Welcome to MarketMaze, the #1 newsletter for staying on top of the latest in Ecommerce & Marketplaces. Get all the insights you need in just 5 minutes!

🧠 Big Story:

12 Months of Google’s AI Overviews📖

📊 Key Data:

Ecommerce Product Mix

📖 Ecommerce ecosystem news:

🇺🇸 YouTube’s Shoppable TV Ads Boost E-Commerce.

🇺🇸 Meta Tests AI Ad Tools for Advertisers.

🇺🇸 Google Unveils AI Shopping Tools at I/O 2025.

🇨🇦 Shopify’s AI Store Builder Simplifies E-Commerce.

🇦🇺 UK Court Halts InPost’s £106M Yodel Buyout.

🇺🇸 Stord Acquires Ware2Go from UPS to Boost Logistics.

+ over 15 handpicked hot ecommerce news from the last week you need to know 🔥

12 Months of Google’s AI Overviews📖

Twelve months ago, Google dropped AI Overviews into search, rewriting the rules for every marketer, publisher, and brand. This isn’t just a product update—it’s a seismic shift. The new BrightEdge report lays it out: if you’re still chasing blue links and clicks, you’re missing the plot. Here’s what’s really happened since AI took over the world’s biggest discovery engine—and why it’s time to rethink how you show up in search.

