TODAY’S MAZE

Happy Sunday! The European regulatory landscape just heated up significantly for cross-border retailers. A massive group of over 100 established French trade federations and retailers has launched a multi-billion-euro lawsuit against Shein.

This collective action is a potent signal that traditional markets are done tolerating disruptive business models that bypass strict local regulations for cost advantages.

In today’s MarketMaze:

France’s retail giants file a multi-billion-euro lawsuit against Shein

Amazon Autos expands into certified pre-owned vehicles with Ford CPO listings

AI agents force brands to shift focus from storytelling to accurate product data

+

Handpicked recent news you need to know:

🏬 Ecommerce Players (Marketplaces, e-Retailers, D2C)

📣 Ecommerce Ecosystem (Marketing, Tools, Logistics)

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Over 100 established French retailers and major trade federations are suing Shein, alleging the e-commerce platform relies on systemic non-compliance with local regulations to achieve unfair competitive advantage.

The action involves a massive, united front of trade federations and roughly 100 retailers who demand fair competition based on respect for the law.

Retailers demand recognition of the economic damage suffered, estimating that total liabilities could reach several billion euros.

Plaintiffs argue that Shein sells products that are often non-compliant with French regulations, while established local retailers must follow strict standards or risk closure.

Why it matters: This collective action signals that traditional European markets will actively resist business models that disregard regulatory compliance for cost advantage. Marketplace operators must prioritize local product safety and operational standards now to mitigate significant future legal and financial exposure.

FROM OUR PARTNERS

This 20-minute growth session could save you millions.

Looking for growth answers in all the wrong places?

Now's your chance to meet 1-1 with Galactic Fed's advisors. They will understand your business, audit your channels, and show you where the fastest growth opportunities are hiding.

Their team’s data comes from managing millions in ad spend across 600+ brands like Quizno's, Varo, Edible and more. And they'll apply all that insight to your marketing.

It’s free, it’s personalized, and it’s the same process that’s helped clients get funded, acquired, and go from startup to standout.

MAZE STORY

The Maze: Ford has become the latest major automaker to begin selling certified pre-owned (=CPO) vehicles through Amazon Autos, significantly expanding Amazon’s presence in the lucrative, high-value durable goods sector. This move signals that marketplace giants intend to capture more high-ticket consumer spending by offering familiar shopping experiences for complex purchases.

Amazon’s marketplace strategy follows deals with manufacturers like Hyundai Motor Co. and other fleet partners, rapidly building out its digital vehicle sales platform.

Shoppers can purchase certified pre-owned vehicles online but must still visit a participating dealer in Dallas, Seattle, or Los Angeles to pick up their purchase, similar to Amazon’s previous deal with Hertz.

Success hinges on maintaining impeccable product data, as experts warn that any gaps or discrepancies in mileage or condition notes risk breaking customer trust and triggering AI shopper red flags.

Why it matters: This push into used cars proves that consumers value convenience even for major purchases, forcing traditional dealerships to finally adopt modern ecommerce workflows. The immediate takeaway is that high-value sales depend entirely on perfect data fidelity, which is paramount for Amazon as it continues to leverage its scale and performance.

FROM OUR PARTNERS

Ecommerce moves fast. You do not need more meetings. You need protected focus and smarter scheduling. Reclaim.ai auto-blocks tasks, habits, and 1:1s, finds time across teams, syncs every calendar, and reschedules when priorities change. Launch faster. Burn out less.

✔ Auto-schedule tasks before due dates

✔ Defend deep work with smart buffers

✔ Scheduling links that find time across time zones

✔ Sync Google and Outlook while keeping personal private

✔ Pull tasks from Asana, Jira, ClickUp, and Todoist

✔ Slack status, reminders, and real-time updates

Give your team back hours each week. Spend time on growth, not calendar Tetris.

MAZE STORY

The Maze: AI assistants quietly sit between people and products and start calling the shots. As more shoppers let agents choose, brands win or lose on how clearly machines can read their catalog. If your product data is vague, you do not exist on the digital shelf, no matter how pretty your story looks.

According to Fashion United, In 2025, around 24% of people using AI already ask assistants to pick products for them, which shifts real power from glossy store displays to ranking systems that decide what appears on the first screen.

Kantar study reports that product data now acts like oxygen for visibility, since details on material, fit, durability and live price updates feed the models that rank items, while weak size guides or missing facts push brands to the bottom of results.

Kantar analysis highlights that creator spend and retail media budgets keep rising, yet only a small part of this content truly builds brand memory, so winners will be the teams that test performance, double down on high trust micro communities and learn what signals move the needle.

Why it matters: Ecommerce becomes a game of machine legibility first and human emotion second. If assistants cannot clearly parse your catalog, your brand drops out of shortlists long before a shopper sees a page. The brands that structure data, prove performance and plug into trusted communities will own the next decade of digital demand.

