Welcome to MarketMaze, the #1 newsletter for staying on top of the latest in Ecommerce & Marketplaces. Get all the insights you need in just 5 minutes!

🧠 Big Story:

China’s Grip on Apparel Loosens 🧵

📊 Key Data:

Consumers Picked Price Over Speed

📖 Ecommerce ecosystem news:

🇺🇸 Amazon's AI Pause Ads Hit Prime Video.

🇺🇸 Microsoft Shuts Xandr DSP for AI Ads.

🇳🇱 Channable Acquires Producthero to Boost Multichannel Sales.

🇫🇷 Mirakl-Storfund Partnership Speeds Up Marketplace Payments.

🇬🇧 DHL eCommerce UK Merges with Evri to Boost Delivery.

🇺🇸 Amazon Partners with FedEx for Delivery Support.

+ over 15 handpicked hot ecommerce news from the last week you need to know 🔥

We’re sorry for the recent email hiccups. For now, we’ve switched back to sending from [email protected] and have reached out to Beehiiv for support before we try moving to our own domain again. If we attempt the change, we’ll let you know in advance. As always, you can reach out to us anytime by answering this email or to me on Linkedin.

On a positive note—our recent post on Amazon on LinkedIn (link) hit 500 likes and 100,000 views! Thank you for being part of our growing community. We’ll keep bringing you breaking insights!

If you want quick, punchy startup insights in your inbox, check out Quick Pitch. Each edition breaks down one hot startup idea—what it is, how it works, and why it matters—in under two minutes. Great for anyone looking to stay sharp on best in class early stage startups.