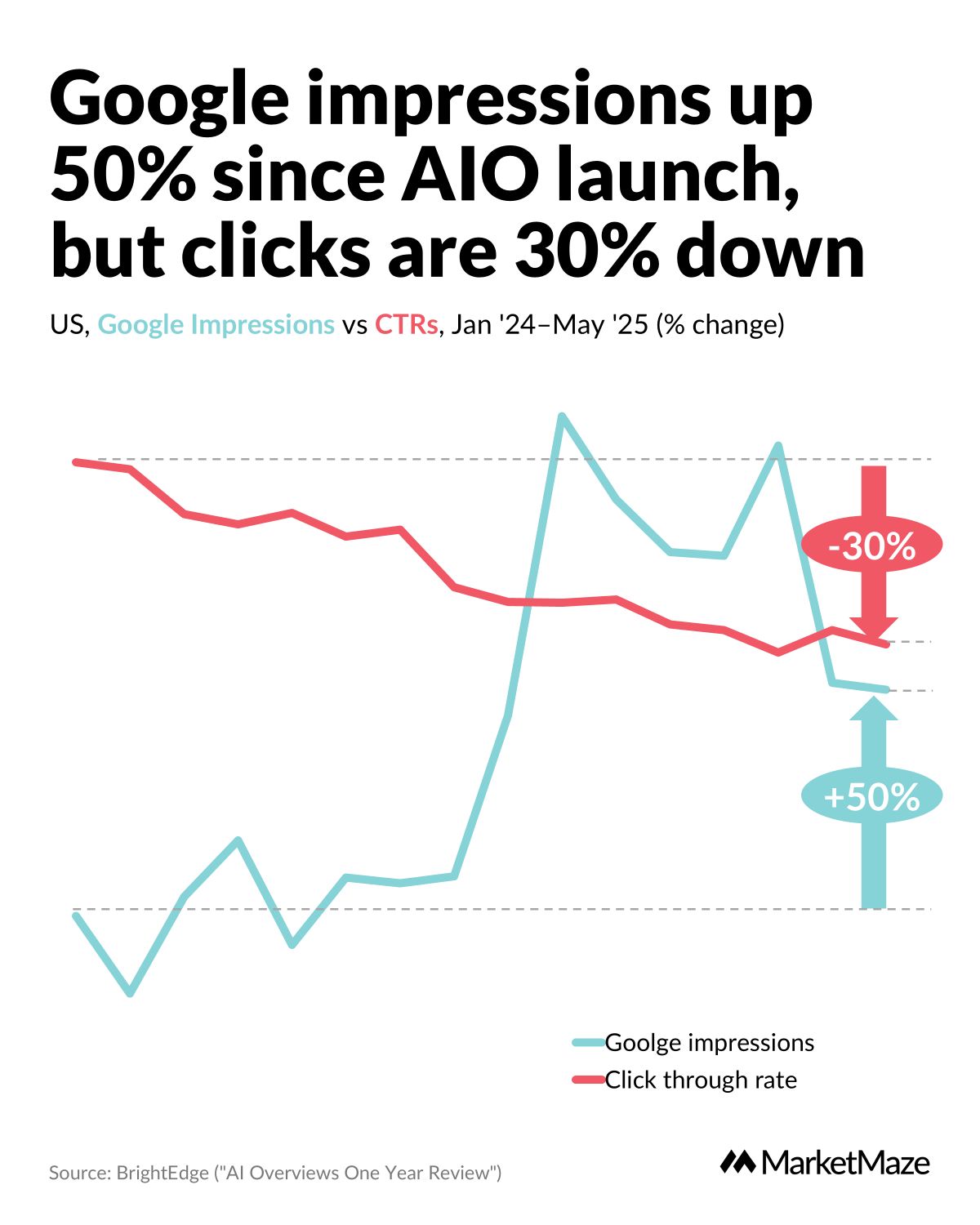

Google search booms, but clicks disappear 📉

Since AI Overviews hit the scene, Google search impressions have exploded—up 50% in a year. But don’t celebrate yet: click-through rates have crashed by 30%. More people are searching, but fewer are visiting sites. The result? The funnel is bigger, but most journeys end on Google, not your homepage.

