🌀TODAY’S MAZE

Happy Sunday! AI is moving from hype to payroll. Amazon is cutting humans to fund machines, and Allegro just made chat the new checkout. Regulators are circling fast-fashion giants while Meta, Pinterest, and Shopee race to own your shopping intent.

Maze Focus🌀

🇺🇸 Trade Truce Tango

🇨🇳 The Great Seller Audit

🤖 Allegro’s AI Leap

🛒 Amazon Owns Attention

+

Last week handpicked news you need to know

🛒 General Ecommerce

👗 Vertical Ecommerce

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

🌀 MAZE STORY

🇺🇸 Trade Truce Tango

The Maze: The US and China are dancing again, not fighting. Trump and Xi agreed on a framework to pause tariffs and ease rare-earth export limits. It’s a truce dressed as a deal—no one wins, but both get to look strong. TikTok’s fate, soybean sales, and critical minerals are the chips on this poker table.

In Busan on 30 Oct 2025, Trump and Xi are set to seal a plan halting the 100% tariff threat and reopening China’s soybean imports worth $6B a year.

Beijing will delay its rare-earth export restrictions for one year, giving the US time to diversify supply chains for tech and defense firms.

The TikTok deal gives US companies control of the algorithm and 6 of 7 board seats, a symbolic win before Trump’s re-election push.

Why it matters: The truce calms markets but doesn’t end rivalry. China still dominates 90% of rare-earths, and the US still wants to own the tech narrative. For ecommerce, this means fewer price shocks on electronics and devices—but the next tariff tweet could flip the script overnight.

📣 FROM OUR PARTNERS

Is Your PPC Strategy Leaving Money on the Table?

Digital marketing has changed. Is your strategy keeping up?

With Levanta’s Affiliate Ad Shift Calculator, you can learn how creator-driven affiliate programs stack up against traditional performance models, and how a small shift in budget can have major impact.

Input your monthly ad spend and Amazon monthly revenue to uncover where you’re leaving money on the table. Find out how much revenue you could reclaim by leveraging smarter, creator-led affiliate partnerships.

The calculator helps you estimate:

Potential revenue lift from creator-driven partnerships

ROI impact based on commission and conversion data

Efficiency gains compared to your current ad model

See how small changes could lead to massive increases in ROI, growth, and efficiency.

Run your numbers today to help future-proof your affiliate strategy in Q4 and beyond.

🌀 MAZE STORY

🇨🇳 The Great Seller Audit

The Maze: China just forced Amazon to hand over data on every Chinese seller. The first report landed Oct 31, 2025, giving Beijing full visibility into sales, revenue, and fees. The gold rush for cheap Chinese listings is ending, replaced by a tax audit waiting room that stretches back five years.

China’s new rule forces quarterly seller data reports from Amazon and others, covering identity, transaction count, and total revenue starting Q3 2025.

The law carries penalties up to RMB 500k ($70K) and can suspend platforms that don’t verify data.

U.S. scrapped the de minimis duty in August 2025, ending duty-free entry for goods under $800 — roughly 1.4 billion parcels in 2024 now face tariffs.

Why it matters: This isn’t just tax reform. It’s the end of margin arbitrage between East and West. Chinese exporters will shrink or consolidate, ad prices on Amazon may dip, and global e-commerce finally starts playing by one set of rules.

📣 FROM OUR PARTNERS

Ecommerce moves fast. You do not need more meetings. You need protected focus and smarter scheduling. Reclaim.ai auto-blocks tasks, habits, and 1:1s, finds time across teams, syncs every calendar, and reschedules when priorities change. Launch faster. Burn out less.

✔ Auto-schedule tasks before due dates

✔ Defend deep work with smart buffers

✔ Scheduling links that find time across time zones

✔ Sync Google and Outlook while keeping personal private

✔ Pull tasks from Asana, Jira, ClickUp, and Todoist

✔ Slack status, reminders, and real-time updates

Give your team back hours each week. Spend time on growth, not calendar Tetris.

