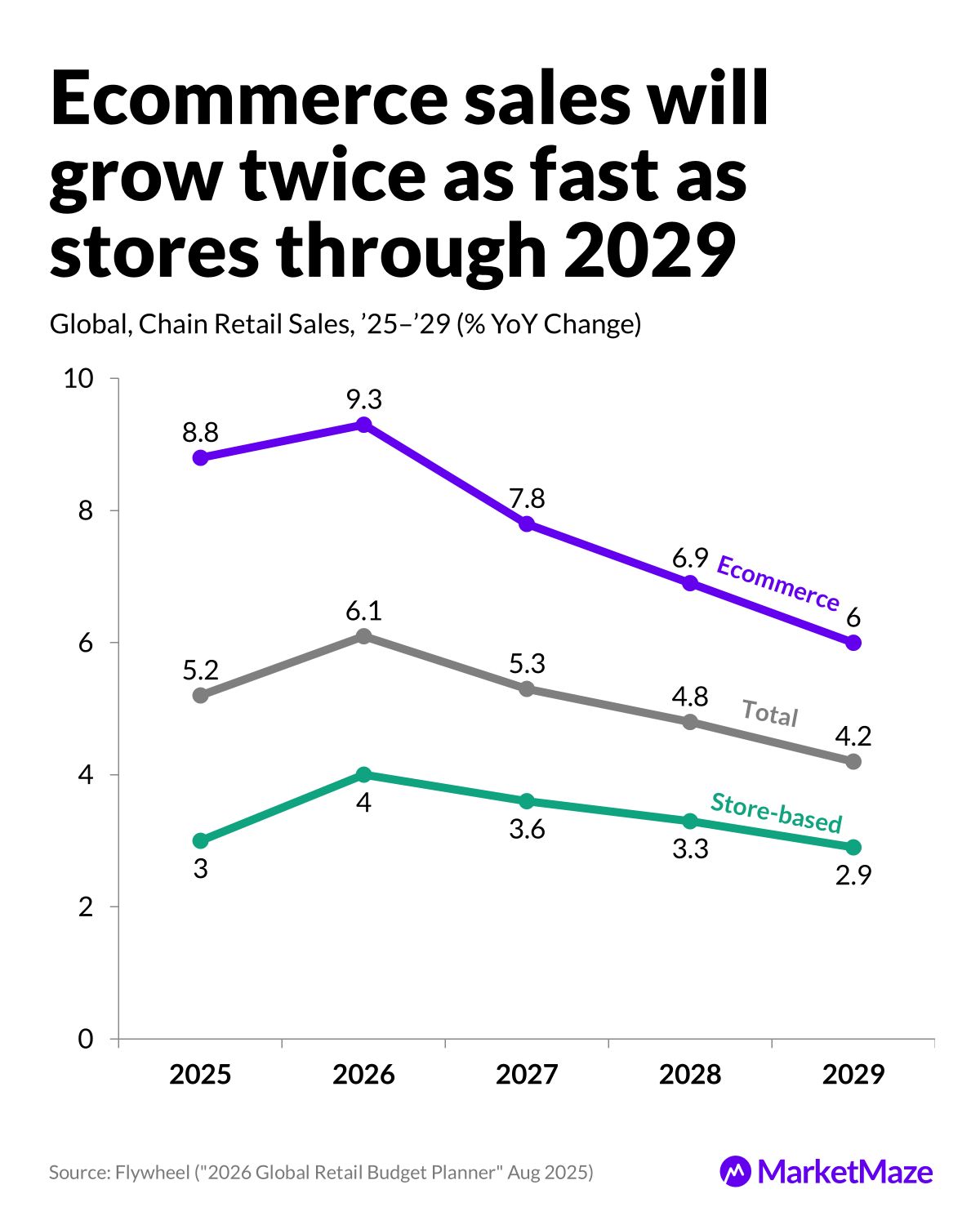

Ecommerce sales keep pulling ahead 🚄

Ecommerce isn’t just growing; it’s lapping the competition. From 2025–2029, online sales rise at nearly twice the pace of physical stores—peaking at 9.3% YoY growth in 2026. Store-based sales can barely crack 4%. As the digital lead becomes structural, legacy retailers face a stark choice: adapt to the digital surge, or fade into irrelevance.