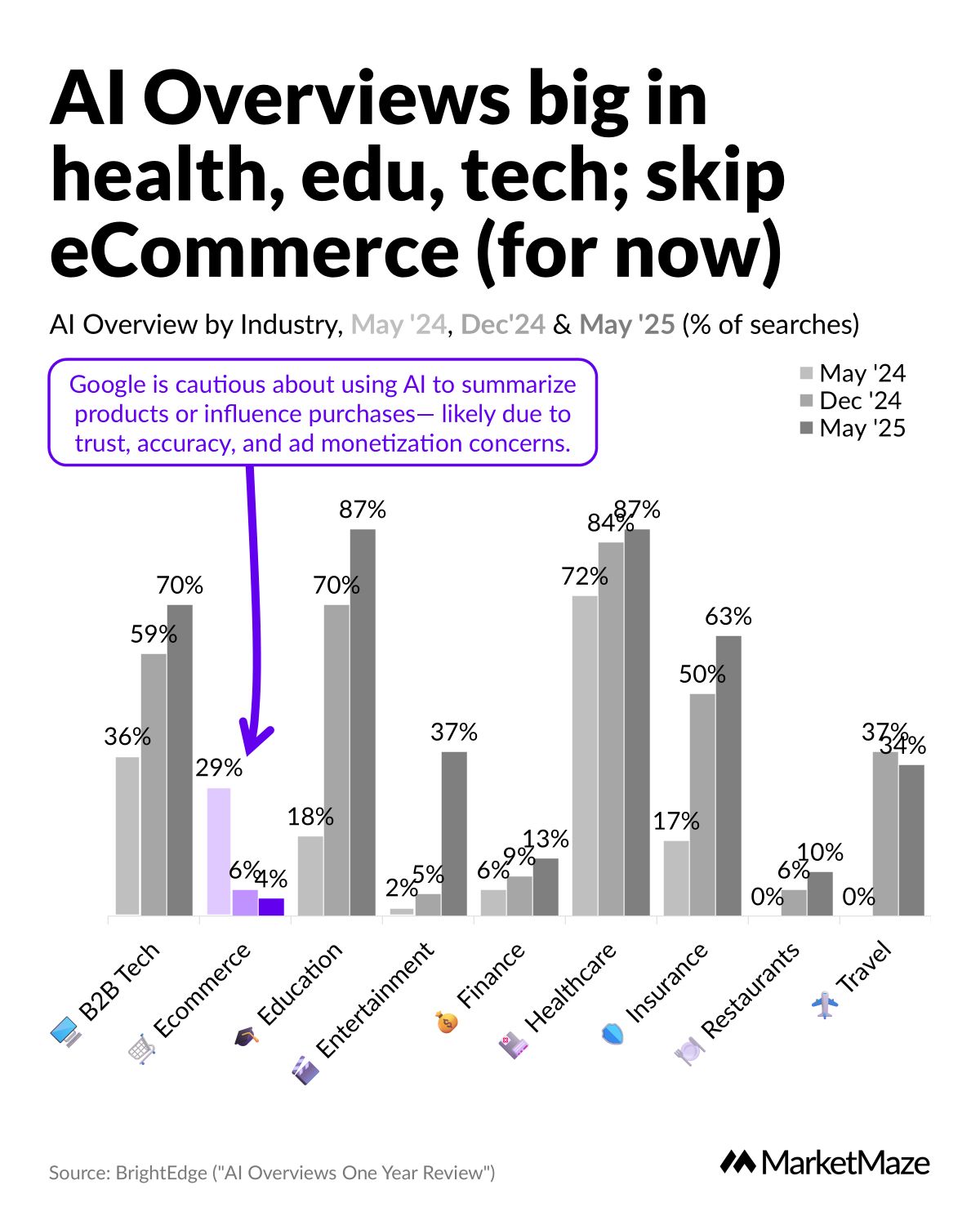

AI Overviews take over health, education, and tech 🏥

Google’s AI Overviews have gone all-in where facts matter most. By May 2025, nearly 90% of searches in healthcare, education, and B2B tech feature AI-generated summaries. E-commerce? Skipped—coverage plummeted from 29% to 4%, as Google tiptoes around product recommendations and ad dollars.