💎 DATA TREASURE

🤖 Allegro’s AI Leap

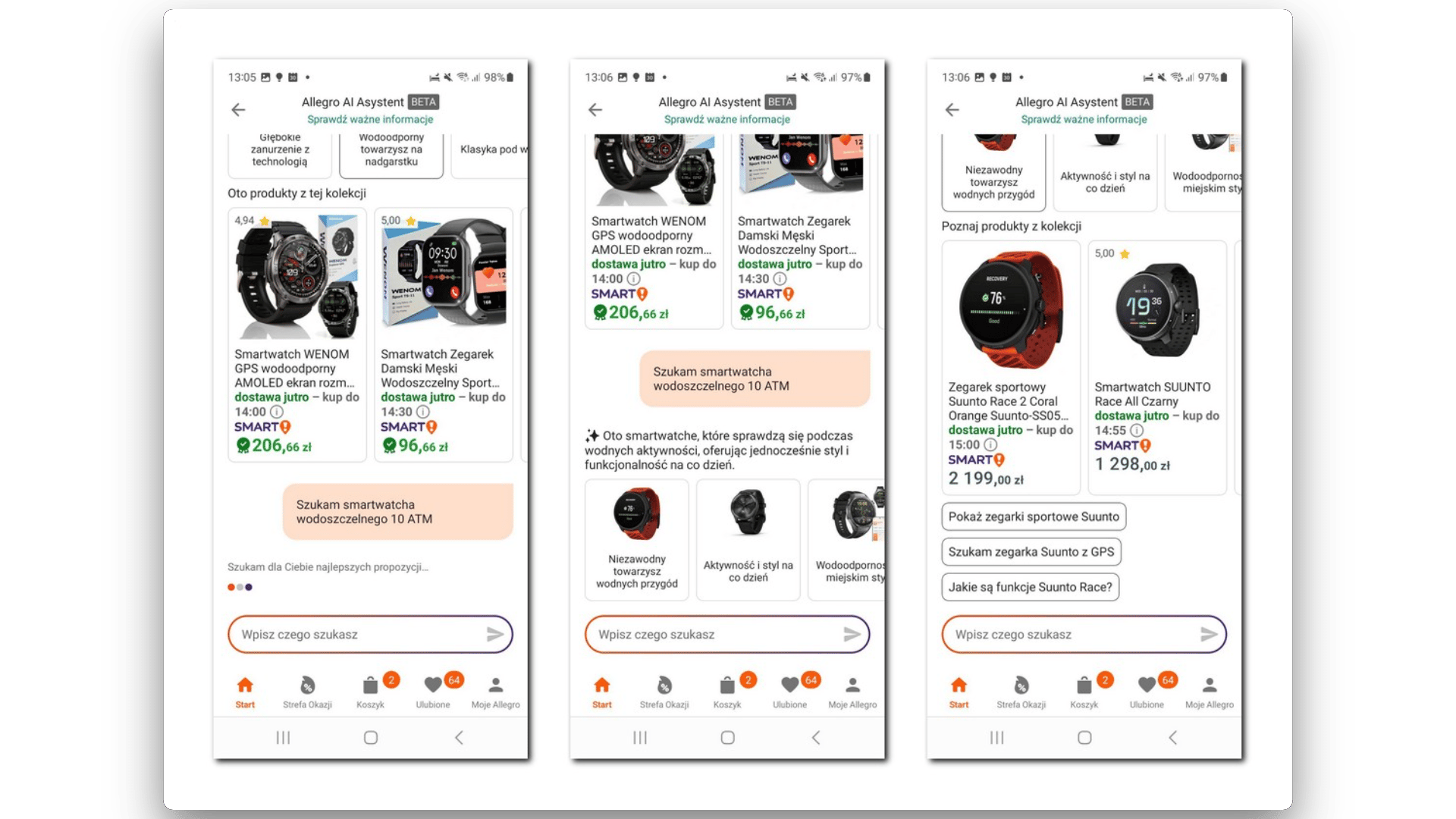

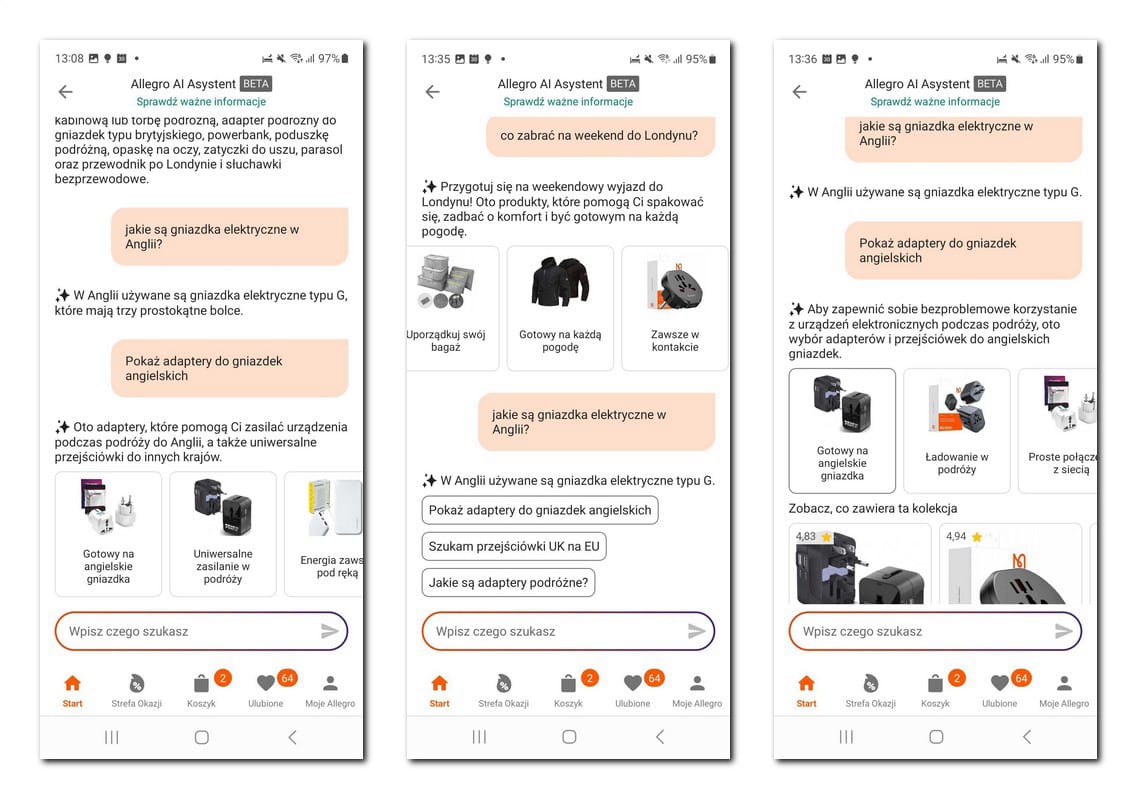

The Maze: Poland’s largest marketplace just launched its AI Shopping Assistant, turning search into conversation. It understands context, answers naturally, and helps users pick the right product faster. The pilot started in the mobile app in November, with a web rollout planned next. Allegro is quietly testing how far AI can replace filters with dialogue.

Source: Antyweb

The rollout: Early access is limited to selected users on mobile. The assistant can interpret queries like “a charger for iPhone 15 to use in the UK,” compare specs, and suggest verified offers. It also warns when data might be incomplete, keeping a human-in-the-loop for accuracy.

Source: Antyweb

The investment: Allegro allocates about €210–250 million this year for tech and logistics, including 2,500 new One Box lockers, expanding convenience for the AI’s promise of “fast and certain” delivery.

Leadership and scale: With Marcin Kuśmierz taking over as CEO in mid-2025, the company set a goal that 40% of all projects will include AI by 2026, embedding automation across search, ads, and logistics.

Why it matters: The AI agent race in retail is shifting from hype to product. Allegro joins Amazon’s Rufus and TikTok Shop’s recommendation engines in building digital concierges. The winners will be those who turn AI trust into conversion, making e-commerce feel less like scrolling and more like talking to a smart seller.

💎 DATA TREASURE

🛒 Amazon Owns Attention

The Maze: The web’s most valuable real estate is not Google or TikTok. It’s Amazon’s product pages. The company draws 2.7B visits a month, equal to the population of China and Europe combined. Temu is catching up fast with 1.6B, but clicks are not customers. Attention is abundant. Trust is scarce.