China’s Grip on Apparel Loosens 🧵

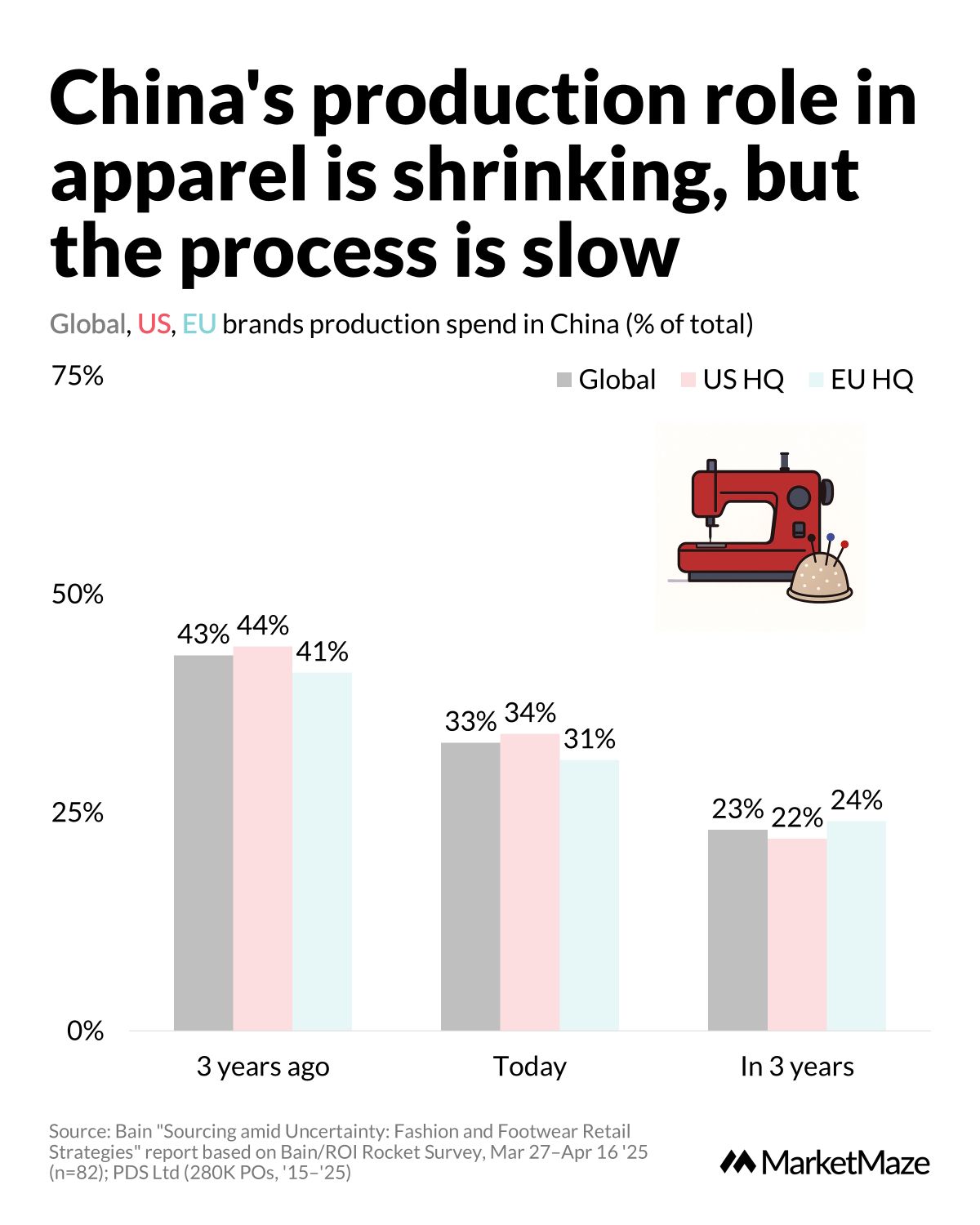

Three years ago, China dressed the world. According to Bain study 44% of US, 43% of global, and 41% of EU apparel production spend flowed there. That dominance is unraveling: today, those shares drop to 34%, 33%, and 31%. Looking out to 2028, China’s slice falls further, projected at just 22–24%. Brands are cautiously shifting production closer to home, but let’s not pretend it’s a jailbreak—nearshoring remains tricky and expensive, with most companies admitting that full onshoring would be a Herculean task thanks to labor costs nearly 10% higher. Resilience is in, but the exodus from China is more slow march than sprint.

