🌀TODAY’S MAZE

Happy Sunday! When Amazon’s cloud went dark, half the internet froze. When China slowed, half the world held its breath. The future of global commerce runs on invisible wires — and both stories show how fragile those wires really are.

P.S. After weeks of testing, tweaking, and taking in your feedback, we’re almost there. MarketMaze will now land in your inbox every Sunday and Friday around noon (EU) or morning (US) — short, sharp, and loaded with insights for ecommerce execs, marketers, sellers, and agencies. Got thoughts? Hit reply.

Maze Focus🌀

☁️ When AWS Went Dark

🏮 China’s Two-Speed 2025

💎 Local Giants and Global Challengers

+

📰 General Ecommerce news from the last week you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

🌀 MAZE STORY

☁️ When AWS Went Dark

The Maze: One glitch in Amazon’s cloud froze the internet for hours. It exposed how fragile the digital world really is.

On October 20, 2025, Amazon Web Services suffered a massive outage in its US-EAST-1 region, disrupting apps like Coinbase, Signal, and Robinhood.

The issue started around 3:11 a.m. ET and lasted several hours, traced to a faulty internal DNS record that required manual repair.

More than 60 internal AWS services and major platforms such as Snapchat, Canva, and Fortnite went offline, hitting hundreds of millions of users.

Why it matters: When AWS sneezes, the internet catches a cold. One technical fault in Amazon’s backbone crippled everything from finance to gaming, reminding companies that multi-region and multi-cloud setups aren’t just best practice—they’re survival tools.

📣 FROM OUR PARTNERS

Most teams don’t need more calls, they need better recall. Fathom turns conversations into searchable notes: automatic recording and transcription, instant summaries and highlights, and one-click sharing that gets action items where work happens.

✔ Record and transcribe every call automatically

✔ Get instant summaries and highlight clips

✔ Works with Zoom, Microsoft Teams, and Google Meet

Let your meetings do the writing. You focus on decisions.

🌀 MAZE STORY

🏮 China’s Two-Speed 2025

The Maze: China’s economy is walking a tightrope between policy-fueled growth and structural slowdown. The numbers look stable, but the story underneath isn’t.

The IMF expects China’s GDP to grow 4.8% in 2025, down from 5.0% this year, with a further drop to 4.2% in 2026.

2 Chinese developers: Country Garden and Sunac are restructuring a combined $22B in offshore debt, as the property crisis drags into its fourth year.

September’s CPI fell 0.3% (mild deflation), while factory prices have been negative for almost three years, showing deep demand weakness.

Why it matters: China’s slowdown isn’t just a local problem. It pushes cheap exports into global markets, fueling deflation abroad and hurting margins everywhere. The government wants to pivot from real estate and investment to consumption, but confidence and jobs are too fragile to make it happen fast.

📣 FROM OUR PARTNERS

Ecommerce moves fast. You do not need more meetings. You need protected focus and smarter scheduling. Reclaim.ai auto-blocks tasks, habits, and 1:1s, finds time across teams, syncs every calendar, and reschedules when priorities change. Launch faster. Burn out less.

✔ Auto-schedule tasks before due dates

✔ Defend deep work with smart buffers

✔ Scheduling links that find time across time zones

✔ Sync Google and Outlook while keeping personal private

✔ Pull tasks from Asana, Jira, ClickUp, and Todoist

✔ Slack status, reminders, and real-time updates

Give your team back hours each week. Spend time on growth, not calendar Tetris.