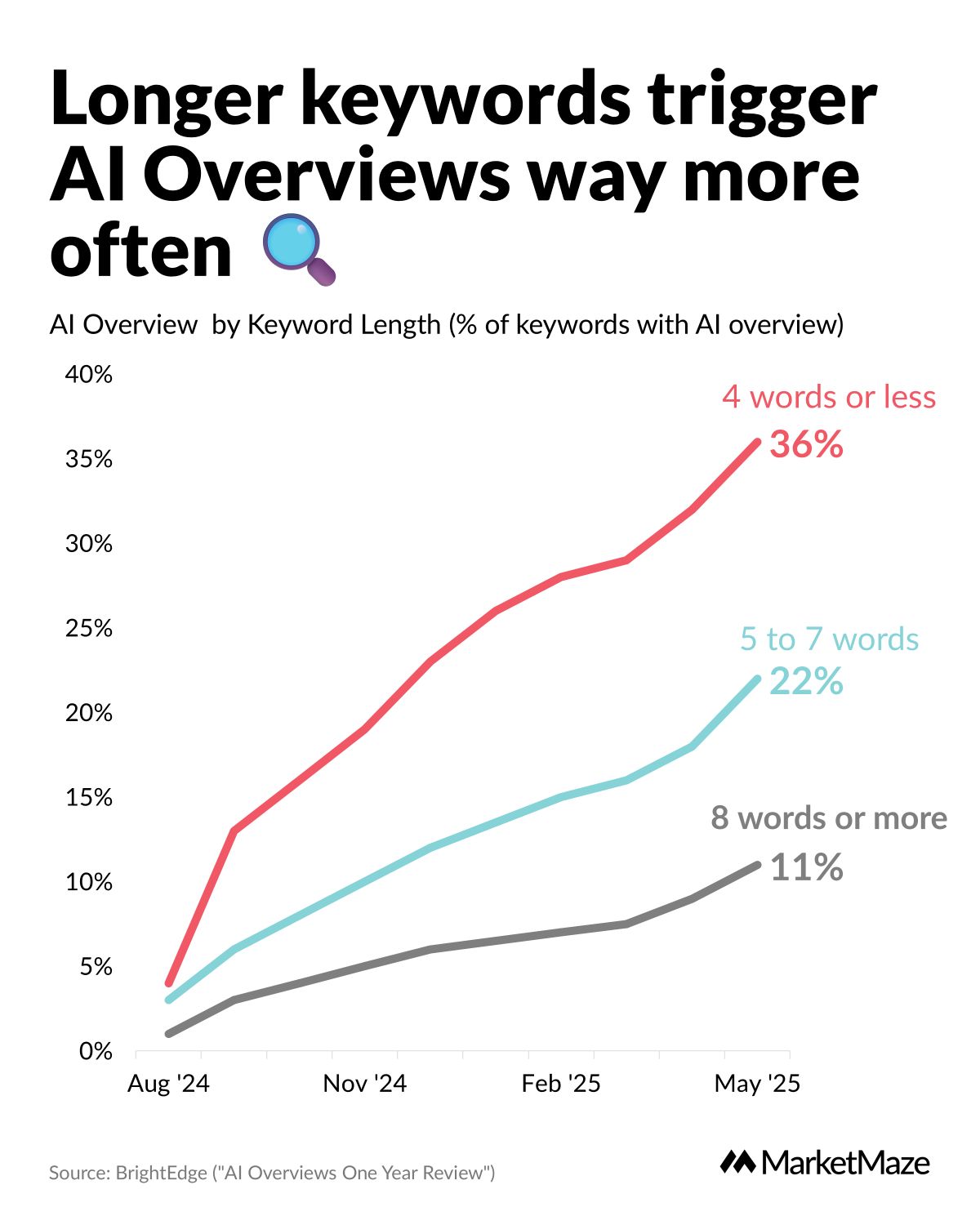

Long, complex queries unlock more AI answers 🔍

Welcome to the era of the wordy search. There’s been a 7x increase in queries with eight or more words. Google’s AI thrives on specifics: the longer and more detailed your question, the more likely you’ll see an AI-powered answer.

