Welcome to MarketMaze, the #1 newsletter for staying on top of the latest in Ecommerce & Marketplaces. Get all the insights you need in just 5 minutes!

🧠 Big Story:

Ad Truths of 2025 😂

📊 Key Data:

What Haunts Europe’s Brands at Amazon? 😱

📖 Ecommerce players news:

🇺🇸 Nike Returns to Amazon After Six-Year Break.

🇺🇸 Walmart Prepares for AI Shopping Agents.

🇪🇺 EU Plans 2 Euro Fee for Online Parcels.

🇫🇷 Shein Hires Ex-Politicians to Lobby.

🇺🇸 Amazon’s Grubhub Deal Boosts Prime Engagement.

🇧🇬 Bolt Launches Food Delivery in Bulgaria.

+ over 15 handpicked hot ecommerce news from the last week you need to know 🔥

Apologies for today’s late sendout—took a few days off, but we’re back and rolling! This issue lands today, and you can expect our regular update again on Wednesday.

On a brighter note, another post of ours crossed 100,000 views on LinkedIn ! 🚀 Big thanks for your support and engagement—it truly drives us to keep sharing the best e-commerce and marketplace insights.

As always, thanks for being with us—let’s dive in!

Ad Truths of 2025 😂

Wondering why your ads are skipped, your ROI is flat, and Gen Z barely notices your brand? Welcome to Ad Truths of 2025—where funny is king, video is the only language that matters, and Gen Z’s trust is hard-won. All insights below come from a May 2025 Adobe survey of 1,000 people in the UK and US, showing what really works in digital ads now.