China’s Raw Material Hold Still Strong 🏭

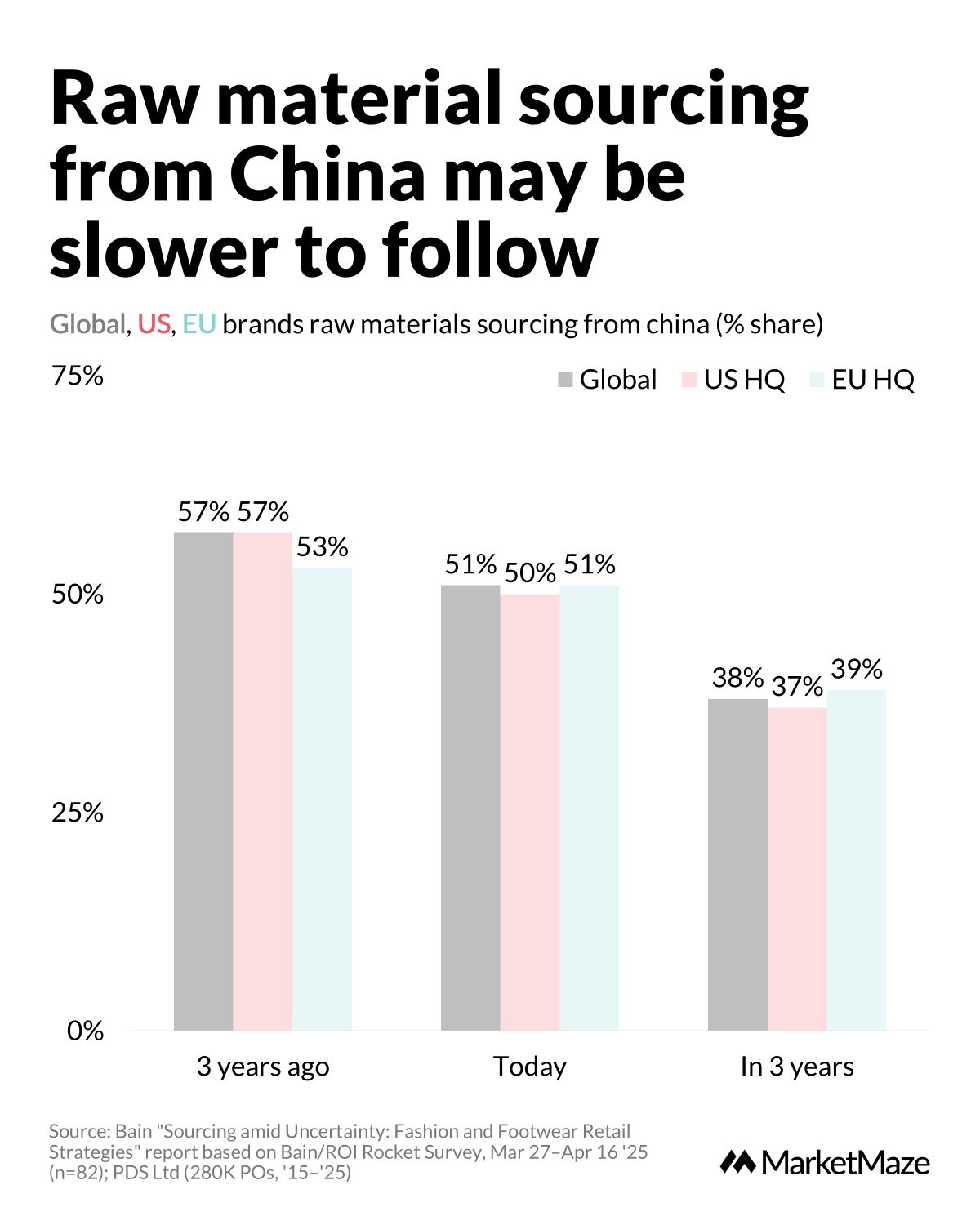

If moving finished goods is a slog, moving raw materials is like running a marathon in flip-flops. Three years ago, more than half of all raw material sourcing was China-based: 57% for both global and US brands, 53% for EU. Today, the world still relies on China for half its fabric—51% globally and in Europe, 50% in the US. Even by 2028, those numbers only dip to 37–39%. The takeaway: even as sewing machines leave Beijing, the raw goods are still rolling out of China. Brands want out, but their supply chains have commitment issues.