DATA TREASURE

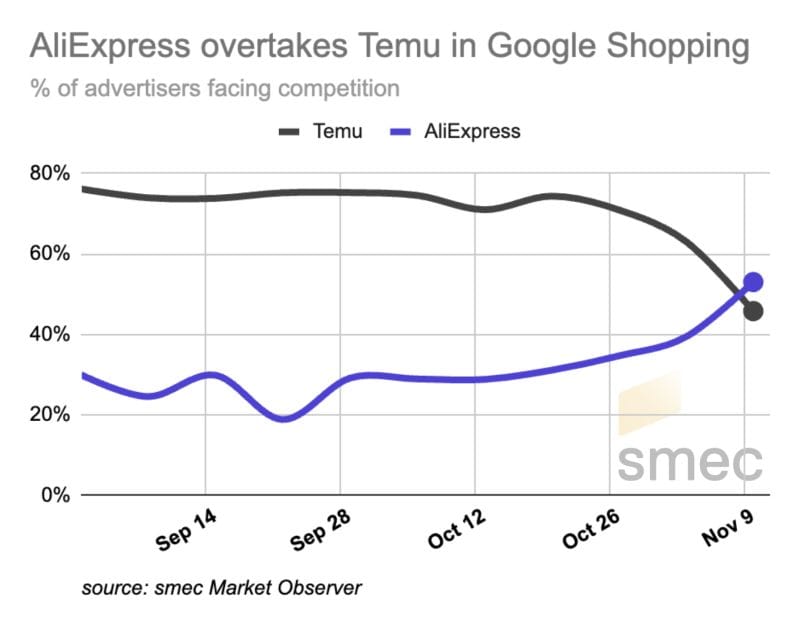

The Maze: In one month, AliExpress has doubled its presence in European Google Shopping auctions, moving from a side player to the main Chinese challenger to Amazon. Temu owned about three quarters of advertiser competition earlier in the year, now AliExpress shows up for more than half. European retailers are swapping one ultra cheap rival for another just as peak season spend ramps up.

In mid September Temu appeared alongside roughly 75% of advertisers, while AliExpress showed up for about 25% of them, but by early November AliExpress had surged past 50% and Temu slipped toward 60%, flipping the balance of Chinese competition in many accounts.

Earlier in the year Amazon temporarily pulled back from Shopping in parts of Europe and Temu briefly halted global ads after tariff talk in the United States, opening space that new money from AliExpress is now occupying with aggressive bids and expanded product coverage.

Why it matters: When AliExpress pours money into auctions that Temu dominated a few weeks earlier, CPCs rise and margins compress while nothing else in your business changes. If you are not watching who you compete with, you are just reacting to price pressure.

DATA TREASURE

The Maze: In the United Kingdom, the Friday before Black Friday already captures around 80% of Black Friday traffic, turning a warm up day into a peak event. Search interest in deals now starts climbing three to four days before Singles Day and overall Q4 demand in 2024 was up roughly 27% versus 2023. Brands that still think in terms of one big day are planning for a world that no longer exists.

By 2024 early season deal interest ran almost 50% higher than in 2023 and more than 60% of shoppers said they started holiday buying before November, pulling demand into the first half of the quarter and stretching decision cycles for higher ticket purchases.

For retailers, Fake Friday and the surrounding 48 to 72 hours are now the real golden window, so smart teams pre approve best sellers in Merchant Center, upload promotions days in advance and use diagnostics to clear price mismatch and GTIN issues before traffic spikes.

Why it matters: Peak season has become a two week negotiation where shoppers research early, compare across platforms and wait for the right deal before they commit. If your brand only goes all in on Black Friday itself, you show up after the best customers have already bought. We hope you treated Fake Friday as your first crescendo where you tested offers, built remarketing pools and let Black Friday scale what already proved it converts.

BRIEFING

🏬 Everything else in Ecommerce & key players

🇺🇸 The retail sector recorded 14 notable bankruptcy cases in 2025, with several big-name chains entering Chapter 11 for a second time as store-based and specialty retail remain under heavy pressure.

🇬🇧 UK retail sales fell unexpectedly in October as cautious shoppers delayed spending ahead of Black Friday and the government’s budget announcement.

🇺🇸 Walmart reported strong Q3 sales and raised its annual forecast, confirming success in attracting both high and low-income shoppers leaning toward value.

🇺🇸 Amazon third-party sellers are cutting back on Black Friday and Cyber Monday deals as rising platform fees and import tariffs squeeze already thin margins.

🇧🇪 Amazon has become the second-largest online retailer in Belgium, underlining its steady share gains in smaller European markets beyond its traditional core.

🇬🇧 B&Q Marketplace is opening its doors to European sellers, turning the UK DIY giant into a broader cross-border platform for home improvement brands.

🇺🇸 Amazon’s Rufus shopping assistant is adding new features for the holidays, giving customers more AI-guided product discovery tools and sellers another surface to influence purchase decisions.

🇬🇧 Frasers Group has acquired Braehead Shopping Centre, adding another major asset to its retail estate and tightening its grip on UK physical shopping destinations.

BRIEFING

📣Everything else in Ecommerce ecosystem

🌐 Google is testing sponsored ads directly inside Search AI Mode results, creating a new high-visibility ad surface that performance marketers and retail media teams will need to track closely.

🇬🇧 Half of UK shoppers now abandon online purchases over trust and security concerns, signalling that checkout confidence has become a bigger conversion lever than pure speed.

🌐 Google Search will soon route more complex queries straight into Gemini-powered AI Mode, reshaping how users see results and how brands compete for top-of-page visibility.

🇺🇸 The US has exempted coffee and several other agricultural imports from Brazil from new tariffs, easing cost pressure across grocery and packaged food supply chains.

🇩🇪 Picnic has raised 430 million in fresh funding to accelerate its German rollout, backing further dark-store, fleet, and last-mile capacity in one of Europe’s key grocery battlegrounds.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

RECOMMENDED NEWSLETTERS

Craving more sharp reads? Check out these MarketMaze-recommended newsletters.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

See you next time in the maze!

MarketMaze team