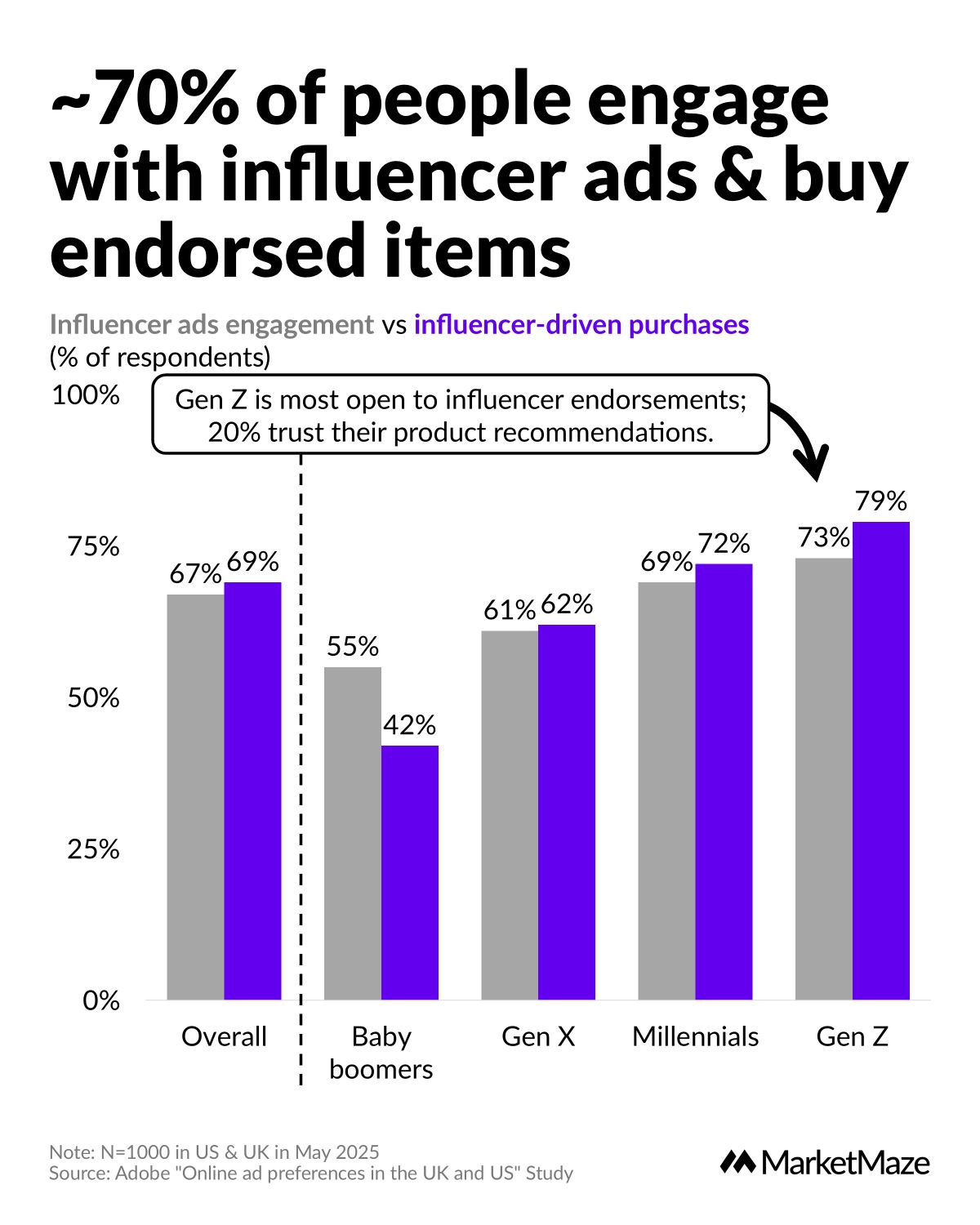

Gen Z leads influencer ad trust 🧢

Influencers move more than products—they drive buying. Nearly 70% of people engage with influencer ads and buy what’s endorsed. Gen Z leads: 79% buy influencer picks, 73% engage, and 20% trust those recommendations. Boomers lag way behind at just 42%.