Top Suppliers Get a Bigger Cut 💰

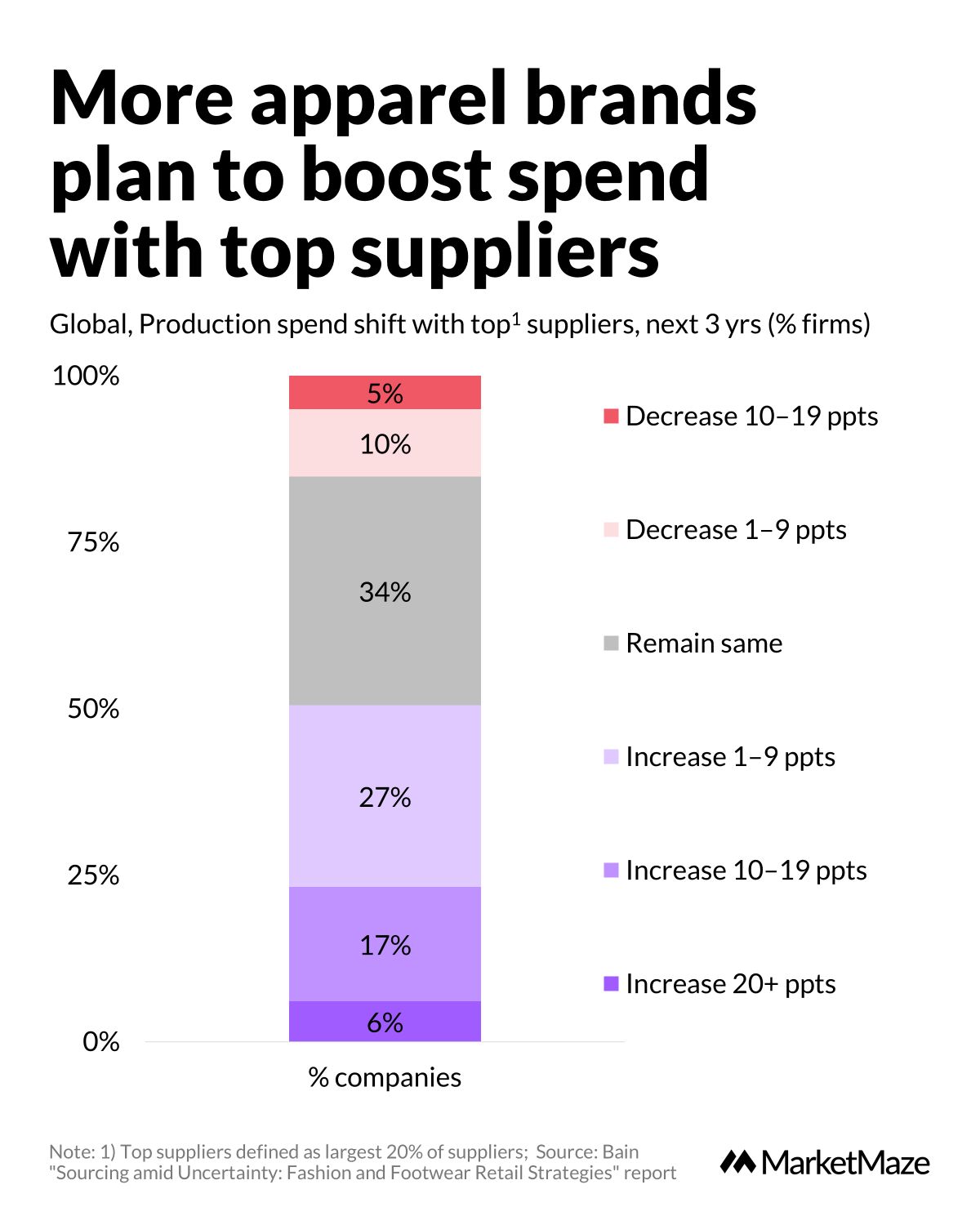

Facing supply chain drama and cost spikes, brands are sticking close to their “ride or die” suppliers. In the next three years, 50% of apparel brands plan to boost spend with their top 20% suppliers—27% will nudge up by up to 9 points, while 23% are planning double-digit jumps. Just 15% expect to pull back. This isn’t just about loyalty—it’s about negotiating power, cost control, and keeping surety of supply in a world where flexibility and resilience now beat chasing the lowest sticker price. When the going gets tough, brands want their A-team in the trenches.