💎 DATA TREASURE

🌏 Local Giants and Global Challengers

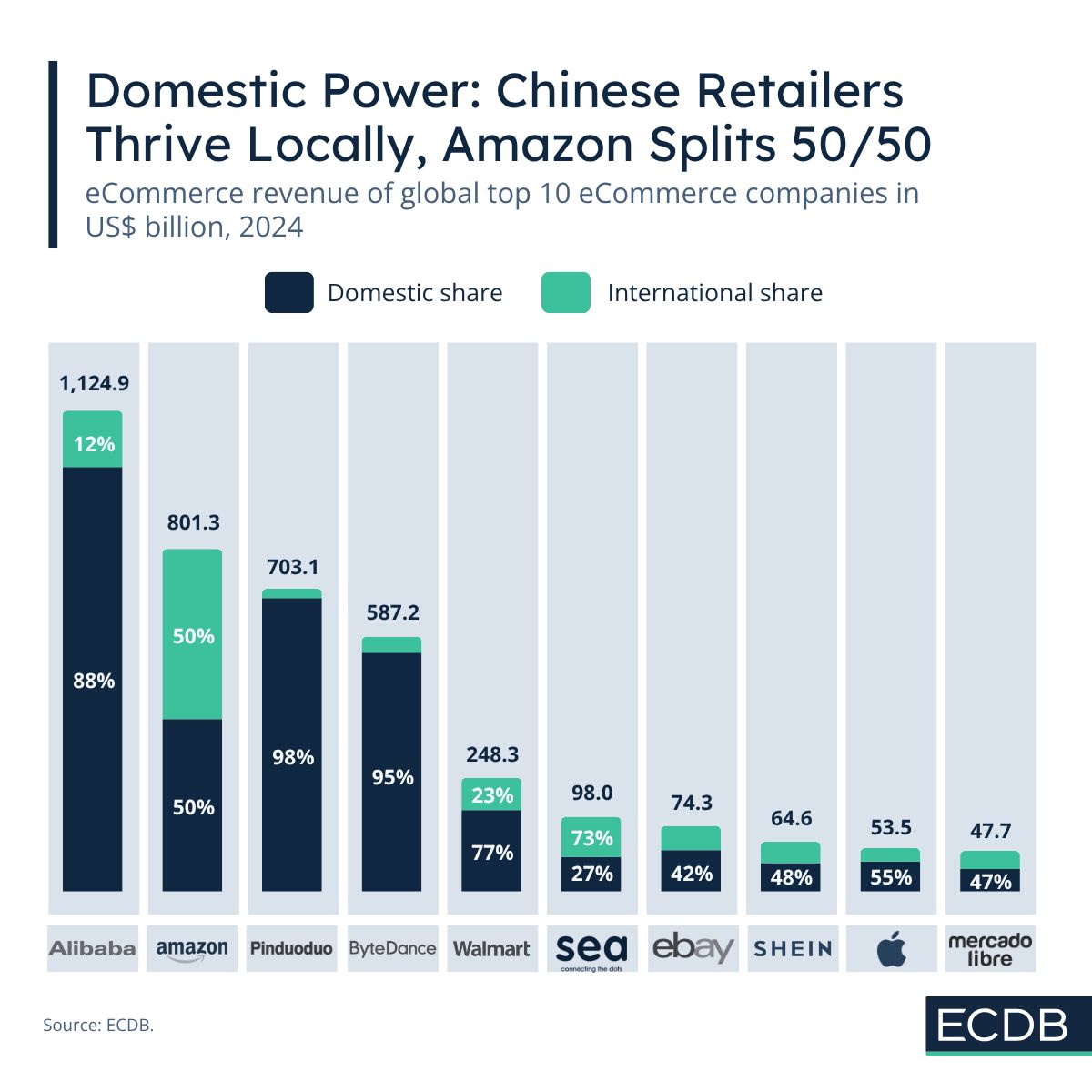

The Maze: The ECDB data shows a divided eCommerce world. Chinese players dominate domestically, while Western rivals chase cross-border scale.

Alibaba earns 88% of its eCommerce revenue in China, while Amazon splits 50/50 between local and global markets. The contrast defines global eCommerce strategy.

Sea Group and Shein earn over half abroad, while Walmart and PDD remain mostly domestic. Market size dictates expansion appetite.

Cross-border leaders rely on asset-light models and pricing flexibility, while domestic giants scale through logistics and loyalty ecosystems.

Why it matters: Expansion should fit market geometry, not ego. Balancing home strength with international reach preserves growth and margin.

📰 BRIEFING

🛒Last week in General Ecommerce/ Marketplaces

🇺🇸 Amazon adds AI buying explainer. Launched Oct 23, 2025, it gives one top pick with reasons in the U.S. app and web, powered by LLMs on AWS and tools like Bedrock, OpenSearch, and SageMaker.

🇨🇳 Alibaba unveils Quark AI Glasses. Priced at ¥4,699 with presales from Oct 24 and shipping in December in China, they add calls, music, live translation, and notes, pitched as a rival to Meta’s Ray-Ban line with Qwen models under the hood.

🇺🇸 Amazon targets wide warehouse automation. Internal plans point to avoiding about 600k hires by 2033 and ~160k by 2027, saving roughly $12.6B, while Amazon says the docs reflect one team and that seasonal hiring continues across operations.

🇵🇱 Empik lines up Warsaw IPO. Penta-backed retailer eyes about €200M in 2026, works with Morgan Stanley and Trigon, posts 2024 revenue near PLN 3.1B and core profit PLN 311M, and keeps options open on size and structure.

🇹🇭 Thailand online sales keep climbing. Shopee, Lazada, and TikTok drive 2024 to 2025 growth, with Thailand leading Southeast Asia and the region’s digital economy near $263B as live video and better logistics lift orders.

🇧🇷 MercadoLibre partners with Casas Bahia. From November 2025, Casas Bahia sells on MELI with big item delivery handled by the retailer, adding electronics and home goods while it restructures.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

🧠 RECOMMENDED NEWSLETTERS

Craving more sharp reads? Check out these MarketMaze-recommended newsletters.

THAT’S IT FOR TODAY!

Before you go we’d love to know what you thought of today's maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team