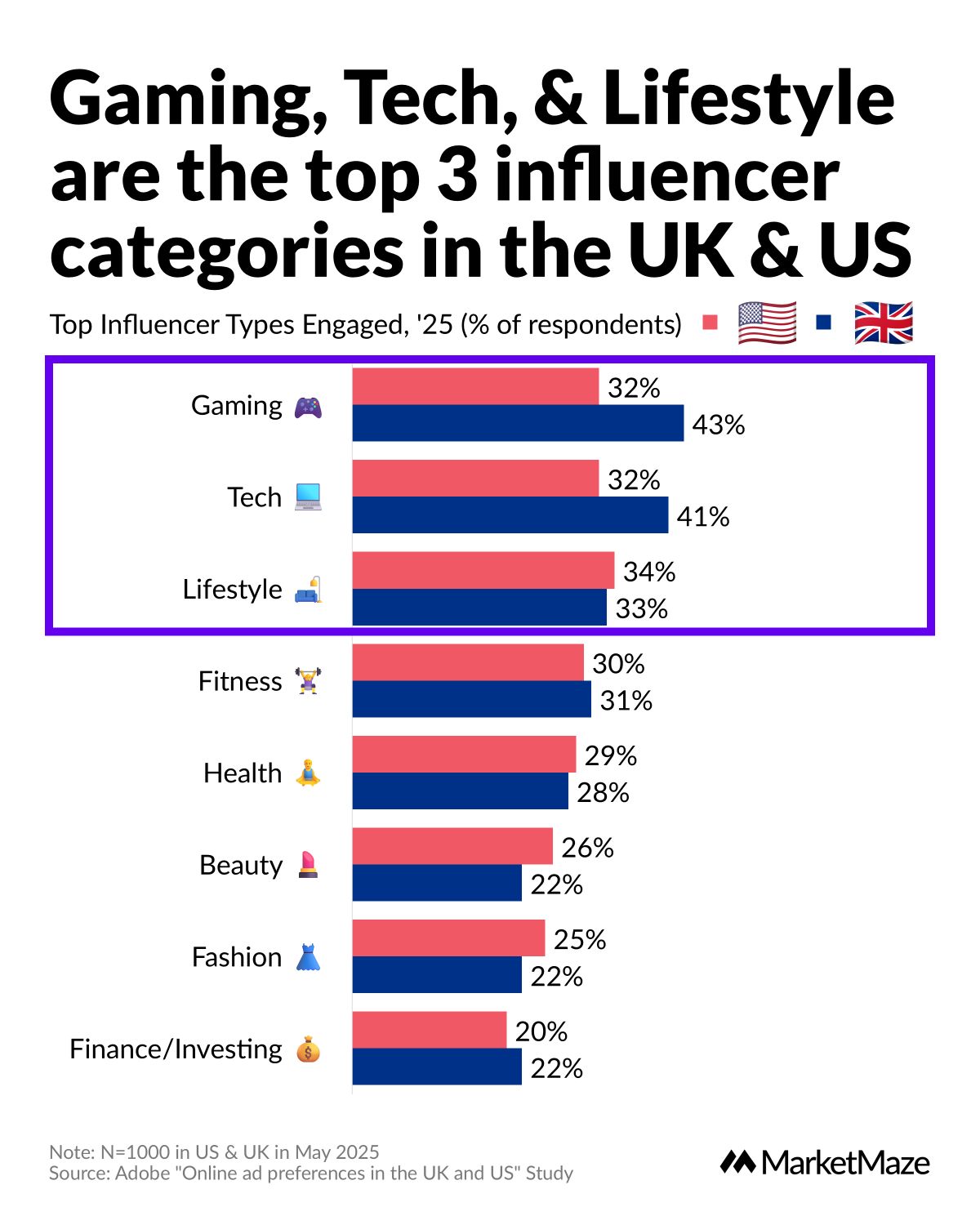

Gaming, tech, and lifestyle top charts 🎮

If you want attention, forget finance—focus on gaming, tech, and lifestyle influencers. In the UK, gaming rules (43%), then tech (41%) and lifestyle (33%). In the US, lifestyle leads (34%), with tech and gaming close behind. Fitness, beauty, and finance influencers barely make a dent—finance is last at just over 20%.