AI Bets Big on Demand Planning 🤖

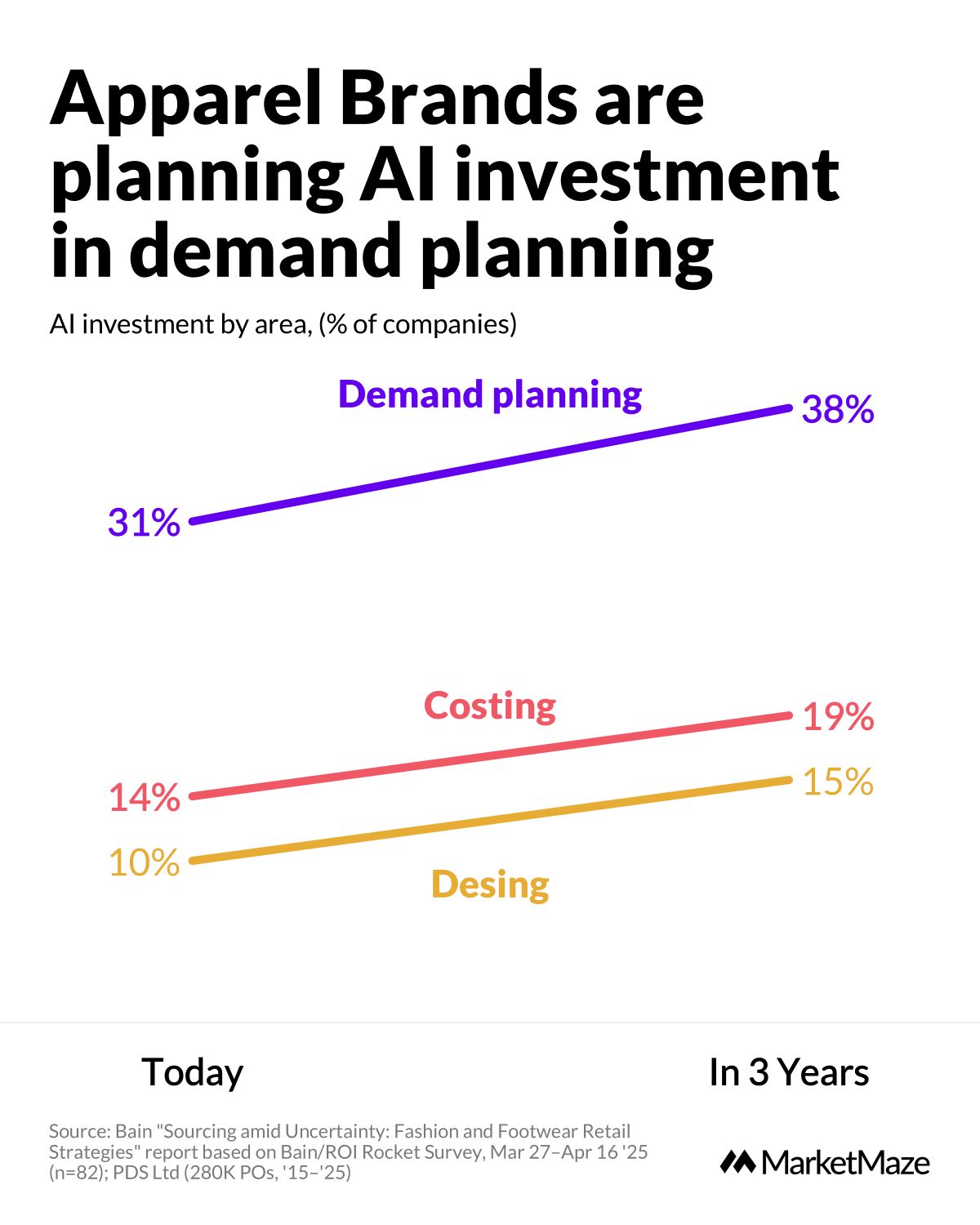

Apparel’s new secret weapon? AI, and it’s going straight to the nerve center: demand planning. Today, 31% of brands invest in AI for predicting what will fly off the shelves; in three years, that’s set to rise to 38%. Costing and design are also getting a tech upgrade, but trail behind at 14% and 10% today, rising to 19% and 15%. Everyone’s talking about generative AI, but the smart money is on bots that help forecast the next “it” item—because if you can predict demand, you can dodge markdowns, outmaneuver supply chaos, and keep your CFO smiling

I'd like to invite you to the hellotax 10x5 Amazon Hack Series Webinar on Wed May 28th 7 PM CET/1pm EST

Sponsored by hellotax eCom Hot Sauce Insiders, TraceFuse, CronosNow, Blue Amber Digital and AMZ Optimized

👁️👁️ 15 Badass Amazon hackers are gathering for a badass showdown! Each speaker will share a hack in 5 mins! Let's see … WHO is the BEST OF THE BEST!

😎 Host:Nick Penev - Co-founder @ Xtreme Power Brands and eCom Hot Sauce and Partnerships Advisor @ hellotax and 40+ companies in the ecom space.

🎙️ Selected Speakers:

Sebastian Eduard - The Hidden Profit Thief: Why Your Ad Spend Keeps Increasing But Your Profits Don't!

Jasa Furlan - Forget ACoS – Here’s What 7-Figure Sellers Actually Track!

Pasha Knish - Boost SEO with AI on AMZ!

Paula de la Vega - Tariffs Got You Cornered? It’s Time to Cross the Pond!

Colin Raja - What’s Killing Your Sales? Two Data-Driven Hacks to Catch It Before It’s Too Late!

Stephanie Khalikyar - Tariff Mitigation Strategies!

Grab Your Spot Here Limited to 500 attendees!