Amazon’s empire spans .com, .de, .co.jp, and .co.uk, each pulling 300–500M visits monthly, showing how localization compounds scale.

Temu’s rise is driven by subsidies and viral marketing, but repeat purchases remain below 25% in many Western markets.

Etsy and Rakuten show that community and culture still matter, proving there’s room for niche marketplaces in a platform world.

Why it matters: In e-commerce, distribution beats discovery. Sellers follow traffic, and traffic follows trust. The next big shift won’t be a new platform—it’ll be a new model of loyalty that blends low prices with reliable service. The web may be flat, but retail gravity still bends toward Amazon.

📰 BRIEFING

🛒Last week in General Ecommerce

🇺🇸 Amazon unveils Project Rainier AI cluster. Nearly 500k Trainium2 chips power Anthropic’s Claude; scale targets 1M chips by end-2025, adding multigigawatt capacity and pushing AWS custom silicon as capex and power buildouts accelerate.

🇬🇧 AliExpress launches UK price-match scheme. “Brand+” starts with ~1,500 SKUs and matches Amazon, Temu, Shein, and eBay to lift trust and conversion; early focus on electronics and lifestyle with on-platform verification and refund rules to curb abuse.

🇳🇱 Amazon to invest €1.4B in the Netherlands. Spend over three years boosts marketplace tools, logistics, and AI for SMBs; Amazon trails Bol.com locally and will watch hiring pace, capex mix, and regulatory scrutiny on marketplace fairness.

🇨🇳 Taobao to launch convenience store chain. Stores extend one-hour “instant retail” with 24/7 service and 30-minute delivery via Ele.me; expect dark-store roles, local SKU curation, and unit-economics tests versus Meituan and JD.

🇨🇳 Alibaba debuts consumer AI in Quark. Quark adds text/voice chat on Qwen3 and launches ¥4,699 AI glasses; push targets Singles’ Day lift and daily use, with retention and cross-sell into commerce as the key scorecard.

🇧🇪 Cainiao cancels Liège airport expansion. Two planned warehouses are scrapped amid political and environmental scrutiny; existing capacity and alternate hubs remain, but peak-season flexibility and routing options tighten.

🇺🇸 Etsy names Kruti Patel Goyal as CEO. She succeeds Josh Silverman as executive chair through 2026; Q3 showed revenue growth but falling GMS and users, putting focus on demand re-acceleration, search relevance, and take-rate discipline.

📰 BRIEFING

👗Last week in Vertical Ecommerce

🇫🇷 Shein Paris store faces backlash. Protests, petitions, and inspections meet the Rue de Rivoli plan as unions and designers question labor and environmental standards ahead of the brand’s European retail push.

🇪🇺 Shein removes unsafe items worldwide. EU tests flagged chemical non-compliance in children’s goods, triggering global delistings, recalls across several states, and fresh calls for stronger traceability and controls.

🇩🇪 Ceconomy Q4 mixed finish and outlook. Sales slipped as online grew and EBIT held, with guidance pointing to disciplined cash, retail media gains, and AI pricing as the group manages soft demand.

🇩🇪 Zalando appoints new CFO. Andrea Euenheim steps in to tighten costs, push automation, and support margin recovery after a period of flat GMV and rising fulfillment expenses.

🇵🇱 Vinted photo policy sparks debate. Allowing some nudity in listings raises safety concerns under the DSA as the marketplace weighs expression against stronger filters and identity checks.

🇸🇪 H&M to end virgin down by 2025. The retailer shifts to recycled and certified materials, linking animal welfare with emissions cuts and aligning with its 2030 sourcing goals.

🇺🇸 Etsy names Kruti Patel Goyal CEO. The Depop alum takes the helm to reignite growth through personalization and AI discovery while knitting Etsy and Depop seller ecosystems closer together.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

🧠 RECOMMENDED NEWSLETTERS

Craving more sharp reads? Check out these MarketMaze-recommended newsletters.

THAT’S IT FOR TODAY!

Before you go we’d love to know what you thought of today's maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team