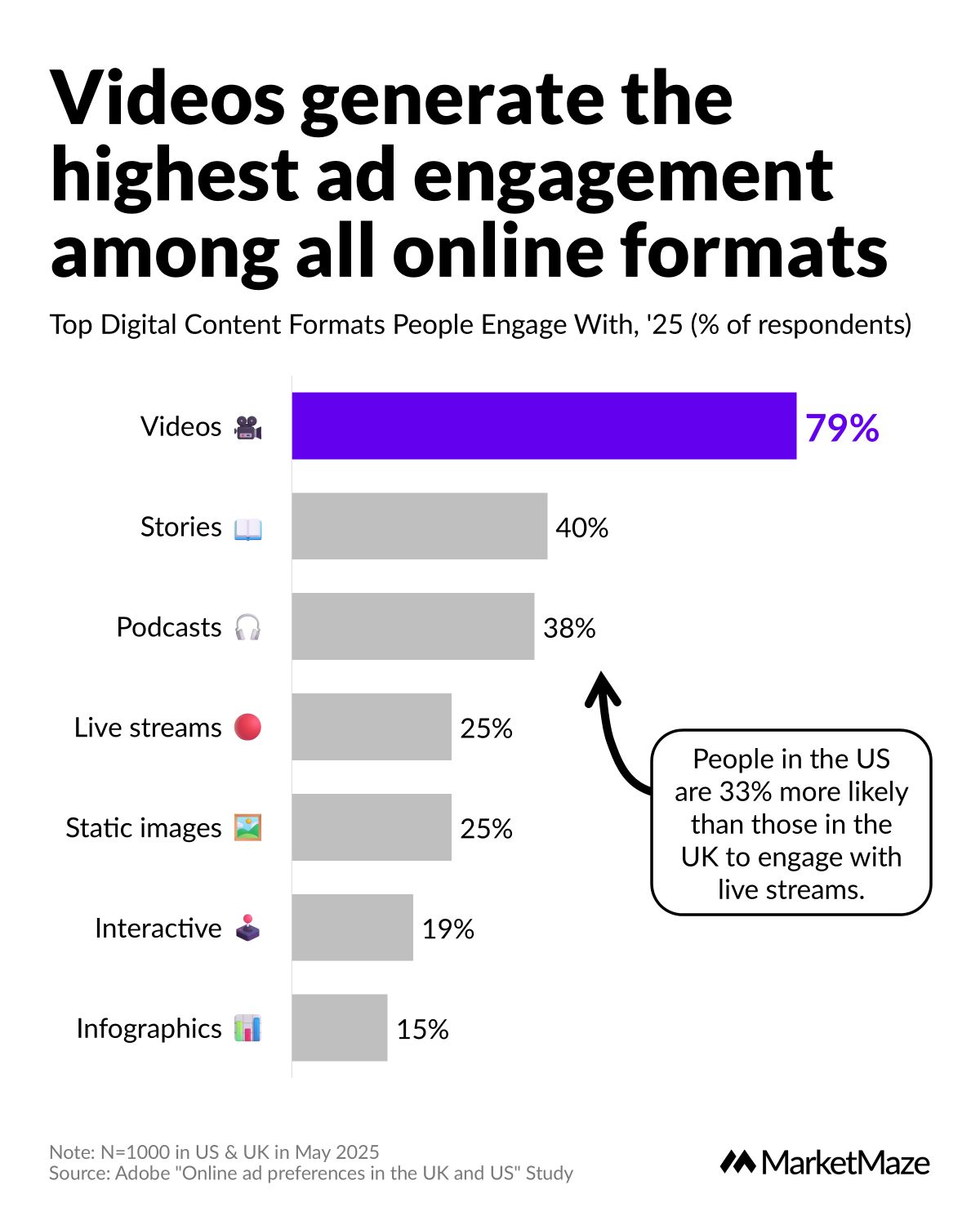

Video dominates online ad formats 📹

Static ads fade into the background—video wins every time. A huge 79% engage with video, far ahead of stories (40%) and podcasts (38%). Live streams and static images pull in just 25%. Americans are more likely to tune in live than Brits. Interactive formats and infographics? Practically ignored.