Consumers Picked Price Over Speed

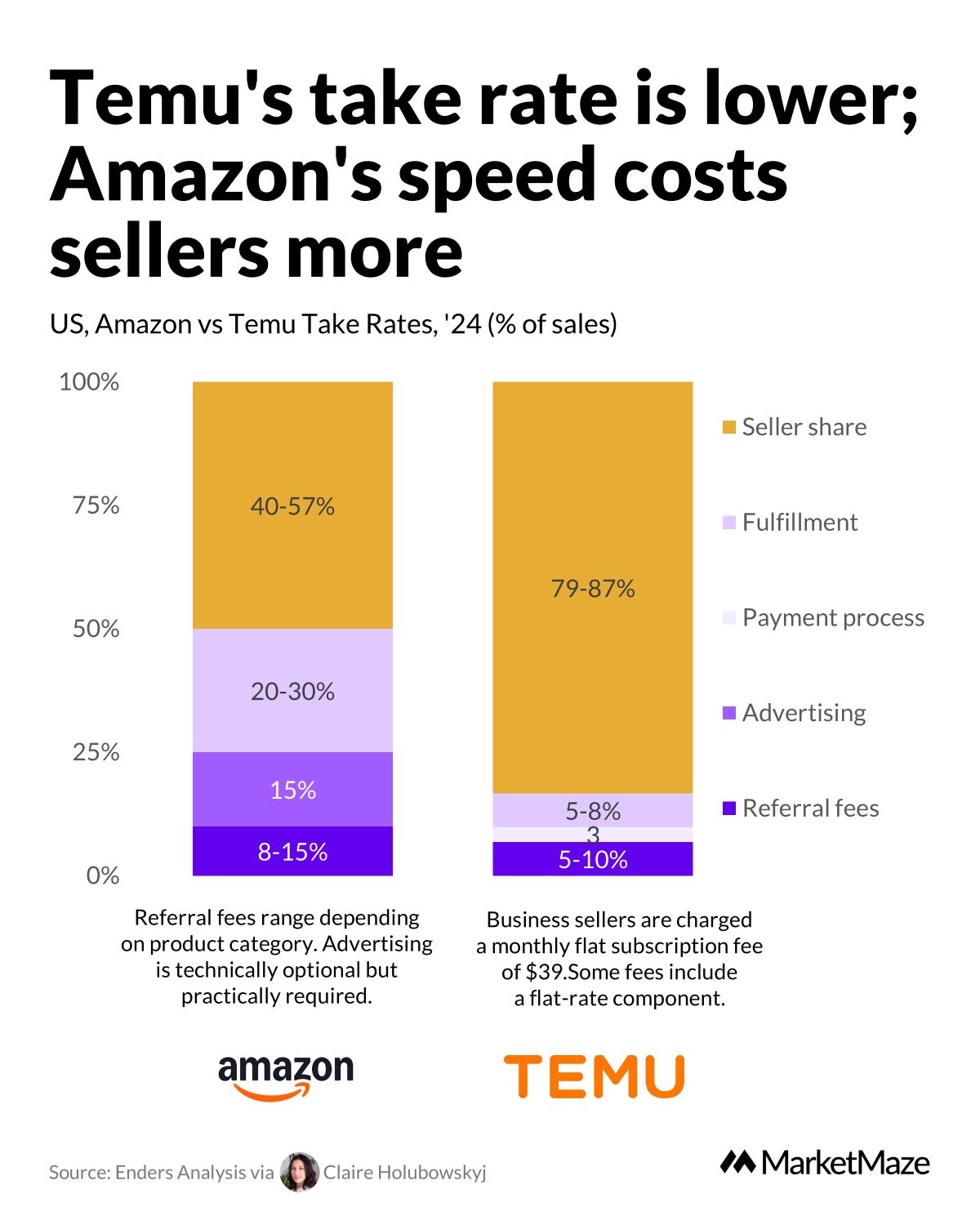

Amazon vs Temu isn’t just a pricing story.

(It’s a consumer psychology shift.)

Amazon spent 20 years teaching us:

Speed = value.

Temu came in and proved:

Price > speed.

And it worked.

• Cheaper supply chain

• Lower take rate

• Delivery speed? No longer a deal-breaker

While Amazon sellers lose up to 60% in fees and ads,

Temu sellers keep up to 87% of the sale according to Enders Analysis data

That’s not a feature.

That’s a whole new value system.

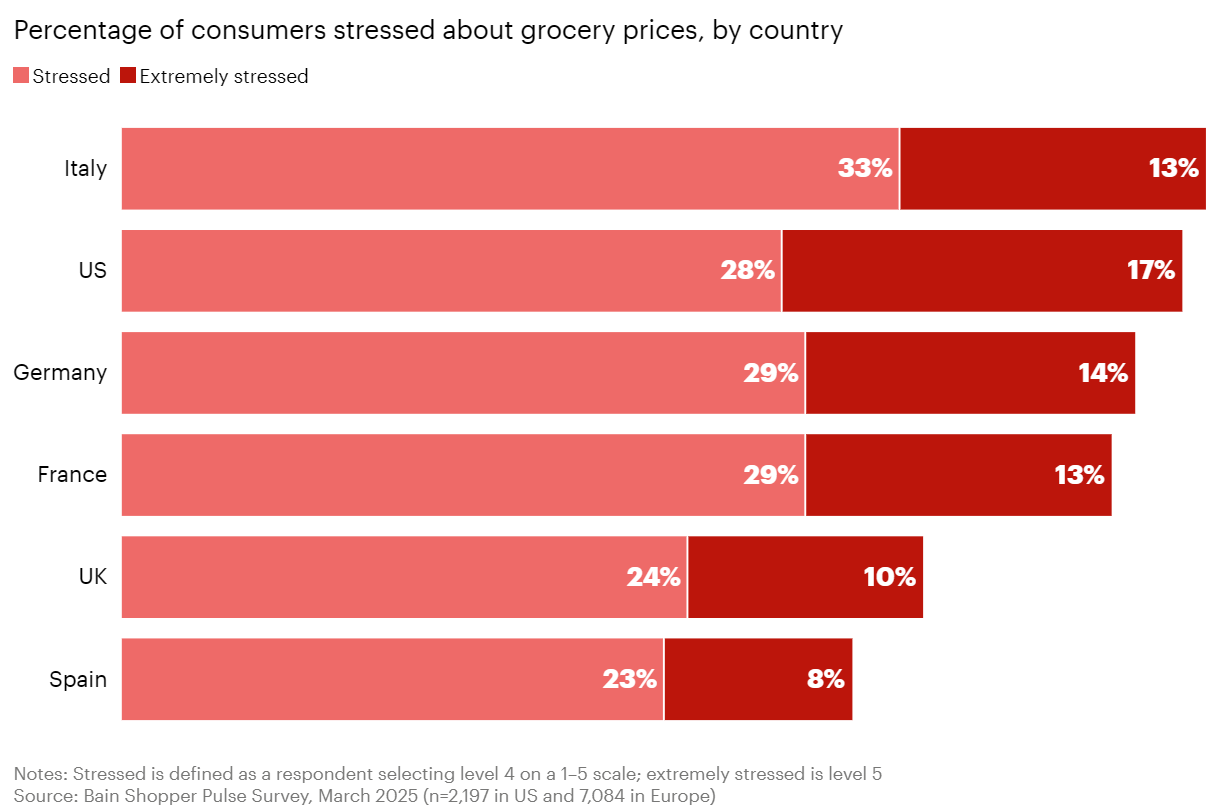

Where grocery price inflation is causing the most shopper stress, by country.