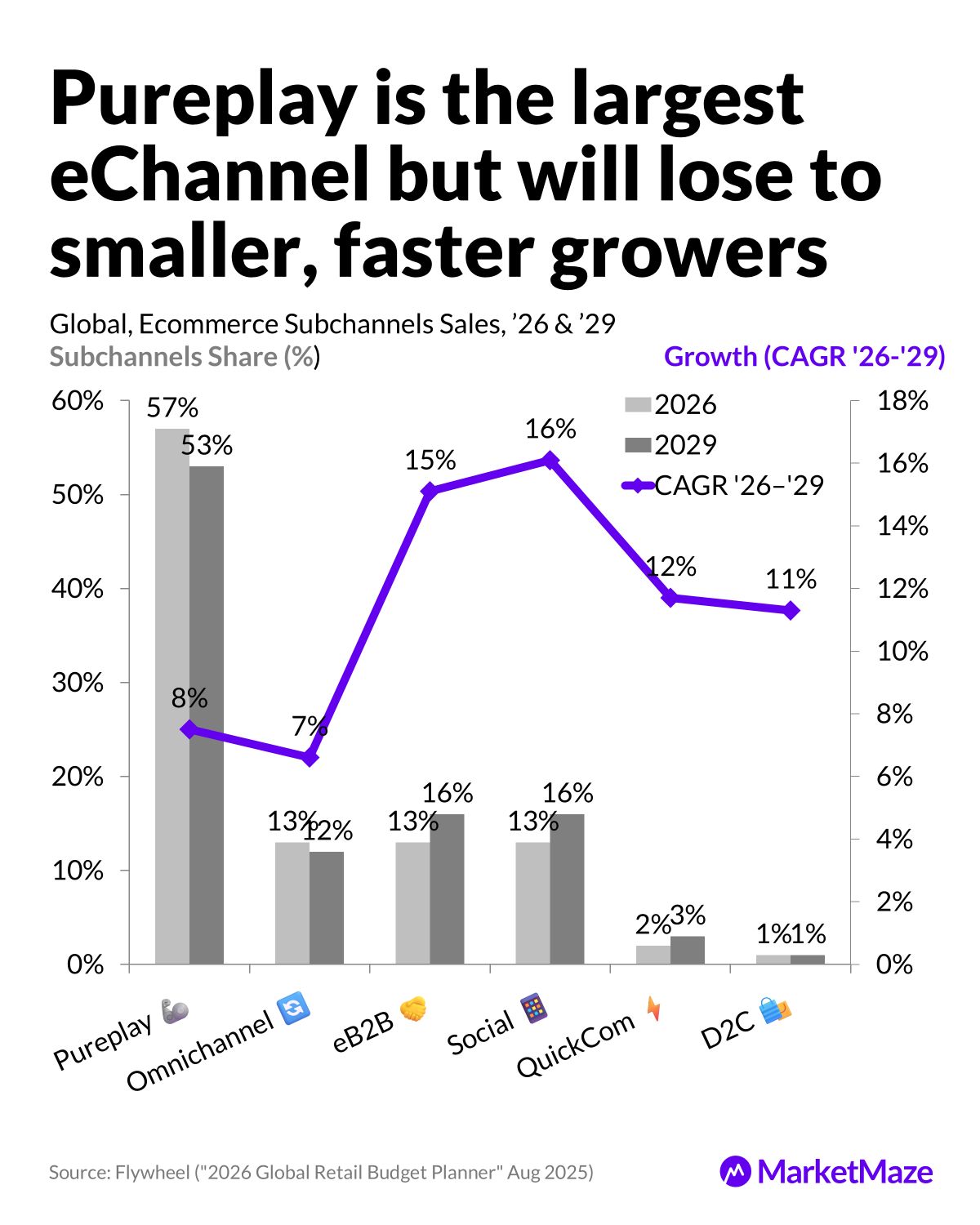

Pureplay faces new challengers as channels fragment 🧩

Pureplay giants like Amazon still command the biggest slice, but their dominance is slipping—falling to 53% of global ecommerce by 2029. Social commerce, eB2B, and quick commerce are growing at breakneck speed, each logging double-digit CAGRs through 2029. The future is fragmented: smaller, nimbler channels are grabbing share while the old guard watches from the sidelines.