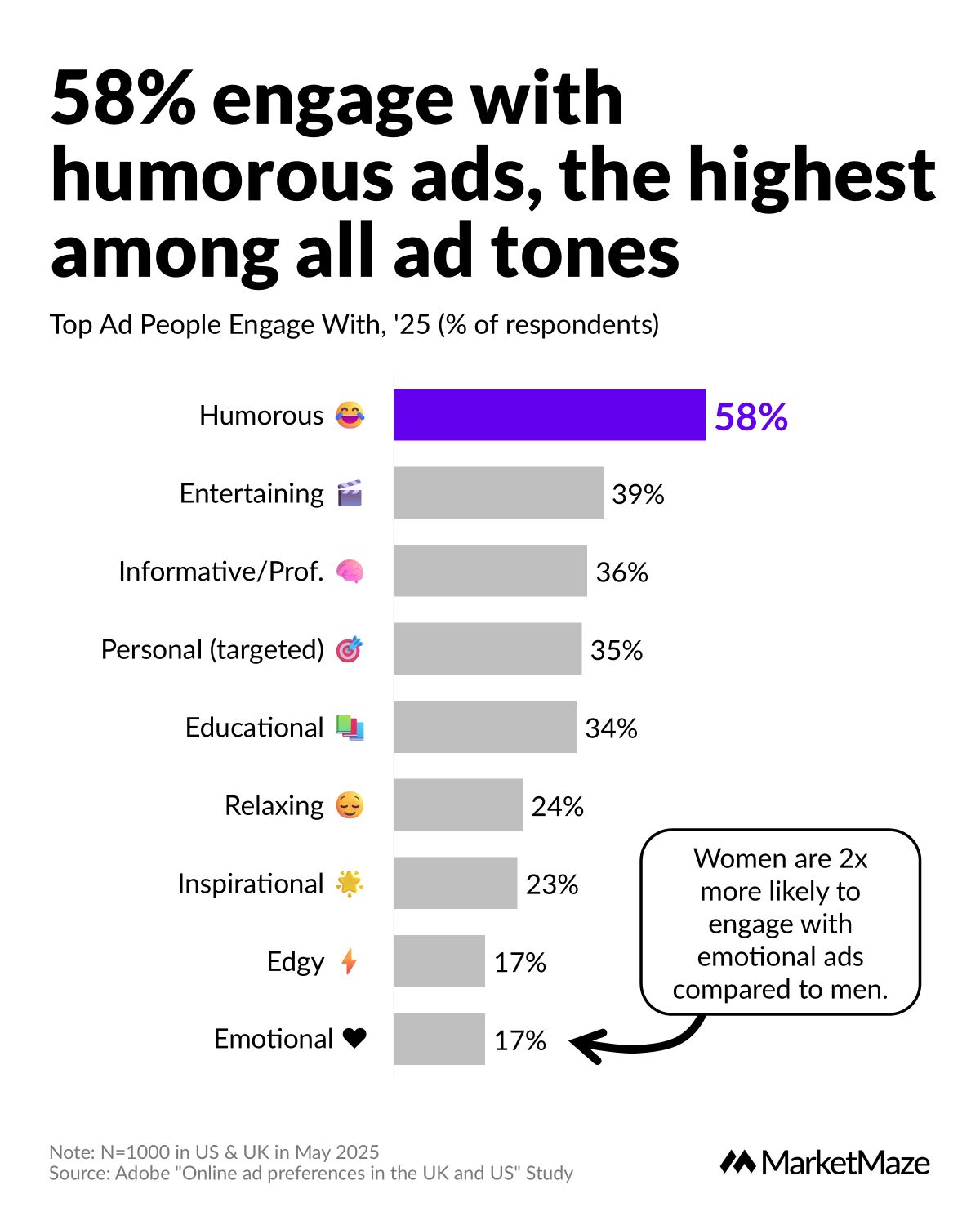

Humor wins the ad engagement game 😂

Want results? Make them laugh. Humor drives 58% of people to engage—well ahead of entertaining (39%) or informative (36%) ads. Emotional ads barely register at 17%, though women are twice as likely as men to respond. Men prefer straight facts, 32% more than women. Want to stand out? Go funny, not sappy.

100 Genius Side Hustle Ideas

Don't wait. Sign up for The Hustle to unlock our side hustle database. Unlike generic "start a blog" advice, we've curated 100 actual business ideas with real earning potential, startup costs, and time requirements. Join 1.5M professionals getting smarter about business daily and launch your next money-making venture.