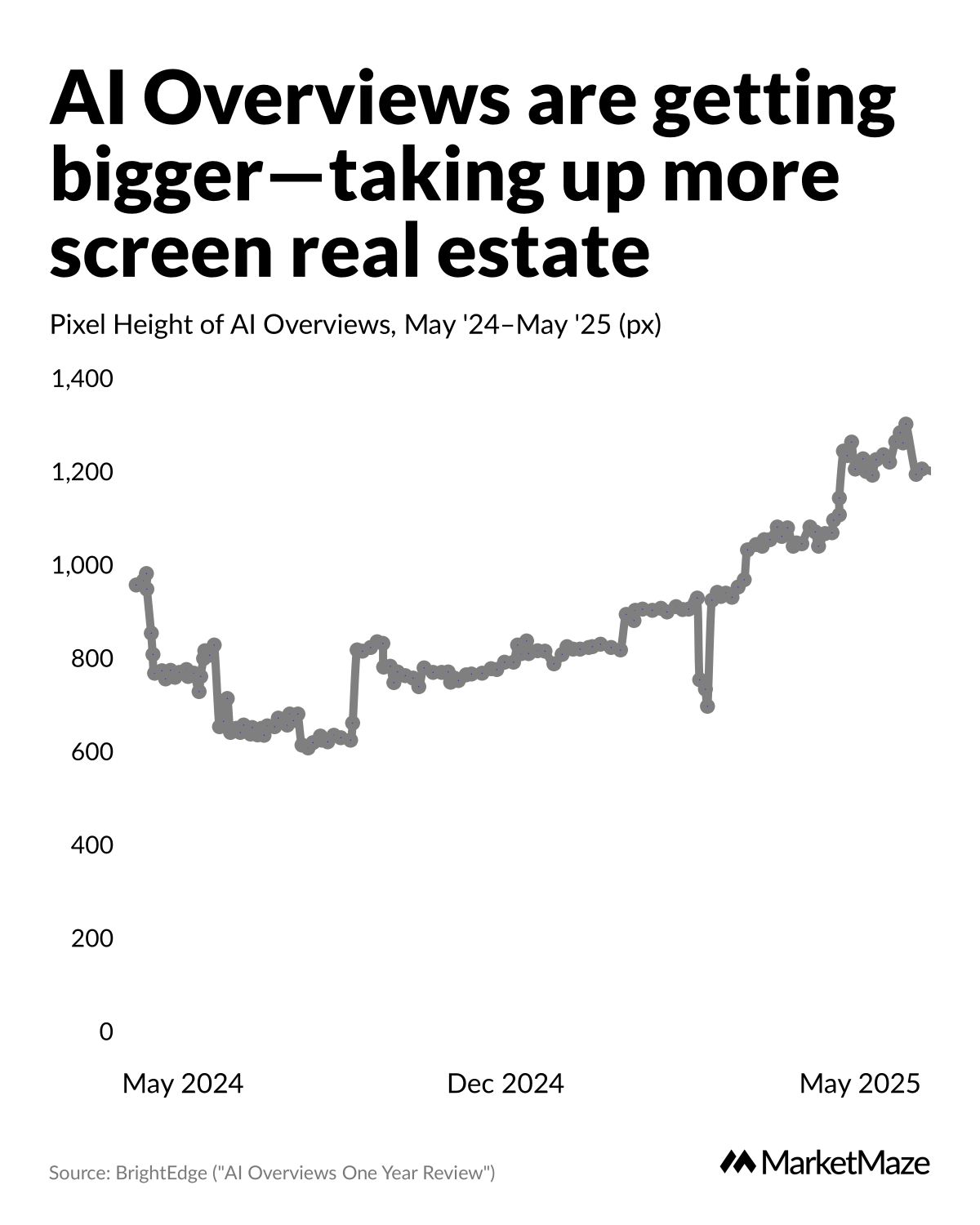

AI Overviews dominate your screen real estate 🖥️

Google’s AI Overviews have gone supersized. Now regularly topping 1,000 pixels, these summaries push traditional search results far below the fold, especially for medical, financial, and how-to queries. It’s a 40% jump in size since last summer, filled with lists, carousels, and multi-paragraph deep dives. Even a #1 organic rank can get buried. For brands, the new battle is winning real estate inside the AI box—or risk being invisible.

Start learning AI in 2025

Keeping up with AI is hard – we get it!

That’s why over 1M professionals read Superhuman AI to stay ahead.

Get daily AI news, tools, and tutorials

Learn new AI skills you can use at work in 3 mins a day

Become 10X more productive

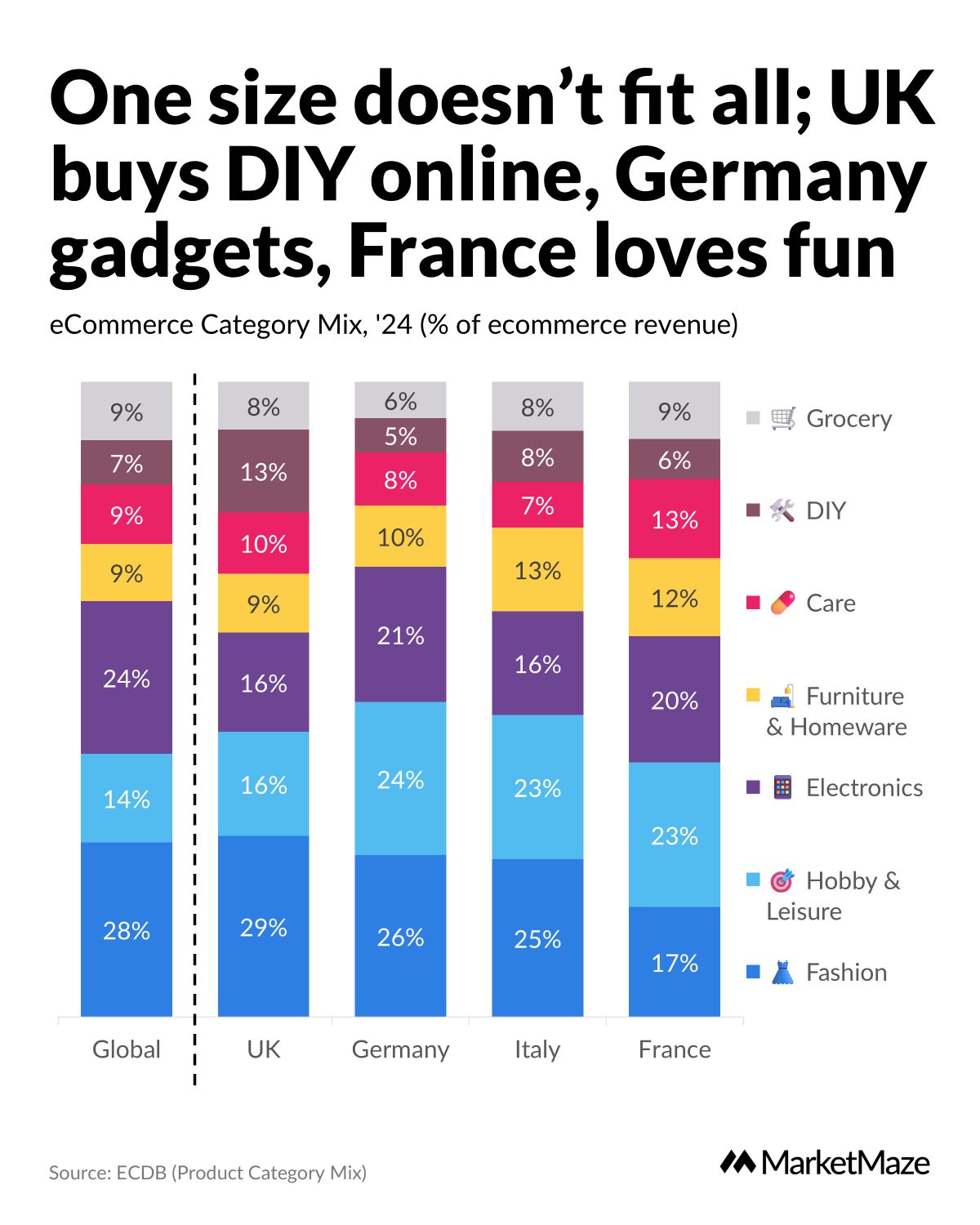

Ecommerce Product Mix

Where eCommerce categories win (and where they don’t)