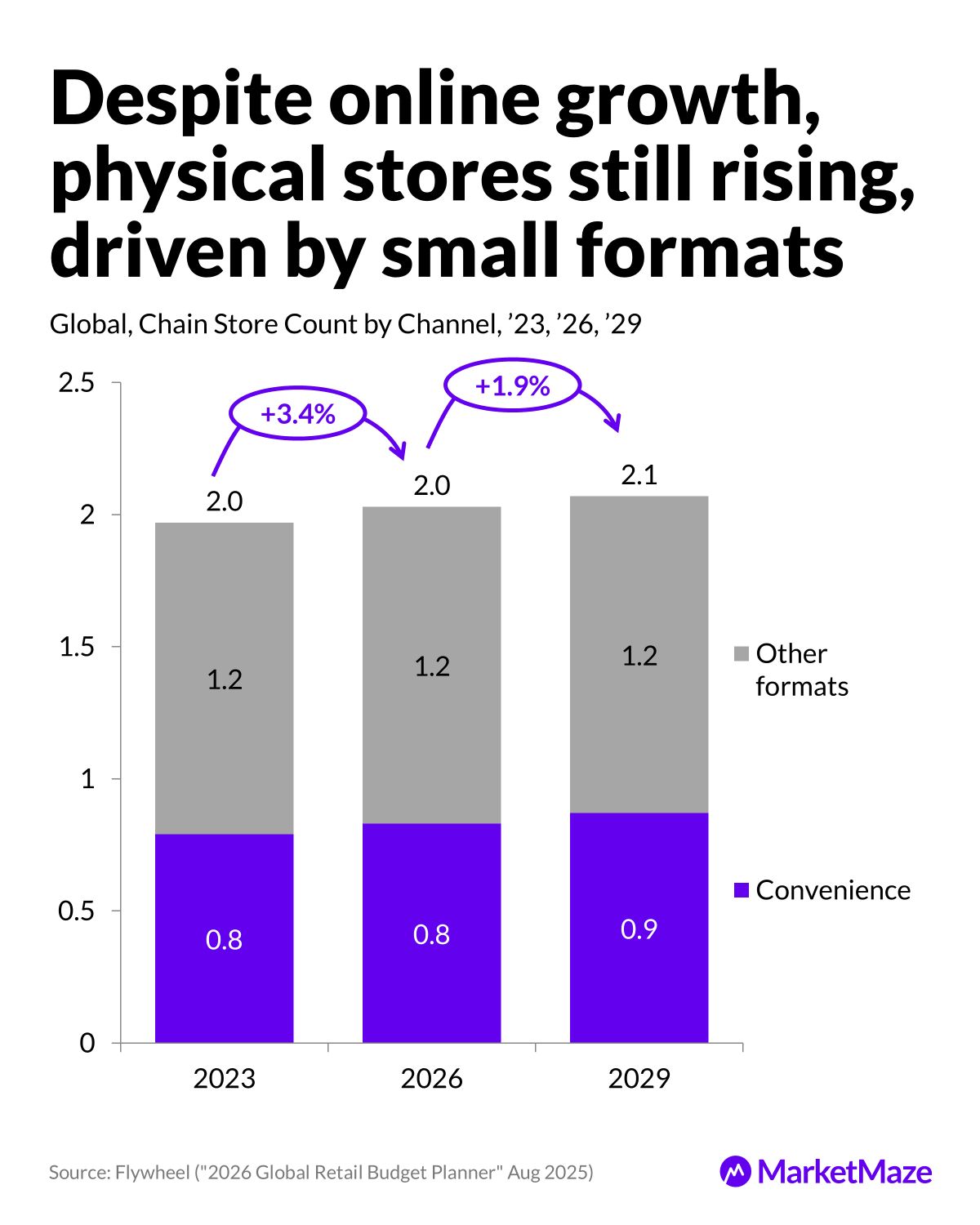

Physical stores aren’t dead—just shrinking and shifting 🏪

Don’t call it a comeback, but the number of global chain stores is still ticking up—crossing 2M by 2029. The secret? Not hypermarkets, but small formats like convenience stores and club shops, which now drive most of the growth. Bricks-and-mortar isn’t dying; it’s morphing into local, fast, and everywhere, giving retailers who can adapt a real-world edge as online and offline worlds collide.

Sources: 🔒 Available for MarketMaze+ subscribers

From our partners

With KeepCart or Without It — See the Margin Difference

Every checkout leak costs you. KeepCart shows exactly how coupon extensions quietly shrink your revenue — and how blocking them can recover hundreds per order. Your profit margin deserves a before-and-after moment.

Top brands like Bucketlisters and Quince have already seen the difference.

💎 Data Treasure

Retail’s $1T Growth Race🚀

The future of retail isn’t evenly distributed—it’s concentrated, digital, and brutal. According to the latest Flywheel 2026 Global Retail Budget Planner, nearly three-quarters of all new sales will come from just ten markets and ten companies, with most of the action shifting online. If you’re betting on retail’s future, the rules are changing: scale wins, digital dominates, and picking the right battleground is everything.

Top 10 markets will fuel most retail growth 🔥