What Haunts Europe’s Brands at Amazon? 😱

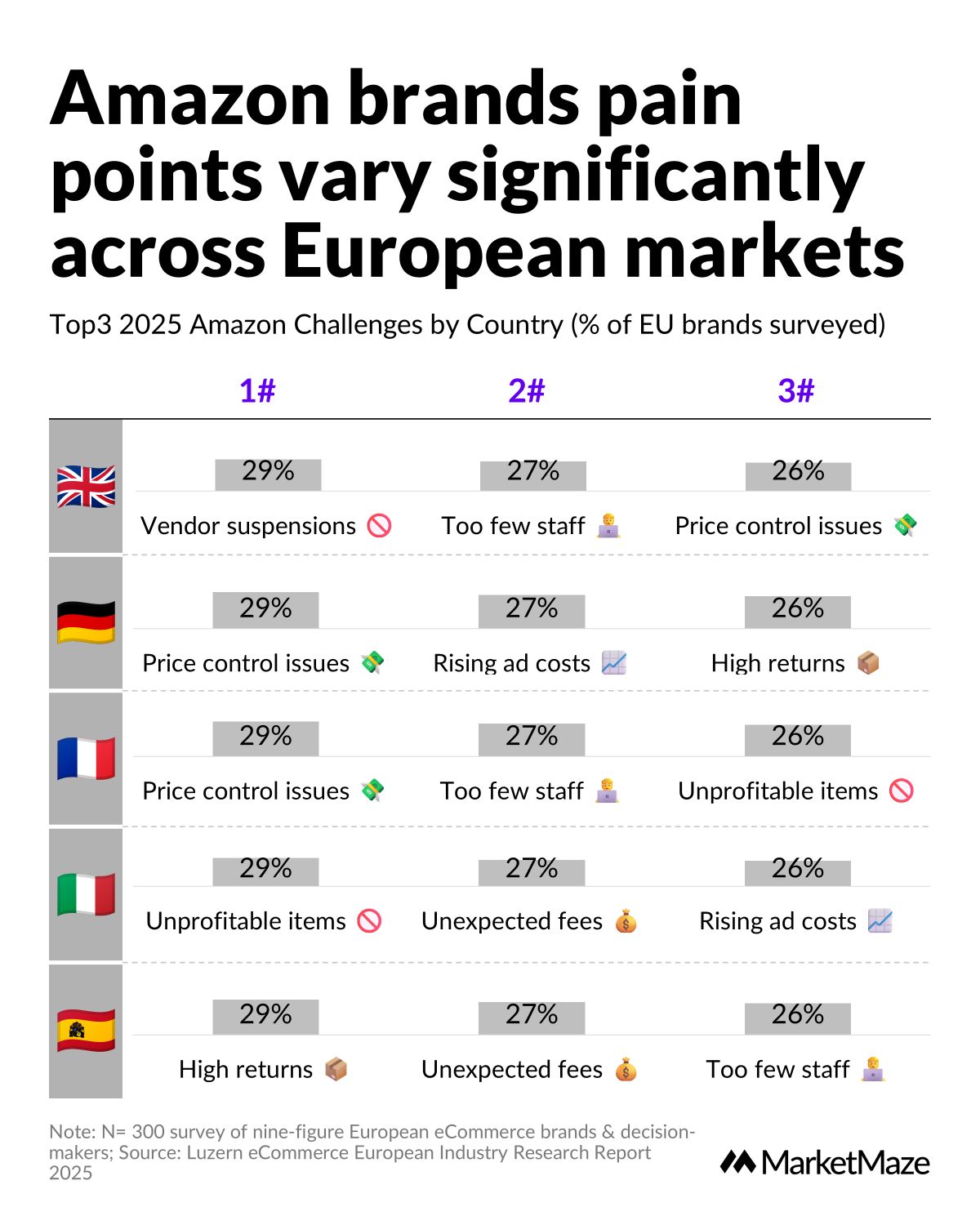

Luzern’s latest European eCommerce Industry Research Report 2025 makes one thing clear: Amazon is now a stress test, not just a sales channel. Winning takes more than presence—brands have to diversify, adapt, and stay sharp as challenges mount. Here’s what’s really keeping Europe’s eCommerce leaders up at night, straight from the data.

Channel Diversification & Agility: Top Priority 🌍

Seventy-nine percent of brands plan to expand beyond Amazon in 2025, eyeing platforms like Zalando, eBay, and Allegro for new customers and growth. The same share are adopting hybrid 1P/3P or managed 3P models to regain price control, ensure inventory, and spread risk. Channel mix is now non-negotiable.

Margin Pressure & Talent Gaps: Amazon Headaches 💸

Nearly 30% of brands are squeezed by non-stop price wars, while 27% admit their teams can’t keep up. Amazon’s cuts of unprofitable items, surging returns, and rising ad costs add even more pressure. The reality: brands must fight just to stand still.

No Two Countries, Same Pain

Each market brings its own Amazon nightmare. The UK faces vendor suspensions and staff shortages; Germany, price pressure and ad inflation. Surviving means adapting to every local battle.

