Welcome to this week’s MarketMaze. Circularity is the new black in fashion, but most brands are still playing dress-up. Today, we unpack who’s leading, who’s stalling, and which “sustainable” moves actually cut through the hype—and the emissions.

TODAY’S MAZE

♻️ Circular Fashion: Progress, Not Transformation

🚦 Circularity Gains Plateau After 2022

🧵 Circularity Levers: Pilot Projects, Not Core Business

⛰️ Outdoor Brands Lead; Fast Fashion and Footwear Lag

🛠️ Rental and Repair: Still Rare, Still Optional

🌍 Europe Pulls Ahead in Circularity, Others Trail

👗 Fashion’s Real Climate Wins: Returns & Overproduction

💎 Luxury’s Shortcut: Less Stuff, More Value

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

🌀 Maze Story

Fashion’s Circularity Progress? ♻️

Circular fashion has momentum, but the engine’s still running on half power. Kearney’s 2025 Circular Fashion Index (CFX) is the largest global look yet—246 brands, seven levers, five years. They scored brands 1–10 for actions like design, care, repair, resale, rental, and recycling, using only public data. The result? A global industry moving, but still not transforming.

Progress Stalls After a Fast Start 🚦

Fashion brands inch forward on circularity but progress stalls. After a burst from 2020 to 2022, average scores for circularity plateaued, rising just 0.2 points in the last two years to hit 3.4 out of 10 in 2025. The median sits at 3.2, and even the bottom 80% are stuck at 2.9. Translation: most brands moved past lip service, but almost nobody is breaking out of “moderate” maturity. Kearney’s 1–10 scale means <3 is just basic or symbolic, 3–7 is moderate, and >7 is truly extensive. But almost nobody gets there—circularity isn’t business as usual, it’s a checklist.