From 2026 to 2029, the US, China, and a handful of other markets will account for nearly three-quarters of all new chain retail sales. The US will add $600B, China $500B, and the rest of the big ten grab most of the rest. Markets like the UK and Japan are smaller but post solid growth rates, while Brazil leads in percentage gains. All other countries together? They barely break a quarter of the total. Brands that want real growth need to focus where the money’s moving—concentration is the game.

The global market matrix: where to play, where to wait 🎯

Strategy in retail is all about picking winners before they win. The matrix splits the world: you must win now in big mature markets (US, China, UK, Germany, Japan) and prepare to win in surging “future bet” countries like Brazil, India, Mexico, Turkey, and Indonesia. Ignore slow, small markets—there’s little upside. The smart money? Invest for growth in markets like Nigeria, Vietnam, UAE, and South Africa, where ecommerce is exploding off a low base. Your budget should match this grid, or you’re playing the wrong game.

Five of the top 10 are digital pure-plays by 2029 💻

A decade ago, the world’s retail titans were all about stores. Today, half the top 10 are digital to the core. Amazon, Alibaba, Pinduoduo, ByteDance (yes, TikTok), and JD.com run almost entirely online and keep growing at 7–10% yearly. Walmart remains the store king but only by bolting on $200B in ecommerce. The rest—Costco, Schwarz, Home Depot, Kroger—barely move the needle. By 2029, if your growth doesn’t come from ecommerce, you’re not on the leaderboard.