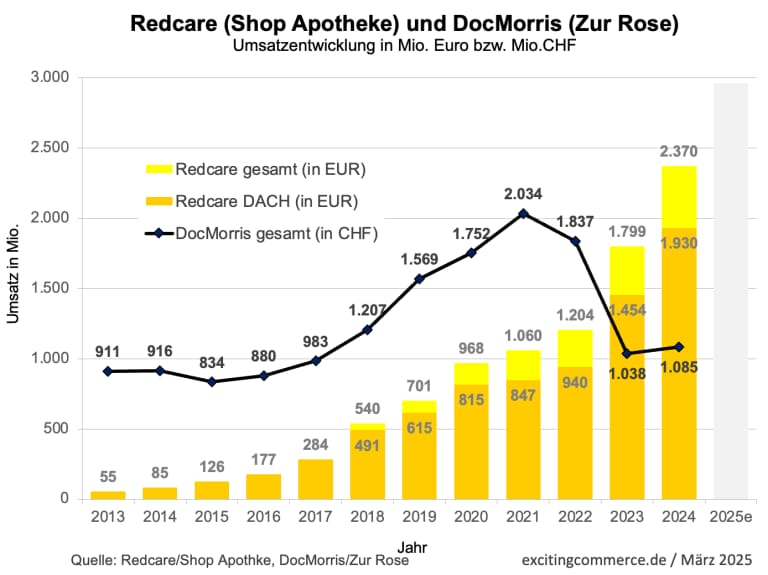

Poland’s Pelion Buys Big Stake in DocMorris—Shakes Up Online Pharmacy Sector.

*Sales Development in Million EUR and Million CHF

Pelion, Poland’s top healthcare company, has acquired nearly 10% of DocMorris. This move gives Pelion a strong foothold and signals growing cross-border ambitions in digital health. It marks a strategic shift for DocMorris as it seeks new partners amid fresh capital raising. 👉 excitingcommerce.de

Amazon Isn’t Winning Everywhere: Walmart and Local Giants Shake Up FMCG eCommerce.

Fernando Angulo highlights a global FMCG e-commerce ranking showing Walmart’s lead and Amazon’s limited dominance outside the US. The chart uncovers how top brands rely on different platforms and markets, with China and the UK as key battlegrounds. 👉 LinkedIn

How 15 Small Brands Achieved Remarkable Marketing Results

Stop believing you need a big budget to make an impact. Our latest collection highlights 15 small brands that transformed limited resources into significant market disruption through innovative thinking.

Case studies revealing ingenious approaches to common marketing challenges

Practical tactics that delivered 900%+ ROI with minimal investment

Strategic frameworks for amplifying your brand without amplifying your budget

These actionable insights can be implemented immediately, regardless of your team or budget size. See how small brands are making big waves in today's market.

🇺🇸 Nike Returns to Amazon After Six-Year Break. Nike resumes direct sales on Amazon, ending a 2019 halt due to counterfeits, with third-party restrictions by July 2025. Prices for items over $100 rise $2-$10 due to tariffs, led by CEO Elliott Hill. 👉 The Verge

🇺🇸 Walmart Prepares for AI Shopping Agents. Walmart explores marketing to AI agents that shop for consumers, shifting retail dynamics. CTO Hari Vasudev says advertising must evolve for this future. 👉 The Wall Street Journal

🇺🇸 Walmart’s AI Speeds Up Apparel Production. Walmart’s AI cuts apparel production from 6 months to 6-8 weeks, boosting brands like No Boundaries ($2B). SVP Jen Jackson Brown says it frees designers to create. 👉 Talk Business

🇺🇸 Walmart’s E-commerce Turns Profitable. Walmart’s online business hits profitability in Q1 2025 with 22% global growth, despite tariff-driven price hike risks. CEO Doug McMillon notes $165.6B revenue, slightly below estimates. 👉 Benzinga

🇺🇸 TikTok Shop Faces US Job Cuts. TikTok Shop’s US staff brace for layoffs as new head Mu Qing restructures for efficiency. Sales slumped due to tariffs, despite a $100M Black Friday 2023 peak. 👉 Tech in Asia