Bain & Company presents a global comparison of how much grocery prices are stressing consumers in the US and Europe, based on recent survey data. The chart highlights which countries feel the squeeze the most and offers insights into current retail sentiment. 👉 Bain & Company

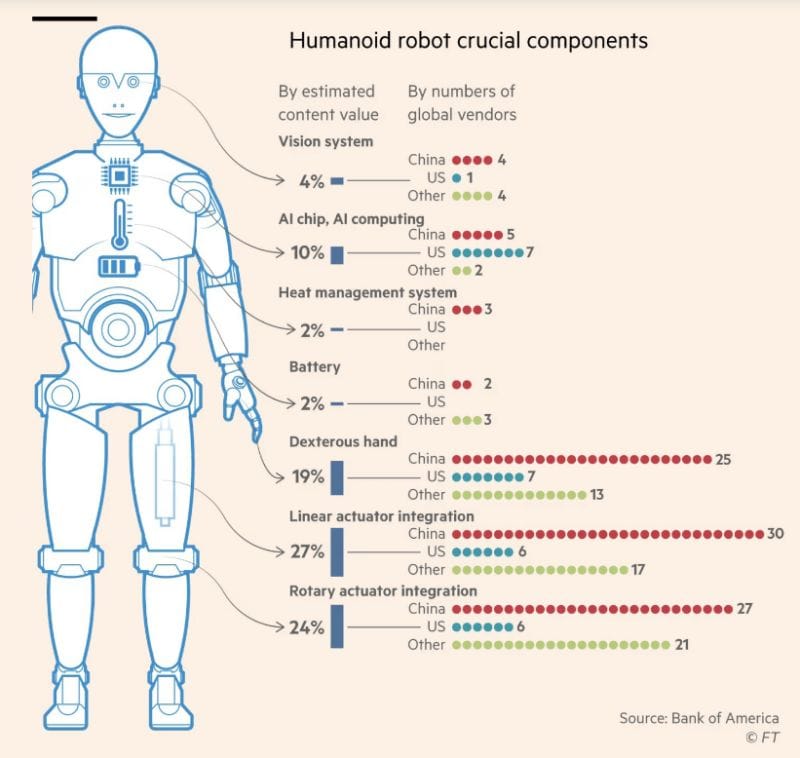

Who dominates the global humanoid robot supply chain?

The Financial Times, with data from Bank of America, maps out the vendors behind crucial components for humanoid robots and highlights China’s dominant position in several categories. This visual guide makes it clear who is leading the race to build the future of robotics. 👉 Financial Times / image

🚨 Want to become famous(er), grab more customers, and 100X your reach?

Stop burning budget on ads and hoping for clicks. Podcast listeners lean in, hang on every word, and buy from guests who deliver real value. But appearing on dozens of incredible podcasts overnight as a guest has been impossible to all but the most famous.

PodPitch.com is the NEW software that books you as a guest (over and over!) on the exact kind of podcasts you want to appear on – automatically.

⚡ Drop your LinkedIn URL into PodPitch.

🤖 Scans 4 Million Podcasts: PodPitch.com's engine crawls every active show to surface your perfect podcast matches in seconds.

🔄 Listens to them For You: PodPitch literally listens to podcasts for you to think about how to best get the host's attention for your targets.

📈 Writes Emails, Sends, And Follows Up Until Booked: PodPitch.com writes hyper-personalized pitches, sends them from your email address, and will keep following up until you're booked.