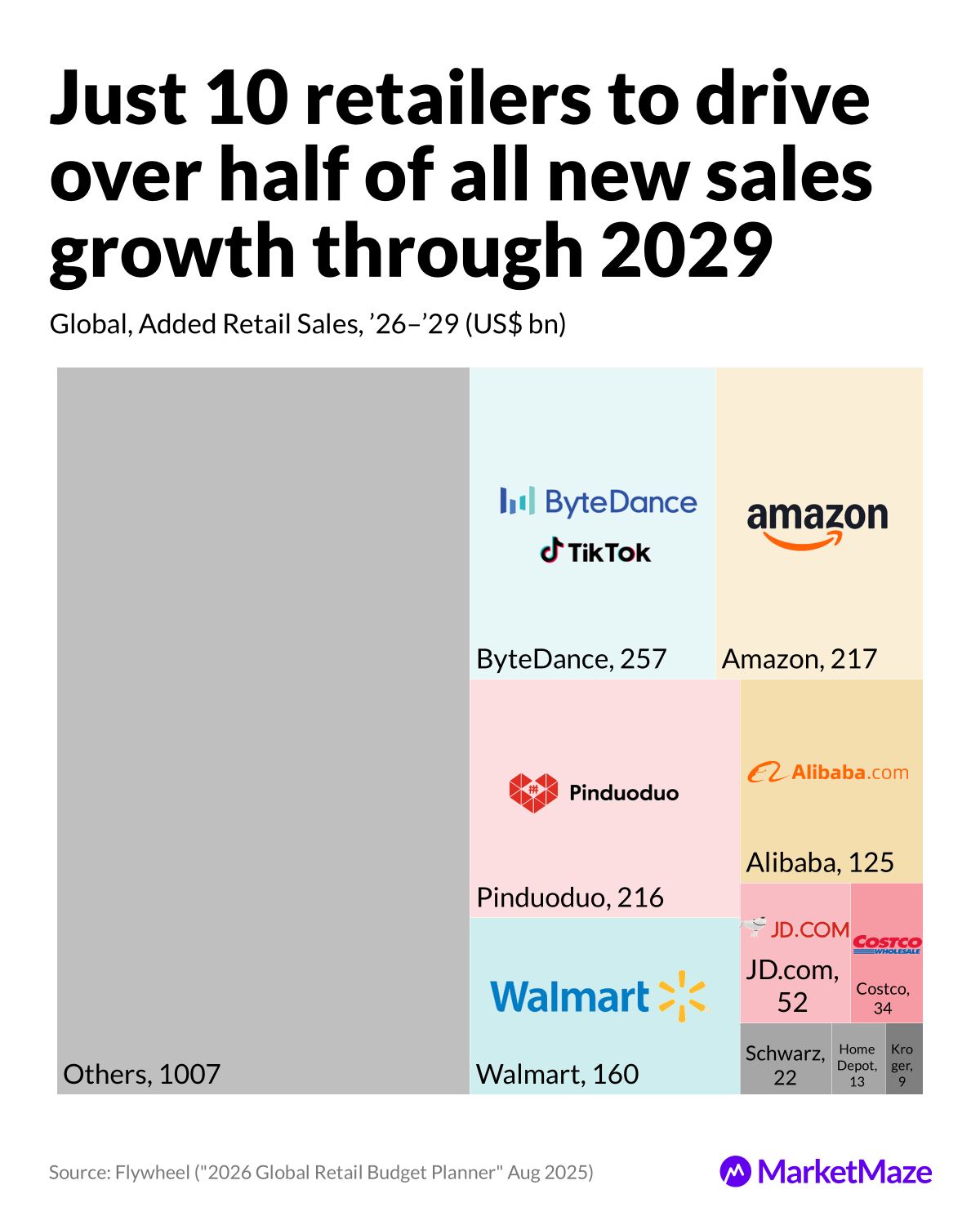

Just 10 companies drive over half of all new sales 📊

Retail is now a winner-take-all sport: the top 10 companies alone will capture 52% of all global sales growth through 2029. ByteDance, Amazon, and Pinduoduo lead with over $200B each in new sales, and Walmart, Alibaba, and JD.com round out the big club. The rest of the world’s retailers—the “others”—scramble for what’s left, split over a thousand companies. In the age of platform giants, the middle is vanishing. You’re either a scale winner or background noise.

Sources: 🔒 Available for MarketMaze+ subscribers

From our partners

Stay Ahead of the Market

Markets move fast. Reading this makes you faster.