Circularity Levers: Pilot Projects, Not Core Business 🧵

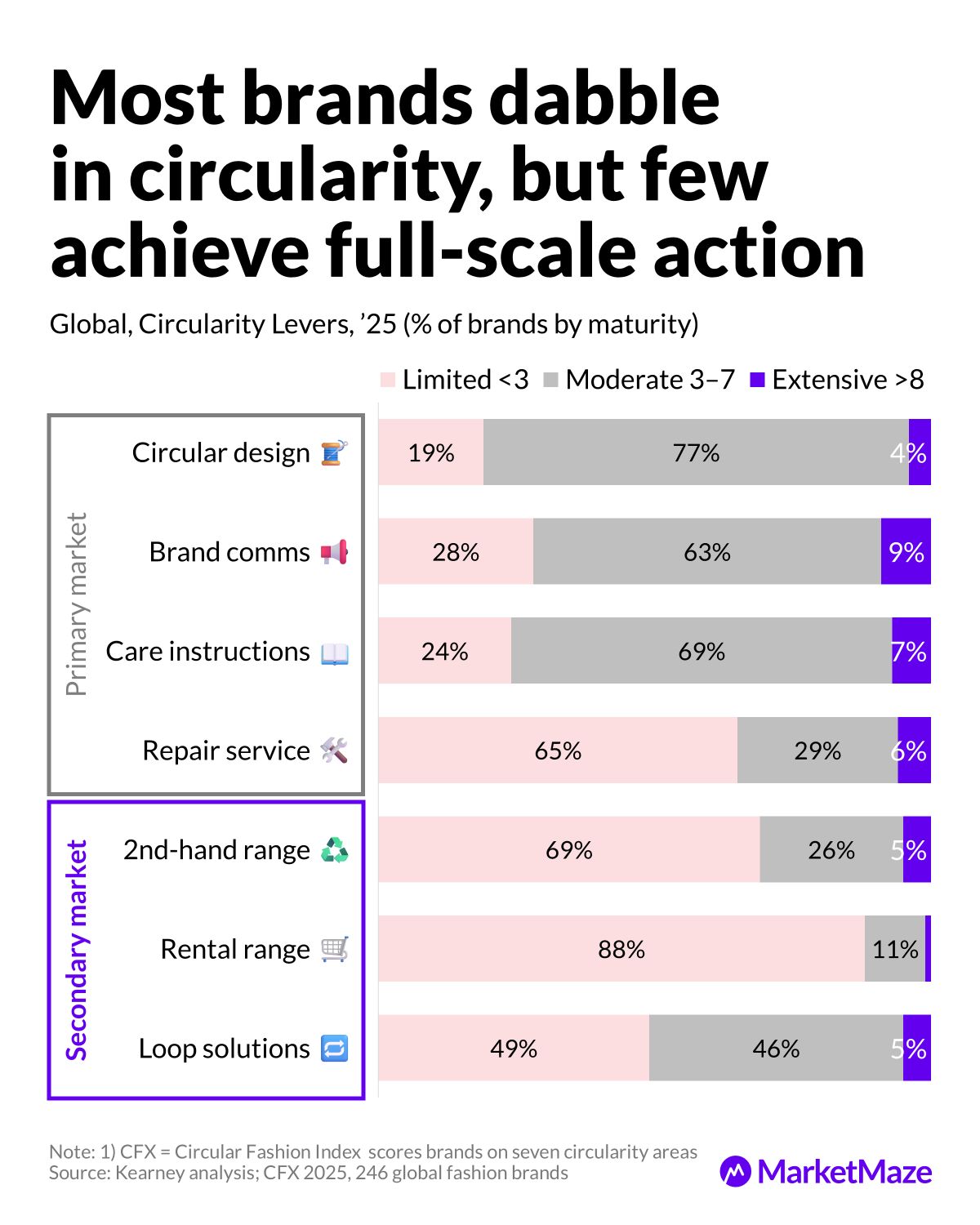

Most brands dabble in circularity, but few achieve full-scale action. Circular design is the most widely adopted lever: 77% of brands hit “moderate” maturity. Care instructions and brand comms are also solid, but repair (65% limited), resale (69% limited), and especially rental (88% limited) remain stuck in pilot mode. Only 1–9% of brands are truly best-in-class across any lever. Rental is basically a ghost town. It’s progress, but it’s not the revolution every sustainability deck promised.

From our partners

Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs behind Uber and eBay also backed Pacaso. They made $110M+ in gross profit to date. They even reserved the Nasdaq ticker PCSO. Now, you can join, too.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

🌀 Maze Story

Categories: Outdoor Leads, Fast Fashion & Footwear Lag ⛰️

Circularity is a mixed bag: outdoor leads; fast fashion, footwear, and underwear lag. Outdoor is the only segment showing real leadership, with a score of 5.6 and “high” marks for design, care, repair, and loop closing. Most categories hover in the 3.0–3.6 range. Fast fashion, as expected, is in the rearview mirror. The “progress” is mostly concentrated in easy wins—design, comms, and care. Harder stuff like rental, repair, and pre-owned assortment? Still rare.

Rental and Repair: Still Rare, Still Optional 🛠️

Rental and repair is rare… design, comms, and care already strong. Heat maps make it obvious: nearly all the color is stacked on design and comms. Rental and repair are faint across the board. Even in outdoor and sports, with natural fit for circularity, only modest scores show up. There’s a gulf between aspiration and execution—most brands still treat circularity as a PR boost, not a real business model.

EU Jumps Ahead, North America and APAC Play Catch-Up 🌍

EU leads global circularity scores; APAC and North America lag behind. In 2025, Europe posts a 3.6 average (up 0.4), North America drifts at 3.4 (up 0.1), and APAC trails at 2.7 (up 0.3). Europe’s jump is driven by regulation—think repair bonuses, EPR schemes, and eco-design mandates. For everyone else, the pace is glacial. The regional gap is widening, and supply chains are feeling the ripple.

From our partners

Financial News Keeps You Poor. Here's Why.

The scandalous truth: Most market news is designed to inform you about what already happened, not help you profit from what's coming next.

When CNBC reports "Stock XYZ surges 287%"—you missed it.

What you actually need:

Tomorrow's IPO calendar (not yesterday's launches)

Crowdfunding deals opening this week (not closed rounds)

What real traders are positioning for (not TV talking heads)

Economic data that moves markets (before it's released)

The financial media industrial complex profits from keeping you one step behind.

Stocks & Income flips this backwards. We focus entirely on forward-looking intel that helps you get positioned before the crowd, not informed after the move.

Stop chasing trades that happened already.

Start prepping for the next one.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

💎 Data Treasure

Fashion’s Carbon Moves 👗

If you think fashion’s climate problem is all about wool sweaters and private jets, you’re missing the point. Bain’s 2025 analysis cuts through the greenwashing to show which decarbonization moves actually work—and which ones just torch cash. Their marginal abatement cost curves for apparel and luxury fashion put a dollar sign on every ton of CO2 saved, no PR spin, no sustainability theater.

Fashion’s Best Climate Wins Are Cheap 💡

Here’s the punchline: the easiest, most cost-effective ways to cut fashion’s emissions are the least glamorous. Limiting e-commerce returns and slashing overproduction aren’t sexy, but they are money machines. Reducing overproduction drops both costs and CO2. Limiting returns? It’s practically free profit—less shipping, less waste, less hassle. Yet, what do most brands do? Pour money into pricey moonshots like electrifying factories or nearshoring production. Those “ROI-negative” moves eat cash and barely move the climate needle. In fashion, common sense isn’t common practice.

Luxury’s Shortcut: Less Stuff, More Value 💎

Luxury is a different animal—but the lesson’s the same. The biggest, fastest decarbonization wins? Cut the endless cycle of overproduction and take ownership of resale. Bain shows that luxury brands love to chase status with bio-leather and secondhand programs, but most of these are financial black holes unless they truly replace new sales. The real unlock? Selling less, wasting less, and turning resale from a cost center into a loyalty engine. When luxury brands get ruthless about inventory, they help both the planet and their bottom line. In a world obsessed with more, the real flex is doing less, better.

Share with friend!

That's it for today! Before you go we’d love to know what you thought of today's maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team