🇩🇪 Otto Group Swings Back to Profit. Otto Group posts €165M profit after a €426M loss, with Otto.de marketplace up 9% to €7B. CEO Petra Scharner-Wolff targets €10B GMV by 2030. 👉 Ecommerce News

🇬🇧 OnBuy Acquires Comet for Q4 2025 Relaunch. OnBuy buys Comet with a £10M investment to challenge Amazon in the £25B UK electronics market. CEO Cas Paton leverages OnBuy’s £150M 2024 sales for growth. 👉 ChannelX

🇪🇺 EU Plans 2 Euro Fee for Online Parcels. The EU proposes a 2 euro ($2.27) fee on low-value e-commerce packages to handle 4.6B parcels, mostly from China’s Shein and Temu. It aims to ensure safety but may raise retailer costs. 👉 Reuters

🇫🇷 Shein Hires Ex-Politicians to Lobby. Shein recruits former officials like Christophe Castaner to defend against labor and competition criticism. The move, including US hires like Cesar Conda, sparks debate over ethics. 👉 Le Monde

🇬🇧 Vinted Wins Best Retail App 2025. Vinted’s second-hand clothing app scores 4.86/5, beating Amazon and ASOS for its eco-friendly focus. It leads in customer satisfaction, showing the rise of sustainable shopping. 👉 Retail Times

🇮🇳 Amazon Rebrands GenZ Platform as Serve. Amazon’s fashion platform for GenZ, now called Serve, sees 3x more young customers and 4x growth in smaller cities. It offers 350+ brands with monthly trend updates. 👉 Startup News

🇺🇸 Lowe’s Expands Marketplace with Mirakl. Lowe’s partners with Mirakl to grow its online marketplace, adding furniture and tools, with $20.93B in Q1 FY25 sales. An AI customer service tool boosts its Total Home Strategy. 👉 Retail Insight Network

🇺🇸 Glance Launches AI Fashion Shopping App. Glance AI uses selfies to suggest outfits, with 1.5M users and 40M style requests in US trials. It’s on Google Play and Apple App Store, expanding to beauty and travel. 👉 Apparel Resources

🇸🇬 Myntra Launches Global in Singapore. Myntra targets Singapore’s 650,000 Indian diaspora with 35,000 styles from 100 Indian brands. It sees 30,000 monthly visitors and aims for 12–15% market reach. 👉 MarketTech APAC

🇺🇸 IKEA Boosts Loyalty Program Rewards. IKEA U.S. updates its loyalty program, letting members earn points for events (50 points) or registries (10 points). Nicole King says it adds value for engaged customers. 👉 Retail TouchPoints

🇺🇸 Amazon’s Grubhub Deal Boosts Prime Engagement. Over 90% of orders are from Prime members, with Grubhub+ signups up 50%+. Saves $300/year on fees; Amazon plans Alexa+ food delivery in 2025. 👉 Fast Company

🇧🇬 Bolt Launches Food Delivery in Bulgaria. Bolt Food hit Sofia, part of Bolt’s 600+ city network. With 6M+ users and 30K+ restaurants globally, it’s taking on Glovo in Bulgaria. 👉 SeeNews

🇪🇸 Glovo, Finmid Offer Loans to Small Businesses. Glovo and finmid give 24-hour loans in Spain, Portugal, Poland. Laura from Art Na Brasa says it’s “quick”; funds aid equipment, marketing. 👉 Retail Tech Innovation Hub

🇺🇸 DoorDash Ends AI Voice-Ordering Product. DoorDash axes AI voice-ordering after a 1-year trial ending April 2025. Hired AI talent but shifted focus, says spokesperson. 👉 Bloomberg

❤️ Your Opinion matters!

Share your thoughts on today’s email with just 1 click in the poll—it’s quick and helps us improve.

What do you think of this issue?

For questions or more feedback, reply to this email.

Best,

MarketMaze team