Every weekday, you’ll get a 5-minute Elite Trade Club newsletter covering the top stories, market-moving headlines, and the hottest stocks — delivered before the opening bell.

Whether you’re a casual trader or serious investor, it’s everything you need to know before making your next move. Join 160k+ other investors who get their market news the smart and simple way.

👀 Outside the Maze

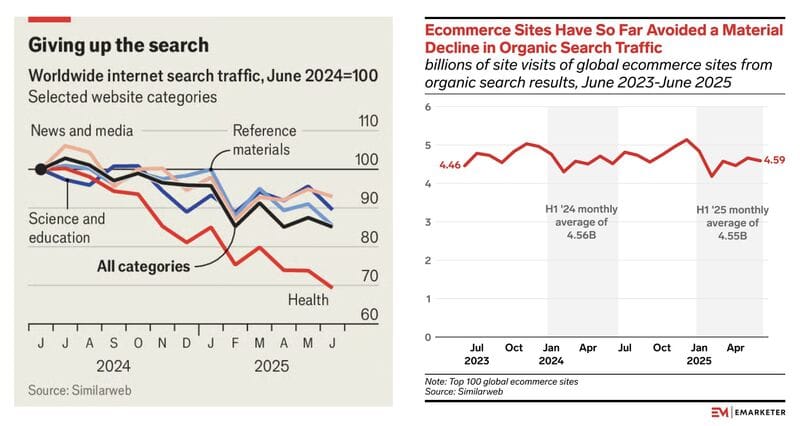

Ecommerce Defies the AI Traffic Dropoff 🌊

The Economist and EMARKETER both put a spotlight on what AI is doing to web traffic. As news, health, and education sites see visits fall, ecommerce is standing strong. EMARKETER’s Vladimir Hanzlik calls out the elephant in the room: what happens when AI can shop for you? For now, ecommerce still gets the clicks—4.6B+ organic visits per month—while most other categories are sliding. But with AI agents growing fast, the next chart might look very different. 👉 The Economist & EMARKETER on LinkedIn