(This one’s for the eCom strategists and curious shoppers)

Globally, Fashion dominates eCommerce—27.5% of revenue.

But Europe? A whole different story:

📍 UK

Fashion leads (28.5%)

DIY punches above its weight (13.0%)

📍 Germany

Fashion is top (25.5%)

But Electronics & Hobby & Leisure are huge too

📍 Italy

Fashion leads (24.8%)

Furniture & Homeware shines (13.2%)

📍 France

Only country where Fashion isn’t #1

Hobby & Leisure takes the crown (22.8%)

So why Fashion?

✔️ Easy to ship

✔️ Big marketing push

✔️ Tech (like virtual try-ons) helps

Electronics? Globally big—but not everywhere.

Germany loves it. UK, Italy, France... not as much.

And Grocery?

Fast-growing globally—but still underperforms in Europe.

👀 The lesson?

eCommerce success = understanding local habits

Not just selling a trending product.

The Marketplace⚡Mastery Hacks Bible

8 powerful Amazon growth hacks from top experts like Jon Elder, Max Sigurdson-Scott, Max Sinclair, Elizabeth Greene, Kristina Mertens, Danielle Zalniker and more. These are real, actionable tips Jordi Ordonez have gathered into a 20-page doc. No BS, just high-leverage tactics that work. 👉 Marketplace⚡Mastery

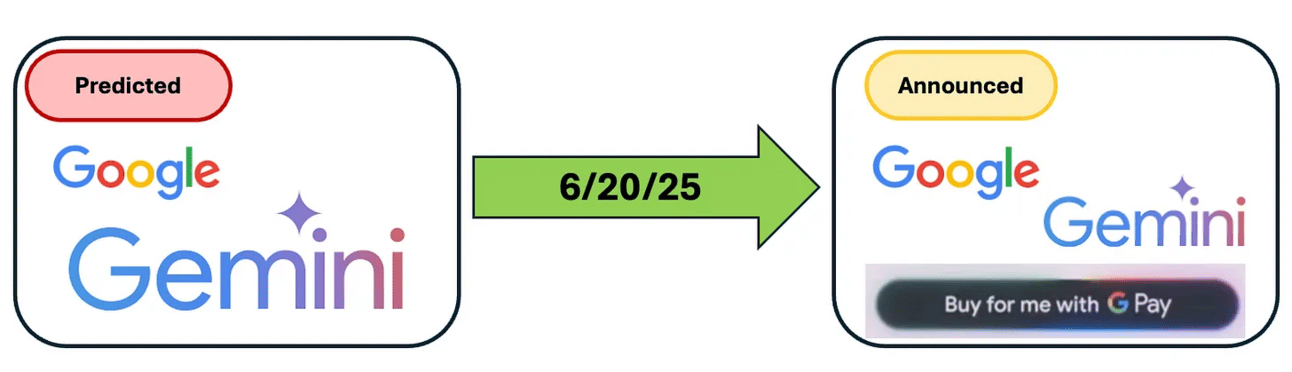

Google’s Shopping Agent: Looks Great, But What’s Under the Hood?.

RetailGentic explores Google Gemini’s evolution into an AI-powered shopping assistant, comparing predicted features to what was actually launched. The piece breaks down Google’s integration with GPay and what it means for the future of online shopping. 👉 RetailGentic