👉 Want to go on 7+ podcasts every month? Book a demo now and we'll show you what podcasts YOU can guest on ASAP:

🇺🇸 Amazon's AI Pause Ads Hit Prime Video. Amazon launched AI-powered pause ads and shoppable inventory on Prime Video, reaching 130M U.S. viewers monthly. These ads match on-screen content and let users buy products directly with real-time Amazon data. 👉 Deadline

🇺🇸 Microsoft Shuts Xandr DSP for AI Ads. Microsoft will close Xandr DSP by Feb 2026 to focus on AI-driven ad solutions, after buying it for $1B in 2021. A new chatbot-style ad-buying product is planned for March 2026, with layoffs hitting the ad tech team. 👉 Best Media Info

🇺🇸 Google Adds "Ads Funded By" Labels. Google will show “Ads funded by” labels in search results to clarify who pays for ads, starting soon. This move, spotted by ADSQUIRE’s CEO Anthony Higman, aims to build user trust with transparent ad funding. 👉 Search Engine Land

🇺🇸 Roblox Creators Sell Physical Goods. Roblox now lets creators sell physical products in games via Commerce APIs, with Twin Atlas earning six figures. Partnered with Shopify, 90% of orders are in-game, and Fenty launched a shoppable “Grape Splash” experience. 👉 TechCrunch

🇺🇸 Walmart Prepares for AI Shoppers. Walmart is gearing up for AI agents to shop for consumers, a trend also seen with Visa and PayPal. Analyst Jerry Sheldon calls it “inevitable,” signaling a major shift in how retail could work. 👉 Pymnts

🇨🇳 Alibaba Boosts Sales with AI Ads. Alibaba’s Q1 2025 sales hit $13.97B, up 9%, driven by AI-powered ads on Taobao and Tmall. Despite trade tensions, experts like Kai Wang see strong growth, predicting a big “618” shopping festival. 👉 CNBC

🇺🇸 Meta Targets $62B Retail Media Market. Meta is chasing $62B in retail media ad spend with new APIs and ad formats since 2021. Ads driving in-store and online sales have 21% higher returns, and Meta is partnering with retailers to share data. 👉 Adweek

🇳🇱 Channable Acquires Producthero to Boost Multichannel Sales. Channable, a Dutch firm, bought Producthero to create a one-stop platform for managing and advertising products across channels. This follows their 55M euro funding in 2022 and promises AI-driven features for retailers. 👉 Ecommerce News

🇫🇷 Mirakl-Storfund Partnership Speeds Up Marketplace Payments. Mirakl and Storfund’s Daily Advance lets sellers on 400+ marketplaces like Macy’s get paid upon shipping, not after 25 days. Storfund finances 11.2B in sales yearly, boosting cash flow for businesses. 👉 AFP

🇺🇸 eBay’s AI Tool Turns Images into Seller Videos. eBay’s new AI tool transforms product photos into social media videos for platforms like TikTok, no editing needed. It’s available in Seller Hub, helping US sellers boost marketing easily. 👉 ChannelX

🇺🇸 WooCommerce Names Square as Key POS Partner. WooCommerce, powering 4M+ stores, partners with Square to sync online and in-store sales across eight countries. This helps merchants manage inventory and customers seamlessly. 👉 PR Newswire

🇸🇪 Klarna Rehires Humans After AI Chatbot Struggles. Klarna’s AI handled 2.3M chats but faced quality issues, prompting the rehiring of human agents. CEO Sebastian Siemiatkowski emphasizes human support for better customer experience. 👉 Silicon Canals

🇺🇸 Miva 10.12 Adds AI Search and No-Code Tools. Miva’s new platform update includes AI-powered search and no-code design tools for easier store management. CEO Rick Wilson says it gives merchants “superpowers” without needing developers. 👉 PR Newswire

🇩🇪 Billie Brings B2B BNPL to Stripe in 10+ Countries. Billie’s Buy Now, Pay Later for B2B integrates with Stripe, letting merchants offer 30-day terms while getting paid upfront. It’s live in countries like Germany and France, reducing payment risks. 👉 The Paypers

🇬🇧 DHL eCommerce UK Merges with Evri to Boost Delivery. DHL Group acquires a stake in Evri, handling 1B parcels yearly. Martijn de Lange leads, aiming for faster, sustainable service. 👉 ChannelX

🇺🇸 Amazon Partners with FedEx for Delivery Support. Amazon’s February 2025 deal with FedEx fills UPS’s delivery cut by 2026. It saves costs and boosts large-item shipping with 6.3B parcels in 2024. 👉 Business Insider

🇪🇸 Bloq.it Funds Vinted’s Spain, Portugal Expansion. Bloq.it invests €2.5M for Vinted Go’s Madrid launch in May 2025. The move, led by Miha Jagodic, targets sustainable e-commerce growth. 👉 ChannelX

🇺🇸 US-China Tariff Pause Disrupts Supply Chains. A 90-day tariff cut to 30% causes chaos, with 50% more goods to Canada. Shipping costs may hit $7,500 per container, says Fraser Johnson. 👉 The Globe and Mail

❤️ Your Opinion matters!

Share your thoughts on today’s email with just 1 click in the poll—it’s quick and helps us improve.

What do you think of this issue?

For questions or more feedback, reply to this email.

Best,

MarketMaze team