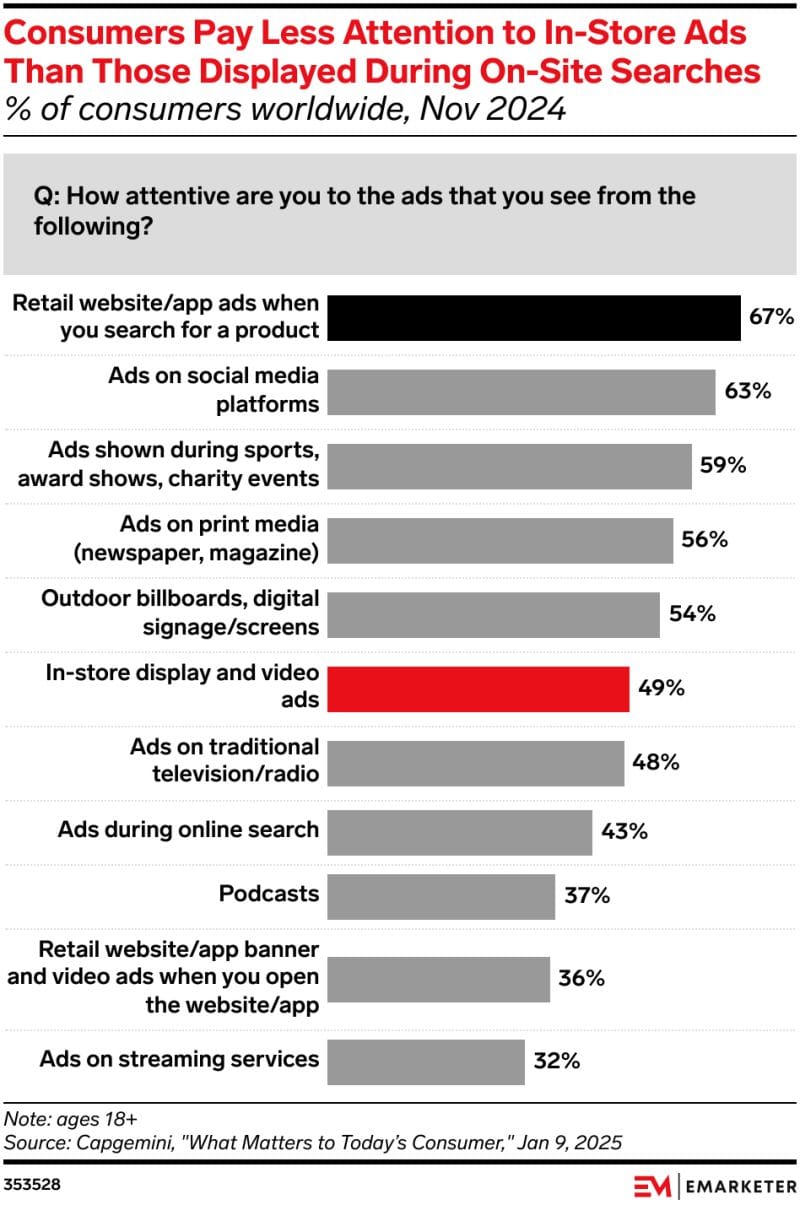

In-Store Retail Media: Hidden Giant or Missed Shot? 🏬

85% of Western European retail sales still happen offline. Yet just 49% of shoppers pay attention to in-store ads, making this a gold mine that’s barely tapped. The missing link? In-store media is too often a “silent partner,” with brands stuck guessing at impact. But that’s changing. AI, sensors, and loyalty data are tying screens to sales, and new ad formats—from QR to NFC—are proving that in-store media can drive nearly double the action most marketers expect. Treat the store as a true media channel, not just a shelf, and the payoff could be huge. 👉 Retail Media Discussion on LinkedIn

Nordics: One Region, Four Marketplace Winners 🧊

PostNord’s new data reveals the Nordics don’t shop alike. Norway loves Temu (41% share), Denmark and Finland go for Zalando (35% and 29%), and Sweden puts Amazon first at 34%. It’s a region of digital neighbors with wildly different marketplace loyalties—proof that one size does not fit all, even in the North. 👉 PostNord Insights on LinkedIn

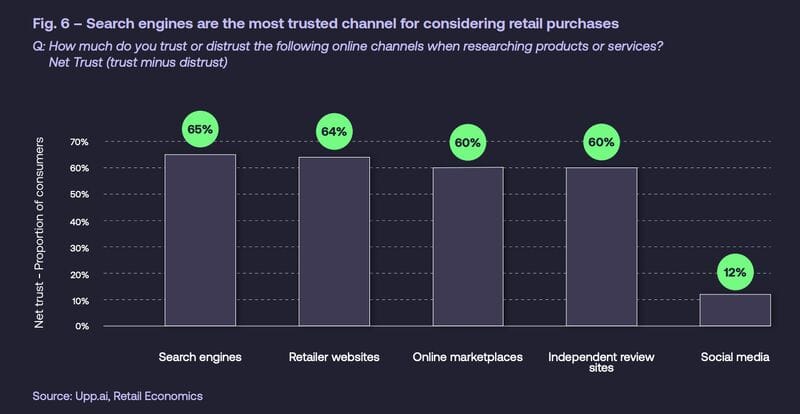

Search Engines: Still the Retail Trust Champion 🔍

New research from Upp.ai and Retail Economics confirms that 65% of consumers trust search engines most when starting a purchase journey, just edging out retailer sites (64%) and marketplaces (60%). That trust gets stronger with higher incomes and when buyers are exploring new brands. Plus, 72% of shoppers turn to search first for serious product research. The path from discovery to checkout is now shorter—and more search-driven—than ever. 👉 Upp.ai Research on LinkedIn

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

That's it for today! Before you go we’d love to know what you thought of today's maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team