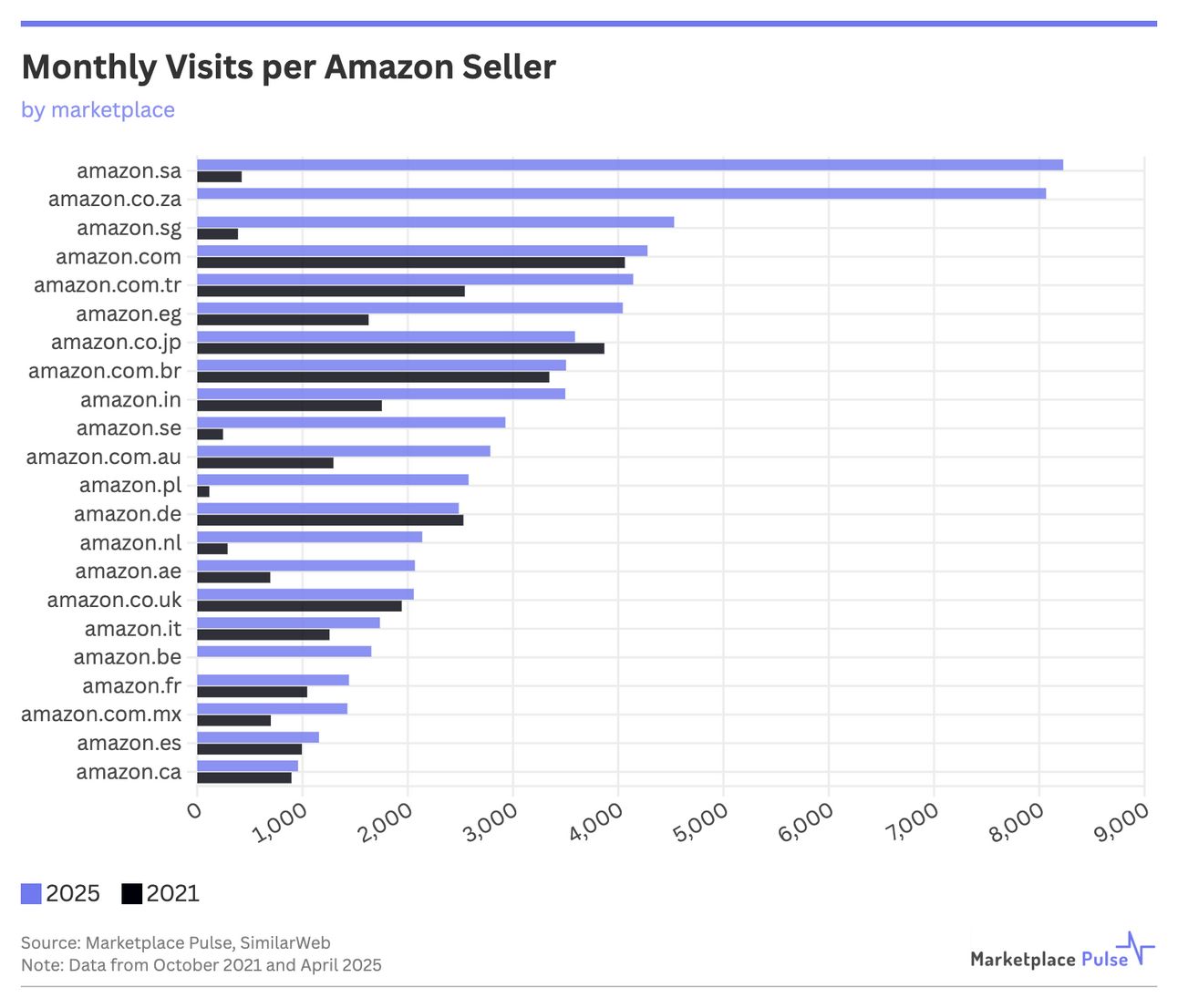

Amazon Is Less Competitive Than Four Years Ago, New Data Shows.

Marketplace Pulse analyzes how seller competition has changed across Amazon’s global marketplaces since 2021. The article reveals which Amazon sites are now seeing fewer visits per seller, and why this matters for merchants. 👉 Marketplace Pulse

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

🇵🇱 MediaMarkt Launches Marketplace in Poland. MediaMarkt unveiled its own marketplace, adding third-party sellers to its e-commerce platform. The move aims to boost online sales and strengthen omnichannel strategy. 👉 CRN

🇺🇸 YouTube’s Shoppable TV Ads Boost E-Commerce. YouTube launched an interactive product feed for TV ads, letting viewers shop via QR codes. Over 50M monthly conversions in Q4 2024 show its potential to drive sales. 👉 TechCrunch

🇺🇸 Meta Tests AI Ad Tools for Advertisers. Meta’s “Early Release” program offers AI tools for ad creation on Facebook and Instagram. It drove $42B in Q1 2025 revenue, up 16% year-over-year. 👉 Social Media Today

🇺🇸 Google’s AI Marketing Advisor Simplifies Ads. Google’s Marketing Advisor, an AI Chrome tool, helps advertisers manage campaigns. It’s set to launch later in 2025 to tackle marketing complexity. 👉 Search Engine Land

🇺🇸 Google Clarifies EEAT for Trustworthy Content. Google updated EEAT guidelines to focus on human evaluators, not algorithms. This ensures reliable content for e-commerce and SEO strategies. 👉 Practical Ecommerce

🇺🇸 Walmart’s Ad Business Grows 50% with Vizio. Walmart’s ad revenue soared 50% in Q1 2026 after a $2.3B Vizio acquisition. Vizio’s 19M SmartCast accounts boost its connected TV ad market. 👉 Marketing Dive

🇺🇸 Google Unveils AI Shopping Tools at I/O 2025. Google launched AI-powered shopping features, including Shop with AI Mode, price tracking, and virtual try-on, using its 45B+ product Shopping Graph. These tools enhance discovery and checkout, rolling out in the U.S. soon. 👉 TechCrunch

🇨🇦 Shopify’s AI Store Builder Simplifies E-Commerce. Shopify’s new AI tool creates full store layouts from keywords, offering three design options. Vanessa Lee says it cuts setup time, with Sidekick users doubling since January 2025. 👉 TechCrunch

🇨🇦 Shopify’s Horizons Update Boosts Merchant Tools. Shopify’s Summer ’25 Edition, Horizons, adds 150+ updates like AI themes, POS discounts, and new APIs. Deann Evans notes it helps merchants adapt to dynamic markets. 👉 ChannelX

🇺🇸 Cart.com Raises $50M for Commerce Expansion. Cart.com secured $50M at a $1.6B valuation to grow its unified commerce platform. CEO Omair Tariq plans to use funds for global expansion and tech upgrades. 👉 Cart.com

🇺🇸 Roblox Integrates Shopify for In-Game Sales. Roblox’s Shopify integration lets creators sell physical products in-game to 97M daily users. The Approved Merchandiser Program partners with brands like The Weeknd and Fenty Beauty. 👉 Roblox

🇺🇸 Zoho Payments Enters U.S. Market. Zoho launched Zoho Payments, supporting 135+ currencies and integrating with its CRM and Books tools. Raju Vegesna says it streamlines payments for businesses. 👉 BusinessWire

🇬🇧 Ontik Raises €3.2M for B2B Trade Credit. London’s Ontik raised €3.2M to automate trade credit for wholesalers, starting with the £100B UK building sector. Chris Smith aims to modernize manual processes. 👉 EU-Startups

🇬🇧 UK Court Halts InPost’s £106M Yodel Buyout. A High Court injunction, likely from Shift and Corja’s 66% share claim, pauses InPost’s £106M acquisition of Yodel, delaying UK expansion. This blocks integration and asset sales over £25K. 👉 ChannelX

🇺🇸 Stord Acquires Ware2Go from UPS to Boost Logistics. Stord buys Ware2Go, adding 2.5M sq ft of fulfillment centers to handle $6B in commerce. The deal, with a new UPS partnership, aims to rival Amazon’s fast shipping. 👉 Stord

🇨🇳 Transpacific Shipping Faces Cargo Delays, Rate Hikes. Tariffs spark a 180K-540K teu cargo backlog in China, with 30-40% fewer bookings. Shippers await stable rates, causing 4-6 week delays. 👉 The Loadstar

🇺🇸 Walmart Cuts 1,500 Tech, E-Commerce Jobs. Walmart axes 1,500 jobs in tech and e-commerce to streamline operations despite 2.5% Q1 revenue growth. The move supports AI-driven retail shifts. 👉 PYMNTS

🇺🇸 FedEx, Amazon Team Up for Large-Package Delivery. In 2020, FedEx and Amazon partnered for big-package shipping, leveraging FedEx’s pickup edge. The deal aimed to boost FedEx’s per-package revenue. 👉 Supply Chain Dive

❤️ Your Opinion matters!

Share your thoughts on today’s email with just 1 click in the poll—it’s quick and helps us improve.

What do you think of this issue?

For questions or more feedback, reply to this email.

Best,

MarketMaze team